Most Serious Problems — Correspondence Examination126

Legislative

Recommendations

Most Serious

Problems

Most Litigated

Issues

Case Advocacy Appendices

MSP

#8

CORRESPONDENCE EXAMINATION: The IRS’s Correspondence

Examination Procedures Burden Taxpayers and Are Not Effective

in Educating the Taxpayer and Promoting Future Voluntary

Compliance

RESPONSIBLE OFFICIALS

Mary Beth Murphy, Commissioner, Small Business/Self-Employed Division

Ken Corbin, Commissioner, Wage and Investment Division

TAXPAYER RIGHTS IMPACTED

1

The Right to be Informed

The Right to Quality Service

The Right to Pay No More than the Correct Amount of Tax

The Right to Challenge the IRS’s Position and be Heard

The Right to a Fair and Just Tax System

DEFINITION OF PROBLEM

Internal Revenue Code (IRC) § 7602(a) provides the IRS with the authority to conduct examinations

for the purposes of determining whether a tax return is correct, creating a return where the taxpayer has

not filed, and determining a taxpayer’s tax liability. In fiscal year (FY) 2017, the IRS audited almost

1.1 million tax returns (including business and individual returns), approximately 0.5 percent of all

returns received that year.

2

During FY 2017, the IRS conducted approximately 71 percent of all audits

(business and individual) by correspondence.

3

Proponents of correspondence examinations argue they

are beneficial because they allow the IRS to audit many taxpayers without complex issues and minimize

burden for them. However, in many cases, the issues deemed as “not complex” may involve complicated

rules and procedures, or complicated fact situations, or both as in the case of the Earned Income Tax

Credit (EITC). In addition, taxpayers audited by correspondence may suffer greater burden because of:

The difficulty of sending and receiving correspondence (including having it considered at the

right time);

The lack of clarity in IRS correspondence; and

The lack of a single employee assigned to the taxpayer’s case.

1

See Taxpayer Bill of Rights (TBOR), www.TaxpayerAdvocate.irs.gov/taxpayer-rights. The rights contained in the TBOR are

also codified in the Internal Revenue Code (IRC). See IRC § 7803(a)(3).

2

IRS Data Book, 2017, Publication 55B, 21 (Mar. 2018). This number does not include certain returns, such as those of

tax exempt and government entities, nor does it include other compliance contacts that can be considered “unreal” audits,

and which make the number much higher. See National Taxpayer Advocate 2017 Annual Report to Congress 49-63 (Most

Serious Problem: Audit Rates: The IRS Is Conducting Significant Types and Amounts of Compliance Activities that It Does Not

Deem to Be Traditional Audits, Thereby Underreporting the Extent of Its Compliance Activity and Return on Investment, and

Circumventing Taxpayer Protections).

3

IRS Data Book, 2017, Publication 55B, 22 (Mar. 2018).

Taxpayer Advocate Service — 2018 Annual Report to Congress — Volume One 127

Legislative

Recommendations

Most Serious

Problems

Most Litigated

Issues

Case AdvocacyAppendices

For FY 2018 correspondence audits, the IRS took more than 65 days to respond to the majority of

taxpayer replies in both EITC cases and non-EITC refundable credit cases.

4

During FY 2018, the

Small Business/Self-Employed Division (SB/SE) exam employees answered the exam phone line only

about 35 percent of the time

5

and, not surprisingly, SB/SE reported receiving only about 0.87 incoming

calls per correspondence exam potentially because taxpayers could not get through.

6

These problems are

exacerbated when the audited taxpayer is low income, has limited English proficiency, or there are other

impediments that hinder communication during the audit.

An examination is primarily an education vehicle, so the taxpayer learns the rules, corrects mistakes, and

can comply in the future. The tax assessed from the examination is a byproduct of the exam, but it is

not the purpose. In fact, the IRS gains about twice as much from the long-term effects of an audit than

it does from the actual audit itself.

7

The National Taxpayer Advocate is concerned that:

Audit selection procedures may lead to complex cases being audited by correspondence and a

disproportionate burden on low income taxpayers;

Insufficient training on complex issues for correspondence examiners may prevent them from

correctly determining the liability or knowing when to transfer a case to an employee with

specific expertise;

A substantial number of taxpayers audited by correspondence face barriers to understanding and

effectively participating in the audit;

The IRS’s correspondence is often confusing and does not provide sufficient time for the taxpayer

to respond; and

The IRS metrics do not consider taxpayer needs and preferences when determining the

effectiveness of its correspondence exam program, and the IRS prioritizes measures such as cycle

time and closures, which ignore the impact on the taxpayer.

ANALYSIS OF PROBLEM

Background

In the past ten years, the percentage of overall audits (including businesses and individuals) conducted

by correspondence has remained steady, around 80 percent. However, overall audits have decreased

substantially, as shown in Figure 1.8.1.

4

IRS, W&I RICS Examination PAC 7F Reports (Sept. 2018), combining correspondence statuses 55 and 57. See Internal

Revenue Manual (IRM) 4.19.13.11, Monitoring Overaged Replies (Feb. 9, 2018) instruction to give either a 107 or a 150-day

follow up expectation to taxpayers. For a discussion of the IRS’s practice of mothballing overaged audit responses from

taxpayers, see Case Advocacy section, infra.

5

IRS, Product Line Detail (Enterprise Performance) Snapshot report (week ending Sept. 30, 2018).

6

IRS response to TAS information request (Oct. 24, 2018).

7

Jason DeBacker, Bradley T. Heim, Anh Tran, and Alexander Yuskavage, Once Bitten, Twice Shy? The Lasting Impact of

IRS Audits on Individual Tax Reporting (Aug. 25, 2015) (working paper, Indiana University), https://pdfs.semanticscholar.

org/3833/61d62ea27f93deb89bf2c4b926bc5e96e14b.pdf.

Most Serious Problems — Correspondence Examination128

Legislative

Recommendations

Most Serious

Problems

Most Litigated

Issues

Case Advocacy Appendices

FIGURE 1.8.1

8

Number of Correspondence Audits, Office Audits,

and Field Audits Closed during Fiscal Years 2009 through 2018

Correspondence Audit

Office Audit

Field Audit

2009

2018

20132010 2011

2012

2014

2015

2016

2017

300,000

600,000

900,000

1,200,000

As shown in Figure 1.8.2, in FY 2018, SB/SE closed about 266,000 correspondence exams,

9

and Wage

and Investment Division (W&I) closed about 461,000 correspondence exams, with EITC exams

comprising about 72 percent of W&I’s exams.

