SFFAS 54 LEASE GUIDANCE:

RIGHT-TO-USE LEASES:

DEEMED “CAPITAL LEASES” FOR BUDGETARY TREATMENT

EFFECTIVE FISCAL YEAR 2024

PREPARED BY:

GENERAL LEDGER AND ADVISORY BRANCH

BUREAU OF THE FISCAL SERVICE

U.S. DEPARTMENT OF THE TREASURY

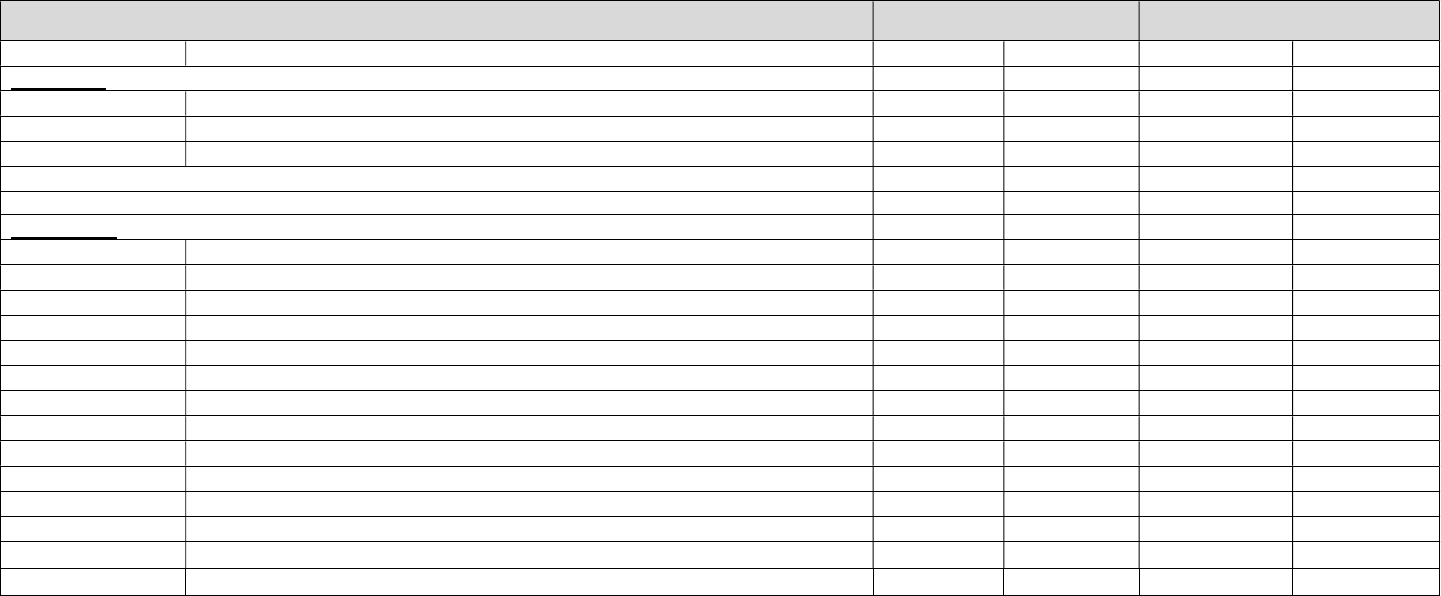

Version

Number

Date Description of Change Effective USSGL TFM

1.0

01

/20

2

3

Original

TFM Bulletin No. 20

23

-

0

3

1.1

03/2023

Lessee T

ransactions

6

-

8

updated with budget/accrual guidance.

TFM Bulletin No. 2024

-

01

1.2

04/2023

Lessor Year 1 Transactions updated with USSGL 593900

TFM Bulletin No. 2024

-

01

1.3 05/2023 Assumptions for Proprietary Interest Rates clarified per SFFAS

61

amendment

s

.

