THE LONG-RANGE DISABILITY ASSUMPTIONS

FOR THE 2023 TRUSTEES REPORT

OFFICE OF THE CHIEF ACTUARY

SOCIAL SECURITY ADMINISTRATION

March 31, 2023

Disability, Page 2

DISABILITY

ASSUMPTIONS FOR THE 2023 TRUSTEES REPORT

OFFICE OF THE CHIEF ACTUARY, SSA

TABLE OF CONTENTS PAGE

1 OVERVIEW ................................................................................................................................... 3

2 DISABILITY INCIDENCE RATE ..................................................................................................... 4

2.1 EFFECTS OF ECONOMIC CYCLES AND POLICY CHANGES ON DI INCIDENCE RATES .................................................. 4

2.2 ASSUMED FUTURE DISABILITY INCIDENCE RATES ................................................................................................... 5

3 DISABILITY DEATH RATE ............................................................................................................ 6

4 DISABILITY RECOVERY RATE ..................................................................................................... 7

5 DISABILITY PREVALENCE RATES ............................................................................................... 8

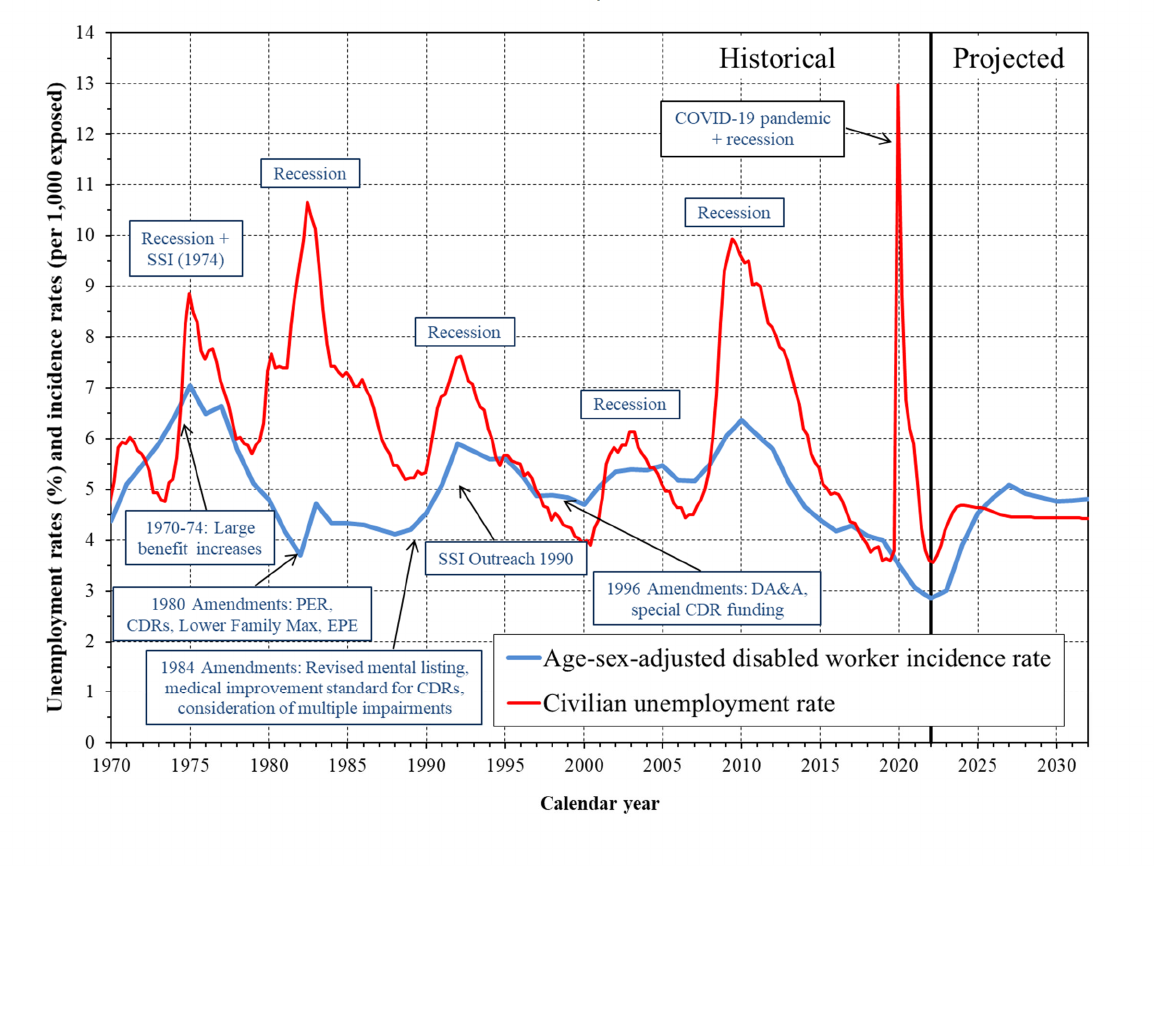

CHART 1: EFFECT OF THE ECONOMY ON THE DI INCIDENCE RATE ................................................................................. 9

CHART 2: NEW DISABLED-WORKER AWARDS PER 1,000 EXPOSED (INCIDENCE RATE) ............................................... 10

CHART 3: MALE DISABLED-WORKER AWARDS PER 1,000 EXPOSED (INCIDENCE RATE) BY AGE GROUP .................... 11

CHART 4: FEMALE DISABLED-WORKER AWARDS PER 1,000 EXPOSED (INCIDENCE RATE) BY AGE GROUP ................ 12

CHART 5: AGE-SEX-ADJUSTED COMPARISON OF SSA GENERAL POPULATION MORTALITY TO DISABLED WORKER

MORTALITY .......................................................................................................................................................... 13

CHART 6: DISABLED-WORKER RECOVERIES PER 1,000 BENEFICIARIES ....................................................................... 14

CHART 7: DISABLED-WORKER PREVALENCE RATES THROUGH NRA (PER 1,000 INSURED POPULATION) ................... 15

Disability, Page 3

1 Overview

Each year the Board of Trustees of the Federal Old-Age and Survivors Insurance (OASI) and

Disability Insurance (DI) Trust Funds provides an annual report to the Congress on the financial

and actuarial status of the Old-Age, Survivors, and Disability Insurance (OASDI) program. The

Office of the Chief Actuary (OCACT) produces projections of future cost and income based on

three separate sets of long-range (75-year) assumptions for three key disability variables. The