10

FIGURE 1.8.2

11

W&I and SB/SE Correspondence Audits Closed by

EITC and Non-EITC for FY 2017 to 2018

FY 2017 FY 2018

EITC

SB/SE

Non-EITC

SB/SE

EITC

W&I

Non-EITC

W&I

130,485

253,720

265,690

268 46

131,397

326,265

330,033

8

IRS response to TAS Fact Check (Dec. 20, 2018). For the purposes of this chart, correspondence audits include audits

closed by campus tax examiners in the Wage and Investment Division (W&I) and Small Business/Self-Employed Division

(SB/SE). Field audits include audits closed by revenue agents in SB/SE and Large Business and International (LB&I).

Office audits include audits closed by tax compliance officers in SB/SE.

9

IRS response to TAS information request (Oct. 24, 2018).

10

Id.

11

IRS response to TAS fact check (Dec. 20, 2018). IRS response to TAS information request (Oct. 24, 2018).

Taxpayer Advocate Service — 2018 Annual Report to Congress — Volume One 129

Legislative

Recommendations

Most Serious

Problems

Most Litigated

Issues

Case AdvocacyAppendices

SB/SE handles discretionary correspondence audits, including over 30 individual tax issues, such

as nonrefundable credits, Schedule A and Schedule C expenses, and unreported income.

12

Of the

nearly 447,000 Schedule C exams closed by SB/SE in the last two fiscal years, about 29 percent were

conducted by correspondence. Schedule C correspondence exams represented about 38 percent

of all correspondence exams conducted by SB/SE.

13

The IRS has indicated that it may conduct

correspondence exams for some issues related to the new deduction for qualified business income under

IRC § 199A, but has not projected the volume.

14

SB/SE uses a variety of sources to determine which cases to audit. To determine the exam work plan,

SB/SE reports looking at the staffing/hours to work returns, projections for inventory already started

or delivered to the various Exam functions, and the Exam Planning Scenario Tool (EPST), which

determines the mix of inventory for Discriminant Index Function returns for Correspondence Exam

Discretionary as well as Field Revenue Agents (RAs) and Tax Compliance Officers (TCOs).

15

EPST

provides scenarios of optimized mix by activity codes for Field (RA & TCO) and by project codes for

Campus, based on historical business results.

16

Activity codes describe the financial scope of the return

and its complexity, which help determine the appropriate type of examiner.

17

Project Codes identify a

specific feature or item on a tax return that the IRS would like to monitor for compliance purposes, for

example, Schedule A – Casualty Loss.

18

Starting in FY 2016, W&I exclusively worked all new EITC correspondence exams.

19

The majority of

the inventory in the Refundable Credits Examination Operation (RCEO) is derived from the computer

program known as the Dependent Database (DDb).

20

In FY 2014, DDb identified more than 77

percent of the closed EITC audits.

21

12

See IRM 4.19.15.1 through 4.19.15.43 (Dec. 1, 2017). SB/SE does not specifically audit Earned Income Tax Credit (EITC),

but they will make automatic adjustments to EITC, the American Opportunity Tax Credit, and the Child Tax Credit when the

Adjusted Gross Income changes due to other audit adjustments, including changes to Schedule C income.

13

IRS response to TAS fact check (Dec. 20, 2018).

14

The IRS anticipates a low volume of IRC § 199A exams during FY 2019 since most examinations efforts during that fiscal

year will be tax year 2017 and earlier returns. IRS response to TAS information request (Oct. 24, 2018).

15

Discretionary exams are conducted by choice, as opposed to EITC exams that are driven by the Revenue Protection Strategy

or the refundable credits exams identified by risk based scoring criteria. See IRM 4.19.15.1.3, Roles and Responsibilities

(Dec. 1, 2017); IRM 4.19.14.1.1, Background (Dec. 7, 2017); IRM 4.19.14.1.4, Program Management and Review (Dec. 7,

2017).

16

IRS response to TAS information request (Apr. 27, 2018). The activity code identifies the type of return examined, e.g.,

Form 1040 in a specified income range and the project code identifies the examination issue(s), e.g., EITC. See Document

6036 (October 2017).

17

IRM Exhibit 4.4.1-1, Reference Guide (Apr. 15, 2016). An activity code would present a brief description of the return such

as: Non-Farm Business with Schedule C or F where Total Gross Receipts are between $XX and $XX, and Total Positive

Income is less than $XX. IRS, Document 6036, Examination Division Reporting System Codes Booklet 18-24 (Oct. 2017).

The activity codes include the actual dollar range, which TAS redacted here. “In general, total positive income is the

sum of all positive amounts shown for the various sources of income reported on the individual income tax return, and

thus excludes losses.” IRS 2017 Databook, October 1, 2016 to September 30, 2017, 33, https://www.irs.gov/pub/irs-

soi/17databk.pdf.

18

IRS, Project Code Listing (Oct. 16, 2018).

19

IRS response to TAS information request (Oct. 24, 2018).

20

IRS response to TAS information request (June 22, 2018).

21

Government Accountability Office (GAO), Certain Internal Controls for Audits in the Small Business and Self-Employed Division

Should Be Strengthened, 16-103 (Dec. 2015). The IRS may not be using the Dependent Database (DDb) effectively because

it concentrates its EITC audit resources on taxpayers with a noncompliance issue that is relatively minor (the relationship

test), compared to an issue associated with 75 percent of all EITC qualifying child errors (the residency test). National

Taxpayer Advocate 2015 Annual Report to Congress 248-260 (Most Serious Problem: Earned Income Tax Credit (EITC): The

IRS Is Not Adequately Using the EITC Examination Process As an Educational Tool and Is Not Auditing Returns With the Greatest

Indirect Potential for Improving EITC Compliance).

Most Serious Problems — Correspondence Examination130

Legislative

Recommendations

Most Serious

Problems

Most Litigated

Issues

Case Advocacy Appendices

FIGURE 1.8.3, Top 5 Project Codes Examined by W&I and SB/SE Correspondence Audit

Programs in FY 2010 and FY 2018

22

Project Description FY 2010 Project Description FY 2018

First Time Homebuyer Credit (Pre-Refund case) 281,446 EITC DDb (Pre-Refund) 105,765

EITC DDb (Pre-Refund) 160,647 Employee Business Expense 71,429

Non-Filer Program 113,612 Schedule C Expenses 57,657

Employee Business Expense 69,106 EITC-DDb Post refund 47,903

EITC-DDb Post Refund 67,841 Non-Filer Program 37,791

As shown in Figure 1.8.4, correspondence audits generally have lower no change rates, lower

agreed rates, and significantly higher non-response rates. Appealed rates are surprisingly low for

correspondence audits, given the low agreed rates, and may reflect taxpayers who are not receiving

the correspondence or who have simply given up. On the other hand, audit reconsiderations are

significantly higher for correspondence exams, which may reflect that taxpayers do not understand their

appeal rights or do not realize what has happened until the IRS tries to collect from them.

