EMPOWERING

PATIENTS

How Price Transparency Will

Lower Healthcare Costs

BY MIRANDA SPINDT & WILL FLANDERS, PHD

OCTOBER

Executive

Summary

WILL FLANDERS, PHD

RESEARCH DIRECTOR

Flanders@will-law.org

MIRANDA SPINDT

POLICY ASSOCIATE

Miranda@will-law.org

Empowering Patients

1

The Wisconsin Institute for Law & Liberty (“WILL”) exists to

advance the public interest in the rule of law, individual liberty,

constitutional government, and a robust civil society.

Healthcare costs have skyrocketed around the

country in recent years. Wisconsin is no exception

to this trend, with recent research finding that

the state has the fourth highest hospital costs

in the country. Coupled with inflation across the

economy at large, many Wisconsin families worry

about being able to pay their medical bills. Under

the Trump administration, there was an attempt

to introduce more market forces to the healthcare

industry by requiring that the prices for common

procedures be posted publicly, but compliance

remains low with this measure.

Healthcare is one of the only sectors of our

economy where consumers are expected to

purchase a good or service without knowing the

ultimate price. Price transparency works under

the theory that pricing information is a vital

component of the free market. Just as we can

compare the costs of gasoline at various stations

or cars at various dealerships, consumers ought

to be able to compare the cost of common

medical procedures at providers in their area. In

this report, we explore the possibility of bringing

healthcare price transparency to Wisconsin.

Among the key takeaways:

• Prices on shoppable services vary

extensively. For example, A CT scan

ranges from about $858 to $2,803 within

Wisconsin. This price variation means that

better information on prices could lead to

real savings for patients and businesses that

provide insurance to employees.

• 28% of workers are on High Deductible

Health Plans (HDHP) that incentivize

shopping around. High Deductible Plans,

often coupled with Health Savings Accounts,

require patients to cover a larger share of

the actual cost of their care. This means that

consumers have more potential to gain from

seeking out lower costoptions.

• Research suggests transparency can

work. Studies of insurance companies and

states that have implemented transparency

measures have found significant savings

forconsumers.

Policy makers should consider:

• Implementing full price transparency.

Require that healthcare providers and

insurance companies work together to

create a website where consumers can see

the “out-the-door” price at every provider

in the state for a list of common shoppable

procedures under their insurance.

• Creating incentives for shopping. Some

states have implemented systems that

require insurers to share savings with

consumers when a lower cost option is

chosen. This gives consumers additional

incentive to weigh the cost versus quality of

every potential provider.

Photo by Matheus Ferrero

Introduction

With healthcare costs consuming almost 20%

of our national GDP,

1

these spiraling costs have

become a considerable concern for individuals

and families all over the country. One in five

American households are in healthcare debt,

2

and about half of those report that it came from

unexpected medical bills.

3

A Kaiser Family

Foundation poll found that 67% of people worry

about unexpected medical bills which is more

than the percentage who worry about basic

necessities such as rent, food and gas.

4

Even

25% of Americans have reported delaying

treatment for a serious medical condition

because of cost.

5

This is likely even more true

in Wisconsin, which recent research has found

has the fourth highest hospital prices in the

nation.

6

With the crippling costs of healthcare

leading hardworking people into debt or to avoid

getting treatment in the first place, it is clear that

solutions are desperately needed across the

country and in Wisconsin.

Perhaps the most eicient way to address

these rising healthcare costs is to introduce

free-market mechanisms into the healthcare

sector. Competition and consumer choice are

the best ways to incentivize high-quality care

at lower prices. If consumers are given clear

pricing information about their medical goods

and services before ever getting treatment, they

would be empowered to make better decisions

about where they receive their healthcare.

When consumers are equipped to respond to

healthcare prices, there will be a meaningful

eect in reducing the cost of healthcare.

Photo by Nataliya Vaitkevich

2

Empowering Patients

Wisconsin has the 4th highest

hospital prices in the nation.

Empowering Patients

3

The Problem

When a patient seeks medical treatment, they are

often unaware of what their cost of care will be at the

end of the day. Hospitals, insurance companies, and

other third-party negotiators create deals, mostly in

secret, to determine the cost of a service and how

much of that cost will be paid for by the consumer.

