OCTOBER 2015

Study funded by:

Intelligent Mobility: the smarter, greener and more efficient movement of people and goods around the world

Foreword

Marking the beginning of the Information Age,

the Digital Revolution has already dramatically

changed how we live our lives and is poised to

transform how we travel in the future. As we

move into this new era of ‘Intelligent Mobility’

characterised by the smarter, greener and more

efficient movement of people and goods, the UK

must not waver in its commitment to drive global

leadership in transport.

Moving from the current ‘modal-centric’

to future ‘user-centric’ transport systems is

by no means a small feat. It will require new

thinking and collaboration across industry,

academia and government to define and develop

Intelligent Mobility opportunities worth pursuing.

The Transport Systems Catapult is committed

to creating an environment that will help make

the UK a world leader in this area.

In order to capture a substantial share of

this emerging market, it will be essential to

understand the barriers and fundamental

enablers required to prioritise targeted

investments that build sustainable capabilities.

The Automotive Council Technology Group

was established to analyse evidence and

provide advice on UK automotive research and

development investment opportunities. It is

developing an Intelligent Mobility strategy for

the UK which will utilise emerging technologies

to enable user-focused, integrated, efficient

and sustainable transport systems focused on

meeting the needs of travellers in the UK.

This study represents such an endeavour and

is unique in its kind, taking a multi-modal and

end-to-end approach to both traveller needs

and Intelligent Mobility capabilities in the UK.

We hope you find this report an enjoyable,

interesting and stimulating read into

understanding the UK traveller.

THE UK HAS A LONG HISTORY OF TRANSPORT INNOVATIONS. FROM

THE SHIPBUILDERS WHO PAVED THE WAY FOR GLOBALISATION, TO THE

RAILWAYS THAT UNDERPINNED THE INDUSTRIAL REVOLUTION – THE UK

HAS ALWAYS BEEN A GLOBAL LEADER IN THE TRANSPORT INDUSTRY.

BY 2025, THE INTELLIGENT MOBILITY

MARKET IS ESTIMATED TO BE WORTH

£900BN ANNUALLY AND AS THE FUTURE

OF TRANSPORT SYSTEMS, IS VITAL TO

CREATING JOBS AND SECURING LONG-

TERM ECONOMIC GROWTH IN THE UK.

STEVE YIANNI

CEO Transport Systems Catapult

GRAHAM HOARE

Chairman Automotive Council Technology Group

About the

Transport Systems Catapult

Opp:

The Transport

Systems

Catapult LUTZ

Pathfinder Pod.

IIIII

Traveller Needs and UK Capability Study

Foreword

About the Transport Systems Catapult

Exploring Intelligent Mobility

www.ts.catapult.org.uk

WE ARE THE UK’S TECHNOLOGY AND INNOVATION

CENTRE FOR INTELLIGENT MOBILITY – THE FUTURE

OF TRANSPORT SYSTEMS.

We exist to drive UK global leadership in Intelligent Mobility, promoting

sustained economic growth and wellbeing, through integrated, efficient

and sustainable transport systems.

Our vision is to create an environment that will make the UK a world

leader in transport systems innovation.

© Transport Systems Catapult 2015. All Rights Reserved.

TSC-TN-OCT15-V01

Contents

Preface

This report was written by Corporate Value

Associates and revised and produced by the

Transport Systems Catapult’s Customer

Experience Business Unit.

This benchmarking report would not have

been possible without the generous help

and efforts of many. We would foremost like

to thank Innovate UK, the Department for

Transport, and the Department for Business,

Innovation and Skills for their foresight in

funding this ground-breaking study. We would

also like to acknowledge the generous support

received from: Arup, BMW, Ford, Jaguar Land

Rover, MIRA, and Nissan. We are also very

thankful for the Catapult support of the Digital

Catapult, Future Cities Catapult, and Satellite

Applications Catapult. We deeply appreciate the

endorsement by the Chairs of the Automotive

Council Technology Group and IM-PACT UK.

We would like to express our special thanks to

our University Partnership Programme and the

Innovate UK Monitoring Officer Brian Cumming

for their support to the study.

Thanks to our Expert Panel for their quality

assurance on deliverables in this study and we are

very grateful for the insights provided by all Expert

Interviewees. Building on this we are also thankful

for the large number of people who completed

the questionnaire in our traveller research.

Authors

■

Philip Wockatz, Transport Systems Catapult

■

Philipp Schartau, Corporate Value Associates

Project Team

■

Andrew Everett, Project Executive and Chief

Strategy Officer, Transport Systems Catapult

■

Philip Wockatz, Lead Project Manager and

Senior Technologist, Transport Systems

Catapult

■

Jamie Chan-Pensley, Project Advisor and

co-author, Transport Systems Catapult

■

Nick Knorr, Programme Director - Customer

Experience, Transport Systems Catapult

■

Yusuf Che-Noh, Project Coordinator

■

Toby Hiles, Project Advisor and Head of Strategy

and Planning, Transport Systems Catapult

■

Robert Tailby, Project Advisor

■

Paul Blakeman, Planning Team Member

■

Luke Streeter, Planning Team Member

■

John Simlett, London Managing Partner, CVA

■

Philipp Schartau, Senior Manager, CVA

■

Tim Helme, Case Manager, CVA

■

Anselm Karitter, Senior Consultant, CVA

■

Josh Blackburn, Consultant, CVA

The report and all related visual material are

produced by NEET-STUDIO LTD. We thank its

Director and Graphic Designer Anita Devlin for

her excellent work.

About the Transport Systems Catapult II

Foreword III

Preface IV

Executive Summary 1

Introduction 6

Intelligent Mobility 6

Traveller Needs and UK Capability Study 7

Key Findings 9

A Hot-bed for Intelligent Mobility 9

Hierarchy of Traveller Needs 10

Realising Potential Value from Intelligent Mobility 19

Traveller Needs Challenges 19

Identified Value Spaces 21

Summary of Value Spaces 31

Four Transformational Themes for Intelligent Mobility 33

Access Theme 34

Demand and Supply Theme 35

Integration Theme 37

Automation Theme 38

Combining the Four Transformational Themes 39

Capabilities for Intelligent Mobility 41

Capability Assessment 43

UK Competitive Positioning 44

Capability Priority Matrix 46

Investing in Intelligent Mobility (Recommendations) 48

Research and Development 49

Experimentation and Business Model Innovation 50

Policy, Legislation and Regulation 50

Conclusions and Stakeholder Implications 52

Methodology 53

Market Research 54

Expert Interviews 55

Literature Review 55

Acknowledgements 56

References 58

Endnotes 59

Your Thoughts... 60

Contacts 62

Above:

The Transport Systems

Catapult ‘Virtual Reality’

capability on a treadmill.

VIV

Traveller Needs and UK Capability Study

Contents

Preface

Executive Summary

INTELLIGENT MOBILITY IS CURRENTLY UNDERGOING RAPID DEVELOPMENT,

PRESENTING A UNIQUE MOMENT FOR THE UK TO BECOME A MAJOR PLAYER.

Previous Transport Systems Catapult research has

suggested that this global market will be worth around

£900bn annually by 2025 [1], with the UK primed to

be a hot-bed for Intelligent Mobility. This study was

commissioned to help unearth the UK’s innovation

potential in the Intelligent Mobility space. It focuses on

developing shared knowledge of what UK travellers need

and value, acknowledging there needs to be an end user

willing to pay for products and services. 10 specific Value

Spaces for Intelligent Mobility with estimated £56bn

of value (revenue opportunities) from the UK traveller

have been identified. The Transport Systems Catapult

is helping the UK capture as much of this global market

as possible – supporting businesses, creating jobs, and

driving economic growth.