23

22

IRS, Compliance Data Warehouse (CDW) Audit Information Management System (AIMS) fiscal year (FY) 2010 and FY 2018

(Dec. 2018), and IRS response to TAS fact check (Dec. 20, 2018). TAS chose project codes because they show why a

return was selected and reflect the number of EITC adjustments. Issue codes reflect the adjustment line item on the tax

return, e.g., the issue code for exemptions means that the exemptions were in question and the examiner classified that

issue. However, issue codes do not include EITC in the top five because the EITC is an automatic adjustment, so the

examiner does not classify it. For example, changing the number of dependents would automatically calculate an EITC

adjustment, but EITC would not be reflected in the issue code.

23

IRS, CDW AIMS, Individual Master File (IMF), Business Master File (BMF) FY 2017 (Nov. 2018). Correspondence Audit

includes SB/SE and W&I closures. IRM 4.4.12.5.49.1, No Change Disposal Codes (June 1, 2002) defines a no change as

case closed by the examiner with no additional tax due (disposal code 1 and 2). In the IRS response to TAS fact check

(Dec. 20, 2018), SB/SE notes disposal code 1 as an agreed closure. TAS does not agree with SB/SE’s definition because

these cases do not require agreement from the taxpayer since there is no additional tax liability (see, e.g., IRM 4.10.8.2.2,

No Change with Adjustments Report Not Impacting Other Tax Year(s) (Sept. 12, 2014)) and the taxpayers agreement, or

disagreement, with the adjustment(s) as it pertains to another’s year’s liability is not known. Treasury Inspector General for

Tax Administration (TIGTA) Report 2018-30-069 concurs with TAS’s definition. Additionally, SB/SE includes ‘partially agreed’

cases (in which a taxpayer executes an agreement to some, but not all, of the proposed adjustments) as agreed cases in

their reporting. TAS excludes those cases since the final disposition of the case is unknown (see, e.g., IRM 4.4.12.2.6,

Final Disposition After Input of Partial Assessment (Sept. 17, 2015), which indicates that cases closed as partial agreements

must be updated to reflect either a later agreement or the issuance of a notice of deficiency). IRS response to TAS fact

check (Dec. 20, 2018) did not disagree with TAS’s definitions for no change or agreed closures.

Taxpayer Advocate Service — 2018 Annual Report to Congress — Volume One 131

Legislative

Recommendations

Most Serious

Problems

Most Litigated

Issues

Case AdvocacyAppendices

FIGURE 1.8.4

24

Closing Rates, Appealed Rate, and Audit Reconsideration Rate for

Correspondence Audit, Office Audit, and Field Audit Closed in FY 2017

Office Audit Field Audit

Correspondence Audit

Agreed Rate

No Change

Rate

Default Rate

Non-Response

Rate

Appealed

Rate

Audit

Reconsideration

Rate

50%

40%

30%

20%

10%

Audit Selection Procedures May Lead to Complex Cases Being Audited by

Correspondence and a Disproportionate Burden on Low Income Taxpayers

The IRS selects taxpayers for correspondence audit who have legally and factually complex issues, such

as taxpayers claiming the EITC or Child Tax Credit (CTC) with differing relationships with the child

claimed, complicated living situations where a child may not reside in one residence the entire year, and

multiple sources of support for the child.

25

Taxpayers claiming the EITC with qualifying children must

have a timely issued Social Security number (SSN) for the taxpayer and children; and there are three

primary tests for each qualifying child:

Age test: the child must be younger than the taxpayer and under 19 at the end of the calendar

year (or under 24 if a full-time student, or any age if permanently and totally disabled).

26

Relationship test: the child must be the taxpayer’s son or daughter, stepchild, foster or adopted

child, or a descendant of any of them (e.g., a grandchild), or a child who is a sibling, stepsibling,

or half-sibling of the taxpayer, or a descendant of any of them (e.g., a nephew or grandnephew).

27

Residence test: the child must live with the taxpayer for more than half the calendar year.

28

Taxpayers entering correspondence exams may be unfamiliar with these rules because they may have had

little involvement in filing their returns due to using a paid preparer. For EITC returns filed for tax year

2017, over half were prepared by paid preparers.

29

24

IRS, CDW AIMS, IMF, BMF FY 2017 (Nov. 2018). FY 2017 will have a low audit reconsideration compared to older years

due to the lack of time since the audit closing date. Correspondence Audit includes SB/SE and W&I closures. Field Audit

includes SB/SE and LB&I closures.

25

GAO explains: “Verifying eligibility with residency and relationship requirements can be complicated and subject to

interpretation,” and the IRS itself acknowledges on its website: “EITC is complex and many special rules apply.” GAO,

Comprehensive Compliance Strategy and Expanded Use of Data Could Strengthen IRS’s Efforts to Address Noncompliance

16-475 (May 2016); IRS, Do I Qualify for the Earned Income Tax Credit? (Jan. 2017), https://www.irs.gov/newsroom/do-i-

qualify-for-the-earned-income-tax-credit.

26

IRC § 152(c)(3).

27

IRC § 152(c)(2).

28

IRC § 152(c)(1)(B).

29

IRS, CDW, IRTF tax year 2017. (Dec. 2018).

Most Serious Problems — Correspondence Examination132

Legislative

Recommendations

Most Serious

Problems

Most Litigated

Issues

Case Advocacy Appendices

In addition to using correspondence exams for complex family status issues, the IRS is increasingly using

them to audit Schedule C taxpayers. SB/SE increased its percentage of Schedule C exams conducted

by correspondence from 18 percent in FY 2017 to 24 percent in FY 2018.

30

The National Taxpayer

Advocate is concerned about the IRS’s potential use of correspondence exams for the IRC § 199A

qualified business deduction, which involves highly complex issues as evidenced by the almost 47-page

proposed regulations.

31

Insufficient Training on Complex Issues for Correspondence Examiners May Prevent

Examiners From Correctly Determining the Liability or Knowing When to Transfer a Case

to an Employee With Specific Expertise

Currently, tax examiners (who conduct correspondence audits for W&I and SB/SE) receive

approximately 85 hours of basic income tax law training when they are hired. This training covers

primarily items on the Form 1040, U.S. Individual Income Tax Return, but may be supplemented by

training on additional deductions or specific issues.

32

For example, a correspondence examiner may

subsequently complete the six-hour course #17877, Schedule C Travel, Meals & Entertainment, the

18-hour course #17874, Mortgage Interest, or the 1.5 hour course, #17872, Schedule C Exams: Legal and

Professional Fees.