TFM Bulletin No. 2024-01

1.4 09/2023 SFFAS 62 practical accommodation added to “Proprietary

Accounting Requirements & Agency Decision Points”

TFM Bulletin No. 2024-01

1.5

12/2023

New Lease Transaction Codes added after November IRC

TFM Bulletin No. 2024

-

01

RIGHT-TO-USE LEASES GUIDANCE: BUDGETARY CAPITAL

Effective Fiscal 2024

Page 3 of 69 November 2022

Proprietary Accounting Requirements & Agency Decision Points

SFFAS No. 54, Leases, as amended by SFFAS No. 60 and SFFAS No. 61, replaces proprietary lease accounting and disclosure standards for general

purpose federal financial reports. SFFAS No. 54 is effective for reporting periods beginning after September 30, 2023. (Early implementation is not

permitted.)

A lease is defined as “a contract or agreement whereby one entity (lessor) conveys the right to control the use of PP&E (the underlying asset) to another

entity (lessee) for a period of time as specified in the contract or agreement in exchange for consideration.” (SFFAS 54, Par. 6.) SFFAS No. 54 requires

that federal lessees recognize a lease liability and a right-to-use lease asset (also referred to as a lease asset), and that federal lessors recognize a lease

receivable and unearned revenues at the commencement of the lease term, unless the lease meets the definitional criteria of a short-term lease, contract

or agreement that transfers ownership, or an intra-governmental lease.

For proprietary accounting, entity management is responsible for exercising professional judgement and collaborating within its agency to reach

certain determinations before establishing proprietary accounting treatment, including:

1) Lease Term, with consideration for Options, Renewals/Terminations, and Cancellation Clauses;

2) Calculation of Lease Asset/Liability; with consideration for Fixed vs. Variable Payments;

3) Selection of Proprietary Interest Rates - Amortization of Discount on Lease Liability/Receivable;

4) Modifications, Terminations, and any respective remeasurements; and

5) Contracts or Agreements Containing Nonlease and Lease Components (if applicable)

Proprietary Lease Term

For proprietary accounting, calculating the lease term is pivotal because the classification between short-term leases and right-to-use leases depends

on the lease duration. The lease term is determined to be the noncancelable lease period, plus certain periods subject to options to extend or terminate

the lease. The noncancelable period is the shorter of the period agreed upon in the lease contract that: (1) precedes any option to extend the lease; or

(2) precedes the first option to terminate the lease. In addition, the lessee’s lease term should include the noncancelable period, along with periods:

Involving an option to extend the lease, if it is probable that the lessee or lessor will exercise that option (SFFAS 54, Par. 15a & 15c)

Following an option to terminate the lease, if it is probable that the lessee or lessor will not exercise that option (SFFAS 54, Par. 15b & 15d)

Some specific provisions may also need to be applied when determining the lease term:

Periods for which the lessee/lessor (1) have an option to terminate the lease without permission from the other entity, or (2) have to agree to

extend, are considered to be cancelable periods and are thus excluded from the lease term (SFFAS 54, Par. 19a.)

An availability of funds/cancellation clause allowing lessees to cancel a lease agreement if funds for the lease payments are not appropriated

should only affect the lease term when it is probable that the clause will be exercised (SFFAS 54, Par. 19c.)

If a lessee has the option to purchase the underlying asset during the lease term and the contract is not a contract that transfers ownership, the

lease term should exclude the period, after the date at which the option is probable of being exercised (SFFAS 61, Par. 6)

RIGHT-TO-USE LEASES GUIDANCE: BUDGETARY CAPITAL

Effective Fiscal 2024

Page 4 of 69 November 2022

Calculating the Lease Asset/Lease Liability Amounts: Fixed vs. Variable Payments

The Lessee’s lease asset and the Lessor’s lease receivable should include the present value of payments expected to be made during the lease term.

Generally, these should include:

Fixed payments;

Variable payments that depend on an index or a rate;

Variable payments that are fixed in-substance; and

Any lease incentives receivable from the lessor.