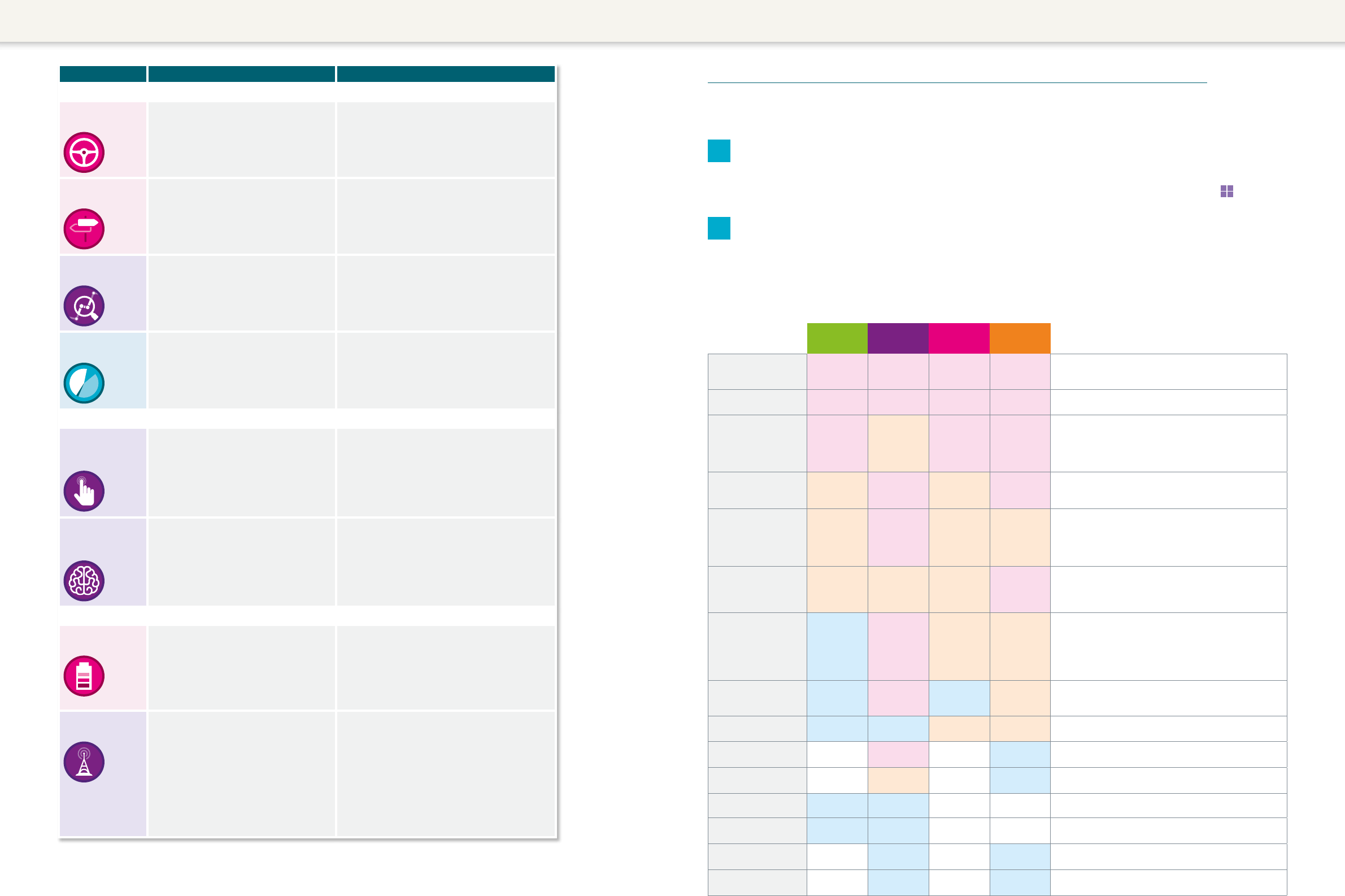

Traveller

1

Type

Description Intelligent Mobility Opportunity

Progressive

Metropolites

Living in the heart of the city, typified by the

technology-savvy young professional, with

significant amounts of personal and business travel.

Want to reduce their transport footprint.

Leverage as lead users for new intelligent

mobility solutions (shared, digital) in urban

environments.

Default

Motorists

High mileage drivers, with a mix of those who enjoy

driving and many for whom it is a functional choice.

Remove the burden of driving – either through

increasing productive time, or by providing

viable alternatives.

Dependent

Passengers

Dependent on others for their mobility needs,

representing a mix of students, elderly, and those

with impairments.

Develop solutions that can increase

independence without relying on being driven

in a personal vehicle.

Urban

Riders

City dwellers, who travel less frequently than the

Progressive Metropolites, making use of public

transport available to them.

Well served today, although potential to

improve access to national transport services.

Local

Drivers

Mainly retirees or stay at home parents, making

low mileage local journeys.

Their needs are currently well met. Possible

opportunity to improve current experiences.

To help unlock this value whilst improving travel in the

UK, this study utilised a large market research sample

of 10,000 respondents as well as 100 expert and 50

company interviews. It has found the UK traveller to be

progressive and ready for new developments in mobility:

■

53% always look for ways to optimise their journeys.

■

72% have smartphones – 54% of which already

consider it essential to their travel experience.

■

57% would not mind sharing their data for better

services and 32% would share their possessions

with others.

■

39% would consider driverless cars today.

■

31% of journeys made today in the UK would not have

been made if alternative means were available that did

not necessitate physical travel (i.e. ‘virtual mobility’).

At the same time, UK travellers are seeking significant improvements to the journeys they make. 75% of all

journeys made in the UK are subject to negative experiences (i.e. pain-points). Above all, it is multi-modal journeys

that are perceived as particularly troublesome, calling for significant improvements in end-to-end mobility. However,

currently only 12% of journeys involve active consideration of modal choice. Therefore, activating travellers on the

remaining 88% of journeys is fundamental to Intelligent Mobility.

Beyond improving today’s journeys, Intelligent Mobility also promises to address significant unmet transport

lifestyle needs across a range of traveller types identified by the study:

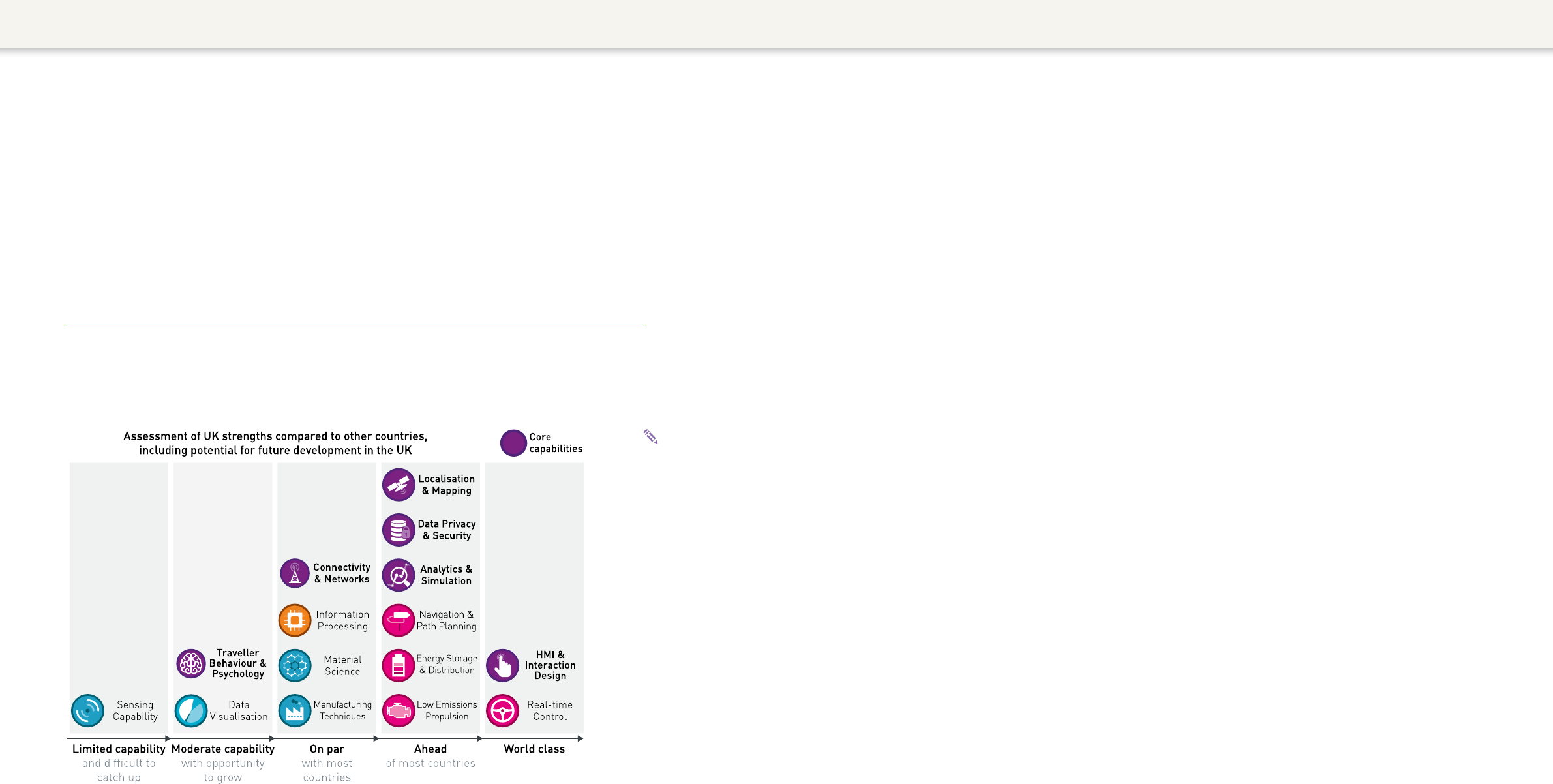

Above:

Capabilities for

Intelligent Mobility.