However, unlike TCOs and RAs conducting office and field examinations, tax examiners do not receive

the full spectrum of training on Form 1040 and related forms and schedules in one comprehensive

training session. This presents difficulties for the IRS and the taxpayer if an exam item expands or

evolves into an issue for which the correspondence examiner has not yet been trained. For example, a

review of a taxpayer’s travel, meals, and entertainment expenses may reveal that the claimed deduction

is actually a car and truck expense. If the tax examiner has not yet completed the two-hour course

#17876, Car and Truck, the taxpayer’s right to pay no more than the correct amount of tax may be

impaired.

33

A Substantial Number of Taxpayers Audited by Correspondence Face Barriers to

Understanding and Effectively Participating in the Audit

Challenges for Low Income Taxpayers

Almost half of all correspondence exams conducted by W&I and SB/SE for individual taxpayers are

EITC exams, which necessarily involve low income taxpayers.

34

Taxpayers with lower incomes and

30

IRS response to TAS fact check (Dec. 20, 2018).

31

Qualified Business Income Deduction, 83 Fed. Reg. 40884 (proposed Aug. 16, 2018) (to be codified at Treas.

Reg. §§ 1.199A–1 through 1.199A–6).

32

IRS response to TAS information request (May 21, 2018); IRS response to TAS information request (June 6, 2018); IRS

response to TAS fact check (Dec. 20, 2018).

33

IRS response to TAS information request (May 21, 2018). Examiners have the option to transfer a correspondence exam

to an area office if the issue is deemed too complex for correspondence and they receive managerial approval. However,

without adequate technical training, an examiner might not recognize the issue should be reassigned to an employee with

more or different expertise. IRM 4.19.13.15.1, Transfers to Area Office (Jan. 1, 2016).

34

Approximately 46 percent of correspondence examinations (excluding partnership audits conducted under the partnership

audit rules of the Tax Equity and Fiscal Responsibility Act (TEFRA)) closed by W&I or SB/SE during FYs 2017 and 2018 were

EITC exams. IRS response to TAS information request (Oct. 24, 2018). IRS response to TAS information request (Oct. 25,

2018). Almost three quarters of W&I correspondence exams closed during FY 2018 were EITC exams. IRS response to

TAS fact check (Dec. 20, 2018).

Taxpayer Advocate Service — 2018 Annual Report to Congress — Volume One 133

Legislative

Recommendations

Most Serious

Problems

Most Litigated

Issues

Case AdvocacyAppendices

education levels may have more difficulty understanding the tax laws and may rely on incompetent or

unscrupulous return preparers.

35

FIGURE 1.8.5, Individual Returns Closed by Correspondence Audit in FY 2010 and

FY 2018 by Activity Code:

36

FY 2010 FY 2018

Form 1040PR/1040SS 382 157

Form 1040, EITC present & TPI <$200,000 and Schedule C/F TGR <$25,000 or EITC with

No Schedule C/F

539,318 350,820

Form 1040, EITC present & TPI <$200,000 and Schedule C/F TGR >$24,999 12,495 7,728

Form 1040, No EITC present – TPI <$200,000 and No Schedule C, E, F, or Form 2106 327,621 119,450

Form 1040, No EITC present – TPI <$200,000 and Schedule E or Form 2106 but No

Schedule C or F

128,243 97,133

Form 1040, No EITC present - Non-farm Business with Schedule C/F TGR <$25,000 and

TPI <$200,000

84,937 74,485

Form 1040, No EITC present - Non-farm Business with Schedule C/F TGR $25,000 -

$99,999 and TPI <$200,000

31,442 17,736

Form 1040, No EITC present - Non-farm Business with Schedule C/F TGR $100,000 -

$199,999 and TPI <$200,000

11,999 10,076

Form 1040, No EITC present - Non-farm Business with Schedule C/F TGR >$199,999 and

TPI <$200,000

1,885 3,333

Form 1040, No EITC present - Farm Business Not Classified Elsewhere and TPI <

$200,000

2,752 2,218

Form 1040, No EITC present - No Schedule C or F and TPI >$199,999 and <$1,000,000 53,931 16,783

Form 1040, No EITC present - Schedule C or F present and TPI >$199,999 and

<$1,000,000

19,079 13,871

Form 1040, No EITC present - TPI >$999,999 9,369 3,210

Correspondence examinations may be especially challenging for taxpayers with a language barrier, who

may benefit from a face-to-face conversation. A 2014 TAS survey found that 70 percent of Hispanic

consumers who are representative of the general Hispanic population age 18 and older were below 250

percent of the federal poverty level, making them more likely to claim refundable credits designed

for low income taxpayers, which are generally audited by correspondence.

37

Furthermore, despite

the high number of low income taxpayers who use paid preparers, low income taxpayers audited by

correspondence may not be represented during the actual audit. A 2007 TAS study found the vast

majority of EITC taxpayers audited were unrepresented.

38

Unrepresented taxpayers may not understand

35

In 2014, 80 percent of students leaving high school (including those who graduated and those who did not) from families with

income in the top quartile enrolled in college, compared with only 45 percent from families in the bottom quartile. The Pell

Institute, Indicators of Higher Education Equity in the United States: 2016 Historical Trend Report 20, http://www.pellinstitute.

org/downloads/publications-Indicators_of_Higher_Education_Equity_in_the_US_2016_Historical_Trend_Report.pdf.

36

IRS response to TAS fact check (Dec. 20, 2018).

37

Forrester Research, Inc., The Taxpayer Advocate Service: Hispanic Underserved Analysis, Q4 2014, 10 (Dec. 2014). See

National Taxpayer Advocate 2015 Annual Report to Congress vol. 2, 101-110 (Research Study: Understanding the Hispanic

Underserved Population).

38

National Taxpayer Advocate 2007 Annual Report to Congress vol. 2 94-116 (Study: IRS Earned Income Credit Audits — A

Challenge to Taxpayers).

Most Serious Problems — Correspondence Examination134

Legislative

Recommendations

Most Serious

Problems

Most Litigated

Issues

Case Advocacy Appendices

the correspondence or how to respond correctly without being able to ask questions face-to-face.

39

In

the 2007 TAS study, TAS found that represented taxpayers were twice as likely to retain EITC after the

audit, and they retained almost twice as much EITC, as unrepresented taxpayers.

40

Difficulty in Receiving Mail and Having Correspondence Timely Reviewed

Compounding other issues is the fact that taxpayers do not always receive correspondence from the IRS.

During the last two fiscal years, approximately eight percent of statutory notices of deficiency (SNODs)

in EITC correspondence exams and four percent of SNODs in non-EITC exams conducted by W&I

were undeliverable.

41

Undeliverable mail rates for the SNODs in SB/SE correspondence exams were

higher than W&I correspondence exams during FYs 2017 and 2018, indicating that small businesses

and self-employed taxpayers may have more problems with receiving SNODs.