As a result, the same procedure can have vastly

dierent costs from hospital to hospital and even

from patient to patient. For example, a CT scan of the

head can range in price from about $858 to $2,803 in

the state of Wisconsin.

7

This dierence in cost might

make sense if the treatment were better quality, but

there is often no correlation between higher costs

and higher quality of care or outcomes.

8

Instead,

what consumers pay is determined by what the

insurance company and hospital agreedupon.

Costs can get especially out of control when a

patient receives a surprise bill for out-of-network

care. While this usually happens in emergency

situations, it is possible for shoppable procedures

as well when a patient gets care from a facility or

provider that does not have an agreement with

their insurance company. If the insurance company

and the out-of-network hospital or provider cannot

reach an agreement on cost, they will pass on the

entirety of the bill to the patient. It is important to

note that this doesn’t just happen when a consumer

chooses to go to out-of-network facilities. Instead,

sometimes out-of-network services are provided at

in-network facilities,

9

making it nearly impossible for

consumers to make decisions about what healthcare

provider will result in the lowest cost. About 57% of

Americans have received a surprise medical bill, and

it is the most common reason for medical debt.

10

Photo by Drew Hays

A CT scan can range from

$858 to $2,803 in Wisconsin.

4

Empowering Patients

Photo by National Cancer Institute

Price Transparency

and the Free Market

4

Empowering Patients

Empowering Patients

5

To address the issue of rising costs and surprise

billing, many states across the nation have passed

price transparency laws, which make information

on pricing more readily available to consumers.

This enables the consumer to know what they will

pay for their healthcare before they receive it, not

after, giving consumers the opportunity to shop

for their scheduled treatments and procedures.

Not only will this help consumers save money, but

hospitals, providers, and insurance companies

will be incentivized to compete to provide the best

quality care at the lowest price possible. Consistent

with the free-market principles we see as being

eective in most other areas of the economy, this

competition should work to drive down overall

healthcare costs.

Typically, healthcare is considered an inelastic

good, meaning that a consumer will seek out

medical care regardless of the cost. This is in

contrast to most other consumer markets where

we may decide to buy less or seek alternatives due

to price increases. While High Deductible Health

Plans (HDHP) have become more common, for

many, third-party payers like insurance still cover

a large portion of our healthcare costs, meaning

there is a reduced incentive to know what we

will be paying for services before receiving them.

When hospitals and insurance companies are able

to keep patients in the dark, incentives change.

They can negotiate prices that are higher than

the cash price of the service, and the price for the

same service can vary widely depending on the

hospital, the provider, and the insurance company

a patient uses.

11

* For 2022, the IRS defines a high deductible health plan as any plan with a deductible of at least $1,400 for an individual or

$2,800 for a family. An HDHP’s total yearly out-of-pocket expenses (including deductibles, copayments, and coinsurance) can’t

be more than $7,050 for an individual or $14,100 for a family. (This limit doesn’t apply to out-of-network services.)

Source: https://www.healthcare.gov/glossary/high-deductible-health-plan/

In situations such as sudden illness or accident, a

patient will seek out medical care no matter what

it costs. Insurance is meant to financially protect

us from the cost of this type of catastrophic

care. However, about 80% of healthcare goods

and services are “shoppable” meaning that the

decision of where to get treatment does not

have to be made immediately.

12

This includes

services such as CT scans, blood tests, and

psychotherapy. It is these non-emergency

procedures where out-of-pocket price information

can be available for the consumer to decide

where to be treated for the best price.

As alluded to earlier, changing trends in

employer-sponsored health-insurance plans

also provide a strong incentive for greater

transparency. In an eort to control healthcare

costs, many employers have begun transitioning

their employees to HDHP paired with a

supplemental Health Savings Account (HSA).*

Since their inception in 2004, high deductible

plans have grown in popularity, covering about

28% of workers in 2021.