Opp:

Five Traveller Types (Source:

Traveller Research, CVA Analysis).

1VI

Traveller Needs and UK Capability Study

Executive Summary

Capability Description

HMI & Interaction

Design

Technology, techniques and design methods that enhance the

driver/ passenger experience, enable better driver/ passenger

information and can help to influence traveller behaviour (e.g.

Information and entertainment displays, voice and gesture

recognition Human-Centred Interactive Systems Design).

Traveller Behaviour

& Psychology

Techniques, methods and technologies used to improve

the understanding of traveller decision making processes

and behaviours (e.g. crowd behaviour modelling, heuristics,

selection and decision-making models).

Connectivity

& Networks

Ability to connect different systems, travellers, goods,

infrastructure with the goal of establishing ‘ubiquitous

connectivity’ (e.g. Cellular systems (e.g. 3G, 4G, and 5G),

satellite connectivity, standards and communication protocols

(e.g. V2I, V2V, and V2X).

Localisation

& Mapping

Technologies enabling an understanding of the local

environment (e.g. ‘where you are and what is around you’).

Data Privacy

& Security

Secure flow of data (data security) as well as the safe storage

of data (data protection) (e.g. encryption techniques, data

anonymisation and protection techniques, cyber security

measures).

Analytics

& Simulation

Systems, algorithms and processes ranging from the handling

and analysis of big data, predictive and prescriptive analytics,

and machine learning (e.g. big data, predictive modelling, AI).

Research and

Development

Key technical capability areas

need to be supported, ensuring

the UK can hold IP

2

critical to

the Intelligent Mobility supply

chain. The study highlights six

Core Capabilities for priority

development (see table below).

Experimentation

and Business Model

Innovation

To successfully bring Intelligent

Mobility products and services

to market, a key focus needs

to be on experimentation,

business model innovation,

and real-life learning as much

as technical demonstration and

validation.

Policy and Legislation

There is a need to put in place

key policy measures and

government initiatives that

will enhance and enable the

success of Intelligent Mobility.

These include providing

ubiquitous connectivity, Open

Data, multi-modal ticketing,

standardisation of emerging

technologies, and a focus

(through KPIs) on multi-modal

journey experiences.

2 31

The most pertinent traveller needs and opportunities have been summarised as 12 key challenges

that need to be to be addressed to improve mobility in the UK. Developing solutions for these

challenges will not only deliver on travellers’ needs, but also unlock a number of Value Pools

(revenue opportunities) for innovators in Intelligent Mobility.

To deliver on these challenges, Intelligent Mobility will require the integration of different

technologies, products and services that will result in a step change in mobility. Four Transformational

Themes were identified in the study that map out development paths towards Intelligent Mobility.

They will deliver the greatest impact when combined, delivering seamless end-to-end mobility.

Whilst many innovations in these four themes will occur naturally out of commercial interests,

the study is recommending investments and interventions in three areas to establish the UK as a

world leader in Intelligent Mobility:

Transformational Theme Description

Access

New mobility solutions (e.g. car sharing, ride sharing etc.) that offer more

affordable, more convenient mobility.

Automation

Increased levels of automation in transport, for example the emergence

of automated driving functionality, moving from assisted driving to fully

autonomous drive.

Demand & Supply

Developments that seek to influence travel demand patterns and also better

match supply to demand within transport systems.

Integration

The bringing together of disparate information, systems, and services, to

provide travellers with a seamless end-to-end mobility experience.

Opp:

Four

Transformational

Themes

(Source: Expert

Interviews, CVA

Analysis).

Opp:

Overview of the

12 Challenges

for Intelligent

Mobility (Source:

CVA Analysis).

Opp:

Six Core

Capabilities

(Source: Expert

Panel Workshops,

Expert Interviews,

and CVA Analysis).

32

Traveller Needs and UK Capability Study

Executive Summary

Executive Summary

Stakeholder Imperatives

Central

Government

• Fund research and development activities and skills development in the six Core

Capabilities for Intelligent Mobility.

• Focus on filling the gaps in provision of reliable, fast, and ubiquitous connectivity.

• Establish a data exchange mechanism and mandate open data where appropriate

(e.g. in rail franchises).

• Create a central ticketing platform and multi-modal marketplace and encourage

multi-modal integration to support expected advancements in dynamic pricing and

timetabling.

• Foster cross-industry collaboration to unlock value from Intelligent Mobility.

Local

Government

• Encourage and support new business and participate in experimentation

with new Intelligent Mobility solutions in private and public transport.

• Shift focus towards procuring against challenges rather than procuring for solutions.

• Push for integration and innovation in public transport (e.g. demand responsive

services).

Infrastructure

Operators

• Focus on measuring progress against traveller needs and end-to-end journey

experience across transport modes.

• Understand the extent to which potential investments in Intelligent Mobility

can give better value for money than traditional infrastructure investments.

• Encourage innovation by opening up data streams.

• Set up mechanisms to gather learnings and influence traveller behaviours based

on data insights.

Transport

Operators

• Understand desired position in emerging Intelligent Mobility ecosystems, focusing

on multi-modal transport and collaboration with new digital integrators.

• Collaborate across the industry, by opening data and creating seamless end-to-end

journeys (focus ticketing, pricing, integrated information, commercial models).

• Actively participate and collaborate with digital start-ups, not least by opening up

commercially non-sensitive data and start generating real-time data where missing

(and consider how to monetise valuable data).

• Reduce complexity of planning by increasing availability of information (in particular

expected arrival time, expected level of personal space) and include every element

of the journey (car parking, etc.)

Automotive

Industry

• Continue developing autonomous drive technology and focus on market readiness,

consider target segments.

• Produce vehicles that are suitable for a variety of new mobility modes, such as

autonomous taxis or dynamically timetabled and routed minibuses.

• Consider the role of the connected vehicle in an integrated end-to-end mobility world.

• Establish a presence in new areas of the mobility value chain beyond vehicles sales,

finance and service.

• Develop strategy for data generation and utilisation.

• Take a leading position in defining and implementing standards in V2V

3

and V2I

4

communications.

Rail Industry

• Focus on traveller experience on multi-modal journeys, in particular integration

of ‘new’ modes (bike share, car share, taxi apps, autonomous mobility) and speed

& reliability of interchange.

• Focus on enabling productive time: connectivity, seamless interchange, dynamic

timetabling.

• Focus on accessibility of rail: ‘easy to get to’ / first&last mile.

• Enable digital lifestyles (e.g. journey experience personalisation) and engage

travellers with transport choices.

Transport

Systems

Suppliers

• Prioritise data generation and integration from all possible sources.

• Develop desired position in a world that focuses more on decentralisation

than central ‘command and control’ traffic systems.

• Consider collaboration and integration with new mobility providers and focus

on how to deliver on end-to-end journey experiences.

Academia

• Prioritise traveller behaviour understanding as a core discipline to develop expertise in.

• Focus on skills gaps in algorithms and analytics to educate tomorrow’s Data Scientists.

• Ensure technical degree programmes include a sufficient amount of business and

commercial understanding.

Start-ups

• There is a significant opportunity for innovative and agile new entrants in Intelligent

Mobility.

• Build strong relationships with key players (e.g. automotive OEMs, transport operators,

and local authorities) and understand the different speeds at which these players

move.

To drive UK global leadership in Intelligent Mobility there are a number of imperatives for different

stakeholders as shown below:

Opp:

Intelligent

Mobility

imperatives

for the UK

(Source: Expert

Workshops,

Expert

Interviews, and

CVA Analysis).

Opp/below:

Progressive

Metropolites.

Opp/below:

Urban Riders.

Below:

Default Motorists.

Below:

Petrol Heads

sub-group.

Opp/below:

Car Dependents

sub-group.

Opp:

Local Drivers.

Opp/below:

Dependent

Passengers.