42

Even when mail is received and responded to, it may not be worked in time. Although SB/SE and W&I

report associating exam correspondence to the taxpayer’s file within one or two days, examiners may not

review the correspondence until much later.

43

As shown in Figures 1.8.6 and 1.8.7, W&I was delinquent

in reviewing and responding to responses for the majority of correspondence audits.

44

FIGURE 1.8.6, W&I Response Time for FY 2018 EITC Audits

45

Cases Percentage

Responses 65 days old or greater 55,318 83%

Responses less than 65 days old 11,508 17%

FIGURE 1.8.7, W&I Response Time for FY 2018 Non-EITC Refundable Credit Audits

46

Cases Percentage

Responses 65 days old or greater 22,487 79%

Responses less than 65 days old 5,881 21%

39

See Most Serious Problem: Statutory Notices of Deficiency: The IRS Fails to Clearly Convey Critical Information in Statutory

Notices of Deficiency, Making it Difficult for Taxpayers to Understand and Exercise Their Rights, Thereby Diminishing Customer

Service Quality, Eroding Voluntary Compliance, and Impeding Case Resolution, infra.

40

National Taxpayer Advocate 2007 Annual Report to Congress vol. 2 94-116 (Study: IRS Earned Income Credit Audits — A

Challenge to Taxpayers).

41

TAS response to TAS information request (Oct. 25, 2018). See Most Serious Problem: Statutory Notices of Deficiency: The

IRS Fails to Clearly Convey Critical Information in Statutory Notices of Deficiency, Making it Difficult for Taxpayers to Understand

and Exercise Their Rights, Thereby Diminishing Customer Service Quality, Eroding Voluntary Compliance, and Impeding Case

Resolution, infra.

42

IRS response to TAS fact check (Dec. 20, 2018).

43

IRS response to TAS information request (Oct. 25, 2018). IRS response to TAS information request (Oct. 24, 2018).

44

IRS responses are considered delinquent when the case is in status 55 or 57, which requires at least 65 days to have

elapsed since receiving the taxpayer’s reply. IRM 4.19.13.11, Monitoring Overaged Replies (Feb. 9, 2018); IRS, W&I RICS

Examination PAC 7F Reports (Sept. 2018) (combining correspondence statuses 55 and 57). For a discussion of the IRS’s

inadequate handling of overaged audit responses from taxpayers, see Case Advocacy section, infra.

45

IRS, W&I RICS Examination PAC 7F Reports (Sept. 2018).

46

Id.

Taxpayer Advocate Service — 2018 Annual Report to Congress — Volume One 135

Legislative

Recommendations

Most Serious

Problems

Most Litigated

Issues

Case AdvocacyAppendices

During 2018, taxpayers received an IRS “Interim Letter” informing them of delays of four, five, or, in

many cases, six months just for the IRS to review the taxpayer’s correspondence.

47

Because the IRS

only provides taxpayers with 30 days to provide documentation in a correspondence exam, these delays

may appear patently unfair to the taxpayer, harming trust in the tax system and negatively affecting

voluntary compliance.

48

Since many correspondence exams are conducted pre-refund, taxpayers may not receive their refunds

until the filing season of the next year.

49

TAS elevated the concern to W&I management, who

attributed the long wait times to attrition losses and a heavy volume of mail receipts. The IRS waits at

least 105 days after issuing the SNOD to allow for a taxpayer response before proceeding to assess the

tax by default.

50

However, the SNOD may go out before the IRS considers the taxpayer’s examination

response (including substantiating documents) because the system has advanced the case to the next

stage and will not permit the employee to stop it.

51

Inability To Reach the Employee Who Evaluates the Taxpayer’s Response

Even where the IRS receives the taxpayer’s correspondence and reviews it, taxpayers in correspondence

exams may not be able to speak to an employee familiar with the case because the IRS does not assign

a single employee to each taxpayer’s case, as directed by the IRS Restructuring and Reform Act of 1998

(RRA 98).

52

The IRS will assign the case to a tax examiner if it determines a reply “needs technical

assistance or evaluation of records sent by the taxpayer.”

53

Furthermore, because IRS correspondence does not include the contact information of the employee

who reviewed the taxpayer’s reply, the taxpayer cannot ask questions of the person who made the

decision.

54

Once a tax examiner reviews a taxpayer’s documentation, makes an evaluation, and creates a

letter to the taxpayer explaining why the documentation is not sufficient, such a letter should include the

employee’s name and contact information. RRA 98 states: “…any manually generated correspondence

received by a taxpayer from the Internal Revenue Service shall include in a prominent manner the name,

telephone number, and unique identifying number of an Internal Revenue Service employee the taxpayer

may contact with respect to the correspondence.”

55

By not including this information, the IRS may be

violating the law and is impairing the taxpayer’s right to challenge the IRS’s position and be heard.

47

Letter 3500, Interim Letter to Correspondence from Taxpayer. See Systemic Advocacy Management System (SAMS) issues

39961, 39948, 39794, 39786, 39779, 36457, 36121, 35726, and 34740 documenting use of Letter 3500 and chronic

delays in responding to taxpayer correspondence.

48

For a discussion of how perceived fairness affects voluntary compliance, see Erich Kirchler, Erik Hoelzl, and Ingrid Wahl,

Enforced versus Voluntary Tax Compliance: The ‘‘Slippery Slope’’ Framework, 29 J. Econ. Psychol. 218-219 (2008).

49

During 2018 through the end of October, the IRS sent out approximately 176,000 CP 75 Exam Initial Contact Letter – EIC –

Refund Frozen to taxpayers, indicating that it was holding their refunds pending a correspondence examination. The average

cycle time for a correspondence audit in W&I during the last two fiscal years was about 190 days and 229 for SB/SE. IRS

response to TAS information request (Oct. 25, 2018); IRS response to TAS information request (Oct. 24, 2018).

50

IRM 4.19.10.1.5.2, Standard Suspense Periods for Correspondence Examination (Dec. 8, 2017).

51

See IRM 4.19.13.10.6, Taxpayer Requests Additional Time to Respond, 7-8 (Mar. 30, 2018).

52

Pub. L. No. 105-206 § 3705(b), 112 Stat. 685, 777 (1998). See National Taxpayer Advocate 2014 Annual Report to

Congress 134-144 (Most Serious Problem: Correspondence Examination: The IRS Has Overlooked the Congressional Mandate

to Assign a Specific Employee to Correspondence Examination Cases, Thereby Harming Taxpayers).

53

IRM 4.19.13.10, Taxpayer Replies (Feb. 20, 2018).

54

See, e.g., Letter 525, General 30 Day Letter (Sept. 2014).