For a complete list of payment types to include in the present value of payments, please see SFFAS 54, Paragraphs 40 and 56. (SFFAS 54, Par. 49 also

identifies costs that are to be capitalized as part of Lessor’s lease asset that are not components of a Lessee’s lease liability.)

Variable payments based on future performance of the lessee or usage of the underlying asset should be recognized as lease expense/revenue during

the reporting period to which those payments relate. These variable payments should not be included in the measurement of the lease liability/lease

receivable. (See SFFAS 54, Pars. 41 and 54.) Reporting entity management should consult with appropriate procurement officials, and use professional

judgment, to make determinations on what payments are fixed and what are variable for proprietary lease accounting purposes.

Proprietary Interest Rates - Amortization of Discount on Lease Liability/Receivable - Interest Expense/Revenue

Future lease payments should be discounted using the interest rate the lessor charges the lessee. When the rate is not stated in the lease, SFFAS 61

allows agencies flexibility to use a rate based on a recent marketable Treasury security rate, or a historical average interest rate on marketable Treasury

securities of a similar maturity to the term of the lease: “If the interest rate is not stated in the lease, the interest rate should be based on the interest rate

on marketable Treasury securities at the commencement of the lease term (or at the subsequent financial reporting date), with a similar maturity to the

term of the lease.” (SFFAS 61, Par. 6) Methodology for selecting interest rates based on marketable Treasury securities should be documented and

should be consistent from period to period.

In subsequent reporting periods, the Lessee should calculate the amortization of the discount on the lease liability and recognize that amount as interest

expense for the period. Any payments made should be allocated first to the accrued interest liability and then to the lease liability. (SFFAS 54, Par. 43)

Likewise, the Lessor should calculate the amortization of the discount on the receivable and report that amount as interest revenue for the period

(SFFAS 54, Par. 60.)

Lease Amortization & Lessor Unearned Revenue

During the lease term, the Lessee’s lease asset should be amortized in a systematic and rational manner, over the shorter of: The lease term; or the

useful life of the underlying asset. Meanwhile, the Lessor should amortize the unearned revenue to lease revenue in a systematic and rational manner

over the term of the lease. (SFFAS 54, Par. 65)

RIGHT-TO-USE LEASES GUIDANCE: BUDGETARY CAPITAL

Effective Fiscal 2024

Page 5 of 69 November 2022

Modifications/Terminations

In the event a right-to-use lease is terminated before the end of the contractual lease term (other than by a transfer of ownership/purchase of the

underlying asset), a Lessee should account for the termination by reducing the carrying values of the lease liability and the lease asset and recognizing

a gain/loss for the difference. Likewise, lessors should reduce the carrying value of the lease receivable and the related unearned revenue, and record

a gain/loss for the difference.

Contracts or Agreements Containing Nonlease and Lease Components

For contracts or agreements containing both nonlease and lease components, in which the purpose of the contract is primarily attributable to the nonlease

component(s), entities may elect to apply the practical accommodation in SFFAS 62.

This practical accommodation allows for the entity to treat the entire contact (including lease components) as a nonlease contract and to

expense/recognize as revenue the lease payments, rather than recognizing both expenses/revenue and lease assets/liabilities following the provisions

of SFFAS 54. (See SFFAS 62 for complete details on how to make the election, along with how to apply certain reporting and disclosure requirements.

Entity management must use professional judgement to assess the nature of contracts or agreements to make the most appropriate decision on the

primary purpose of the contract. (SFFAS 62, Par. 5)

RIGHT-TO-USE LEASES GUIDANCE: BUDGETARY CAPITAL

Effective Fiscal 2024

Page 6 of 69 November 2022

Budgetary Accounting Requirements & Agency Decision Points

While proprietary accounting requirements for leases are transformed by SFFAS 54, Leases, budgetary accounting requirements will remain unchanged

and continue to be guided by the lease scorekeeping rule developed by OMB, CBO, and the House and Senate Budget Committees originally in

connection with the Budget Enforcement Act of 1990, and guidance regarding this rule provided in OMB Circular No. A-11, Appendix B, Budgetary

Treatment Of Lease-Purchases and Leases of Capital Assets.