54

Traveller Needs and UK Capability Study

Executive Summary

Executive Summary

5

Introduction

Beyond technology, innovations in business

models and user experiences (e.g. taxi hailing

apps, car sharing schemes, and real-time

traveller information) will be important. The

range of potential innovators in this space is wide

and goes significantly beyond the traditional

transport sector – including digital start-ups,

telecommunications providers, insurers, and

many more. Intelligent Mobility solutions have

the ability to significantly increase the capacity

of transport systems and deliver end-to-end

journey experiences that meet traveller needs

(for both people and goods).

A recent study into the business potential

of Intelligent Mobility suggests that the global

market for this new sector will be worth

around £900bn annually in just over a decade

[1]. As a growth market, it is expected to cut

across and go beyond traditional transport

modes and utilise emerging technologies to

provide travellers with an improved end-to-end

journey experience, but also increased transport

systems efficiencies. As a result we are seeing

a range of potentially disruptive developments

and a number of initiatives have already been

launched (e.g. the Transport Systems Catapult

and UK Autodrive project). Indeed, Intelligent

Mobility is becoming a top priority for the UK

and the Automotive Council believes that this

market has the potential “to increase mobility,

improve safety, and enhance user benefits whilst

simultaneously reducing pollution, consumption,

and congestion” [2].

The underlying enablers of increased

development in Intelligent Mobility have been

the strong growth in mobile connectivity and

smartphone penetration. Further benefits are

expected from the emerging Internet of Things

(including connected vehicles and infrastructure)

and increased digitalisation and availability

of data. Technology in itself will not, however,

realise this value but its applications to meet the

needs of travellers will. Intelligent Mobility not

only seeks to deliver direct value to the traveller

but also to provide sustainable benefits (e.g.

social and environmental) for whole transport

systems, such as mitigating congestion and

emissions, and improving safety. A fundamental

shift in how we realise the value in this new

space is required and there is a need to place

‘users of mobility systems’ at the heart of how

the UK secures a substantial share of the global

Intelligent Mobility market.

The concept of ‘Mobility as a Service’ has

emerged as a key trend within the Intelligent

Mobility domain and represents the shift away

from purchasing products (vehicles) towards

instead purchasing the access (service) for the

benefits of mobility. Increasingly, seamless

on-demand and end-to-end mobility at the

touch of a button is becoming a reality. As one

might expect, these developments will result in

significant shifts in the mobility value chain, and

established transport players will have to think

carefully about their desired position in these

new ecosystems, with new players entering the

transport sector.

Because Intelligent Mobility is an emerging

market it is characterised by a search for new

business models, which is something that

start-ups and digital players traditionally excel

at. As different sectors converge, realising

the value of Intelligent Mobility will require

collaboration between established players and

new entrants that goes beyond the traditional

borders of today.

Above all, the scale of the Intelligent Mobility

opportunity should be appreciated.

The initiative was supported by the Automotive

Council Technology Group. Also, an Industry

Review Group comprising of three other

Catapults and six companies played an

instrumental role in the study’s success.

In bringing together so many people and

organisations, the first steps towards improved

collaboration in, and understanding of, the

Intelligent Mobility space have been made.

Understanding Traveller Needs

The study was designed to fill an identified

existing gap in understanding what travellers

value on their journeys, what pain-points

they encounter and how they make decisions

with regards to their travel options. The study

achieves this by including all available modes

in the research and taking travellers through

an adaptive conjoint-based choice exercise

which helped understand the relative trade-offs

travellers make when deciding how to travel.

Additional information, such as a journey diary,

issues encountered and detailed information

on needs, attitudes and behaviours, helped

understand traveller segments and their

needs on a detailed level. This has provided

an understanding of the key challenges that

the UK will need to overcome in order to

develop and accelerate valuable Intelligent

Mobility opportunities.

To this end, Innovate UK, the Department for

Transport, and the Department for Business,

Innovation and Skills jointly funded an Intelligent

Mobility Special Project called Traveller Needs

and UK Capability Study. The study was led

by the Transport Systems Catapult between

February and July 2015 – involving a combination

of more than 70 organisations from different

sectors, industries and transport modes.

The research conducted in the study comprised

of 10,000 online and 100 offline questionnaire

respondents, 50 company interviews, and 100

expert interviews. There are many studies that

have analysed travel user sentiments. These

studies are, however, most often specific to a

transport mode or geography (e.g. analysing

rail travel or transport in London) and tend to

focus on short-term incremental improvements

of current transport systems. Similarly, a

number of studies have explored future mobility

technologies but these tend to focus on technical

innovations in a specific sector (e.g. rail or

automotive). In contrast, this study attempted to

take a holistic view of Intelligent Mobility across

transport modes, sectors, UK geographies, and

across all aspects of Intelligent Mobility.

In producing this study, a large number of

cross-industry, cross-sector, and cross-modal

stakeholders have been involved (please see

the ‘Acknowledgments’ chapter for a full list).

Corporate Value Associates designed the

approach, delivered the research and analysis

(with quality assurance from an Expert Panel),

led the stakeholder workshops and developed

the study’s conclusions and recommendations.

Traveller Needs and UK Capability Study

TO CAPTURE A SUBSTANTIAL SHARE OF THE GLOBAL INTELLIGENT

MOBILITY MARKET IT IS ESSENTIAL TO UNDERSTAND FUNDAMENTAL

ENABLERS OF VALUE AND PRIORITISE TARGETED INVESTMENTS THAT

BUILD SUSTAINABLE AND INNOVATIVE CAPABILITIES FOCUSED ON

MEETING THE NEEDS OF THE UK TRAVELLER.

Intelligent Mobility

INTELLIGENT MOBILITY IS THE SMARTER, GREENER, AND MORE

EFFICIENT MOVEMENT OF PEOPLE AND GOODS AROUND THE WORLD.

“INTELLIGENT MOBILITY IS THE

CONVERGENCE OF DIGITAL INDUSTRIES,

TRANSPORT INFRASTRUCTURE,

VEHICLES AND USERS TO PROVIDE

INNOVATIVE SERVICES RELATING TO

DIFFERENT MODES OF TRANSPORT

AND TRAFFIC MANAGEMENT.”

MIRA [21]

“HISTORICALLY, MOBILITY HAS BEEN

VIEWED LARGELY AS A PRODUCT. […]

INCREASINGLY, HOWEVER, MOBILITY

IS APPROACHED AS A SERVICE.”

Schneider Electric, ARUP, The Climate Group [22]

“IT IS NOT REALLY ABOUT THE

TECHNOLOGY,” [TIM ARMITAGE] SAID.

“IT IS ABOUT FINDING A COMMERCIAL

MODEL THAT WORKS.”

Financial Times [23]

76

Traveller Needs and UK Capability Study

Introduction

Introduction

Key Findings

Identifying Value Spaces for Intelligent Mobility

This study does not attempt to value the Intelligent

Mobility market as a whole (other studies exist [1]),

or to quantify the socio-economic impact of meeting

traveller needs (e.g. job creation). Instead, the value

modelled in the analysis focuses on specific revenue

opportunities that are available for players in this

space by addressing the specific framed challenges.

Ultimately, value in mobility is derived from

traveller spend, whether this means spend on travel

tickets, vehicle ownership, or services and apps. There

are other sources of value in the mobility value chain

to consider, however, such as government spend on

infrastructure and subsidies, as well as indirect value

realised by making transport more efficient, safer and

cleaner. In quantifying these, two types of calculations

were performed:

Incremental Value

Estimates the additional amount travellers are willing

to spend on their journeys for a better experience.

This is modelled using conjoint data gathered during

the traveller research. The suggested improvements

(e.g. removal of pain-points) are compared to the

current traveller experience. The result is measured

against the traveller price elasticity (which was also

obtained from the conjoint data modelling) to estimate

the direct incremental value travellers assign

to such improvements.

Redistributed Value

Estimates the portion of current transport spend that

will no longer be required in its current form if the

challenges are met and may be available for a new

player offering new mobility services. This is modelled

on a combination of the Office for National Statistics

(ONS), National Travel Survey (NTS), Census, and the

research data from this study.

The actual scale of incremental and redistributed

value realised will depend on the extent to which the

traveller challenges can be addressed. It should be

noted that the numbers obtained are not predictions,

but instead estimate the available ‘Value Pools’ for

Intelligent Mobility within the Value Spaces.

As this study employs innovative approaches

in order to identify potential areas of value, it is

acknowledged that these approaches are different

from traditional transport planning. This report is

intended to supplement, not replace or re-work

traditional transport planning models.