55

Pub. L. No. 105-206, § 3705(a) (1998).

Most Serious Problems — Correspondence Examination136

Legislative

Recommendations

Most Serious

Problems

Most Litigated

Issues

Case Advocacy Appendices

The IRS may not know how many taxpayers are trying to reach the IRS about a correspondence exam

because taxpayers cannot reach an employee at all. During FY 2018, the SB/SE exam phone line only

had a 61 percent level of service, with only 35 percent of calls being answered by an exam employee, and

about 17 percent routed to an automated message.

56

W&I reports receiving an average of only about

1.6 incoming calls per correspondence exam during the last two fiscal years, and SB/SE reports only

about 0.8 incoming calls per correspondence exam.

57

A 2010 IRS analysis found that 62 percent of

correspondence exam callers were repeat callers.

58

In many cases, there is no personal contact before closing a case. In FY 2018, about 42 percent of W&I

and SB/SE correspondence audits were closed with no personal contact.

59

During FYs 2017 and 2018,

W&I reported an average of 0.09 outgoing calls per correspondence exam—approximately one call

for every 11 cases.

60

The IRM touts: “Because the ACE [Automated Correspondence Exam] system

will automatically process the case through creation, statutory notice and closing, tax examiner (TE)

involvement is eliminated entirely on no-reply cases. Once a taxpayer reply has been considered, the

case can be reintroduced into ACE for automated Aging and Closing in most instances.”

61

Because

examinations are an opportunity for the taxpayer to show the IRS that it is wrong (or why the taxpayer

believes the IRS is wrong), closing an exam with no personal contact means the IRS misses an

opportunity to fix its filters or update its educational materials to clarify confusing issues. Further, TAS

has found that outgoing contacts can increase the response rate for taxpayers, reduce the average cycle

time of the exam, and increase the taxpayer agreed rate—which not only saves the IRS resources, but

may mean the taxpayer better understood the exam and why the return was incorrect.

62

56

IRS, Product Line Detail (Enterprise Performance) Snapshot report (week ending Sept. 30, 2018).

57

IRS response to TAS information request (Oct. 24, 2018); IRS response to TAS information request (Oct. 25, 2018).

58

Thirteen percent of correspondence exam callers called more than eight times. POP Team Recommendations, Solutions to

Improve Taxpayer Satisfaction in Correspondence Examination Briefing Document (June 21, 2010).

59

IRS response to TAS fact check (Dec. 20, 2018).

60

Id.

61

IRM 4.19.20.2, Automated Correspondence Exam Overview (ACE) (Jan. 8, 2015).

62

The IRS selected 900 correspondence exam cases for a test group in which Exam telephoned the taxpayers ten days after

the initial contact letter and again just prior to issuing the statutory notice of deficiency (cases were randomly selected

from Project Codes 0261 and 0289 inventory via the DDb starting in cycle 2011-04 and continuing through cycle 2011-

18). For those taxpayers successfully contacted, the response rate was 61 percent compared to 43 for the control group,

the average cycle time was 21 days less than the control group, and the agreed rate was 30 percent compared to just 20

percent for the control group. TAS, Earned Income Tax Credit (EITC) Enhanced Communication Test (CEECT) White Paper

(Nov. 2012).

TAS has found that outgoing contacts can increase the response rate for

taxpayers, reduce the average cycle time of the exam, and increase the

taxpayer agreed rate—which not only saves the IRS resources, but may

mean the taxpayer better understood the exam and why the return was

incorrect.

Taxpayer Advocate Service — 2018 Annual Report to Congress — Volume One 137

Legislative

Recommendations

Most Serious

Problems

Most Litigated

Issues

Case AdvocacyAppendices

The IRS’s Correspondence Is Often Confusing and Does Not Provide Sufficient Time to

Respond

A past TAS survey of taxpayers who were audited on the EITC found that more than 25 percent of

them did not understand the IRS audit notice was telling them they were under audit, and about half

didn’t understand what they needed to do in response to the audit letter.

63

This lack of awareness is not

limited to low income taxpayers claiming refundable credits. A study of self-employed taxpayers audited

by correspondence between 2010 and 2015 found 39 percent of taxpayers did not recall they had been

audited.

64

In a TAS study of enhanced communication during EITC correspondence audits, Exam forwarded

almost 700 cases to TAS that were closed other than as “no change” or “agreed” and TAS was able to

contact 37 percent of these taxpayers. In 44 percent of the cases, the taxpayers acknowledged they

were ineligible for the EITC, but only two percent of these 44 percent said they understood they were

ineligible prior to TAS’s contact.

65

Taxpayers who understand what they did wrong may avoid making

the same mistakes in the future. Further, this taxpayer education may promote voluntary compliance

because multiple studies show that increasing knowledge of tax law results in a higher willingness of

those taxpayers to comply.

66

However, when asked about procedures for educating audited taxpayers

to avoid repeat mistakes, W&I stated: “The document request and publications included in the notices

inform taxpayers of the tax law requirements and examples of documentation that can be provided to

support the audit issues.”

67

The IRS correspondence and forms are clearly inadequate to inform and educate taxpayers. The

CP 75, Exam Initial Contact Letter – EIC – Refund Frozen, one of the most common initial contact

letters in correspondence exams, demonstrates why taxpayers may not understand what documentation

is requested.

68

The CP 75 states at the top that the IRS is auditing the taxpayer’s return, which may

help alleviate confusion over whether the taxpayer is being audited. However, the CP 75 refers the

taxpayer to Form 886-H-EIC to understand which documents a taxpayer must send in to prove EITC

eligibility. As shown in Figure 1.8.8, this form is particularly confusing because it asks taxpayers to

submit information to prove different residency requirements without clearly telling the taxpayer which

documents may be submitted and which may fulfill some of or all of the different requirements.

63

National Taxpayer Advocate 2007 Annual Report to Congress vol. 2, 103 (Study: IRS Earned Income Credit Audits — A

Challenge to Taxpayers).

64

National Taxpayer Advocate 2017 Annual Report to Congress vol. 2, 163 (Matthias Kasper, Sebastian Beer, Erich Kirchler &

Brian Erard, Research Study: Audits, Identity Theft Investigations, and Taxpayer Attitudes: Evidence from a National Survey).

65

TAS, Earned Income Tax Credit (EITC) Enhanced Communication Test (CEECT) White Paper (Nov. 2012).

66

Id.

67

IRS response to TAS information request (June 22, 2018).

68

In FY 2018 the volume of CP75 notices were: CP75, 181,342; CP75A, 48,573; CP75C, 107; and CP75D, 17,949. IRS,

CDW, Notice Delivery System (NDS) FY 2018 (Dec. 2018).