intermediate (alternative II) set of assumptions represents the Trustees’ best estimate for future

experience, while the low cost (alternative I) and high cost (alternative III) sets of assumptions

are more and less favorable, respectively, from the perspective of program cost as a percent of

taxable payroll. In addition, the intermediate assumptions serve as the point of comparison for

sensitivity analysis and the central tendency for the stochastic projections presented in the

OASDI annual report to the Board of Trustees (the “Trustees Report”). This memorandum

presents the long-range disability assumptions used in the 2023 Trustees Report.

At this time, there is no consensus on what the lasting effects of the COVID-19 pandemic on

long-term trends will be. The Trustees continue to assume that the pandemic will have no net

effect on the individual long-range ultimate assumptions.

The key disability assumptions are:

The disability incidence rates by age group and sex,

The disability death rate improvement factors by age group and sex, and

The disability recovery rates by age group and sex.

For the 2023 Trustees Report, the values for these key assumptions beyond the first 10 years of

the projection period are unchanged from those used for the 2022 Trustees Report. There are no

significant method changes in the disability model for the 2023 Trustees Report.

The following table shows values for key summary measures for the disability assumptions.

1

Key Disability Summary Measures for the Last 65 Years of the 75-Year Long-Range Projection Period (except as noted)

2022 Trustees Report and 2023 Trustees Report

2022 Trustees Report

Alternative

2023 Trustees Report

Alternative

2023 Trustees Report

Less 2022 Trustees

Re

p

ort

I II III I II III I II III

Ultimate age-sex-adjusted disability

incidence rate per 1,000 exposed

workers

3.9 4.8 5.8 3.8 4.8 5.8 -0.1 0.0 0.0

Age-sex-adjusted disability death rate

per 1,000 beneficiaries for the last

y

ear of the 75-

y

ear

p

ro

j

ection

21.9 12.5 6.2 21.5 12.4 6.1 -0.4 -0.1 -0.1

Ultimate age-sex-adjusted disability

recovery rate per 1,000 beneficiaries

12.5 10.4 8.3 12.5 10.4 8.3 0.0 0.0 0.0

1

The incidence and recovery rates for each alternative vary slightly over the last 65 years of the 75-year projection

period, so the ultimate rates are presented as averages over those 65 years. The death rates shown are for the last

year of the 75-year projection period. For the 2022 and 2023 Trustees Reports, the last years are 2096 and 2097,

respectively. There is a small amount of mortality improvement reflected in the death rates between 2096 and 2097.