A Hot-bed for Intelligent Mobility

A SUCCESSFUL INTELLIGENT MOBILITY INDUSTRY IN THE UK REQUIRES

TRAVELLERS WHO WELCOME AND EMBRACE INNOVATIVE MOBILITY

PRODUCTS AND SERVICES, CREATING AN ADDRESSABLE MARKET

FOR NEW BUSINESSES.

Describing Transformational Themes for

Intelligent Mobility

There are a number of Intelligent Mobility products

and solutions emerging and many ideas for further

developments. This report describes the key emerging

themes for Intelligent Mobility with an outlook towards

2030. This includes understanding the benefits that

they can deliver in terms of meeting traveller needs

and addressing pain-points – as well as the key

enablers and capabilities required to make these

developments successful.

Targeting Core Capabilities for Intelligent Mobility

Building a successful and profitable Intelligent

Mobility sector in the UK will not be achieved purely

with roadmaps and development plans, but by

enabling and encouraging innovation both from

existing players and new entrants. Increasingly,

the speed of innovation in this emerging sector

will be more akin to that of the Digital Revolution

with fast growth and adoption of services (e.g. Uber

and Citymapper) rather than traditional transport

planning. This report aims to target the Core

Capabilities that are both highly significant to enable

Intelligent Mobility whilst also providing the UK with

a competitive advantage.

Recommendations for Policy Interventions

and Targeted Investments

This report is intended to benefit a number of

stakeholders and help guide policy and investment

decisions. As such, it is meant to stimulate activity

and investment in Intelligent Mobility by identifying

pertinent traveller needs and understanding the

scale of targetable Value Pools.

Whilst a successful Intelligent Mobility industry

should thrive with little policy intervention, many

modes of transport are still reliant on and guided by

central and local policy and support. Some level and

type of intervention will be required in order to deliver

step changes in traveller experience and ensure the

success of Intelligent Mobility developments. This

report aims to identify the key areas where such

policy interventions would be beneficial.

The findings in this study will also support the

Automotive Council Technology Group’s Intelligent

Mobility Roadmap and its broader objectives of

increasing mobility, improving safety and enhancing

user benefits, whilst simultaneously reducing

pollution, consumption, and congestion. It will

also provide an evidence-based baseline for policy

planners, regulators, industry and funding bodies

such as the Department for Transport, InnovateUK

or the Intelligent Mobility Planning, Action and

Coordination Team (IM-PACT UK), which the

Transport Systems Catapult is chairing.

This study has found that the UK exhibits

this trait. From a traveller perspective, the UK

has the key prerequisites to make Intelligent

Mobility successful:

Firstly, UK travellers express a clear need for

travel improvements. 75% of all journeys made

in the UK are subject to negative experiences

(i.e. pain-points), many of which may be

addressed with Intelligent Mobility solutions.

Also, 53% of travellers (making up 57% of

journeys in the UK) state that they actively look

for ways to improve their journeys. This means

that there is an audience willing and waiting for

Intelligent Mobility to improve their lives.

Secondly, UK travellers today exhibit

progressive attitudes and are open to

considering new approaches. The study found

that 57% of respondents would not mind sharing

their personal data in order to get a better

service. Considering frequently voiced concerns

over data privacy, this number was unexpectedly

high and significantly higher than prior research

(equivalent values were about 40% in 2010 [3]).

Instead of simply purchasing mobility products

or consuming mobility services, they realise that

transport as a whole can be improved if they

actively contribute, not least with their personal

data. In a similar vein, the lines between ‘ownership’

and ‘access’ are beginning to blur for UK travellers.

Today, one third of UK travellers would consider

sharing their possessions with others for money.

The findings in this study resonate well with

the ‘Sharing Economy’ concept [4] and indicate

that the UK provides a critical mass for mobility

services based on shared assets [5]. This trend

is only expected to grow further, with asset

TRAVELLERS ACTIVELY LOOK FOR WAYS

TO IMPROVE THEIR JOURNEYS.

sharing services becoming more mainstream

(e.g. Airbnb, Lyft, and BlaBlaCar). In mobility,

such services increasingly consider both the

vehicle and journey as something that could be

shared and better utilised. Furthermore, 39% of

respondents say that they would consider using

a driverless car – which is also a very high

number for a product that does not yet exist

(typically under 15%

5

). Indeed, this acceptance

of autonomous vehicles is very encouraging

for automotive OEMs

6

and other transport and

logistics players who are innovating in this space,

and there is an emerging acceptance of new

transport modes that go beyond the traditional

car and public transport.

Finally, travellers are increasingly connected

and can be easily reached through apps.

Smartphone penetration in the UK is 72%

and growing (forecast to grow to 81% by 2017

[6]), with more than half of smartphone users

already considering it essential to their travel

experience. The combination of connectivity on

the move, traveller attention and engagement,

and a favourable digital distribution channel

makes smartphones a priority access point

for Intelligent Mobility solutions, ensuring that

emerging value opportunities in Intelligent

Mobility can be captured. In the future, this can

be expected to extend to wearable technologies

such as smart watches.

1

2

FINALLY, BEYOND THIS REPORT THE STUDY HAS PRODUCED A LARGE DATASET OF

TRAVELLER NEEDS AND PAIN-POINTS. THIS DATASET IS A KEY ASSET THAT WILL BE

AVAILABLE TO THE UK FOR FURTHER ANALYSIS TO HELP DIFFERENT STAKEHOLDERS

UNDERSTAND THE IMPLICATIONS OF THE FINDINGS TO THEIR CONTEXT.

98

Traveller Needs and UK Capability Study

Key Findings

Introduction

The most prominent recent innovations

in the mobility space have come from digital

start-ups such as Uber, Hailo, and Citymapper,

who have already taken advantage of these

trends. They deliver tangible improvements to

the end-to-end journey experience by utilising

existing infrastructure and vehicles and relying

on consumer connectivity. There is consensus

amongst the experts interviewed that the UK is

a leader in digital innovation, with many exciting

start-ups in London’s ‘Silicon Roundabout’ and

in other parts of the UK. These start-ups have

a large talent pool with the right skill-sets to

develop further innovations in the Intelligent

Mobility space. The UK must not only continue to

support this start-up scene, but also encourage

developments in Intelligent Mobility through

targeted funding. This includes giving start-ups

access to public and local authority procurement

and by encouraging new collaborations with

traditional players in the mobility value chain.

Enabling Lifestyles

Two core mobility-relevant dimensions were shown to influence the traveller’s fundamental

mobility needs, pain-points, and attitudes directly.

Firstly, how much they travel, for what purpose (e.g. work or leisure), and in which geographies

(local, national, international) – their ‘mobility lifestyle’. Secondly, what transport choices they have

available, where they live and work, and whether they are restricted by personal or family situation

– their ‘mobility situation’. Across these two dimensions, five key traveller segments have been

identified as shown below:

Progressive Metropolites

14% of UK population and 16% of journeys.

‘Progressive Metropolites’ live in large urban centres. They are heavy

travellers both for work and for leisure, typically making 17% more

journeys annually than the average UK adult. They are generally young

professionals (57% are aged 35 or under) with high disposable incomes

(twice as likely to earn more than £40,000 per year compared to average).

They are very ‘technology-savvy’, with a 94% smartphone penetration –

which they consider to be essential to their everyday lives. 70% state that

they like to be the first to try new technologies and that they consider new

digital services to be improvements in their lives – making them early

adopters and a clear target group for new digital products and services.

This is equally true for mobility, as two thirds state that they are excited

by new developments in transport and would consider driverless cars –

significantly above the 39% population average. This transport innovation

awareness, in combination with their digital affinity and their heavy travel

patterns, make them the ideal lead users for new Intelligent Mobility

solutions.

Travellers in this segment are regular users of public transport and in

particular multi-modal transport (one third of their journeys). However, the

private car still plays an important role in their lives as it is used for 48% of

their journeys (33% in London).

Hierarchy of Traveller Needs

THIS STUDY HAS IDENTIFIED A NUMBER OF FUNDAMENTAL TRAVELLER

NEEDS, PAIN-POINTS, AND ATTITUDES THAT INTELLIGENT MOBILITY

SOLUTIONS HAVE THE POTENTIAL TO ADDRESS.

Although what travellers experience is wide-ranging and often relates to specific circumstances,

a number of key needs, pain-points, and attitudes have been identified in the study. These have

been clustered into a ‘Hierarchy of Traveller Needs’ consisting of three areas: Enabling lifestyles,

Enhancing end-to-end journeys, and Removing pain-points.