13

A 2020 study

14

found

that the average deductible for an individual was

now more than $4,000 and more than $8,000

for a family. Under these plans, individuals often

bear a greater share of health-care costs, and

consequently ought to be more incentivized to

shop for services.

80% of healthcare goods

andservices are shoppable.

6

Empowering Patients

Are Transparency

Measures Eective?

Photo by Anna Shvets

6

Empowering Patients

Empowering Patients

7

While the benefits of price transparency seem

clear in free-market theory, it is important to

consider whether they work in practice before

creating new requirements for the healthcare

industry. Of course, it is diicult to know whether

measures will be eective before they have been

tried. Outside of a few examples that will be noted

below, private sector compliance remains low with

federal requirements put in place under the Trump

administration requiring price transparency.

15

Despite a lack of nationwide implementation,

a small body of research has examined more

localized eorts at pricetransparency.

Some research has been conducted by

examining price transparency within the private

sector. One such study of the employees of a

national restaurant chain found that employees

who sought pricing information were able to

lower their costs by about 1.6%.

16

However,

these price-lowering eects were mitigated by

insurance. Of course, such tools are only eective

to the extent that consumers utilize them. One

study of AETNA’s private online pricing tool found

that only about 3.5% of consumers utilized the

tool, but those consumers that did saved more

Photo by Gratuit

than 12% on average for the same procedure.

17

The low utilization rate may be due to lack of

awareness

18

and diiculty using the available

tools,

19

which we believe can be remedied

through legislative and market-driven action.

Moving to studies of state-implemented

transparency programs, a 2019 policy report

from the Wisconsin Institute for Law and Liberty

(WILL)

20

brought together data on the cost

to consumers of healthcare in each state with

data on whether the state had a solid price

transparency law. The results suggested that

having poor transparency laws was correlated

with more residents reporting that they went

without care in the past year because of the cost.

A peer-reviewed study

21

of New Hampshire’s price

transparency system reached similar conclusions.

Looking at the time frame immediately before

and after the creation of a price-transparency

website, the author found that transparency led to

a significant shift toward lower-cost providers, and

a lowering of overall costs for both consumers and

insurers. The study estimated that savings were

about $7.9 million for patients and $36 million for

insurers over the time period of study.

8

Empowering Patients

Price Transparency

Around the Nation

Photo by Andrea Piacquadio

8

Empowering Patients

Empowering Patients

9

Price transparency rules have been enacted

at the federal level, but there has not been

significant compliance with the rules to yield

desired results. In 2019, President Trump signed

an executive order directing his administration

to implement price transparency regulations

which went into eect on January 1, 2021.

22

This

specific rule requires hospitals to post list prices

and negotiated prices for nearly all goods and

services oered. This information must be oered

in a machine-readable format and a consumer-

friendly display.

There is little guidance on what qualifies as

a “consumer friendly” format. As long as it is

searchable and on a publicly available website,

hospitals have the flexibility to decide what

format they use.

23

Unfortunately, this means that

understanding how to use the tools available can

still be diicult and hard to understand. Some

private sector and non-profit organizations have

taken on the task of collecting hospital price

data and making it more intuitive, in an attempt

to overcome these shortcomings. For example,

Turquoise Health

24

allows consumers to search

hospital prices by procedure and zip code, and

Sage Transparency

25

shows a comparison of

hospital prices relative to Medicare costs.

Another issue is that the “list prices” that

hospitals post may bear little relationship to

the final out-of-pocket cost the consumer pays.

To know what a consumer will pay, consumers

also need to know how much their insurance

company will cover for each service. To help

address this side of the transparency equation,

a second rule went into eect on July 1, 2022

26

to hold most group health plans of issuers of

group or individual health insurance to the similar

price transparency requirements. In a machine-

readable file, they must disclose the rates for

all covered items and services between the

plan or issuer and in-network providers. They

must also disclose the amounts allowed for, and

billed charges from, out-of-network providers.

Requirements for an online tool to disclose the

prices of 500 items and services will go into

eect in 2023, and that will change to include all

items and services in 2024.

These are steps in the right direction, but it is

diicult for the federal government to police

compliance across the nation. For the federal

hospital rule, the penalty increased in January of

2022 from $300 a day to a maximum of $5,500

a day.

