Mergermarket

Global & Regional

M&A League Tables 2022

1

Ranking

geography of the target, bidder or seller, and

excl

equity buyout league tables are based on

advisors advising the bidder only on buyout

deals with target dominant geography being

the

count

withdrawn bids. Private equity exit league

tables based on advisors advising the target/

seller on exit deal with target dominant

geography being the country/region and

excludes lapsed and withdrawn bids.

11

12

13

Finding the opportunities in mergers and acquisitions

Global & Regional

League Tables 2022

Financial Advisors

https://mergermarket.com/info/

Mergermarket

Global & Regional

M&A League Tables 2022

2

Regional ranking comparison

Global Advisory League Tables 03

EMEA Advisory League Tables 05

Americas Advisory League Tables 20

Asia - Pacific Advisory League Tables 26

Private Equity Advisory League Tables 33

Criteria and Contacts 37

Contents

https://mergermarket.com/info/

Mergermarket

Global & Regional

M&A League Tables 2022

3

Global League tables

Financial advisor league table by value

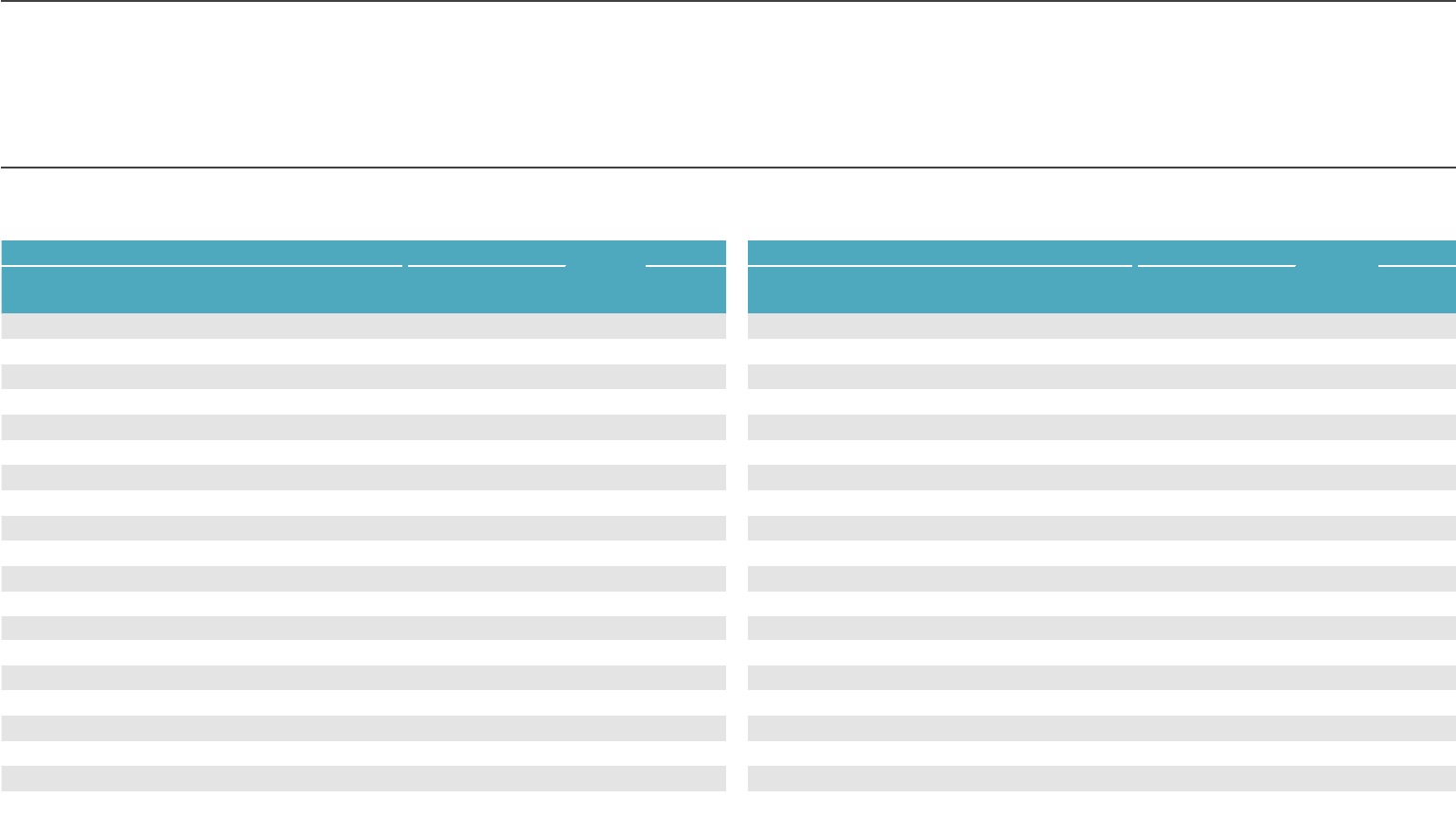

Ranking 2022 2021 Regional ranking comparison

2022 2021 Company Name

Value

(USDm)

Deal Count

% Value

Change

Value

(USDm)

Asia

Pacific

Japan

1 1 Goldman Sachs & Co 1,187,008 379 -33.8% 1,791,778 1 6

1

2 2 JPMorgan 891,924 347 -37.4% 1,424,342 4 4

2

3 3 Morgan Stanley 800,395 270 -34.1% 1,214,842 3 2

3

4 5 Bank of America 661,136 273 -28.4% 923,772 5 9

4

5 4 Citi 627,706 199 -32.4% 928,731 2 10

5

6 6 Barclays 460,341 197 -34.4% 701,355 13 15

6

7 7 Credit Suisse 327,586 127 -34.1% 497,142 8 21

7

8 11 Rothschild & Co 248,932 423 -33.4% 373,886 23 39

8

9 13 BNP Paribas 242,985 139 -11.6% 275,005 9 61

9

10

8 Lazard 229,482 243 -47.7% 438,757 54 18

10

11 9 Evercore 226,943 181 -46.4% 423,479 19 12

11

12 14 Jefferies 222,106 235 -14.4% 259,395 11 -

12

13 10 UBS Investment Bank 193,358 158 -49.0% 379,020 18 3

13

14 21 RBC Capital Markets 186,900 162 29.1% 144,749 20 84=

14

15 15 Centerview Partners 159,833 85 -33.9% 241,764 92 43

15

16 19

Wells Fargo Securities

159,477 49 -1.5% 161,825 - -

16

17 23 Allen & Company 159,381 12 16.6% 136,645 - -

17

18 42

Santander Corporate Investment Banking (SCIB)

157,771 72 122.6% 70,868 121 -

18

19 12 Deutsche Bank 150,302 104 -51.0% 306,803 25 23

19

20 17 HSBC 137,461 46 -26.5% 187,067 10 11

20

2

2

1

1

4

3

4

Europe

US

Middle East &

Africa

Latin

America

1

1

3

13

9

18

16

11

15

10

15

12

61

14

8

40

14

10

16

7

23

17

7

21

5

12

8

9

6

26

16

8

10

33

17

4

5

6

5

2

7

3

4

8

5

633=

9

-

-

17

11

39

39

19

13

20

-

68

10

-

-

22

36

9

36

12

14

61=

6

11

20

7

-

https://mergermarket.com/info/

Mergermarket

Global & Regional

M&A League Tables 2022

4

Global League tables

Financial advisor league table by deal count

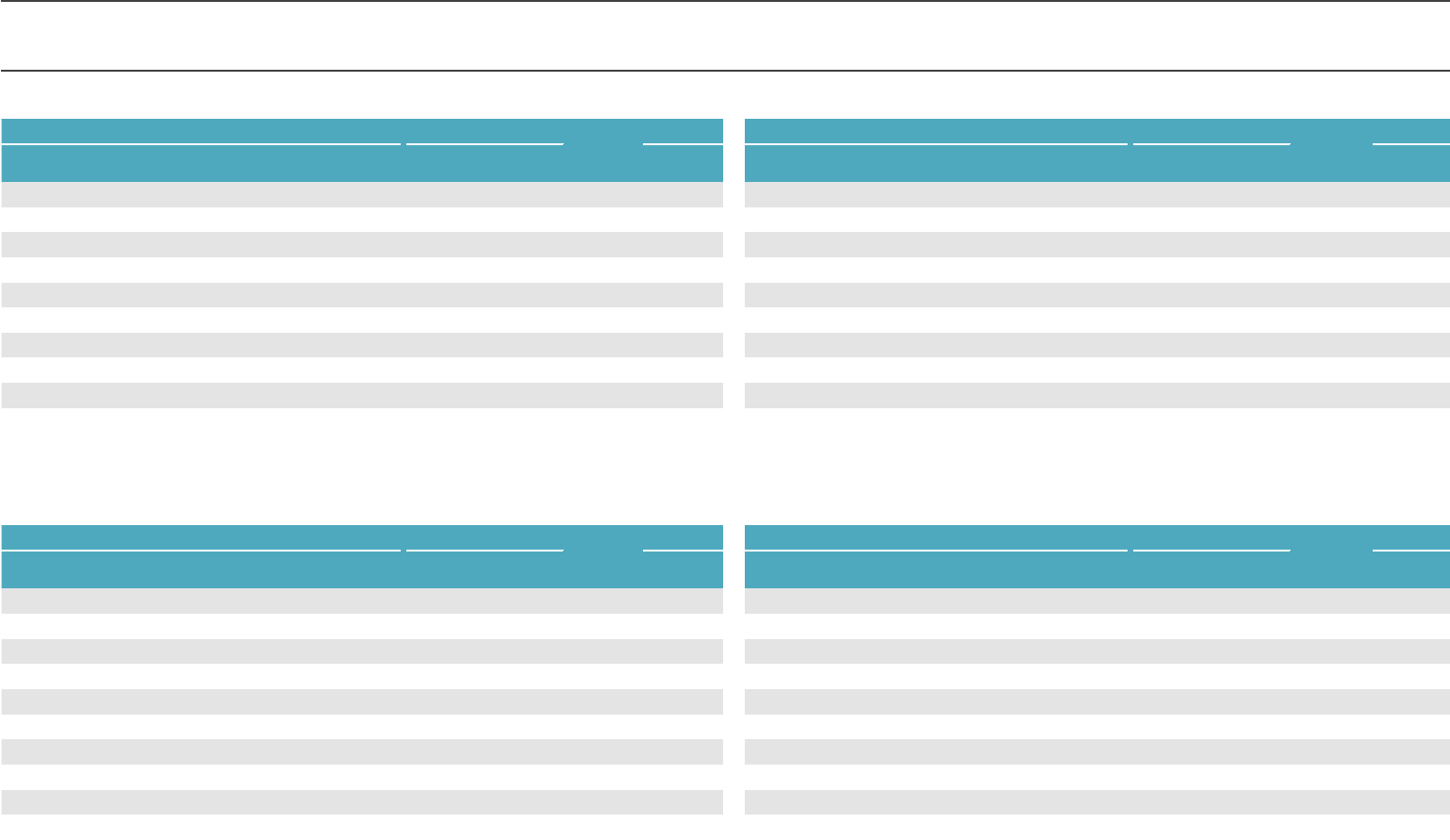

Ranking 2022 2021 Regional ranking comparison

2022 2021 Company Name

Value

(USDm)