The UK is also seen as a world leader in

the more traditional transport systems space.

London’s SCOOT

7

traffic control system is one

of the most advanced in the world, and there

is a thriving transport planning and consulting

industry in the UK. The combination of this

transport expertise and world-class digital

innovation capabilities provides the ideal blend

of expertise for developing Intelligent Mobility

solutions.

Moreover, the UK is considered to be an ideal

testing and learning ground for Intelligent

Mobility due to its unique combination of densely

populated cities and sparsely populated rural

areas. A well-developed transport network that

has to deal with significant demand peaks,

yet at a manageable scale compared to some

global mega-cities, provides the ideal basis

to successfully develop Intelligent Mobility

solutions. The UK’s traveller readiness, digital

innovation capability, traditional transport

expertise, and a geography and infrastructure

ideally suited for transport innovations positions

the UK as a hot-bed for Intelligent Mobility – at

the forefront of Intelligent Mobility development.

THE UK IS A LEADER IN DIGITAL

INNOVATION.

Opp:

Hierarchy of

Traveller Needs

(Source: Traveller

Research and

CVA Analysis).

Opp:

Progressive

Metropolites.

Opp:

Key traveller

segments as %

of UK population

(source: Traveller

Research and CVA

Analysis).

1110

Traveller Needs and UK Capability Study

Key Findings

Key Findings

The car ownership experience is important to them (66%) yet more than

half of the car users in this segment (57%) could imagine giving up their

car if better alternatives were available. Solutions such as car sharing or

ride sharing are likely to be successful in this segment, provided that they

allow a high level of personalisation and customisation to re-create the

benefits of individual car ownership. Travellers in this segment are also

believers in the emerging ‘Sharing Economy’ concept, with 66% agreeing

that services such as Airbnb improve their lifestyles. There could be a

large opportunity to develop such services further in urban transportation,

including peer-to-peer sharing models and packaged mobility offers.

If such offers allowed shared access to different vehicles and transport

services it would enhance their mobility options and mobility lifestyles

significantly beyond that of the single car ownership experience.

This segment also aspires to live a sustainable mobility lifestyle

with 55% trying to optimise their travel for the good of society (compared

to the 30% average) and 53% trying to use transport modes that are good

for the environment (compared to the 29% average). Clearly, with the

remaining high level of private vehicle usage seen in this segment, there

is an opportunity to develop solutions that help them live more sustainable

lifestyles. However, at the same time, such solutions must also help these

travellers optimise their transport costs (73%) and also enable them to use

transport as a way to explore (83%).

Finally, this segment expresses a preference that they would rather

have completed the journey ‘virtually’ (i.e. not travelling at all physically)

for 60% of journeys made today, had they been able to.

This is a key opportunity for further innovation and to develop both

enhanced video conferencing and goods delivery solutions that meet

the needs of this traveller type.

Urban Riders

15% of UK population and 10% of journeys.

The second urban segment are infrequent travellers, which is reflected

both in leisure as well as in work journeys. Half of this segment do not

work at all and include students, home keepers, retirees and unemployed

people. This mix of demographics is also reflected in a typically low

household income. The travel demand of this traveller type is low and

focuses predominately on local journeys within the urban environment.

As such, it is well supported with a multitude of mobility options available

to meet their needs, which typically includes walking or taking the bus.

Very few in this segment drive and in fact only 40% have a driving licence.

Whilst there is little indication that this segment does not consider its

mobility needs sufficiently met, opportunities would include provision

of low cost transport services beyond buses (e.g. ride sharing services

or shared taxis).

This segment is particularly unlikely to be travelling longer distances

and the vast majority of them (79%) make non-local journeys less than

once a month. Despite this, they are as likely to enjoy exploring new

places (71%) just like other segments, which could indicate a latent

need to have improved access to non-local travel at an affordable cost.

Default Motorists

26% of UK population and 37% of journeys.

This is a segment of very frequent travellers who live in smaller urban

centres or suburbs of larger cities. They make a significant number of

journeys for work (twice the UK average) and also make a high number

of leisure journeys (15% more than UK average). The vast majority of

their journeys are taken by private car, which is their ‘default’ mode

of transport. Other modes are either not accessible or are simply not

considered. As such, this ‘always on the road’ segment makes up 46%

of all car journeys in the UK. This is a ‘working age’ segment (typically

26 to 65) and the vast majority of them (three quarters) are employed,

with middle household incomes (60% earn between £10,000 and £40,000

per year). As such, they represent a broad cross-section of the UK

working population.

Interestingly, not all travellers within this segment enjoy driving

privately. Two sub-groups have been identified based on their attitudes

towards driving.

Default Motorists: Petrol Heads

9% of UK population and 13% of journeys.

The first sub-group, representing one third, actively enjoys driving and

would even consider it their hobby. Car ownership is very important to

them and they cannot imagine relinquishing their car in the future. They

are very unlikely to consider mobility sharing schemes and are not excited

about new technologies in transport such as driverless cars (only 25% are

excited). Whilst there is limited scope to develop new mobility options for

Petrol Heads, they will continue to be a target group for OEMs. Beyond

selling vehicles to this sub-group there could be scope to offer additional

mobility services which enhance their driving and ownership experience.

Default Motorists: Car Dependents

17% of UK population and 24% of journeys.

For this group, driving is purely a functional choice. They represent

two thirds of the Default Motorist segment but do not identify with their

car and do not value car ownership. In fact it is questionable whether they

actually want to drive or whether it is simply the only sensible mobility

option available to them (80% use their car every day). There is a sizeable

opportunity to reduce their burden of daily driving.

Firstly, their driving time could be made more productive. 42% in

this sub-group would consider autonomous vehicles – which is a clear

opportunity for OEMs to consider and a direct benefit to these travellers

in productive time.

Secondly, mobility options that reduce the active driving time might

equally be of benefit for this sub-group – whether it is ride sharing,

parking guidance to reduce time spent looking for parking, or multi-modal

integration to reduce car dependency for longer journeys. Providing access

to alternative modes would significantly enhance the mobility experience

for this sub-group and 69% could imagine giving up their car. New

mobility alternatives would need to deliver the same flexibility and door-

to-door convenience that private cars do. Dynamic timetabling and routing,

seamless integration both at a local and national level, and sufficient space

and connectivity for work would generally be of benefit to them.

PROGRESSIVE METROPOLITES

ARE EARLY ADOPTERS AND IDEAL

LEAD USERS FOR NEW INTELLIGENT

MOBILITY SOLUTIONS.

URBAN RIDERS INCLUDE

MANY TYPES OF TRAVELLER IN

URBAN ENVIRONMENTS WITH

LOW TRAVEL DEMANDS.

DEFAULT MOTORISTS MAKE

UP 46% OF ALL CAR JOURNEYS

IN THE UK, BUT TWO THIRDS

OF THEM DO NOT VALUE CAR

OWNERSHIP.

Opp:

Urban Riders.

Opp:

Default Motorists.

Opp:

Petrol Heads

sub-group.

Opp:

Car Dependents

sub-group.

Opp:

Urban Riders

transport modal

segmentation

(Source:

Traveller

Research and

CVA Analysis).

1312

Traveller Needs and UK Capability Study

Key Findings

Key Findings

Local Drivers

24% of UK population and 19% of journeys.

Local Drivers are a more suburban or rural, typically older segment

(70% aged 55 or over and 60% are retired). They are non-working (either

retired or have chosen to stay at home) and their travel demand is very

much focused on local journeys. They own cars but tend not to be heavy

drivers (half drive less than 5,000 miles per year). As a whole, they do not

appear to have any significant unmet lifestyle needs, and the private car

is a complete mobility option for them, with 63% making daily local trips

for leisure or personal business. They are much less likely to state that

they would rather not have travelled (22% compared to the 31% average)

and many of their journeys (47%) are completed without any stated pain-

points, which indicates that their needs are well met with private cars. Not

only do they complete journeys without complaints, they also actively focus

on enjoying their travel – with 55% often taking a slower route for a better

experience (compared to the 45% average). There could be an opportunity

for Intelligent Mobility to enhance their journeys further through context-

aware information services focusing on the driving experience.

Whilst this segment shows average internet usage and is comfortable

making payments online, there is a relatively low smartphone uptake (62%)

and only 25% of smartphone owners consider it essential to their travel

experience. Whilst this is a barrier for new app-based mobility services

today this segment is expected to become increasingly more comfortable

with mobile technology.

Dependent Passengers

21% of UK population and 18% of journeys.