27

However, an August 2022 study found

that only 16% of sampled hospitals were fully

complying with the regulation, including only

21% of Wisconsin hospitals.

28

It remains to be

seen how insurance company rule compliance

will fare. Indeed, the Foundation for Government

Accountability recently filed a lawsuit against

the Centers for Medicare and Medicaid Services

for failing to enforce compliance with the

federalrules.

29

Additionally, Congress passed the “No Surprises

Act” which went into eect on January 1, 2022.

30

This law protects patients from surprise billing

by requiring insurance companies to cover out-

of-network claims the same way they would for

in-network claims, and they cannot charge more

than in-network claims. It also establishes a

dispute resolution plan in the case that provider

and insurance company are not able to come to

an agreement on their own. This ensures that the

best interest of the patient comes first.

10

Empowering Patients

What Other States

Have Done

Photo by Olga Guryanova

10

Empowering Patients

Empowering Patients

11

FULL PRICE

TRANSPARENCY

States with complete price transparency require

cost estimates from all providers and insurance

carriers in virtually all instances, most closely

resembling the federal rules on price transparency.

However, how that information is delivered

varies from state to state. For example, providers

and insurers must provide price information

within two business days upon patient request

in Massachusetts,

31

whereas Alaska

32

and

Minnesota

33

require it within 10 business days.

In Texas, they take it a step further than other

states by also requiring user-friendly websites and

having stronger enforcement mechanisms.