Deal Count

Count

Change

Deal Count

Asia

Pacific

Japan

1 3 Deloitte 53,464 704 -7 711 2 1

1

2 1 PwC 88,404 703 -94 797 1 10

2

3 2 KPMG 47,470 504 -220 724 4 4

3

4 7 Rothschild & Co 248,932 423 -120 543 12 23

4

5 4 EY 57,707 422 -205 627 3 14

5

6 8 Houlihan Lokey 51,237 383 -48 431 23 6

6

7 5 Goldman Sachs & Co 1,187,008 379 -235 614 6 12

7

8 6 JPMorgan 891,924 347 -261 608 11 13

8

9 10 Bank of America 661,136 273 -72 345 15 15

9

10 9 Morgan Stanley 800,395 271 -157 428 7 7

10

11 14 Lazard 229,482 243 -53 296 33 22

11

12 11 Jefferies 222,106 235 -108 343 21 -

12

13 13 Lincoln International 13,986 234 -64 298 40 39

13

14 21 BDO 9,447 213 -2 215 25 25

14

15 12 Citi 627,706 199 -142 341 14 21

15

16 15 Barclays 460,341 197 -79 276 16 17

16

17 23 Evercore 226,943 181 -32 213 35 26

17

18 25 Oaklins 6,579 180 -27 207 38 34

18

19 22 Piper Sandler & Co 30,821 167 -47 214 81 61

19

20 24 Stifel/KBW 32,066 164 -48 212 101 37

20

21

Europe

US

Middle East &

Africa

Latin

America

3

27

16

25

4

21

1

7

2

12

7

8

1

20

3

10

9

1

4

21

10

3

6

5

5

23

2

42

7

2

18

52

8

16

14

12

20

4

11

23

14

5

8

3

15

6

9

18

34

16

8

38

32

6

42

30

56

21

15

5

11

19

10

22

66

7

34

-

32

13

15

43

29

9

24

22

11

44

26

20

https://mergermarket.com/info/

Mergermarket

Global & Regional

M&A League Tables 2022

5

EMEA Advisory League tables

Europe league table by value Europe league table by deal count

Ranking 2022 2021 Ranking 2021

2022 2021 Company Name

Value

(USDm)

Deal Count

% Value

Change

Value

(USDm)

2022

Count

Change

Deal Count

1 1 Goldman Sachs & Co 411,298 155 -41.1% 698,242

1

1 -28 537

2 2 JPMorgan 298,590 147 -40.9% 505,428

2

2 -13 507

3 4 Bank of America 267,086 110 -25.0% 356,350

3

3 -116 474

4 3 Morgan Stanley 232,506 105 -47.0% 438,706

4

4 -76 432

5 6 Rothschild & Co 216,740 356 -33.0% 323,592

5

5 -135 422

6 5 Citi 203,645 81 -41.5% 347,874

6

6 14 162

7 9 BNP Paribas 171,582 124 -19.5% 213,097

7

7 0 163

8 7 Lazard 163,669 162 -30.0% 233,939

8

8 -3 165

9 11 Barclays 143,282 86 -23.7% 187,864

9

9 -86 241

10 12 UBS Investment Bank 104,933 71 -29.7% 149,221

#

10 -87 234

11 10 Deutsche Bank 103,510 55 -45.6% 190,104

#

11 -5 148

12 25

Santander Corporate Investment Banking (SCIB)

78,275 47 26.8% 61,718

#

12 -56 181

13 16 Mediobanca 71,324 45 -23.5% 93,202

#

13 -2 126

14 14 Evercore 70,081 54 -40.3% 117,301

#

14 -14 124

15 24 PwC 64,101 509 1.6% 63,069

#

15 -47 152

16 36 UniCredit Group 62,196 45 52.3% 40,826

#

16 -51 156

17 33 RBC Capital Markets 60,678 40 32.2% 45,905

#

17 -33 126

18 17 Jefferies 57,647 86 -37.6% 92,391

#

18 35 52

19 18 Centerview Partners 53,767 38 -40.5% 90,437

#

19 -14 100

20 40 EQUITA S.I.M 49,328 14 58.2% 31,180

#

20 -22 108

#

#

20

Jefferies

57,647

86

45

GCG

217

87

21

Barclays

143,282

86

12

Lincoln International

3,575

105

18

Grant Thornton

2,491

93

19

Bank of America

267,086

110

13

Morgan Stanley

232,506

105

358

8

Clearwater International

2,080

125

17

BNP Paribas

171,582

124

7

JPMorgan

298,590

147

14

Oaklins

3,674

143

9

Lazard

163,669

162

6

Goldman Sachs & Co

411,298

155

2022

2021

Company Name

Value

(USDm)

Deal Count

1

PwC

64,101

509

11

BDO

2,641

176

10

Houlihan Lokey

23,751

163

4

Rothschild & Co

216,740

356

5

EY

28,476

287

2

Deloitte

24,942

494

3

KPMG

23,645

https://mergermarket.com/info/

Mergermarket

Global & Regional

M&A League Tables 2022

6

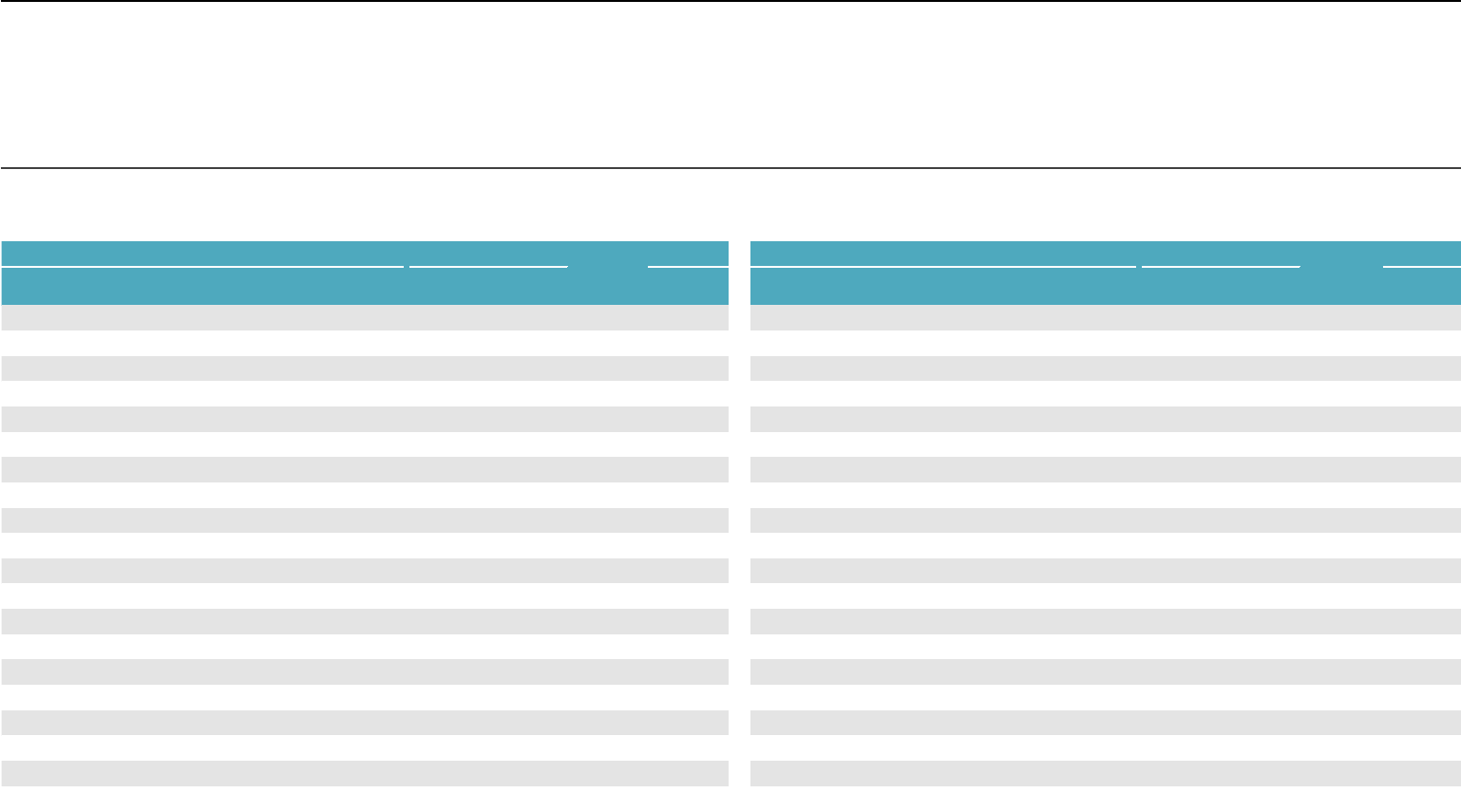

EMEA Advisory League tables

UK league table by value

UK league table by deal count

Ranking 2022 2021 Ranking 2021

2022 2021 Company Name

Value

(USDm)

Deal Count

% Value

Change

Value

(USDm)

2022

Count

Change

Deal Count

1 1 Goldman Sachs & Co 127,538 44 -42.5% 221,964

1

1 -52 185

2 4 Bank of America 91,824 36 -17.6% 111,476

2

2 -27 126

3 7 Morgan Stanley 81,634 43 5.6% 77,291

3

3 -15 93

4 3 Rothschild & Co 80,237 133 -31.7% 117,474

4

4 -5 75

5 2 JPMorgan 76,710 50 -57.4% 180,216

5

5 -35 100

6 5 Citi 69,881 27 -26.1% 94,566

6

6 -21 84

7 6 Barclays 60,928 39 -35.2% 94,066

7

7 7 51

8 14 Evercore 42,656 35 24.9% 34,165

8

8 2 55

9 8 Jefferies 37,653 48 -41.1% 63,913

9

9 -60 115

10 15 RBC Capital Markets 32,106 19 4.4% 30,752

#

10 -41 91

11 9 Lazard 31,854 58 -49.1% 62,543

#

11 -14 62

12 21 UBS Investment Bank 29,434 25 64.6% 17,881

#

12 -65 109

13 38 Macquarie Group 26,871 28 224.6% 8,277

#

13 -18 62

14 18 HSBC 25,920 13 11.5% 23,246

#

14 -4 47

15 17 Robey Warshaw 21,354 5 -18.0% 26,031

#

15 -6 45

16 19 Numis Securities 19,999 15 -10.0% 22,213

#

16 -11 50

17 10 Jamieson Corporate Finance 19,097 39 -69.4% 62,363

#

17 -4 42

18 12 Deutsche Bank 18,992 15 -50.9% 38,680

#

18 -2 39

19 16 Centerview Partners 16,720 19 -39.7% 27,711

#

19 -15 52

20 13 BNP Paribas 14,947 21 -61.1% 38,443

#

20 -14 50

#

13

Clearwater International

877

37

15

Bank of America

91,824

36

23

Oaklins

411

38

25

Daiwa Securities Group / DC Advisory

1,710

37

22

Barclays

60,928

39

16

Jamieson Corporate Finance

19,097

39

11

Lincoln International

1,511

44

19

Morgan Stanley

81,634

43

10

Jefferies

37,653

48

4

Goldman Sachs & Co

127,538

44

3

KPMG

3,427

55

7

JPMorgan

76,710

50

14

Lazard

31,854

58

12

BDO

781

57

5

Grant Thornton

1,008

65

8

EY

9,194

63

6

Deloitte

3,866

78

9

Houlihan Lokey

9,479

70

1

Rothschild & Co

80,237

133

2

PwC

14,141

99

2022

2021

Company Name

Value

(USDm)