‘Dependent Passengers’ is a segment that is dependent on others

to meet its mobility needs. This traveller type consists of a number of

groups, such as young people (who typically get driven by their parents),

elderly people, and travellers with impairments. They take a majority of

their journeys as car passengers and the remainder is typically covered by

either bus or by walking, with journeys split representatively between work

and leisure. In this segment, Intelligent Mobility solutions could provide

more independence and enable better access to travel. This could include

driverless mobility options that enable more journeys as a car passenger,

dynamic bus services that offer greater flexibility, and digital navigation

and assistance tools that enhance independent journeys. The attitudes

in this segment are generally supportive of Intelligent Mobility, with

51% being happy to use increasingly automated services (compared to

the 55% average) and 59% are happy to share their data for better

services (compared to the 57% average).

There are, however, a number of challenges to overcome. 74%

within this segment do not have a driving licence and will not be able

to access current car sharing solutions. Also, this is a low household

income segment (50% earn less than £20,000 per year with almost half

unemployed) and 70% of their journeys currently entail no cost to them at

all (e.g. car passengers, walking or concessionary travel). Therefore any

mobility services offered here need to be affordable and cost-effective.

Where transport for this segment is subsidised, these services could

potentially be made more efficient with Intelligent Mobility solutions

(e.g. through dynamically routed buses).

Improving ‘Mobility Fit’

Enabling lifestyles is about more than just enabling and improving physical travel.

31% (19bn) of journeys made today would rather not have been made if alternative

means were available (e.g. online shopping). This includes 3.2bn journeys for

shopping, 1.5bn for business travel, 1.8bn for education, and 0.5bn medical visits.

Not wanting to travel could be for a variety of reasons, for example preferring to

spend the travel time in other ways, or a particularly poor journey experience.

Those journeys that can be completed ‘virtually’ would be removed from the

transport system, reducing demand and pressure at peak times. In the case of

shopping trips this would, of course, result in an increased number of goods

deliveries. The impact on traffic remains to be seen, especially where previous

multi-purpose shopping trips are replaced by the delivery of many individual items

as and when they are desired by the shopper. Whilst there is a risk of increased

congestion, it is also an opportunity for innovation and Intelligent Mobility to help

improve fast, reliable, and convenient delivery.

Intelligent Mobility has the ability to bring a significant step change to the lifestyles

of many traveller types. In particular, the scale of unmet traveller needs is greatest

in three segments (Progressive Metropolites, Default Motorists, and Dependent

Passengers), constituting approximately 60% of the population and making up 73%

of annual journeys in the UK. Together with enabling virtual mobility these three

traveller types in particular might be more open to Intelligent Mobility solutions.

As such, four key challenges

can be framed:

Help the urban population

reduce their transport

footprint and enable digital,

asset-light lifestyles.

Reduce the burden on the

car dependent population.

Provide independent

mobility for car passengers.

Push the boundaries of

virtual mobility to provide

the freedom to not travel.

1

2

3

4

INTELLIGENT MOBILITY

SOLUTIONS COULD PROVIDE

MORE INDEPENDENCE AND

ENABLE BETTER ACCESS

TO TRAVEL.

THE PRIVATE CAR IS A

COMPLETE MOBILITY OPTION

FOR LOCAL DRIVERS.

Enhancing End-to-end Journeys

This section investigates the key reasons for the choices that travellers make

during their end-to-end journey, how to encourage transport modal shifts, and

what other factors affect their journey experience.

The majority of travel in the UK is currently by road (64%) and the key reasons that

travellers use the car are flexibility and convenience. Being able to travel when they

want is the most important attribute to travellers (49%) and public transport is more

likely to be chosen when it is easily accessed (47%). Therefore, public transport needs

to offer the flexibility and convenience that the private car has traditionally provided

to encourage some modal shift. Such public transport systems will need to include

dynamically routed and timetabled transport, and seamless and fast interchanges

between transport modes. Special consideration should be given to the ‘first and

last mile’ where the private car currently provides the greatest convenience.

Opp:

Local Drivers.

Opp:

Dependent

Passengers.

Opp:

Dependent

Passengers’

modal split.

Opp:

Travel in the UK

(Source: ONS,

NTS, and Traveller

Research -

numbers may

not add up due

to rounding).

1514

Traveller Needs and UK Capability Study

Key Findings

Key Findings

Another key challenge to overcome is the

broader integration of multiple operators,

which will increasingly also include providers

of new transport modes of mobility such as

car- and bike sharing schemes and ride sharing

services. Offering integrated ticketing, traveller

information, and dynamic timetabling (e.g. for

infrequent transport services) would help give

public transport the flexibility and convenience

it currently lacks. Beyond this, the end-to-end

journey for those who currently already travel

multi-modally needs to be improved – as multi-

modal travel is currently associated with a

significant amount of pain-points (discussed

further in the ‘Removing Pain-Points’ section).

Engaging Travellers in Modal Choice

For the vast majority of journeys (typically

more local journeys), travellers do not plan their

journeys or consider what transport modal

choices they have available. In fact it is only

12% of journeys that include travellers actively

considering their transport modal choices – as

visualised below.

There are several important insights to note

here. Firstly, the large number of journeys (67%)

that are habitual and – from the traveller

perspective – do not warrant any active planning

or pre-journey consultation of information (e.g.

routing, timetable or traffic information). For

these types of journeys, it will be difficult to

encourage travellers to consider their transport

choices. As such, information services that

enhance the traveller’s experience but also

encourage transport modal shifts or other

behaviour change will not be actively considered

on these journeys – which reduces the ability to

enhance the overall efficiency and flow of the

transport network.

The remaining 33% of journeys (typically

longer ones) are irregular and are unfamiliar

to the traveller such that some active planning

is needed. Yet in the majority of cases when

transport modal choices are available they

are not considered. Instead, travellers default

to their typically used transport mode, which

in many cases is the car. As such, even those

travellers who claim that they look for ways to

improve their journeys only actively consider

their mobility options for a small proportion

of journeys. Increasing this number should be

seen as an imperative and could be an important

step in reducing private car-dependence, which

would encourage uptake of both cleaner and

congestion reducing transport modes. Potential

end-to-end mobility options that span across

transport modes and transport operators will

depend on travellers actively considering their

mobility options before and during every journey.

This will require continued development of

integrated planning and information tools with

a view towards providing more personalised

and prescriptive information.

Confidence in Arrival Time

Regardless of transport mode chosen, a

critical end-to-end journey attribute for the

traveller is the time spent travelling. This study

found that in a choice exercise where travellers

are offered the possibility of having journey time

reduced or other journey attributes improved,

journey time was identified as the most valued

attribute. As such, this highlights the need for

Intelligent Mobility solutions to provide overall

transport flow improvements in a way that

shortens overall journey times. In addition to

the journey time, travellers also value avoiding

unexpected delays and having confidence

in their arrival time. In fact, these attributes

are more ‘top-of-mind’ for travellers than the

journey time itself, with 26% spontaneously

stating these as important factors. 21% of road

journeys (motorways and A roads) and 10% of

rail journeys already experience delays today [7],

and increased pressure on the transport network

is forecasted [8]. As a consequence there will

be increasing demand for mobility options to

provide arrival time confidence. Intelligent

Mobility could help in a number of ways either

through flow optimisation on the existing

transport network (e.g. optimising traffic light

flows and smart rail signalling), or through

increasing network resilience to incidents

(e.g. dynamic routing, dynamic timetabling).

Journey Information

Irrespective of transport mode there are a

number of factors that appear to consistently

impact the traveller’s perceived journey

experience. Where travellers are on a time-

critical journey (a journey which requires

the traveller to arrive by a specific time, e.g.

commute to work, school run) perceived ‘journey

quality’ is impacted (with a particular focus on

delays). When having to take responsibility for

others (e.g. children) or luggage on a journey,

travellers experience overall worse journeys.

Conversely, when travelling with an adult

companion, the end-to-end journey is perceived

as significantly smoother. Counter to intuition,

familiar journeys (i.e. those done on a regular

basis) are more problematic. One plausible

explanation is that travellers have an expectation

baseline that has been set by prior experience

– alternatively, travellers may be reducing their

contingency buffer time and therefore are more

sensitive to delays.

Improving ‘Mobility Choice’

Enhancing end-to-end journeys has the ability

to not only meet traveller needs but also to

optimise transport flows and increase available

transport capacity across the UK.

In delivering better end-to-end Journeys

a number of key challenges need to be

addressed:

Aim for transport systems to offer

the flexibility and convenience that

the private car has traditionally offered.