Most Serious Problems — Correspondence Examination138

Legislative

Recommendations

Most Serious

Problems

Most Litigated

Issues

Case Advocacy Appendices

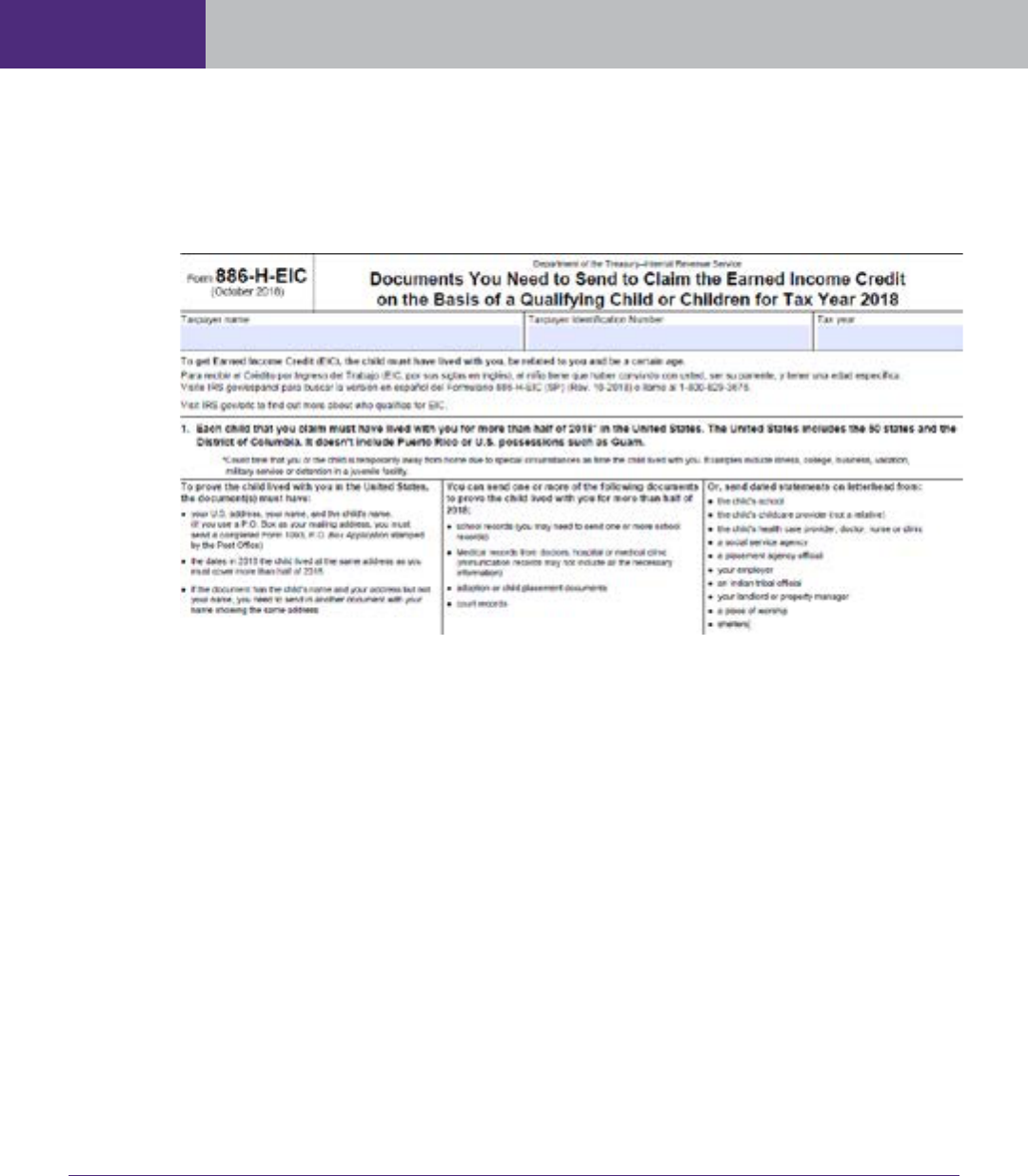

FIGURE 1.8.8, Excerpt of Question 1 from Form 886-H-EIC

A taxpayer reading this form may wonder: What kind of document is sufficient to prove residency in

the United States? Can only the documents in the second column related to proving the child lived with

the taxpayer be used to show residency in the United States? Are the documents in the third column

alternatives for both the first and the second column? What information must be included on a dated

statement? Would a school record issued at the end of the year demonstrate residency for more than half

the year, or would two be required? These questions could go on and on but, unfortunately, a taxpayer

has only 30 days to seek clarification from the IRS and provide the records. Although taxpayers can

request an extension of time to provide information, it appears either not many EITC taxpayers take

advantage of this or not many of these requests are granted. During the last two fiscal years, W&I

granted approximately 2,100 of these requests for additional time to respond, compared to SB/SE, which

granted approximately 27,000.

69

Furthermore, without an IRS employee being able to view the record a taxpayer is proposing to submit,

the examiner may not know that such a record would be inadequate until after the taxpayer already

mails it in.

70

Then, assuming the documentation is not accepted, instead of a conversation about how

to remedy the problem, the taxpayer would receive a “30-day letter,” indicating how the IRS proposes

to adjust the return and providing the taxpayer a 30-day window to provide further documentation

before the IRS issues the SNOD.

71

In some cases, the taxpayer may receive the 30-day letter at the

initiation of the audit, where the IRS combines the initial contact letter and the preliminary report into

69

Approximately 72 percent of W&I correspondence exams are EITC exams. Starting in 2016, SB/SE started no new EITC

correspondence audits. IRS response to TAS information request (Oct. 24, 2018); IRS response to TAS information request

(Oct. 25, 2018). Neither operating division could provide the number of denied requests for additional time to provide

documentation.

70

Virtual service delivery and other videoconferencing technology could mitigate this problem by allowing a taxpayer to show

records to an IRS employee in real time. See National Taxpayer Advocate 2014 Annual Report to Congress 154-162 (Most

Serious Problem: Virtual Service Delivery: Despite a Congressional Directive, the IRS Has Not Maximized the Appropriate Use of

Videoconferencing and Similar Technologies to Enhance Taxpayer Services).

71

IRC § 6213(a). Once a taxpayer receives the Statutory Notice of Deficiency (SNOD), the taxpayer may still provide

documentation to the IRS, but the 90-day period for petitioning the U.S. Tax Court to challenge the liability before paying has

begun.

Taxpayer Advocate Service — 2018 Annual Report to Congress — Volume One 139

Legislative

Recommendations

Most Serious

Problems

Most Litigated

Issues

Case AdvocacyAppendices

a “combo-letter.” This letter confuses the taxpayer and sends a message that the IRS has already made a

preliminary decision about the taxpayer’s case without even reviewing the taxpayer’s documentation.