Deal Count

https://mergermarket.com/info/

Mergermarket

Global & Regional

M&A League Tables 2022

7

EMEA Advisory League tables

Ireland league table by value Ireland league table by deal count

Ranking 2022 2021 Ranking 2021

2022 2021 Company Name

Value

(USDm)

Deal Count

% Value

Change

Value

(USDm)

2022

Count

Change

Deal Count

1 2 Citi 10,500 2 -80.6% 54,010

1

1 6 30

2 1 Goldman Sachs & Co 10,251 4 -84.1% 64,668

2

2 5 28

3 37 HSBC 6,700 1 618.9% 932

3

3 3 13

4 6 JPMorgan 5,729 3 -78.8% 27,018

4

4 -5 16

5 8 Bank of America 4,530 2 -78.9% 21,496

5

5 -4 14

6 27 Jefferies 2,090 4 13.6% 1,839

6

6 -1 9

7 25 Barclays 1,890 1 -12.8% 2,167

7

7 0 6

8 15 Jamieson Corporate Finance 1,842 5 -70.0% 6,132

8

8 -5 11

9 12 Credit Suisse 1,474 2 -81.4% 7,917

9

9 4 2

10 47 Goodbody Corporate Finance 1,378 6 234.5% 412

#

10 2 4

#

#

DACH league table by value DACH league table by deal count

Ranking 2022 2021 Ranking 2021

2022 2021 Company Name

Value

(USDm)

Deal Count

% Value

Change

Value

(USDm)

2022

Count

Change

Deal Count

1 1 Goldman Sachs & Co 105,879 44 -32.5% 156,917

1

1 -1 87

2 3 JPMorgan 75,658 37 -39.7% 125,570

2

2 -2 76

3 2 Bank of America 56,072 31 -56.1% 127,697

3

3 -21 87

4 4 Deutsche Bank 54,968 27 -43.2% 96,819

4

4 -7 68

5 10 Rothschild & Co 54,464 61 24.3% 43,813

5

5 13 42

6 20 Barclays 53,491 21 205.3% 17,520

6

6 -52 103

7 7 Citi 40,330 21 -51.5% 83,218

7

7 2 49

8 5 Morgan Stanley 37,408 20 -59.4% 92,175

8

8 -8 52

9 9 Perella Weinberg Partners 33,817 11 -32.7% 50,265

9

9 -8 45

10 13 Lazard 33,750 23 3.5% 32,594

#

10 -1 32

16

Bank of America

56,072

31

6

Goldman Sachs & Co

105,879

44

9

JPMorgan

75,658

37

1

EY

5,648

51

7

BDO

558

51

5

Rothschild & Co

54,464

61

11

Houlihan Lokey

8,496

55

4

Deloitte

3,849

74

2

KPMG

7,209

66

2022

2021

Company Name

Value

(USDm)

Deal Count

3

PwC

21,580

86

27

Benchmark International

-

6

10

JPA Brenson Lawlor

108

6

54

Mazars

13

6

11

Clearwater International

-

8

16

Goodbody Corporate Finance

1,378

6

4

IBI Corporate Finance

1,091

11

7

EY

730

10

2

KPMG

623

33

8

PwC

229

16

2022

2021

Company Name

Value

(USDm)

Deal Count

1

Deloitte

1,198

36

https://mergermarket.com/info/

Mergermarket

Global & Regional

M&A League Tables 2022

8

EMEA Advisory League tables

Germany league table by value Germany league table by deal count

Ranking 2022 2021 Ranking 2021

2022 2021 Company Name

Value

(USDm)

Deal Count

% Value

Change

Value

(USDm)

2022

Count

Change

Deal Count

1 2 Goldman Sachs & Co 50,530 26 -47.2% 95,653

1

1 -9 59

2 13 Rothschild & Co 49,463 42 83.2% 27,005

2

2 16 29

3 3 Deutsche Bank 41,519 22 -54.1% 90,523

3

3 3 42

4 18 Barclays 36,930 13 195.5% 12,499

4

4 -4 46

5 4 JPMorgan 36,479 26 -59.3% 89,731

5

5 -18 60

6 5 Morgan Stanley 34,608 18 -44.9% 62,837

6

6 -32 70

7 7 Perella Weinberg Partners 32,115 9 -31.6% 46,932

7

7 5 28

8 14 Lazard 29,307 15 20.4% 24,336

8

8 6 21

9 1 Bank of America 25,020 20 -75.3% 101,216

9

9 -8 34

10 34 PwC 18,969 50 406.2% 3,747

#

10 -3 29

11 12 BNP Paribas 16,554 15 -42.1% 28,601

#

11 -18 42

12 22 Macquarie Group 14,868 9 80.0% 8,258

#

12 -10 32

13 108 PJT Partners 13,776 6 33500.0% 41

#

13 -3 23

14 49 Evercore 13,496 6 1233.6% 1,012

#

14 -17 36

15 171 Mediobanca 10,340 4 - -

#

15 -3 21

16 6 UBS Investment Bank 8,129 11 -84.0% 50,803

#

16 -7 23

17 30 Centerview Partners 6,950 6 35.4% 5,133

#

17 -3 18

18 8 Citi 6,338 11 -85.9% 44,903

#

18 2 13

19 - Robey Warshaw 6,183 2 - -

#

19 5 10

20 21 Jamieson Corporate Finance 6,164 7 -34.8% 9,458

#

20 -9 24

#

38

Proventis Partners

2,600

15

14

UniCredit Group

509

15

21

Lazard

29,307

15

30

BNP Paribas

16,554

15

17

Morgan Stanley

34,608

18

16

IMAP M&A Consultants

114

16

15

Bank of America

25,020

20

7

Lincoln International

269

19

6

Carlsquare

540

24

9

Deutsche Bank

41,519

22

8

Goldman Sachs & Co

50,530

26

10

JPMorgan

36,479

26

12

BDO

524

33

20

Saxenhammer

24

27

2

KPMG

5,771

42

1

EY

3,007

38

5

Deloitte

629

45

4

Rothschild & Co

49,463

42

3

PwC

18,969

50

11

Houlihan Lokey

5,664

45

2022

2021

Company Name

Value

(USDm)

Deal Count

https://mergermarket.com/info/

Mergermarket

Global & Regional

M&A League Tables 2022

9

EMEA Advisory League tables

Switzerland league table by value Switzerland league table by deal count

Ranking 2022 2021 Ranking 2021

2022 2021 Company Name

Value

(USDm)

Deal Count

% Value

Change

Value

(USDm)

2022

Count

Change

Deal Count

1 2 Goldman Sachs & Co 51,960 15 4.3% 49,811

1

1 2 31

2 5 JPMorgan 36,051 9 -0.5% 36,230

2

2 5 17

3 4 Citi 29,938 10 -19.6% 37,214

3

3 0 21

4 6 Bank of America 29,198 9 -4.2% 30,493

4

4 -2 22

5 - SEB 21,137 2 - -

5

5 -7 23

6 7 Centerview Partners 20,722 2 -15.5% 24,529

6

6 -7 23

7 - BDT & Company 20,722 1 - -

7

7 2 14

8 25 Barclays 13,644 5 171.7% 5,021

8

8 5 11

9 12 Deutsche Bank 13,449 6 6.0% 12,688

9

9 0 15

10 1 Credit Suisse 11,705 13 -81.5% 63,305

#

10 -10 23

#

Austria league table by value Austria league table by deal count

Ranking 2022 2021 Ranking 2021

2022 2021 Company Name

Value

(USDm)

Deal Count

% Value

Change

Value

(USDm)

2022

Count

Change

Deal Count

1 2 Citi 4,054 1 -42.7% 7,078

1

1 -8 20

2 1 Goldman Sachs & Co 3,389 4 -71.0% 11,695

2

2 -9 19

3 5 JPMorgan 3,128 4 -44.0% 5,586

3

3 -10 17

4 4 UniCredit Group 2,961 6 -53.6% 6,387

4

4 3 4

5 8 Lazard 2,941 4 77.1% 1,661

5

5 0 6

6 38 Barclays 2,917 3 - -

6

6 1 4

7 -

Santander Corporate Investment Banking (SCIB)

2,721 2 - -

7

7= 4 1

8 - Credit Suisse 2,172 3 - -

8

7= 1 4

9 - Nomura Holdings 2,042 1 - -

9

9 0 4

10 7 Bank of America 1,854 2 -5.6% 1,965

#

10 2 2

8

Goldman Sachs & Co

3,389

4

17

JPMorgan

3,128

4

49

goetzpartners

-

5

11

MP Corporate Finance

-

5

4

UniCredit Group

2,961

6

10

Lincoln International

233

5

3

EY

1,434

7

12

PwC

-

7

1

Deloitte

350

12

2

KPMG

190

10

3

Credit Suisse

11,705

13

2022

2021

Company Name

Value

(USDm)

Deal Count

15

The Corporate Finance Group

15

16

9

Goldman Sachs & Co

51,960

15

5

Rothschild & Co

4,252

16

11

Houlihan Lokey

2,421

16

6

BDO

34

20

4

UBS Investment Bank

10,797

16

8

KPMG

1,411

22

7

Deloitte

2,870

21

2022

2021

Company Name

Value

(USDm)

Deal Count

1

PwC

2,611

33

https://mergermarket.com/info/

Mergermarket

Global & Regional

M&A League Tables 2022

10

#

EMEA Advisory League tables

France league table by value France league table by deal count

Ranking 2022 2021 Ranking 2021

2022 2021 Company Name

Value

(USDm)

Deal Count

% Value

Change

Value

(USDm)