Actively engage traveller in journey

planning and transport modal

consideration.

Enable faster journeys and increased

confidence in arrival time.

Create relevant, personalised and

context-aware information.

A ‘virtual journey assistant’ that takes the

role of the adult companion could give travellers

confidence in arrival time and a smoother

end-to-end experience during time-critical

circumstances that are demanding for travellers

or where expectations are high. Such information

would need to be personalised and context-

aware to provide travellers with greatest value.

IN ALL OF THESE CASES BETTER END-

TO-END JOURNEY INFORMATION CAN

ENHANCE THE JOURNEY EXPERIENCE.

5

6

7

8

Opp:

Journey

planning and

transport modal

consideration

(Source: Traveller

Research and

CVA Analysis).

Below:

A LUTZ Pathfinder

Pod simulated

journey.

1716

Traveller Needs and UK Capability Study

Key Findings

Key Findings

Realising Potential Value

from Intelligent Mobility

Removing Pain-Points

Pain-points are key sources of frustration or desires for improvement that affect 75% of journeys

in the UK. Whilst traveller pain-points are varied and include complaints such as pot-holes or

dirty trains, there are a number of key pain-points that should be prioritised for Intelligent Mobility

solutions. Improving these journey attributes not only positively affects the experience of travellers

but can also represent a value opportunity for mobility operators.

Multi-Modal Pain-Points

Journeys involving modal interchanges are particularly prone to causing pain-points for travellers.

With each additional transport mode in the journey, the number of pain-points experienced by the

traveller increases, as shown below.

Multi-modal travellers find the planning of their journeys to be complicated and difficult. They are

especially unable to rely on their estimated arrival time and are often delayed. Multi-modal travellers

also complain that their journeys take an excessive amount of time and their data connectivity need

is great. Improvements on multi-modal journeys are needed, such as providing simpler ticketing

or reducing perceived complexity of planning (e.g. better planning tools and information before and

during journeys). Providing better guidance and wayfinding during interchanges could prove to be

a huge step forward. This would not only enhance the travel experience for those already making

interchanges between transport modes but could also potentially encourage other travellers to

consider multi-modal journeys.

Private Car Pain-Points

On car journeys drivers often complain about

the ‘start-stop’ nature of driving, which includes

queuing in traffic but also stopping for traffic

controls and junctions. This affects 10% of all

private car journeys in the UK (3.5bn journeys

each year) and drivers would value having the

continuity of their journeys improved. Finding

parking is another key pain-point. Travellers

struggle to find parking on 4.3bn journeys, which

represents 12% of car journeys, rising to 14%

if considering only urban journeys and 19% of

journeys in London. Whilst parking could be a

‘quick win’ for Intelligent Mobility if live space

availability data was to be generated, reducing

the ‘start-stop’ nature of driving is likely to

require more system-level change such as a

better step change in traffic light phasing. More

likely, it will require a combination of connected

infrastructure and autonomous driving.

Public Transport Pain-Points

Public transport users experience twice as

many pain-points as drivers. The pain-points

expressed are often direct results of not

delivering on the end-to-end journey and

public transport is generally considered poor

value for money, with the high cost of the

journey being one of the most cited pain-points

(17% overall and 25% for rail users). Lack of

personal space due to crowding (20%) and an

inability to sit down (12%) are common across

all public transport modes at certain times of

the day – along with lack of cleanliness (12%).

Rail journeys in particular struggle with limited

internet connectivity (14%).

Better management of supply and demand is

one way that Intelligent Mobility might address

many of the pain-points in public transport (this will

be discussed more in the ‘Four Transformational

Themes for Intelligent Mobility’ chapter).

Traveller Needs Challenges

THE KEY CHALLENGES IDENTIFIED NOT ONLY REPRESENT A GREAT LEVEL

OF BENEFIT TO TRAVELLERS IF SOLVED BUT ALSO A POTENTIAL REVENUE

OPPORTUNITY FOR NEW OR EXISTING PLAYERS IN INTELLIGENT MOBILITY.

Within the 12 Traveller Needs challenges,

10 Value Spaces that have the potential to create

a profitable Intelligent Mobility industry in the UK

have been identified. Challenges 5 and 6 have

not been valued as the both act as fundamental

enablers to many of the other challenges rather

than as discrete opportunities in their own right.

Challenge 5 is an enabler to Challenge 1

and 2, referring to car users utilising different

modes, whereas Challenge 6 is a broad enabler

of all Intelligent Mobility solutions that require

traveller interaction and engagement.

Improving ‘mobility experience’

Intelligent Mobility can help address many

traveller pain-points across both private and

public transport.

Four key challenges need to be addressed:

Solve the parking challenge.

Enable smoother drives.

Increase user experience and

perceived value of public transport.

Improve and enable multi-modal

journeys – reducing complexity,

enhancing connectivity, and improving

speed and reliability.

9

10

11

12

Opp:

Overview of the

12 Challenges for

Intelligent Mobility

(Source: CVA

Analysis).

Opp:

Pain-points in

multi-modal

travel (Source:

Traveller

Research and

CVA Analysis).

19

Traveller Needs and UK Capability Study

18

Realising Potential Value from Intelligent Mobility

Key Findings

Within each overarching Value Space, specific Value Pools (revenue opportunities) have been

quantified. Two different types of value have been considered:

■

Incremental Value is money that travellers

are willing to spend on top of their transport

spend today. Incremental value can

be realised through:

– New personal vehicle features – making car

use easier, smoother, and less burdensome

– Information to help travellers during their

journeys – across all modes

– Enabling journeys that were not previously

possible

– Other journey improvements (e.g. meeting

pain-points) that travellers will pay extra for

■

Redistributed Value is money currently spent

on transport today that travellers would

rather have spent on different mobility solutions

or where government spend could be more

efficiently spent otherwise. Redistributed

value can be realised through:

– ‘Mobility as a Service’ – removing the need

for ownership and/or removing the burden

of driving

– ‘Virtual mobility’ – shifting trip spend to

alternative solutions (online shopping,

video conferencing)

– Efficient public transport – optimising

demand and supply across all modes

of transport

The Value Pools have been considered across a number of different aspects of the transport sector:

Identified Value Spaces

VALUE SPACE: PROGRESSIVE METROPOLITES

CHALLENGE 1: HELP THE URBAN POPULATION REDUCE THEIR

TRANSPORT FOOTPRINT AND ENABLE DIGITAL, ASSET-LIGHT LIFESTYLES.

Description

Progressive Metropolites epitomise the emerging opportunity for Intelligent Mobility. They have

high disposable household incomes, are tech-savvy early adopters, aspire to lead sustainable lives,

and have to deal with congestion in the urban environment. 48% of their journeys are still made by

private car but they are open to replacing their car ownership with alternative mobility options that

meet their needs.

Value Pools

Addressing this challenge will cause a shift in value from private vehicle ownership and operation

to transport services (e.g. ride sharing or shared vehicles). These travellers also represent a key lead

market for potential future driverless taxis, due to their high degree of acceptance of autonomous

developments and desire to move away from ownership. Being highly engaged in transport this value

shift may happen quickly with the right mobility options, as they are eagerly looking for ways to improve

their travel. The total Value Pool is £8.4bn and includes current spend on private car ownership and

usage by those who would give up their car if they could. These people make a total of 1.6bn journeys

each year with their cars and spend the equivalent of £5.40 per journey. In the short- to medium-

term, unless Intelligent Mobility solutions deliver across all their journeys, they are likely to retain

their car ownership but replace individual trips with new mobility options. In the longer term, however,

this Value Pool may be fully captured where private ownership is replaced by flexible and shared

mobility solutions.

Implications

Shared and environmentally friendly transport solutions already exist in the UK but these have

not made significant inroads into the urban travel mix despite these needs being present in urban

environments. Further insights are required to fully understand why uptake has been limited, what

can be done to successfully design and implement mobility solutions with significant uptake, and

what would trigger the Progressive Metropolites to actually give up car ownership. It is likely that

different types of mobility solutions need to be tested to understand travellers’ mobility patterns and

preferences. Local authorities should encourage trials of innovative solutions with an expectation

that they may fail. Acceptance of experimentation should include the type of vehicle that is offered,

price structure and mobility ‘packages’ available, level of multi-modal integration, and the digital

user experience. Structured learning and understanding will be important so that successful

Intelligent Mobility solutions can be deployed.

Below:

Areas of the

transport sector

considered in

value analysis

(Source: CVA

Analysis).

Below:

Progressive

Metropolitans –