34

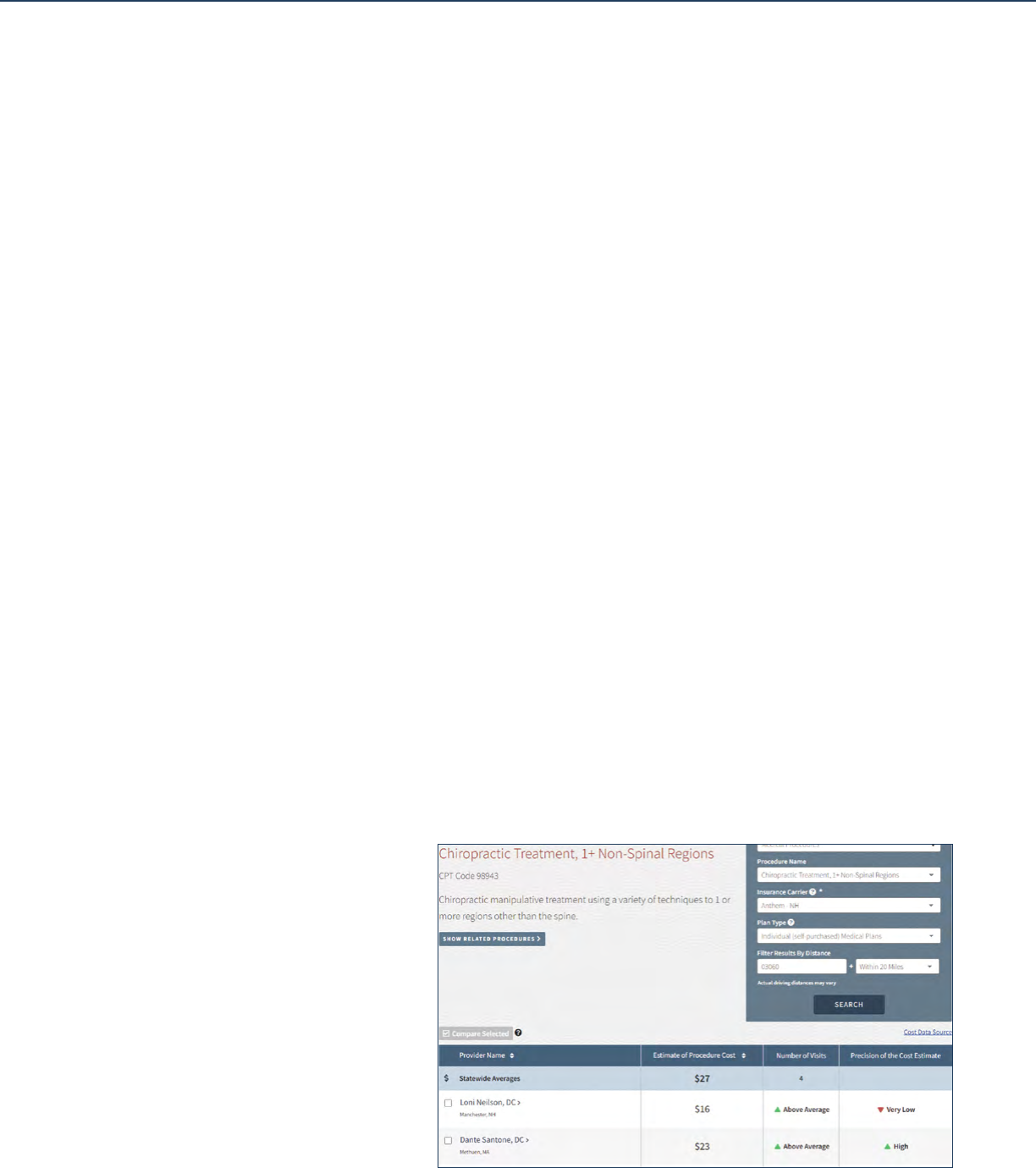

An example of how a price transparency website

could look is included in Figure 1 from New

Hampshire. New Hampshire was a pioneer in

providing pricing information to consumers,

with a website that predates the federal law on

the subject. The New Hampshire Department of

Insurance runs their state website which uses

insurance information to estimate the cost of over

120 procedures. The site allows a consumer to

pick between medical or dental care, input their

insurance company, and choose a procedure to

receive an estimate for the out-of-pocket cost

ofcare.

In Figure 1, we have searched for chiropractic care

with Anthem insurance within 20 miles of a ZIP

code in Nashua. The website returns the statewide

average cost of the procedure, as well as the typical

number of visits required for treatment. This is

followed by the cost at various providers within the

Nashua area. Note that these are cost estimates

based on data that has been collected in the state’s

All Payer Claims Database (APCD). The precision

of the estimate is based on the amount of data

points they have for that provider. In this case, the

estimate is more precise for Dr. Santone than it is

for Dr. Neilson. The information they can provide

is more personalized than a general estimator

tool, but it is not guaranteed that they have all the

necessary information to give an accurate out-

of-pocket cost to the consumer. In Washington, a

similar website was established by the state’s Oice

of Financial Management and oers cost estimates

for about 85 procedures based on ZIP code.

Figure 1.

New Hampshire Price

Transparency Example

12

Empowering Patients

While this may be a more desirable standard

for state law, even states with complete price

transparency do not necessarily have an easy

and accessible way for consumers to receive the

price information for the laws to be eective.

PARTIAL PRICE

TRANSPARENCY

States with partial price transparency require

price transparency for providers, hospitals

or insurance, but not all of them. Florida,

for example, requires hospitals to give cost

estimates within seven days upon request, but

not providers or insurance companies.

35

On the

other hand, Tennessee requires out-of-pocket

cost estimates be provided by insurance carriers

through a public website,

36

and Nebraska

requires cost estimates from providers for

uninsured and self-pay patients.

37

LIMITED PRICE

TRANSPARENCY

Limited Price Transparency describes states

which have price transparency requirements for

either providers or insurers, but only in certain

situations. For example, cost estimates in New

Jersey are only available if a non-emergency

procedure is scheduled in advance or if it is

out-of-network, and must be provided before

the appointment.

38

In Montana, patients are

* https://www.hcinnovationgroup.com/population-health-management/article/21118480/liberating-data-in-wisconsin-how-the-

state-is-evolving-its-allpayer-claims-database

only entitled to price information within ten

days of the request if the treatment is greater

than $500.

39

California exclusively requires cost

estimates for those who are uninsured, but

does not enforce responsiveness.

40

Additionally,

California requires hospitals to post the average

charges of the 25 most common inpatient and

outpatient procedures to their website, and

update ityearly.