2022

Count

Change

Deal Count

1 4 Goldman Sachs & Co 55,035 22 -46.2% 102,307

1

1 -3 150

2 3 Rothschild & Co 52,903 147 -59.6% 131,051

2

2 -2 63

3 1 BNP Paribas 48,056 61 -66.2% 142,171

3

3 10 47

4 8 JPMorgan 43,193 27 -45.7% 79,606

4

4 -11 66

5 2 Lazard 42,118 55 -68.5% 133,824

5

5 14 41

6 5 Societe Generale 36,380 32 -56.4% 83,377

6

6 -9 59

7 10 Bank of America 33,355 15 -32.8% 49,630

7

7 -14 61

8 9 Credit Agricole 32,930 29 -49.2% 64,802

8

8 2 39

9 19 Citi 27,670 13 -5.0% 29,122

9

9 -8 41

10 25 Barclays 23,970 13 32.4% 18,103

#

10 -2 34

11 6 Morgan Stanley 22,837 19 -72.5% 83,054

#

11 7 25

12 23 UBS Investment Bank 17,109 11 -17.6% 20,773

#

12 -8 39

13 12

Santander Corporate Investment Banking (SCIB)

15,076 9 -65.9% 44,245

#

13 -31 60

14 26 Nomura Holdings 14,145 15 -21.5% 18,011

#

14 -10 38

15 24

PwC 13,933 50 -23.8% 18,291

#

15 1 26

16 21 Centerview Partners 12,994 11 -41.8% 22,326

#

16 0 24

17 11 Credit Suisse 12,630 8 -73.6% 47,856

#

17 14 10

18 49 Jefferies 12,577 15 135.9% 5,332

#

18 -11 33

19 36 Evercore 11,493 10 18.2% 9,725

#

19 6 16

20 29 EY 9,883 28 -30.8% 14,274

#

20 -2 21

20

Morgan Stanley

22,837

19

15

Goldman Sachs & Co

55,035

22

30

Global M&A Partners

303

22

19

Bryan, Garnier & Co

717

24

48

Translink Corporate Finance

199

24

13

EY

9,883

28

16

JPMorgan

43,193

27

11

Clearwater International

533

31

5

Credit Agricole

32,930

29

14

Societe Generale

36,380

32

32

16

Oaklins

18

12

Cambon Partners

618

41

10

Lincoln International

1,099

33

6

PwC

13,933

50

4

KPMG

1,954

47

2

Lazard

42,118

55

9

Deloitte

5,968

55

3

BNP Paribas

48,056

61

8

Natixis

9,650

57

2022

2021

Company Name

Value

(USDm)

Deal Count

1

Rothschild & Co

52,903

147

https://mergermarket.com/info/

Mergermarket

Global & Regional

M&A League Tables 2022

11

#

EMEA Advisory League tables

Benelux league table by value Benelux league table by deal count

Ranking 2022 2021 Ranking 2021

2022 2021 Company Name

Value

(USDm)

Deal Count

% Value

Change

Value

(USDm)

2022

Count

Change

Deal Count

1 1 Goldman Sachs & Co 76,752 26 -2.5% 78,749

1

1 -1 68

2 3 JPMorgan 71,713 18 93.9% 36,987

2

2 23 37

3 4 Rothschild & Co 51,991 43 93.8% 26,828

3

3 -15 58

4 18 BNP Paribas 41,881 17 612.7% 5,876

4

4 -21 64

5 2 Morgan Stanley 37,940 16 -50.7% 77,010

5

5 -27 67

6 12 Bank of America 31,799 9 260.5% 8,820

6

6 -31 69

7 65 Centerview Partners 31,647 4 5088.0% 610

7

7 19 16

8 10 Deutsche Bank 27,308 4 111.2% 12,930

8

8 -17 47

9 73 RBC Capital Markets 25,015 3 6887.4% 358

9

9 4 22

10 - Eastdil Secured 24,734 2 - -

#

10 2 23

#

Iberia league table by value Iberia league table by deal count

Ranking 2022 2021 Ranking 2021

2022 2021 Company Name

Value

(USDm)

Deal Count

% Value

Change

Value

(USDm)

2022

Count

Change

Deal Count

1 1 PwC 26,008 143 -13.3% 30,001

1

1 56 97

2 2 JPMorgan 23,338 14 -18.5% 28,643

2

2 19 124

3 6 Bank of America 20,218 15 -8.3% 22,041

3

3 -3 48

4 4

Goldman Sachs & Co 18,875 9 -18.7% 23,214

4

4 -15 56

5 5 Lazard 16,271 15 -26.4% 22,096

5

5

BDO

6 22

6 3 Citi 15,377 11 -37.6% 24,645

6

6 6 16

7 10

Santander Corporate Investment Banking (SCIB)

15,145 21 -1.8% 15,428

7

7

Santander Corporate Investment Banking (SCIB)

-6 27

8 9 BNP Paribas 14,516 11 -24.7% 19,277

8

8 3 17

9 7 Deloitte 13,723 153 -37.6% 21,987

9

9 7 11

10 30

Evercore 13,198 7 437.2% 2,457

#

10 1 17

22

Oaklins

138

18

11

Norgestion

18

18

5

15,145

21

10

Arcano Partners

576

20

6

352

28

12

Rothschild & Co

10,106

22

4

EY

10,402

45

3

KPMG

7,478

41

2

Deloitte

13,723

153

1

PwC

26,008

143

12

Oaklins

3,019

25

2022

2021

Company Name

Value

(USDm)

Deal Count

6

Rabobank

5,921

30

13

Goldman Sachs & Co

76,752

26

1

PwC

1,986

38

21

BDO

39

35

4

KPMG

614

43

3

EY

579

40

8

GCG

73

60

5

Rothschild & Co

51,991

43

2022

2021

Company Name

Value

(USDm)

Deal Count

2

Deloitte

1,975

67

https://mergermarket.com/info/

Mergermarket

Global & Regional

M&A League Tables 2022

12

#

EMEA Advisory League tables

Spain league table by value Spain league table by deal count

Ranking 2022 2021 Ranking 2021

2022 2021 Company Name

Value

(USDm)

Deal Count

% Value

Change

Value

(USDm)

2022

Count

Change

Deal Count

1 1 PwC 25,182 138 -15.1% 29,667

1

1 59 81

2 2 JPMorgan 22,638 13 -17.6% 27,469

2

2 23 115

3 4 Bank of America 19,808 13 -10.1% 22,041

3

3 -5 43

4 7 Goldman Sachs & Co 18,875 9 -9.3% 20,816

4

4 -13 51

5 6 Lazard 16,165 14 -25.7% 21,747

5

5 6 22

6 3 Citi 15,377 11 -37.6% 24,645

6

6 -5 25

7 10

Santander Corporate Investment Banking (SCIB)

14,759 20 -4.3% 15,428

7

7 4 16

8 9 BNP Paribas 13,921 9 -27.8% 19,277

8

8 3 17

9 5 Deloitte 13,683 140 -37.3% 21,837

9

9 0 17

10 31

Evercore 13,198 6 526.1% 2,108

#

10 0 14

11 15 EY 10,402 38 9.6% 9,489

#

11 -4 17

12 14 Rothschild & Co 9,719 20 -5.3% 10,268

#

12 -1 14

13 8 Morgan Stanley 7,853 8 -61.6% 20,431

#

13 2 11

14 24 KPMG 7,242 38 89.6% 3,819

#

14 -5 17

15 27 Banco Bilbao Vizcaya Argentaria 4,856 9 71.4% 2,833

#

15 -1 12

16 18 Barclays 4,580 7 -39.6% 7,583

#

16 1 9

17 57 Deutsche Bank 4,384 7 826.8% 473

#

17 6 4

18 66 PJT Partners 4,301 4 1310.2% 305

#

18 3 7

19 77 Perella Weinberg Partners 4,271 2 1983.4% 205

#

19 1 8

20 39 Liberty Corporate Finance 3,492 5 162.2% 1,332

#

20 -3 12

#

17

BNP Paribas

13,921

9

31

Baker Tilly International

-

10

25

Goldman Sachs & Co

18,875

9

23

Oaklins

94

10

49

Translink Corporate Finance

75

10

8

AZ Capital

2,331

12

16

Citi

15,377

11

14

Bank of America

19,808

13

19

Houlihan Lokey

1,527

13

15

Lazard

16,165

14

7

JPMorgan

22,638

13

9

Arcano Partners

576

20

10

Norgestion

18

17

5

Santander Corporate Investment Banking (SCIB)

14,759

20

11

Rothschild & Co

9,719

20

3

KPMG

7,242

38

6

BDO

352

28

1

PwC

25,182

138

4

EY

10,402

38

2022

2021

Company Name

Value

(USDm)

Deal Count

2

Deloitte

13,683

140

https://mergermarket.com/info/

Mergermarket

Global & Regional

M&A League Tables 2022

13

EMEA Advisory League tables

Italy league table by value Italy league table by deal count

Ranking 2022 2021 Ranking 2021

2022 2021 Company Name

Value

(USDm)

Deal Count

% Value

Change

Value

(USDm)

2022

Count

Change

Deal Count

1 4 Goldman Sachs & Co 63,725 15 43.9% 44,276

1

1 5 101

2 17 Morgan Stanley 62,482 13 413.3% 12,173

2

2 -24 112

3 2 JPMorgan 62,108 16 16.0% 53,522

3

3 3 70

4 7 Bank of America 62,012 11 93.4% 32,057

4

4 13 52

5 11 Citi 61,075 16 112.4% 28,755

5

5 23 16

6 16 BNP Paribas 60,065 22 391.0% 12,233

6

6 -16 51

7 6 UniCredit Group 59,193 20 74.8% 33,861

7

7 -19 49

8 1 Mediobanca 57,707 35 -1.6% 58,625

8

8 2 21

9 9 Lazard 55,545 23 81.3% 30,643

9

9 1 21

10 109

Santander Corporate Investment Banking (SCIB)

54,806 7 - -

#

10 -2 24

11 19 UBS Investment Bank 53,832 13 489.8% 9,127

#

11 -1 21

12 8 EQUITA S.I.M 49,328 14 58.2% 31,180

#

12 5 15

13 18 IMI - Intesa Sanpaolo 16,089 22 32.5% 12,145

#

13 6 12

14 3 Rothschild & Co 15,302 30 -69.9% 50,788

#

14 -5 21

15 5 KPMG 11,683 106 -73.2% 43,656

#

15 9 7

16 26 PwC 11,493 73 146.7% 4,658

#

16 2 13

17 28 EY 10,413 65 178.3% 3,741

#

17 -5 19

18 21 Nomura Holdings 7,341 9 4.0% 7,056

#

18 0 14

19 24 Barclays 6,920 6 14.0% 6,072

#

19 2 11

20 15 Deloitte 6,654 88 -45.8% 12,276

#

20 3 10

#

#

23

Morgan Stanley

62,482

13

25

UBS Investment Bank

53,832

13

12

EQUITA S.I.M

49,328

14

19

Fineurop Soditic

26

14

28

Citi

61,075

16

21

Goldman Sachs & Co

63,725

15

22

Houlihan Lokey

2,385

18

8

JPMorgan

62,108

16

9

UniCredit Group

59,193

20

17

Ethica Group

1,498

20

11

BNP Paribas

60,065

22

7

IMI - Intesa Sanpaolo

16,089

22

6

Rothschild & Co

15,302

30

10

Lazard

55,545

23

15

Vitale & Co

3,456

39

5

Mediobanca

57,707

35

3

PwC

11,493

73

4

EY

10,413

65

2

KPMG

11,683

106

1

Deloitte

6,654

88

2022

2021

Company Name

Value

(USDm)