Disability, Page 4

The disability incidence and recovery assumptions reach ultimate values for the tenth projection

year and thereafter. During the first ten years of the projection period, the long-range model

reconciles with projections from the short-range model.

The remainder of this memorandum provides details regarding the historical values and future

values for each of the disability assumptions, and the basis for the assumptions.

2 Disability Incidence Rate

2.1 Effects of Economic Cycles and Policy Changes on DI Incidence Rates

Disability incidence rates are the proportion of workers in a given year, insured for but not

receiving disabled-worker benefits (exposed population), who file for and are awarded disabled-

worker benefits. The age-sex-adjusted historical and short-range projected alternative II

incidence rates are shown in Chart 1. A number of specific economic and policy drivers have

influenced disability program cost historically and will continue to have an effect on disability

incidence. Periodic economic recessions, as indicated by the civilian unemployment rate in red

in Chart 1, have been associated with temporary increases in disability incidence. Incidence rates

tend to increase temporarily in bad economic times. Some individuals who gradually develop

conditions that would qualify for DI benefits based on the severity of their medically-

determinable impairment are able to continue work at a level in excess of substantial gainful

activity (SGA) given the opportunity and needed assistance during a period of strong economic

activity and demand for workers. However, with elevated unemployment rates like those seen in

the 2007-09 recession, many of these individuals will lose employment and will seek DI

benefits.

The recession that began in December 2007 resulted in an increase in disability applications and

incidence to peak levels in 2010 that were exceeded only by the peak in 1975. One apparent

exception to the relationship between disability incidence and economic recessions is the strong

recession of 1981-82. The effect of that recession appears to have been offset by the net effects

of the 1980 Amendments, which: (1) sharply increased the levels of pre-effectuation review of

disability allowances and continuing disability reviews of current beneficiaries; (2) introduced

the extended period of eligibility to encourage work; and (3) lowered the maximum family

benefit for DI beneficiaries.

Additional policy changes over the years had significant effects on disability incidence. Double-

digit ad-hoc benefit increases in 1970 through 1974 made disability benefits more attractive.

The 1984 Amendments may have offset the effects of a strong economic recovery with increased

emphasis on multiple impairments and mental listings, and the requirement to show medical

improvement for benefit cessation. The SSI outreach to disabled adults likely added to the

effects of the 1990-91 recession. Also, the effects of a strong economic recovery from 1995 to

2000 on lowering incidence rates may have been enhanced by the 1996 Amendments, which

eliminated drug addiction and alcoholism as disabling conditions.

Incidence rates have fallen steeply since 2010, concurrent with the recovery from the 2007-09

recession. Incidence rates through 2022 have dropped to levels well below those expected over

Disability, Page 5

the long-term, and even below the levels that would be expected from the economic recovery

alone. Contributing factors to the decline through 2019 in disability applications and awards

include the changing nature of jobs in the economy, the improving economy indicated by the low

unemployment rate, the greater availability of health care because of the Affordable Care Act,

and increasing job flexibility and accommodation by many employers in an increasingly

competitive labor market. Incidence rates declined to an extraordinarily low level in 2019, at the

end of an extended period of economic recovery, resulting in the lowest disability prevalence

rate for men since 1995, and a similarly low level for women. Incidence rates dropped even

further in 2020 and 2021, and to an all-time low in 2022, partly due to the effects of the COVID-

19 pandemic. Future policy changes, technological advancements, and economic cycles will

undoubtedly continue to cause fluctuations in disability incidence rates.

2.2 Assumed Future Disability Incidence Rates

For the 2023 Trustees Report, incidence rates are projected to rise to a temporary peak level for

2027 as some of the reduced levels of new benefit awards in the pandemic period are realized in

the next few years. After 2027, incidence rates gradually decline through the rest of the short-

range period to the ultimate assumed level of incidence in 2032. In 2032, at the end of the short-

range period, age-sex-specific incidence rates are assumed to reach the ultimate rates assumed

for the last 65 years of the long-range period. These ultimate age-sex-specific disability

incidence rates were selected based on careful analysis of historical levels and patterns and

expected future conditions, including the impact of scheduled increases in the normal retirement

age. The ultimate incidence rates represent the expected average rates of incidence for the future.