41

NO PRICE

TRANSPARENCY

Unfortunately, a majority of states still have no

price transparency laws on the books. Some of

them do have some kind of price transparency

tool, however, it is not considered to be helpful

enough to help empower the consumer.

Wisconsin is among the states that currently do

not have laws mandating price transparency,

however a pair of private organizations operate

voluntary tools. The Wisconsin Hospital

Association operates a tool called Price Point,

42

which gives the median price charged for

procedures at individual hospitals, but does not

have the information needed to give accurate

out-of-pocket estimates. The Wisconsin Health

Information Organization operates the state’s

independent All-Payers Claim Database,

which collects claims data from insurers,

self-funded employers and the state to cover

approximately 75% of Wisconsin’s population.

*

These capabilities could serve as a baseline

for an eventual implementation of a universal

Empowering Patients

13

transparency measure. There are still about

17 states that do not have any laws or price-

transparency tools.

ANOTHER OPTION:

LOW-COST-SEEKING

INCENTIVES

Some states oer a shared savings program that

incentivizes consumers to choose lower-cost

healthcare services in non-emergency situations.

When a patient chooses lower-cost services, it

may result in savings for the insurer or provider,

which is then shared with the patient through

rewards such as a reduction in copayments,

credits toward a deductible, or cash. In Florida,

there is a shared savings program that is

available to full or part-time state employees on

the State Group health plan.

43

The program is

run by the Department of Management Services,

and the benefits are automatic when enrolled

in the State Group health plan. Enrollees can

use the Healthcare Bluebook

44

to search for

rewardable services or a bundled service from

SurgeryPlus.

45

By doing so, they earn rewards

as a credit to a designated spending or savings

account oered by the State Group health

plan or as a reimbursement for out-of-pocket

medicalexpenses.

In Nebraska, insurance carriers are required to

oer a program that gives 50% of the shared cost

savings to the enrollee, in cash or credit, when

the savings are $50 or more.

46

In Tennessee, they

also require insurance carriers to oer shared

savings incentives through cash, credit towards

the enrollees’ deductible, or reduction of a

premium, copayment, or cost sharing.

47

This can

be used in any state with price transparency laws

regardless of how comprehensive they may be.

Medicaid also oers a shared savings program

which has delivered savings for five years in

a row, including $1.6 billion in 2021, while still

providing high-quality care to patients.

48

Photo by CDC

14

Empowering Patients

Policy Proposals

Photo by Connor Betts

14

Empowering Patients

Empowering Patients

15

The federal rules under the Trump administration,

despite their good intentions, have not been

very successful to date because of the minimal

punishments and lack of enforcement. However,

they do lay a good foundation for the states

to implement their own price transparency

legislation. By codifying the federal rules, price

transparency will be protected in case the federal

rules are ever removed. Then states can also

adjust the legislation to make sure that it fits the

needs of their citizens, have better compliance,

and ultimately produce the healthcare savings

that price transparency makes room for. These

policies are likely to be popular with voters as

well, with recent polling showing that 87% of

Americans support rules that require hospitals to

disclose prices.

49

Model legislation

50

has been proposed that can

serve other states in implementing transparency.

This legislation mandates that each licensed

hospital in the state maintain a list that includes

payor specific charge information for a list

of “shoppable” procedures. If hospitals are

determined to be out of compliance with the

requirement, the legislation provides for fines

from the state. For example, in Colorado they do

not allow hospitals to go to collections on unpaid

bills if they are not in compliance, and in Texas,

top penalties could be $365,000 a year.

51

The next step would be to address surprise

billing. This may include building upon the federal

No Surprises Act by codifying and enforcing

the requirement for an Advanced Explanation

of Benefits (AEOB). When a patient schedules a

healthcare service at least ten days in advance,

the hospital and insurance company must

send them a good faith estimate within three

business days of what it will cost them.

52

It

includes information such as the amount the

insurance plan is paying and contracted rates of

in-network providers. This proposal would not

only make pricing information easier to access

for consumers, but also give more details to help

customers understand the context around pricing

and how they can compare their options. States

have codified and enforced the No Surprises Act

to varying degrees,

53

and ensuring the AEOB

could be a great next step. Other suggestions

for accessibility include requiring all healthcare

facilities, not just hospitals, to disclose prices,

have stricter penalties, and give state agencies

the necessary tools to enforce compliance.