Deal Count

https://mergermarket.com/info/

Mergermarket

Global & Regional

M&A League Tables 2022

14

EMEA Advisory League tables

Nordics league table by value Nordics league table by deal count

Ranking 2022 2021 Ranking 2021

2022 2021 Company Name

Value

(USDm)

Deal Count

% Value

Change

Value

(USDm)

2022

Count

Change

Deal Count

1 1 Goldman Sachs & Co 62,235 29 -46.9% 117,311

1

1 -12 127

2 13 Bank of America 32,377 18 45.2% 22,292

2

2 -50 124

3 7 Citi 31,343 12 -16.1% 37,379

3

3 -48 119

4 9 SEB 27,752 29 -8.2% 30,231

4

4 -21 67

5 3 JPMorgan 22,270 21 -55.5% 50,101

5

5 9 34

6 17 Danske Bank 19,672 28 -2.2% 20,112

6

6 -13 55

7 2 Morgan Stanley 18,066 12 -76.9% 78,162

7

7 -10 48

8 15 Nordea 16,571 17 -20.0% 20,724

8

8 3 31

9 24 DNB Bank 12,734 31 9.4% 11,645

9

9 1 30

10 - Gordon Dyal & Co 12,362 2 - -

#

10 -13 42

11 28 ABG Sundal Collier Holding 10,257 34 17.5% 8,726

#

11 -3 32

12 18 Lazard 10,127 15 -39.5% 16,733

#

12 -14 42

13 20 Jamieson Corporate Finance 7,694 6 -49.5% 15,223

#

13 6 20

14 14 Carnegie Investment Bank 7,279 38 -66.5% 21,740

#

14 -10 33

15 43 Nomura Holdings 6,231 6 56.6% 3,980

#

15 -11 32

16 11 Jefferies 6,147 14 -74.0% 23,632

#

16 2 19

17 35 BNP Paribas 6,108 7 5.2% 5,806

#

17 -3 24

18 4 Barclays 6,106 88 -87.0% 47,115

#

18 -34 54

19 26 Houlihan Lokey 5,249 26 -48.6% 10,213

#

19 -6 25

20 68 FIH Partners 5,174 8 292.0% 1,320

#

20 6 12

#

#

39

Bank of America

32,377

18

6

Rothschild & Co

3,650

20

17

Nordhaven Corporate Finance

155

19

25

MCF Corporate Finance

126

21

18

Translink Corporate Finance

19

21

11

Oaklins

251

23

12

JPMorgan

22,270

21

9

Danske Bank

19,672

28

23

Houlihan Lokey

5,249

26

8

Goldman Sachs & Co

62,235

29

13

SEB

27,752

29

15

ABG Sundal Collier Holding

10,257

34

16

DNB Bank

12,734

31

5

Clearwater International

667

42

7

Carnegie Investment Bank

7,279

38

4

KPMG

381

46

10

BDO

961

43

2

EY

2,287

74

3

Deloitte

1,035

71

2022

2021

Company Name

Value

(USDm)

Deal Count

1

PwC

4,029

115

https://mergermarket.com/info/

Mergermarket

Global & Regional

M&A League Tables 2022

15

EMEA Advisory League tables

Denmark league table by value Denmark league table by deal count

Ranking 2022 2021 Ranking 2021

2022 2021 Company Name

Value

(USDm)

Deal Count

% Value

Change

Value

(USDm)

2022

Count

Change

Deal Count

1 4 Goldman Sachs & Co 14,362 4 51.8% 9,463

1

1 -2 34

2 10 Nordea 13,614 8 195.6% 4,605

2

2 1 29

3 5 Danske Bank 12,639 12 56.0% 8,102

3

3 -23 49

4 - Gordon Dyal & Co 12,362 2 - -

4

4 -11 35

5 - Nomura Holdings 5,353 3 - -

5

5 1 13

6 24 FIH Partners 5,174 7 292.0% 1,320

6

6 -3 15

7 2 JPMorgan 4,324 5 -61.0% 11,081

7

7 4 6

8 33 Citi 4,088 3 959.1% 386

8

8 -1 11

9 88 Credit Agricole 3,936 1 - -

9

9 6 3

10 11 Bank of America 3,287 4 -23.5% 4,295

#

10 0 9

#

Norway league table by value Norway league table by deal count

Ranking 2022 2021 Ranking 2021

2022 2021 Company Name

Value

(USDm)

Deal Count

% Value

Change

Value

(USDm)

2022

Count

Change

Deal Count

1 4 DNB Bank 12,548 26 30.5% 9,617

1

1 9 19

2 10 ABG Sundal Collier Holding 10,175 28 104.0% 4,987

2

2 4 22

3 14 Danske Bank 6,067 14 105.0% 2,960

3

3 0 21

4 126 Lazard 5,138 2 - -

4

4 -6 23

5 11 Carnegie Investment Bank 4,488 12 -7.0% 4,827

5

5 -8 24

6 7 Arctic Securities 4,384 14 -38.0% 7,066

6

6 -5 19

7 1 SEB 3,474 14 -74.2% 13,490

7

7 -2 16

8 60 Alpha Corporate Finance 1,676 14 1496.2% 105

8

8 8 6

9 40 Swedbank 1,657 2 292.7% 422

9

9 3 11

10 3 Goldman Sachs & Co 1,401 1 -88.0% 11,690

#

10 6 8

17

BDO

67

14

21

SEB

3,474

14

14

Alpha Corporate Finance

1,676

14

7

Danske Bank

6,067

14

9

Arctic Securities

4,384

14

2

PwC

878

17

1

EY

68

16

3

DNB Bank

12,548

26

4

Deloitte

492

21

2022

2021

Company Name

Value

(USDm)

Deal Count

6

ABG Sundal Collier Holding

10,175

28

39

Houlihan Lokey

1,150

9

11

Carnegie Investment Bank

745

9

20

ABG Sundal Collier Holding

558

10

10

BDO

-

10

7

KPMG

52

14

5

Danske Bank

12,639

12

1

Deloitte

454

26

2

EY

850

24

3

PwC

2,142

32

4

Clearwater International

345

30

2022

2021

Company Name

Value

(USDm)

Deal Count

https://mergermarket.com/info/

Mergermarket

Global & Regional

M&A League Tables 2022

16

#

EMEA Advisory League tables

Sweden league table by value Sweden league table by deal count

Ranking 2022 2021 Ranking 2021

2022 2021 Company Name

Value

(USDm)

Deal Count

% Value

Change

Value

(USDm)

2022

Count

Change

Deal Count

1 1 Goldman Sachs & Co 44,445 20 -53.7% 95,979

1

1 2 68

2 6 Citi 28,429 9 -13.5% 32,863

2

2 -27 68

3 15 Bank of America 27,504 11 71.7% 16,017

3

3 -28 61

4 7 SEB 24,950 18 -13.1% 28,706

4

4 2 20

5 5 JPMorgan 16,637 11 -51.9% 34,562

5

5 -8 29

6 2 Morgan Stanley 15,966 10 -73.1% 59,364

6

6 -7 27

7 24 Jamieson Corporate Finance 4,787 4 -39.6% 7,926

7

7 -11 31

8 153 BNP Paribas 4,784 3 - -

8

8 -6 24

9 11 Jefferies 4,774 7 -78.2% 21,875

9

9 -19 36

10 3 Barclays 4,604 5 -89.6% 44,414

#

10 7 9

#

#

Finland league table by value Finland league table by deal count

Ranking 2022 2021 Ranking 2021

2022 2021 Company Name

Value

(USDm)

Deal Count

% Value

Change

Value

(USDm)

2022

Count

Change

Deal Count

1 8 Bank of America 2,185 6 -13.1% 2,515

1

1 5 18

2 1 Goldman Sachs & Co 2,027 5 -81.8% 11,133

2

2 0 12

3 3 Danske Bank 1,948 6 -68.2% 6,131

3

3 -6 16

4 7 Nordea 1,655 4 -37.7% 2,656

4

4 -3 13

5 39 BNP Paribas 1,324 3 959.2% 125

5

5 3 5

6 25 Lazard 1,224 2 84.9% 662

6

6 6 1

7 5 Daiwa Securities Group / DC Advisory 1,141 1 -76.3% 4,809

7

7 0 7

8= - Nielen Schuman 1,064 1 - -

8

8 4 2

8= 93 Stifel/KBW 1,064 1 - -

9

9 1 5

10 77 Carnegie Investment Bank 923 7 - -

#

10 2 4

15

Danske Bank

1,948

28

Bank of America

2,185

6

23

Initia Corporate Finance

189

6

6

77

Carnegie Investment Bank

923

7

9

Translink Corporate Finance

-

7

4

MCF Corporate Finance

11

10

16

BDO

28

8

5

Nordhaven Corporate Finance

155

12

3

KPMG

182

10

2022

2021

Company Name

Value

(USDm)

Deal Count

2

PwC

367

23

4

Clearwater International

375

17

29

MCF Corporate Finance

115

16

5

Carnegie Investment Bank

2,150

20

9

SEB

24,950

18

6

KPMG

226

21

7

Goldman Sachs & Co

44,445

20

3

Deloitte

133

33

13

BDO

889

22

2

PwC

1,744

70

1

EY

1,355

41

2022

2021

Company Name

Value

(USDm)

Deal Count

https://mergermarket.com/info/

Mergermarket

Global & Regional

M&A League Tables 2022

17

EMEA Advisory League tables

CEE league table by value CEE league table by deal count

Ranking 2022 2021 Ranking 2021

2022 2021 Company Name

Value

(USDm)

Deal Count

% Value

Change

Value

(USDm)

2022

Count

Change

Deal Count

1 18 Rothschild & Co 14,273 24 569.8% 2,131

1

1 -4 44

2 3 Citi 11,290 5 0.5% 11,231

2

2 -10 41

3 33 Aspring Capital 6,122 2 531.1% 970

3

3 -10 39

4 1 JPMorgan 4,627 6 -78.0% 21,025

4

4 9 15

5 10 Morgan Stanley 3,744 4 -33.3% 5,612

5

5 -27 45

6 8 UniCredit Group 3,041 13 -51.4% 6,255

6

6 10 6

7 20 Barclays 2,614 3 28.5% 2,034

7

7 2 13

8 16

Santander Corporate Investment Banking (SCIB)