For alternative II of the 2023 Trustees Report, the Trustees assume an ultimate age-sex-adjusted

disabled-worker incidence rate of 4.8 per thousand exposed workers, unchanged from the 2022

report. This rate was 5.0 awards per thousand for the 2020 and 2021 Trustees Reports, 5.2

awards per thousand for the 2019 Trustees Report, and 5.4 awards per thousand for the 2012

through 2018 Trustees Reports. The 4.8 ultimate incidence rate is slightly lower than the

historical average experienced from 1995 through 2022 (4.9 awards per thousand) and is 23

percent higher than the most recent ten-year historical average experienced from 2013 through

2022 (4.0 awards per thousand). With the assumed ultimate disability incidence rate above the

average level over the last 10 years, the resulting projected disability prevalence rates will still

rise to sustained levels that are higher than historical rates, other than the temporarily high rates

that resulted from the 2007-09 recession.

The ultimate incidence rates are calculated by age group and sex using a no-lag unemployment

rate regression model for the years 1995-2019. The regression model uses data beginning in

1995 to capture recent higher levels of female disability incidence rates. For ages 60-64, rates

are increased from the regression results to reflect the planned increase in the Social Security

Normal Retirement Age from 66 to 67. Rates for ages 65 and older are calculated using a

weighted average of the base incidence rates and projected exposure. These rates are further

adjusted with a 0.3 percent discount for the reinstatement of the reconsideration step of the

disability appeals process and a 0.25 percent discount for the removal of the inability to

communicate in English as an education category in the disability determination process.

OCACT will continue to monitor experience closely and review the disability incidence

assumption.

Disability, Page 6

The 2011 Technical Panel on Assumptions and Methods, appointed by the independent Social

Security Advisory Board, suggested raising the 2011 Trustees Report ultimate alternative II

incidence rate assumption of 5.2 to 5.8. The 2015 Technical Panel agreed with the ultimate

alternative II incidence rate assumption of 5.4 and suggested that OCACT closely monitor

experience. The 2019 Technical Panel suggested lowering the disability incidence rate to 4.9,

consistent with the panel’s lower long-term unemployment rate assumption of 4.8 percent and

taking into account some of the recent drop in incidence. The 2019 panel also recommended

continued monitoring of trends in the incidence rate (including external consultation with experts

in the private disability industry) and linking the disability incidence rate and unemployment rate

assumptions.

The Congressional Budget Office raised their ultimate disability incidence rate to 5.6 for their

2013 through 2015 Long-Term Budget Outlooks and reduced the assumption to 5.4 for their

2016 through 2018 reports, matching the Trustees. For the 2019 Long-Term Budget Outlook,

they reduced the assumption to 5.2, again matching the Trustees. The 2020-23 Long-Term

Budget Outlooks do not explicitly mention the disability incidence assumption, so we assume it

remains at 5.2.

Chart 2 shows age-adjusted historical and long-range alternative II incidence rates for men and

women. For men, the age-adjusted incidence rate has averaged 5.0 new disability awards per

thousand exposed workers from 1995 through 2022. The female age-adjusted incidence rate has

averaged 4.8 from 1995 through 2022. Since 1980, the age-adjusted incidence rate for women

has increased to a level much closer to the rate for men. For the 2023 Trustees Report, the

Trustees assume ultimate age-adjusted disability incidence rates for both men and women are 4.8

new disability awards per thousand exposed workers.

Chart 3 and Chart 4 show the historical and long-range alternative II incidence rates by age

group for men and women, respectively. The table below shows the 2023 Trustees Report

alternative II ultimate disability incidence rates by age group.

Ultimate

1

Disabilit

y

Incidence Rates

p

er 1,000 Ex

p

osed, 2023 Trustees Re

p

ort Alternative II

Age Group

15-19 20-24 25-29 30-34 35-39 40-44 45-49 50-54 55-59 60-64 65+

Male 0.4 1.3 1.6 1.9 2.6 3.5 4.9 8.3 14.3 18.0 10.0

Female 0.3 0.9 1.3 1.9 2.8 4.1 5.6 8.9 13.8 15.3 8.5

1

Rates vary slightly over the last 65 years of the 75-year projection period, so the ultimate rates are presented as averages

for those 65 years.