The IRS Metrics Do Not Consider Taxpayer Needs and Preferences When Determining

the Effectiveness of Its Correspondence Exam Program, and the IRS Prioritizes Measures

Such as Cycle Time and Closures, Which Ignore the Impact on the Taxpayer

SB/SE points to the following metrics for measuring its examination program:

1. Full time employees

2. Closures and new starts by types of return

3. Inventory

4. Cycle time

5. Employee engagement index

6. Customer satisfaction

7. Reconsiderations

8. Quality score

72

W&I provided an even shorter list in response to TAS, highlighting only three metrics included in its

FY 2017 final Business Performance Review:

1. Cycle time

2. No change rate

3. Accuracy rate

73

Although customer satisfaction may affect voluntary compliance, this measure fails to capture taxpayers

who did not participate in the audit by not responding.

74

The IRS should measure response rates to

determine how many taxpayers participated and use this information to tailor its correspondence or

contacts for certain issues that resulted in low participation rates. Further, the metrics overall are

inadequate to determine the effectiveness of the correspondence examination program in terms of

choosing the best cases to audit, educating the taxpayer, and increasing voluntary compliance. In

addition to customer satisfaction surveys, the IRS could use surveys to gauge how well taxpayers

understand the audit. As discussed above, a 2007 TAS study found that more than 25 percent of EITC

taxpayers audited were not even aware they were being audited.

75

A metric that captured an agreement

rate would be more meaningful in determining effectiveness of compliance education than the summary

“change” rate by which IRS computes its return on investment because it would suggest the taxpayer

understands the error and will avoid making it again.

The IRS could also capture data regarding whether taxpayers understand the information they need

to provide by surveying or conducting focus groups with taxpayers and looking at what types of

documentation taxpayers frequently sent that were deemed insufficient. This could help the IRS better

72

IRS response to TAS information request (Apr. 27, 2018).

73

IRS response to TAS information request (June 22, 2018).

74

SB/SE Campus Exam Mail Customer Satisfaction Report, SB/SE Research TM20349 (Aug. 2018).

75

National Taxpayer Advocate 2007 Annual Report to Congress vol. 2 103 (Study: IRS Earned Income Credit Audits — A

Challenge to Taxpayers).

Most Serious Problems — Correspondence Examination140

Legislative

Recommendations

Most Serious

Problems

Most Litigated

Issues

Case Advocacy Appendices

inform taxpayers about exactly what documentation is acceptable and may even provide an impetus for

the IRS accepting additional forms of documentation as a result of what the surveys show.

Although SB/SE reports audit reconsideration numbers,

76

it does not do so in a meaningful way because

it compares only the sheer number of audit reconsiderations for field audits and correspondence audits

without looking at the percentage. Further, the IRS should measure how many correspondence audits

result in in appeals conferences and the result of those conferences. Additionally, the IRS should track

the number of appeals to the U.S. Tax Court, including what percentage resulted in a lower liability or

a full concession by the IRS, to understand where greater communication or better employee training is

needed.

77

Finally, neither W&I nor SB/SE measure how taxpayers perceive the IRS and how they feel about

paying taxes after a correspondence audit.

78

A recent TAS study found that taxpayers audited by

correspondence report a lower sense of fairness in the examination and are more likely to hold negative

views towards the IRS than individuals audited in-person.

79

Analyzing how correspondence audits affect taxpayer attitudes towards the IRS, including filing and

paying taxes, would go beyond just looking at whether a taxpayer was satisfied with the customer service

received during the audit. The IRS could gather data to analyze filing and payment compliance in the

years following an audit to determine the effect on future behavior.

CONCLUSION

The IRS’s correspondence examination program burdens taxpayers and misses opportunities to educate

the taxpayer. The IRS is ignoring important measures such as the resulting impact on voluntary

compliance and taxpayer attitudes. Focusing on metrics like closures and cycle time has allowed the

IRS to ignore the taxpayer perspective. Failing to assign an employee to a taxpayer’s case, not allowing

the taxpayer to speak with the examiner making decisions about the taxpayer’s case, closing cases with

little or no personal contact, and asking taxpayers to wait six months or more for the IRS to consider

documentation directly undermine the taxpayer’s right to challenge the IRS’s position and be heard, and

impair the rights to be informed, to quality service, to pay no more than the correct amount of tax, and to a

fair and just tax system.

76

IRS response to TAS information request (Oct. 24, 2018).

77

A 2012 TAS study found taxpayers in EITC cases that were fully conceded by the IRS called the IRS on average five times

after petitioning the U.S. Tax Court; yet, only one fifth of the cases were conceded due to the hazards of litigation. National

Taxpayer Advocate 2012 Annual Report to Congress vol. 2 87.

78

SB/SE Campus Exam Mail Customer Satisfaction Report, SB/SE Research TM20349 (Aug. 2018). The taxpayer may add

open-ended comments to the customer satisfaction survey, but the survey does not measure the taxpayer’s perception of

fairness.

79

See Brian Erard, Matthias Kasper, Erich Kirchler, and Jerome Olsen, Research Study: What Influence do IRS Audits Have on

Taxpayer Attitudes and Perceptions? Evidence from a National Survey, infra.

Taxpayer Advocate Service — 2018 Annual Report to Congress — Volume One 141

Legislative

Recommendations

Most Serious

Problems

Most Litigated

Issues

Case AdvocacyAppendices

RECOMMENDATIONS

The National Taxpayer Advocate recommends that the IRS:

1. Require at least one personal contact between an IRS employee and the taxpayer (this can be

satisfied by an outgoing or incoming phone call) before closing a correspondence examination.

2. Measure taxpayers’ filing compliance (including filing a return, making an error on a return, and

underreporting taxes on a return) following correspondence examinations and apply this data to

guide audit selection based on the resulting impact on compliance.

3. Continue to assign a single employee for a correspondence examination when the IRS receives

a response from the taxpayer either by phone or correspondence, and expand on this right by

retaining this employee as the single point of contact throughout the remainder of the exam.

4. Per RRA 98 § 3705(a), place on outgoing taxpayer correspondence the name and telephone

number of the tax examiner who reviewed the taxpayer’s correspondence where a tax examiner

has reviewed and made a determination regarding that specific documentation.

5. Conduct surveys of taxpayers following correspondence examinations to gauge their

understanding of the examination process and their resulting attitudes towards the IRS and

towards filing and paying taxes.

6. Collect data regarding which forms of documentation taxpayers sent in a correspondence

examination that were deemed insufficient and revise existing correspondence examination letters

to better explain documentation requirements.

7. End the practice of using the combination letter and provide taxpayers with an initial

contact prior to issuing the preliminary audit report.