2,588 8 -1.4% 2,624

8

8 -1 14

9 6 Goldman Sachs & Co 1,995 2 -78.1% 9,112

9

9 10 0

10 17 Lazard 1,861 6 -13.0% 2,140

#

10 -1 9

11 57 Raiffeisen Bank International 1,754 5 833.0% 188

#

11 -3 11

12 2 Bank of America 1,754 2 -88.1% 14,794

#

12 7 1

13 13 Credit Suisse 1,667 2 -60.0% 4,170

#

13 4 4

14= - Bank of China 1,667 1 - -

#

14 -9 15

14= 27 Societe Generale 1,667 1 1.9% 1,636

#

15 4 2

16 31

Scotiabank 1,340 2 26.4% 1,060

#

16 -3 9

17 14

PwC

1,333 29 -56.7% 3,078

#

17 -5 10

18 19 Deloitte 1,112 40 -46.8% 2,089

#

18 1 4

19 12 KPMG 766 31 -82.0% 4,253

#

19 0 5

20 9 BNP Paribas 686 8 -88.1% 5,765

#

20 -1 6

#

21

Mazars

-

5

31

Raiffeisen Bank International

1,754

5

24

Porta Finance

14

5

16

Superia

-

6

13

Citi

11,290

5

6

JPMorgan

4,627

6

48

Lazard

1,861

6

152

GRUBISIC & Partners

81

8

36

Grant Thornton

-

8

15

Santander Corporate Investment Banking (SCIB)

2,588

8

12

BNP Paribas

686

8

8

UniCredit Group

3,041

13

-

DLA Piper Business Advisory

-

10

22

Clairfield International

170

16

10

Oaklins

27

15

7

Rothschild & Co

14,273

24

1

EY

658

18

3

KPMG

766

31

4

PwC

1,333

29

2022

2021

Company Name

Value

(USDm)

Deal Count

2

Deloitte

1,112

40

https://mergermarket.com/info/

Mergermarket

Global & Regional

M&A League Tables 2022

18

EMEA Advisory League tables

Poland league table by value Poland league table by deal count

Ranking 2022 2021 Ranking 2021

2022 2021 Company Name

Value

(USDm)

Deal Count

% Value

Change

Value

(USDm)

2022

Count

Change

Deal Count

1 18 Rothschild & Co 11,994 15 2313.3% 497

1

1 8 7

2 - Citi 10,213 2 - -

2

2 -4 17

3 9 PwC 1,131 13 -42.5% 1,968

3

3 6 5

4 5

Santander Corporate Investment Banking (SCIB)

726 6 -72.3% 2,624

4

4 -5 15

5 2

BNP Paribas 686 6 -83.4% 4,129

5

5 4 4

6 6 Lazard 505 2 -76.4% 2,140

6

6 6 2

7 - Greenhill & Co 477 1 - -

7

7 -2 8

8= - Nomura Holdings 342 1 - -

8

8 0 6

8= - Relay Corporate Finance 342 1 - -

9

9 -9 13

10 26 Baker Tilly International 308 2 118.4% 141

#

10 3 1

Turkey league table by value Turkey league table by deal count

Ranking 2022 2021 Ranking 2021

2022 2021 Company Name

Value

(USDm)

Deal Count

% Value

Change

Value

(USDm)

2022

Count

Change

Deal Count

1 - KPMG 3,201 4 - -

1

1 0 6

2 - Morgan Stanley 3,187 1 - -

2

2 1 4

3 - JPMorgan 1,851 4 - -

3

3 3 2

4 2 Bank of America 1,200 1 -47.1% 2,268

4

4 3 2

5 39 Deloitte 782 4 - -

5

5 4 0

6= - Appolonia Advisors 676 1 - -

6

6 4 0

6= - EarlyBirdCapital 676 1 - -

7

7 3 1

6= - Moelis & Company 676 1 - -

8

8 -3 7

6= - UBS Investment Bank 676 1 - -

9

9 1 -8 10

10 13 EY 326 2 56.7% 208

#

10 0 2

#

18

Barclays

319

2

2

Pragma Corporate Finance

68

4

EY

326

2

-

JPMorgan

1,851

4

39

Deloitte

782

4

24

Ventura Partners

57

5

-

KPMG

3,201

4

7

Raiffeisen Bank International

314

5

23

Unlu Yatirim Holding

159

5

2022

2021

Company Name

Value

(USDm)

Deal Count

5

PwC

160

6

66

Excalibur Capital

-

4

7

BNP Paribas

686

6

3

EY

26

4

27

Grant Thornton

-

8

4

Santander Corporate Investment Banking (SCIB)

726

6

2

Deloitte

165

10

12

KPMG

121

8

1

PwC

1,131

13

9

Clairfield International

170

11

2022

2021

Company Name

Value

(USDm)

Deal Count

6

Rothschild & Co

11,994

15

https://mergermarket.com/info/

Mergermarket

Global & Regional

M&A League Tables 2022

19

EMEA Advisory League tables

MEA league table by value MEA league table by deal count

Ranking 2022 2021 Ranking 2021

2022 2021 Company Name

Value

(USDm)

Deal Count

% Value

Change

Value

(USDm)

2022

Count

Change

Deal Count

1 3 JPMorgan 41,574 20 -22.2% 53,449

1

1 -3 37

2 10 Citi 35,016 21 53.4% 22,830

2

2 3 28

3 1 Goldman Sachs & Co 33,992 24 -68.3% 107,082

3

3 15 12

4 2 Morgan Stanley 24,068 12 -68.0% 75,269

4

4 2 22

5 13 Rothschild & Co 18,143 34 42.8% 12,706

5

5 1 20

6 7 Standard Chartered 15,084 12 -51.6% 31,180

6

6 -8 28

7 40 Deutsche Bank 12,268 7 510.3% 2,010

7

7 5 14

8 5 Bank of America 10,579 14 -72.9% 39,098

8

8 -4 18

9 6 HSBC 8,926 7 -74.8% 35,433

9

9 -5 17

10 15 Credit Suisse 8,899 6 9.8% 8,104

#

10 4 8

11 12 Jefferies 7,743 11 -43.4% 13,675

#

11 0 11

12 16 UBS Investment Bank 7,743 4 -2.6% 7,947

#

12 5 6

13 9 EY 7,077 31 -76.0% 29,536

#

13 -2 12

14 19 Standard Bank Group 6,860 10 4.7% 6,553

#

14 3 7

15 24 BDO 6,049 4 51.6% 3,989

#

15 6 3

16 11 Lazard 5,998 10 -56.5% 13,776

#

16 -3 12

17 4 BNP Paribas 5,714 8 -89.1% 52,428

#

17 1 7

18 - Riyad Capital 5,395 1 - -

#

18 6 2

19 18 Nomura Holdings 5,394 3 -23.2% 7,022

#

19 4 4

20 50 Centerview Partners 5,383 3 258.9% 1,500

#

20 5 2

34

Investec

694

8

57

Deutsche Bank

12,268

7

18

BNP Paribas

5,714

8

79

Houlihan Lokey

889

8

47

Stifel/KBW

1,497

9

11

KPMG

568

9

10

Standard Bank Group

6,860

10

19

Lazard

5,998

10

13

Jefferies

7,743

11

23

Moelis & Company

4,034

11

7

Morgan Stanley

24,068

12

16

Standard Chartered

15,084

12

8

Deloitte

777

19

6

Bank of America

10,579

14

5

Citi

35,016

21

2

JPMorgan

41,574

20

12

PwC

2,078

27

4

Goldman Sachs & Co

33,992

24

1

Rothschild & Co

18,143

34

3

EY

7,077

31

2022

2021

Company Name

Value

(USDm)

Deal Count

https://mergermarket.com/info/

Mergermarket

Global & Regional

M&A League Tables 2022

20

#

Americas Advisory League tables

Americas league table by value Americas league table by deal count

Ranking 2022 2021 Ranking 2021

2022 2021 Company Name

Value

(USDm)

Deal Count

% Value

Change

Value

(USDm)

2022

Count

Change

Deal Count

1 1 Goldman Sachs & Co 876,850 278 -38.0% 1,413,985

1

1 -203 481

2 2 JPMorgan 668,147 253 -39.2% 1,098,667

2

2 -196 449

3 3 Morgan Stanley 615,214 177 -37.6% 985,588

3

3 -96 334

4 4 Bank of America 456,053 201 -39.2% 749,942

4

4 -62 263

5 5 Citi 403,093 126 -44.2% 722,997

5

5 -102 285

6 6 Barclays 362,155 141 -38.1% 584,989

6

6 -138 315

7 8 Credit Suisse 230,776 75 -32.8% 343,365

7

7 -7 177

8 7 Evercore 196,945 158 -50.3% 396,244

8

8 -31 189

9 23 RBC Capital Markets 166,618 134 37.2% 121,440

9

9 -53 209

10 15 Wells Fargo Securities 159,477 49 -1.5% 161,825

#

10 -21 177

11 19 Allen & Company 159,381 12 16.6% 136,645

#

11 -83 224

12 9 Lazard 140,379 130 -54.3% 307,394

#

12 -62 201

13 36

Santander Corporate Investment Banking (SCIB)

131,201 41 140.9% 54,455

#

13 -14 148

14 11 UBS Investment Bank 129,101 80 -37.4% 206,384

#

14 -47 181

15 12 Centerview Partners 125,250 74 -39.1% 205,644

#

15 -80 212

16 10 Jefferies 125,227 183 -45.6% 230,261

#

16 -40 171

17 18 BNP Paribas 101,145 46 -30.6% 145,831

#

17 -65 195

18 14 Rothschild & Co 97,774 134 -46.1% 181,464

#

18 -125 251

19 17 Perella Weinberg Partners 88,955 67 -41.4% 151,869

#

19 -94 212

20 26 PJT Partners 85,402 48 -13.3% 98,526

#

20 -88 192

#

15

Robert W. Baird & Co

27,627

104

7

Citi

403,093

126

9

William Blair & Company

23,658

118

22

PwC

35,246

131

14

Lazard

140,379

130

18

Rothschild & Co

97,774

134

10

Raymond James

10,506

132

12

Stifel/KBW

25,664

139

24

RBC Capital Markets

166,618

134

5

Jefferies

125,227

183

21

Lincoln International

12,574

156

8

Barclays

362,155

141

16

Evercore

196,945

158

11

Piper Sandler & Co

28,204

156

2022

2021

Company Name

Value

(USDm)

Deal Count

1

Goldman Sachs & Co

876,850

278

2

JPMorgan

668,147

253

3

Houlihan Lokey

33,157

238

4

Morgan Stanley

615,214

177

20

Deloitte

19,731

170

6

Bank of America

456,053

201

https://mergermarket.com/info/

Mergermarket

Global & Regional

M&A League Tables 2022

21

Americas Advisory League tables

US league table by value US league table by deal count

Ranking 2022 2021 Ranking 2021

2022 2021 Company Name

Value

(USDm)