Because the low-cost and high-cost alternative ultimate disability incidence rates are determined

by adjusting the incidence rates from the intermediate alternative down and up by roughly 20

percent, respectively, rates for these alternatives are not included in the charts.

3 Disability Death Rate

Death rates are much higher for the disabled population than the general population, as seen in

Chart 5. Base probabilities of death by duration, age, and sex (from Actuarial Study No. 125)

are applied to the disabled-worker population. In the first year of the projection period, the death

Disability, Page 7

rate is determined by fitting an exponential curve to historical death rates for disabled workers by

age group and sex. For the rest of the projection period, death rate improvement factors are

applied to the base probabilities of death to reflect the same rate of improvement as the general

population for that age group and sex. For the 2023 Trustees Report, death rates are assumed to

remain elevated through 2024 due to the COVID-19 pandemic, and then return to follow the

underlying declining trend in general population mortality. The age-sex-adjusted death rate

decreases from 28.6 per thousand beneficiaries in 2022 to 12.4 per thousand for 2097 under the

intermediate assumptions for the 2023 Trustees Report.

The disability death rates for the low-cost and high-cost alternatives are determined by

increasing and decreasing by 7.5 percent, respectively, the death rate in the first year of the

projection period. Then the general population mortality improvement for that alternative is

applied to project death rates for the remainder of the 75-year period.

The 2011 Technical Panel recommended a more rapid decline in disability mortality rates for

both men and women from 2020 through 2030. The 2015 Technical Panel stated that they were

comfortable with the Trustees’ assumption. The 2019 Technical Panel did not address this

assumption.

4 Disability Recovery Rate

Beneficiaries stop receiving disability benefits when they (1) die, (2) convert to a retired-worker

benefit at normal retirement age, (3) recover from their medically-determinable disabling

condition, or (4) return to work for an extended period. Disabled-worker beneficiaries who return

to substantial work for an extended period are deemed to have recovered, and their benefits are

then terminated. The recovery rate is the ratio of the number of terminations for reasons (3) and

(4) to the average number of disabled-worker beneficiaries during the year. Base probabilities of

recovery (from Actuarial Study No. 125)

by duration, age, and sex are applied to the disabled-

worker population.

Chart 6 shows age-sex-adjusted historical and projected alternative II recovery rates. The rate of

recovery is, at times, affected by budget appropriations for continuing disability reviews, with no

general upward or downward trend since 1985. The ultimate disability recovery rate under the

intermediate alternative is equal to the average recovery rate by age group and sex for the years

1985-2005, excluding 1997. The averaging period begins in 1985, after the Social Security

Disability Benefits Reform Act of 1984 created medical improvement standards for continuing

disability reviews. The spike in recoveries in 1997 when drug and alcohol addictions were

eliminated as bases for disability entitlement is excluded from the calculation.

The projected age-sex-adjusted recovery rate (medical improvement and return to work) under

the intermediate assumptions decreases from the relatively high level of 19.6 per thousand

beneficiaries in 2022 to the ultimate level of 10.4 per thousand beneficiaries under the

intermediate assumptions for the 2023 Trustees Report. For the 2023 Trustees Report, the

recovery rate is expected to decrease as the backlog of disabled worker reviews is assumed to be

eliminated by the end of 2025. Thereafter, the rate decreases toward the expected long-term

projected rate.

Disability, Page 8

Because the low-cost and high-cost alternative ultimate disability recovery rates are determined

by adjusting the recovery rates from the intermediate alternative up and down by roughly 20

percent, respectively, rates for these alternatives are not included in the chart.

The 2011 Technical Panel suggested reducing the ultimate alternative II recovery rate

assumption from 10.7 to 8.7. The 2015 Technical Panel recommended reducing the ultimate

alternative II recovery rate assumption from 10.4 to 10.1. The 2019 Technical Panel did not

address this assumption.

5 Disability Prevalence Rates

The disability prevalence rate is the percentage of the disability insured population that is in

receipt of disability benefits. Changes in prevalence rates are a direct result of changes in

incidence rates and termination rates. Age-sex-adjusted prevalence rates have increased

primarily because: (1) termination rates, in particular death termination rates, have declined; (2)

incidence rates at younger ages have increased relative to rates at older ages (new beneficiaries at

younger ages have more potential years on the disability rolls); (3) incidence rates have increased

substantially for women to parity with men; and (4) the DI program has matured (disabled

worker benefits became available to those over age 50 at the start of the program in 1957 and to

younger workers in 1960, and disability insured status requirements were eased for those under

age 31 in 1968).