Finally, states could provide incentives for

consumers to use the price transparency

tools available to them. As mentioned above,

states have done this by using shared savings

healthcare programs to reward state employees

for choosing lower-priced procedures, and

asking individual and small business markets

to do the same. These rewards can come in

the form of gift cards, lower premiums and

deductibles, or adding money to health savings

accounts. One way to test this out might be with

a pilot program as exemplified by Kentucky and

New Hampshire.

54

Policymakers interested in

this means of implementation should look to the

example of Florida discussed in the previous

section.

Other actions include ending out-of-network

discrimination so that patients understand other

options, giving smaller companies the ability to

see how their health care dollars are spent, and

banning anti-competitive contracting provisions.

16

Empowering Patients

Conclusion

While some like to use the cost of healthcare

as evidence of free-market failure, in reality the

healthcare marketplace hasn’t been “free” for

decades. From the creation of Medicare to the

Aordable Care Act to the expansion of Health

Maintenance Organizations under President

Nixon, the story of American healthcare is

one of an inexorable march toward putting

barriers between consumers and their care.

Price transparency is far from a silver bullet

for the rising cost of care, but would represent

a meaningful step toward giving power

back to consumers when it comes to their

healthcaredecisions.

Photo by Tima Miroshnichenko

16

Empowering Patients

Empowering Patients

17

1 https://www.statista.com/statistics/184968/us-health-expenditure-

as-percent-of-gdp-since-1960/

2 https://www.nbcnews.com/health/health-news/1-5-households-

medical-debt-includes-people-private-insurance-rcna48076

3 https://www.k.org/report-section/k-health-care-debt-survey-

main-findings/

4 https://www.k.org/health-reform/poll-finding/kaiser-health-

tracking-poll-late-summer-2018-the-election-pre-existing-

conditions-and-surprises-on-medical-bills

5 https://news.gallup.com/poll/269138/americans-delaying-medical-

treatment-due-cost.aspx

6 https://www.wmc.org/op-eds/reforms-needed-to-bring-down-

wisconsins-4th-highest-hospital-prices-in-the-country/

7 https://turquoise.health/service_oerings?q=CT+scan%2C+

head+or+brain%2C+without+contrast&service_name=ct-scan-

head-or-brain-without-contrast&location=53233&provider_

name=&sort=cost&page=1&distance=50

8 https://www.ncbi.nlm.nih.gov/pmc/articles/

PMC4863949#:~:text=These%20studies%20documented%20

large%20variations,outcomes%20(5%E2%80%938)

9 Out-of-Network Doctors at In-Network Hospitals - Consumer

Medical Bill Solutions (mymedicalbillsolution.com)