Deal Count

% Value

Change

Value

(USDm)

2022

Count

Change

Deal Count

1 1 Goldman Sachs & Co 852,973 262 -38.5% 1,386,714

1

1 -196 458

2 2 JPMorgan 619,797 224 -41.3% 1,056,474

2

2 -95 325

3 3 Morgan Stanley 594,941 157 -37.9% 957,524

3

3 -198 422

4 5 Bank of America 441,227 171 -35.0% 679,331

4

4 -103 281

5 4 Citi 377,988 111 -44.5% 681,321

5

5 -68 239

6 6 Barclays 335,899 133 -35.3% 518,942

6

6 -136 293

7 8 Credit Suisse 220,686 64 -33.3% 330,986

7

7 -55 208

8 7 Evercore 192,024 144 -51.2% 393,497

8

8 -18 170

9 19 Allen & Company 159,381 12 16.6% 136,645

9

9 -41 185

10 14 Wells Fargo Securities 158,700 48 -1.9% 161,825

#

10 -76 209

11 23 RBC Capital Markets 135,895 105 30.8% 103,891

#

11 -72 201

12 9 Lazard 131,542 111 -53.4% 282,068

#

12 -9 132

13 11 Centerview Partners 125,250 74 -39.1% 205,644

#

13 -59 181

14 37

Santander Corporate Investment Banking (SCIB)

124,915 13 178.8% 44,807

#

14 -94 210

15 13 UBS Investment Bank 116,933 62 -37.7% 187,706

#

15 -111 222

16 10 Jefferies 116,368 178 -48.8% 227,398

#

16 -66 177

17 18 BNP Paribas 98,376 36 -30.3% 141,065

#

17 -12 117

18 17 Perella Weinberg Partners 85,605 62 -43.6% 151,830

#

18 -88 192

19 26 PJT Partners 84,806 46 -13.4% 97,966

#

19 -77 177

20 12 Deutsche Bank 77,011 56 -59.2% 188,979

#

20 -28 128

#

17

Moelis & Company

56,785

100

22

PwC

34,046

100

23

RBC Capital Markets

135,895

105

12

Robert W. Baird & Co

27,627

104

7

Citi

377,988

111

16

Lazard

131,542

111

14

Stifel/KBW

19,521

122

8

William Blair & Company

23,486

116

11

Raymond James

10,405

129

21

Deloitte

15,639

123

13

Evercore

192,024

144

9

Barclays

335,899

133

10

Piper Sandler & Co

27,914

153

18

Lincoln International

12,562

152

6

Bank of America

441,227

171

4

Morgan Stanley

594,941

157

2

JPMorgan

619,797

224

5

Jefferies

116,368

178

1

Goldman Sachs & Co

852,973

262

3

Houlihan Lokey

32,530

230

2022

2021

Company Name

Value

(USDm)

Deal Count

https://mergermarket.com/info/

Mergermarket

Global & Regional

M&A League Tables 2022

22

Americas Advisory League tables

US North East league table by value US North East league table by deal count

Ranking 2022 2021 Ranking 2021

2022 2021 Company Name

Value

(USDm)

Deal Count

% Value

Change

Value

(USDm)

2022

Count

Change

Deal Count

1 1 Goldman Sachs & Co 375,932 132 -50.7% 762,382

1

1 -124 256

2 2 JPMorgan 305,117 118 -49.9% 608,465

2

2 -112 230

3 4 Bank of America 202,146 82 -42.7% 352,922

3

3 -77 194

4 3 Morgan Stanley 200,827 76 -56.6% 462,586

4

4 -60 153

5 5 Citi 160,458 51 -48.8% 313,358

5

5 -53 135

6 6 Barclays 132,489 72 -57.4% 311,214

6

6 -23 104

7 7 Evercore 102,797 80 -52.2% 215,082

7

7 -36 116

8 16 UBS Investment Bank 94,362 41 5.5% 89,469

8

8 -93 169

9 21 BNP Paribas 90,036 21 35.7% 66,352

9

9 -4 77

10 8 Credit Suisse 84,991 32 -51.8% 176,458

#

10 -45 117

#

#

US Mid West league table by value US Mid West league table by deal count

Ranking 2022 2021 Ranking 2021

2022 2021 Company Name

Value

(USDm)

Deal Count

% Value

Change

Value

(USDm)

2022

Count

Change

Deal Count

1 1 Goldman Sachs & Co 176,359 64 -44.3% 316,896

1

1 4 61

2 3 JPMorgan 142,675 51 -21.6% 181,875

2

2 -25 89

3 2 Morgan Stanley 112,204 38 -47.9% 215,294

3

3 -33 86

4 7 Citi 103,377 22 -9.1% 113,746

4

4 -37 88

5 4 Bank of America 69,945 37 -58.4% 168,283

5

5 -15 64

6 5 Barclays 57,515 29 -54.0% 125,064

6

6 -17 55

7 8 Evercore 55,574 32 -25.6% 74,731

7

7 -33 71

8 23 Guggenheim Partners 48,437 18 239.8% 14,253

8

8 -13 50

9 13 Credit Suisse 40,271 11 8.2% 37,225

9

9 -11 48

10 9 Jefferies 36,587 35 -37.5% 58,525

#

10 -13 49

13

Raymond James

2,755

37

12

Stifel/KBW

2,368

36

4

William Blair & Company

11,013

38

11

Bank of America

69,945

37

6

Piper Sandler & Co

15,147

49

10

Morgan Stanley

112,204

38

3

Houlihan Lokey

12,219

53

2

JPMorgan

142,675

51

8

Lincoln International

3,829

65

1

Goldman Sachs & Co

176,359

64

8

Barclays

132,489

72

2022

2021

Company Name

Value

(USDm)

Deal Count

4

Morgan Stanley

200,827

76

19

Lincoln International

5,969

73

12

Piper Sandler & Co

7,989

81

10

Evercore

102,797

80

5

Jefferies

72,593

93

6

Bank of America

202,146

82

2

JPMorgan

305,117

118

3

Houlihan Lokey

20,961

117

2022

2021

Company Name

Value

(USDm)

Deal Count

1

Goldman Sachs & Co

375,932

132

https://mergermarket.com/info/

Mergermarket

Global & Regional

M&A League Tables 2022

23

#

Americas Advisory League tables

US South league table by value US South league table by deal count

Ranking 2022 2021 Ranking 2021

2022 2021 Company Name

Value

(USDm)

Deal Count

% Value

Change

Value

(USDm)

2022

Count

Change

Deal Count

1 1 Goldman Sachs & Co 204,969 89 -56.3% 469,514

1

1 -54 147

2 2 JPMorgan 165,630 93 -59.3% 407,229

2

2 -40 131

3 4 Morgan Stanley 131,087 52 -49.5% 259,781

3

3 -67 156

4 5 Barclays 118,145 56 -52.6% 249,146

4

4 -43 130

5 6 Bank of America 115,625 70 -52.5% 243,207

5

5 -13 92

6 3 Citi 107,274 48 -60.4% 271,222

6

6 -22 92

7 11 Evercore 92,508 68 2.0% 90,687

7

7 -4 72

8 7 Credit Suisse 84,299 31 -37.8% 135,491

8

8 -2 70

9 21 RBC Capital Markets 72,168 59 47.4% 48,977

9

9 -43 104

10 14 Jefferies 68,323 87 -6.9% 73,420

#

10 -44 104

#

#

US West league table by value US West league table by deal count

Ranking 2022 2021 Ranking 2021

2022 2021 Company Name

Value

(USDm)

Deal Count

% Value

Change

Value

(USDm)

2022

Count

Change

Deal Count

1 1 Goldman Sachs & Co 425,432 98 -28.7% 597,021

1

1 -88 186

2 2 Morgan Stanley 349,536 58 -29.8% 497,820

2

2 -24 116

3 3 JPMorgan 259,469 67 -47.4% 493,278

3

3 -45 117

4 5 Bank of America 214,818 66 -34.5% 328,113

4

4 -112 179

5 4 Citi 206,940 43 -37.1% 328,797

5

5 -27 93

6 6 Barclays 180,705 36 -21.6% 230,417

6

6 -63 121

7 22 Allen & Company 144,037 9 188.5% 49,926

7

7 -12 70

8 8 Credit Suisse 107,089 17 -45.7% 197,280

8

8 -21 73

9 10 Wells Fargo Securities 81,068 18 -25.2% 108,317

9

9 -27 78

10 25

Santander Corporate Investment Banking (SCIB)

71,860 3 95.3% 36,792

#

10 -35 82

12

Moelis & Company

21,342

51

9

Evercore

41,044

47

16

Lincoln International

4,667

58

14

Raymond James

2,103

52

6

Bank of America

214,818

66

3

Morgan Stanley

349,536

58

4

Jefferies

36,111

72

2

JPMorgan

259,469

67

1

Goldman Sachs & Co

425,432

98

5

Houlihan Lokey

9,831

92

6

Robert W. Baird & Co

16,341

60

2022

2021

Company Name

Value

(USDm)

Deal Count

15

Lincoln International

3,651

68

5

Raymond James

6,142

61

7

Bank of America

115,625

70

14

Evercore

92,508

68

4

Jefferies

68,323

87

8

Piper Sandler & Co

10,650

79

3

Houlihan Lokey

10,167

91

1

Goldman Sachs & Co

204,969

89

2022

2021

Company Name

Value

(USDm)

Deal Count

2

JPMorgan

165,630

93

https://mergermarket.com/info/

Mergermarket

Global & Regional

M&A League Tables 2022

24

#

Americas Advisory League tables

Canada league table by value Canada league table by deal count

Ranking 2022 2021 Ranking 2021

2022 2021 Company Name

Value

(USDm)

Deal Count

% Value

Change

Value

(USDm)