Disability prevalence rates for men rose rapidly prior to 1995 and then less rapidly through 2007,

as the program matured. Prevalence rates increased later for women, reaching parity with the

rates for men shortly after 2007. Age-sex-adjusted prevalence rates are now at levels below

those seen in 2007 and are still declining, in part due to the pandemic. Prevalence rates are

projected to grow gradually to levels above those seen in 2007 based on the assumed

stabilization in incidence rates by age and sex at levels above those experienced over the past 10

years. As incidence rates gradually stabilize, the declining death termination rate continues to

have a small influence toward higher disability prevalence rates, because applying the same rate

of reduction in death rates for the disabled as for the general population results in larger declines

in the death rate for the disabled.

The projected age-sex-adjusted disability prevalence rate grows from 34.4 per thousand

disability insured at the end of 2022 to 43.3 per thousand at the end of 2097. Chart 7 illustrates

the historical and projected disabled worker prevalence rates for men and women. The female

prevalence rate rose close to the level of the male rate around 2007, and is slightly higher than

the male rate beginning in 2013, because the disability death and recovery rates are generally

higher for men than women. In 2097, the age-adjusted prevalence rate is 43.1 for men and 43.6

for women. Even with recent low incidence rates, the disability prevalence rates, which were

below 40 per thousand in 2019, are projected to rise substantially, reaching levels above those

experienced prior to the recession of 2007-09.

The low-cost and high-cost alternative disability prevalence rates are determined using the

disability incidence rate, disability death rate, and disability recovery rate assumptions for that

alternative.

Disability, Page 9

Chart 1: Effect of the Economy on the DI Incidence Rate

Note: The projections reflect the Trustees’ assumptions for the 2023 Trustees Report.

Social Security Administration

Office of the Chief Actuary

March 31, 2023

Disabilit

y

,

Pa

g

e 10

Chart 2: New Disabled-Worker Awards per 1,000 Exposed (Incidence Rate)

Age-Adjusted (2000)

Note: The projections reflect the Trustees’ assumptions for the 2023 Trustees Report. The dotted lines show the short-range assumptions for the 2023 Trustees

Report.

Social Security Administration

Office of the Chief Actuary

March 31, 2023

Disabilit

y

,

Pa

g

e 11

Chart 3: Male Disabled-Worker Awards per 1,000 Exposed (Incidence Rate) by Age Group

Note: The projections reflect the Trustees’ assumptions for the 2023 Trustees Report. The dotted lines show the short-range assumptions for the 2023 Trustees

Report.

Social Security Administration

Office of the Chief Actuary

March 31, 2023

Disabilit

y

,

Pa

g

e 12

Chart 4: Female Disabled-Worker Awards per 1,000 Exposed (Incidence Rate) by Age Group

Note: The projections reflect the Trustees’ assumptions for the 2023 Trustees Report. The dotted lines show the short-range assumptions for the 2023 Trustees

Report.

Social Security Administration

Office of the Chief Actuary

March 31, 2023

Disabilit

y

,

Pa

g

e 13

.

Chart 5: Age-Sex-Adjusted Comparison of SSA General Population Mortality to Disabled Worker Mortality

Note: The projections reflect the Trustees’ assumptions for the 2023 Trustees Report.

Social Security Administration

Office of the Chief Actuary

March 31, 2023

Disabilit

y

,

Pa

g

e 14

Chart 6: Disabled-Worker Recoveries per 1,000 Beneficiaries

Age-Sex-Adjusted (2000)

Note: The projections reflect the Trustees’ assumptions for the 2023 Trustees Report. The dotted lines show the short-range assumptions for the 2023 Trustees

Report.

Social Security Administration

Office of the Chief Actuary

March 31, 2023

Disability, Page 15

Chart 7: Disabled-Worker Prevalence Rates through NRA (per 1,000 Insured Population)

Age-Adjusted to the 2000 Insured Population

Note: The projections reflect the Trustees’ assumptions for the 2023 Trustees Report. The dotted lines show the short-range assumptions for the 2023 Trustees

Report.

Social Security Administration

Office of the Chief Actuary

March 31, 2023