10 https://www.norc.org/NewsEventsPublications/PressReleases/

Pages/new-survey-reveals-57-percent-of-americans-have-been-

surprised-by-a-medical-bill.aspx

11 https://www.fiercehealthcare.com/hospitals/hospital-prices-widely-

vary-by-payer-often-higher-than-cash-price

12 https://www.thecentersquare.com/national/audit-of-hospital-

bailout-money-highlights-need-for-reform-health-oicials-say/

article_e8d563c2-9530-11ea-af5f-7756ed4accdc.html

13 https://www.k.org/report-section/ehbs-2021-

section-8-high-deductible-health-plans-with-savings-

option/#:~:text=Enrollment%20in%20HDHP%2FSOs%20

has,HSA%2Dqualified%20HDHPs%20in%202021

14 https://www.ehealthinsurance.com/resources/individual-

and-family/how-much-does-individual-health-insurance-

cost#:~:text=A%20deductible%20is%20the%20amount,and%20

%248%2C439%20for%20family%20coverage

15 https://www.healthcaredive.com/news/only-14-of-hospitals-comply-

with-federal-price-transparency-rules-advocac/618706/

16 https://www.aeaweb.org/articles?id=10.1257/pol.20150124

17 https://www.healthaairs.org/doi/full/10.1377/hltha.2015.0746

18 https://www.healthaairs.org/doi/10.1377/hltha.2015.0746

19 https://www.fiercehealthcare.com/hospitals-health-systems/report-

finds-barriers-to-use-price-transparency-tools

20 https://will-law.org/wp-content/uploads/2021/01/2019-08-09-

health_transparency_brief_final-ii.pdf

21 http://www-personal.umich.edu/~zachb/zbrown_eqm_eects_

price_transparency.pdf

22 https://www.cms.gov/hospital-price-transparency

23 https://www.cms.gov/files/document/steps-making-public-

standard-charges-shoppable-services.pdf

24 https://turquoise.health/

25 https://dashboard.sagetransparency.com/

Endnotes

26 https://www.cms.gov/healthplan-price-transparency

27 https://www.cms.gov/newsroom/press-releases/cms-oppsasc-

final-rule-increases-price-transparency-patient-safety-and-access-

quality-care

28 https://www.patientrightsadvocate.org/august-semi-annual-

compliance-report-2022

29 https://finance.yahoo.com/news/fga-files-lawsuit-against-

centers-202500390.html?guccounter=1

30 https://www.dol.gov/agencies/ebsa/laws-and-regulations/laws/no-

surprises-act

31 https://malegislature.gov/Bills/191/S2984

32 https://www.akleg.gov/basis/statutes.asp#18.23.400

33 https://www.mnhospitals.org/Portals/0/Documents/Member%20

Resources/MN_price_transparency_laws%286%29.pdf

34 https://www.tdi.texas.gov/health/healthprices.html

35 https://law.justia.com/codes/florida/2019/title-xxix/chapter-395/

part-i/section-395-301/

36 https://www.tn.gov/content/dam/tn/tacir/2020publications/2020_

RightToShop.pdf

37 https://nebraskamft.org/2022/01/27/legislative-update-

january-2022/

38 https://pub.njleg.gov/bills/2018/A2500/2039_I1.HTM

39 https://leg.mt.gov/bills/mca/title_0500/chapter_0040/part_0050/

section_0120/0500-0040-0050-0120.html

40 https://www.ncbi.nlm.nih.gov/pmc/articles/

PMC2837489/#:~:text=In%20California%2C%20hospitals%20

must%20provide,receive%20from%20a%20government%20payer

41 https://law.justia.com/codes/california/2005/hsc/1339.50-1339.59.

html

42 https://www.wipricepoint.org/Home.aspx

43 https://www.mybenefits.myflorida.com/content/

download/152414/1014218/Shared_Savings_Program_

FAQ_08.29.2019.pdf

44 https://www.healthcarebluebook.com/ui/home?path=direct

45 https://florida.surgeryplus.com/Client/ClientAccount/

Login?returnUrl=%2F

46 https://nebraskalegislature.gov/laws/statutes.php?statute=44-

1407&print=true

47 https://wapp.capitol.tn.gov/apps/BillInfo/default.

aspx?BillNumber=SB0510&GA=111

48 https://southfloridahospitalnews.com/medicare-shared-savings-

program-saves-medicare-more-than-1-6-billion-in-2021-and-

continues-to-deliver-high-quality-care/

49 https://www.patientrightsadvocate.org/feb2022surveyresults

50 https://alec.org/model-policy/hospital-price-transparency-act/

51 https://www.bizjournals.com/houston/news/2022/03/22/houston-

hospitals-price-transparency-baker-report.html

52 https://www.alaiahealth.com/articles/understanding-the-

advanced-explanation-of-benefits-provisions-in-the-no-surprises-

act#:~:text=to%20implement%20it.-,What%20Is%20An%20

Advanced%20Explanation%20of%20Benefits%3F,service%20is%20

as%20yet%20unscheduled

53 https://www.commonwealthfund.org/publications/maps-and-

interactives/2022/feb/map-no-surprises-act#map

54 https://www.tn.gov/content/dam/tn/finance/fa-benefits/documents/

shared_savings_incentive_programs_report.pdf