2022

Count

Change

Deal Count

1 6 JPMorgan 77,140 25 33.7% 57,706

1

1 8 47

2 11 RBC Capital Markets 66,396 53 188.4% 23,026

2

2 9 44

3 3 Morgan Stanley 59,723 27 -34.4% 91,060

3

3 1 35

4 4 Goldman Sachs & Co 58,581 25 -25.8% 78,913

4

4 11 21

5 5 Barclays 48,992 17 -37.5% 78,448

5

5 -7 38

6 9 Citi 44,024 16 6.2% 41,452

6

6 -1 31

7 1 Bank of America 39,158 21 -65.7% 114,042

7

7 0 27

8 7 TD Securities 37,442 26 -30.4% 53,766

8

8 -10 36

9 2 BMO Capital Markets 33,073 31 -64.5% 93,218

9

9 2 23

10 48 HSBC 30,343 5 1112.7% 2,502

#

10 1 24

11 8 CIBC World Markets 27,449 36 -46.8% 51,635

#

11 1 24

12 16 Credit Suisse 24,068 8 76.1% 13,664

#

12 -17 42

13 13 UBS Investment Bank 21,266 9 20.1% 17,707

#

13 6 18

14 25 PJT Partners 19,740 3 149.6% 7,910

#

14 -10 33

15 23 National Bank Financial 17,915 32 96.3% 9,128

#

15 -18 41

16 - Mizuho Financial Group 16,114 5 - -

#

16 -4 25

17 17 Nomura Holdings 15,994 4 19.6% 13,374

#

17 -18 39

18 10 Evercore 15,787 13 -59.3% 38,765

#

18 2 17

19 - Allen & Company 15,344 2 - -

#

19 -6 23

20 15 Scotiabank 14,658 30 -11.9% 16,643

#

20 -1 17

#

#

21

Citi

44,024

16

22

Houlihan Lokey

2,233

19

15

Barclays

48,992

17

12

Bank of America

39,158

21

5

EY

5,564

21

9

Stifel/KBW

6,746

23

4

KPMG

2,961

23

19

Rothschild & Co

12,939

24

13

Goldman Sachs & Co

58,581

25

3

PwC

1,180

25

7

TD Securities

37,442

26

16

JPMorgan

77,140

25

14

Canaccord Genuity Group

14,226

25

10

Scotiabank

14,658

30

11

Morgan Stanley

59,723

27

17

National Bank Financial

17,915

32

6

BMO Capital Markets

33,073

31

2

RBC Capital Markets

66,396

53

8

CIBC World Markets

27,449

36

2022

2021

Company Name

Value

(USDm)

Deal Count

1

Deloitte

5,046

55

https://mergermarket.com/info/

Mergermarket

Global & Regional

M&A League Tables 2022

25

Americas Advisory League tables

Latin America league table by value Latin America league table by deal count

Ranking 2022 2021 Ranking 2021

2022 2021 Company Name

Value

(USDm)

Deal Count

% Value

Change

Value

(USDm)

2022

Count

Change

Deal Count

1 3 JPMorgan 24,696 31 -13.3% 27,989

1

1 -1 62

2 2 Banco Itau BBA 16,608 43 -59.4% 40,862

2

2 3 40

3 1 Banco BTG Pactual 15,972 61 -67.0% 48,377

3

3 21 15

4 13 Rothschild & Co 14,489 24 79.1% 8,089

4

4 -1 35

5 21 Bank of America 11,138 36 145.1% 4,545

5

5 3 28

6 7

Santander Corporate Investment Banking (SCIB)

10,191 34 -23.7% 13,358

6

6 3 23

7 4 Citi 9,724 15 -64.5% 27,386

7

7 -2 26

8 8 Credit Suisse 9,273 14 -26.7% 12,652

8

8 12 5

9 6 Morgan Stanley 8,688 12 -36.3% 13,648

9

9 -13 29

10 12 Lazard 6,882 15 -24.7% 9,143

#

10 1,059 5 11

11 14 Banco Bradesco BBI 6,839 26 10.8% 6,173

#

11 -9 24

12 18 Scotiabank 6,352 12 28.5% 4,943

#

12 1 14

13 5 Goldman Sachs & Co 5,385 11 -65.6% 15,667

#

13 -2 17

14 84 Evercore 4,028 10 11408.6% 35

#

14 2 13

15 23 Jefferies 3,819 6 15.7% 3,301

#

15 -5 19

16 35 Barclays 3,691 4 178.4% 1,326

#

16 2 12

17 9 XP Investimentos CCTVM 3,166 15 -72.9% 11,662

#

17 7 6

18 15 BR Partners 2,660 15 -56.3% 6,089

#

18 -1 13

19 97 Olimpia Partners 2,517 3 20875.0% 12

#

19 0 12

20 29 Grupo Safra 2,393 3 37.1% 1,746

#

20 -1 13

17

UBS Investment Bank

174

14

18

Scotiabank

6,352

12

11

XP Investimentos CCTVM

3,166

15

15

BR Partners

2,660

15

16

Oaklins

290

12

31

RGS Partners

62

13

14

Morgan Stanley

8,688

12

15

21

PwC

16

13

Lazard

6,882

15

6

Rothschild & Co

14,489

24

36

Deloitte

472

17

4

Vinci Partners

1,959

16

7

Citi

9,724

5

JPMorgan

24,696

31

9

Banco Bradesco BBI

6,839

26

12

Bank of America

11,138

36

3

Santander Corporate Investment Banking (SCIB)

10,191

34

1

Banco BTG Pactual

15,972

61

2

Banco Itau BBA

16,608

43

2022

2021

Company Name

Value

(USDm)

Deal Count

14

9,273

Credit Suisse

10

https://mergermarket.com/info/

Mergermarket

Global & Regional

M&A League Tables 2022

26

Asia Pacific Advisory League tables

Asia Pacific (excl. Japan) league table by value Asia Pacific (excl. Japan) league table by deal count

Ranking 2022 2021 Ranking 2021

2022 2021 Company Name

Value

(USDm)

Deal Count

% Value

Change

Value

(USDm)

2022

Count

Change

Deal Count

1 1 Goldman Sachs & Co 149,680 62 -30.2% 214,467

1

1 -46 222

2 4 Citi 138,841 40 -12.7% 159,027

2

2 21 88

3 2 Morgan Stanley 116,227 56 -42.5% 202,088

3

3 -70 171

4 3 JPMorgan 115,200 44 -31.5% 168,150

4

4 -49 148

5 10 Bank of America 93,905 37 43.3% 65,553

5

5 -20 97

6 9 CITIC Securities Co 93,384 49 5.4% 88,602

6

6 -25 87

7 6 China International Capital Corporation 91,743 77 -18.3% 112,354

7

7 -27 83

8 16 Credit Suisse 90,156 41 94.1% 46,447

8

8 -9 62

9 46 BNP Paribas 79,045 15 762.1% 9,169

9

9 -27 76

10 19 HSBC 78,882 16 153.4% 31,128

#

10 -17 62

11 30 Jefferies 71,212 22 343.2% 16,068

#

11 -37 81

12 29 Moelis & Company 68,115 22 256.2% 19,125

#

12 -17 59

13 7 Barclays 66,150 36 -34.1% 100,353

#

13 -9 50

14 41 Nomura Holdings 65,236 19 513.5% 10,633

#

14 -25 65

15 69 Arpwood Capital 63,245 5 1234.8% 4,738

#

15 -10 47

16 38 JM Financial 62,296 9 398.1% 12,507

#

16 9 27

17 8 Macquarie Group 52,878 45 -41.9% 91,003

#

17 13 16

18 5 UBS Investment Bank 41,547 53 -73.5% 156,602

#

18 -2 31

19 13 Evercore 34,655 13 -34.0% 52,510

#

19 -9 38

20 28 RBC Capital Markets 27,417 29 43.2% 19,150

#

20 5 18

#

#

37

BDA Partners

3,771

23

17

Avendus Capital

6,368

29

16

China Renaissance Holdings

2,059

29

21

Barclays

66,150

36

38

RBC Capital Markets

27,417

29

15

Bank of America

93,905

37

13

Rothschild & Co

22,393

42

10

Citi

138,841

40

14

Credit Suisse

90,156

41

12

Macquarie Group

52,878

45

8

JPMorgan

115,200

44

11

UBS Investment Bank

41,547

53

9

CITIC Securities Co

93,384

49

6

Goldman Sachs & Co

149,680

62

7

Morgan Stanley

116,227

56

3

KPMG

21,713

99

4

China International Capital Corporation

91,743

77

5

Deloitte

15,406

109

2

EY

23,477

101

2022

2021

Company Name

Value

(USDm)

Deal Count

1

PwC

26,370

176

https://mergermarket.com/info/

Mergermarket

Global & Regional

M&A League Tables 2022

27

Asia Pacific Advisory League tables

Asia (excl. Australasia & Japan) league table by value

Asia (excl. Australasia & Japan) league table by deal count

Ranking 2022 2021 Ranking 2021

2022 2021 Company Name

Value

(USDm)

Deal Count

% Value

Change

Value

(USDm)

2022

Count

Change

Deal Count

1 5 Goldman Sachs & Co 123,178 39 67.5% 73,528

1

1 -29 175

2 7 Citi 116,438 30 76.2% 66,073

2

2 -35 124

3 2 Morgan Stanley 105,182 43 -16.2% 125,528

3

3 -29 113

4 1 JPMorgan 95,314 33 -31.8% 139,760

4

4 25 53

5 4 CITIC Securities Co 93,384 49 5.4% 88,602

5

5 -20 97

6 3 China International Capital Corporation 91,743 77 -18.3% 112,354

6

6 -27 76

7 12 Bank of America 87,866 29 181.2% 31,242

7

7 -16 59

8 17 Credit Suisse 85,925 35 344.1% 19,349

8

8 -11 50

9 13 HSBC 78,882 16 153.4% 31,128

9

9 3 32

10 37 BNP Paribas 77,837 13 1149.6% 6,229

#

10 -33 66

11 24 Moelis & Company 67,133 14 615.0% 9,389

#

11 -19 49

12 23 Nomura Holdings 64,519 14 507.1% 10,627

#

12 -3 33

13 38 Jefferies 64,240 11 950.7% 6,114

#

13 -2 31

14 51 Arpwood Capital 63,245 5 1234.8% 4,738

#

14 -2 31

15 21 JM Financial 62,296 9 398.1% 12,507

#

15 -9 38

16 11 PwC 22,740 146 -27.6% 31,406

#

16 -11 37

17 10 EY 22,707 89 -47.3% 43,054

#

17 5 17

18 18 Barclays 20,451 17 17.5% 17,407

#

18 5 15

19 6 UBS Investment Bank 19,307 30 -71.8% 68,564

#

19 1 18

20 22 Rothschild & Co 17,892 26 62.4% 11,020

#

20 1 16

#

#

22

RBSA Advisors

1,119

19

28

Barclays

20,451

17

27

BDA Partners

3,721

22

30

Gram Capital

7,900

20

11

China Renaissance Holdings

2,059

29

12

Rothschild & Co

17,892

26

15

Bank of America

87,866

29

16

Avendus Capital

6,368

29

5

CITIC Securities Co

93,384

49

10

Citi

116,438

30

13

UBS Investment Bank

19,307

30

14

Credit Suisse

85,925

35

6

JPMorgan

95,314

33

3

KPMG

15,477

84

1

PwC

22,740

146

2

EY

22,707

89

2022

2021

Company Name

Value

(USDm)

Deal Count

77

91,743

China International Capital Corporation

4

8

Deloitte

11,779

78

7

Morgan Stanley

105,182

43

9

Goldman Sachs & Co

123,178

39

https://mergermarket.com/info/

Mergermarket

Global & Regional

M&A League Tables 2022

28

Asia Pacific Advisory League tables

Japan league table by value Japan league table by deal count

Ranking 2022 2021 Ranking 2021

2022 2021 Company Name

Value

(USDm)

Deal Count

% Value

Change

Value

(USDm)

2022