For budgetary accounting, entity management is responsible for exercising professional judgement and collaborating within its agency to reach

certain determinations before establishing budgetary accounting treatment, including:

1) Operating vs. Capital Lease (as defined by Appendix B of OMB Circular No. A-11);

2) Budgetary Lease Term, with consideration for Cancellation Clauses;

3) The Budgetary Interest Rate is selected per OMB Circular No. A-94, Appendix C guidance; and

4) Budget Authority and Outlays.

Operating/Capital/Lease Purchase

Reporting entities should apply professional judgment, consistent with the guidance in Appendix B of OMB Circular No. A-11, on Operating

Leases/Capital Leases criteria to discern the correct budgetary treatment of each lease contract. Budget Authority for Capital Leases should be recorded

up-front in an amount equal to the “asset cost,” as defined in Appendix B. Meanwhile, outlays of Capital Leases are scored over the lease term in an

amount equal to the annual lease and other contractually required payments.

“Amounts. The up-front budget authority required for both lease-purchases and capital leases is called the asset cost. This equals the present value of the

minimum lease and other contractually required payments excluding payments for identifiable annual operating expenses that would be paid by the

Government as owner, such as utilities, minor maintenance, and insurance. Property taxes will not be considered to be an operating expense and will be

included in the calculation of the up-front budget authority. (See section 3 for the treatment of property taxes for purposes of distinguishing operating leases

from capital leases.) Other contractually required payments include any and all costs related to the asset being leased in addition to the rent fee applied under

the lease.

For example, other contractually required payments would include all costs under triple net or other unique arrangements. The present value of the lease and

other contractually required payments is discounted as of the date of the first payment (or the beginning of the lease term, whichever is earlier) using the

appropriate interest rate (see section 4 for a more detailed explanation and the treatment of multiple deliveries).”

Listing of USSGL Accounts Used in This Scenario:

Account Number Account Title

Budgetary

406000

Anticipated Collections From Non

-

Federal Sources

411900

Other Appropriations Realized

RIGHT-TO-USE LEASES GUIDANCE: BUDGETARY CAPITAL

Effective Fiscal 2024

Page 7 of 69 November 2022

426600

Other Actual

Business

-

Type Collections From Non

-

Federal Sources

445000

Unapportioned

–

Unexpired Authority

449000

Anticipated Resources

-

Unapportioned Authority

451000

Apportionments

459000

Apportionments

–

Anticipated Resources

–

Programs Subject to

Apportionment

461000

Allotments

–

Realized Resources

480100

Undelivered Orders

–

Obligations, Unpaid

490100

Delivered Orders

–

Obligations, Unpaid

490200

Delivered Orders

–

Obligations, Paid

Proprietary

101000

Fund Balance With Treasury

134000

Interest Receivable

-

Not Otherwise Classified

175000

Equipment

175900

Accumulated Depreciation on Equipment

193000 Lessor Lease Receivable*

1

193900 Allowance for Loss on Lease Receivable*

195000 Lessee Right-To-Use Lease Asset*

195900 Accumulated Amortization on Lessee Lease Assets*

214000

Accrued Interest Payable

-

Not Otherwise Classified

233000 Unearned Lessor Revenue*

293000 Lessee Lease Liability*

310000

Unexpended Appropriations

-

Cumulative

310100

Unexpended Appropriations

–

Appropriations Received

310700

Unexpended Appropriations

-

Used

-

Accrued

310710

Unexpended Appropriations

-

Used

-

Disbursed

331000

Cumulative Results of Operations

531000

Interest Revenue

-

Other

570000

Expended Appropriations

–

Used Accrued

570010

Expended Appropriations

-

Disbursed

593300 Amortization of Unearned Lessor Revenue*

593900 Contra Revenue for Lessor Lease Revenue*

633000

Other Interest Expense

671000

Depreciation, Amortization, and Depletion

671300 Lessee Lease Amortization*

1

See Treasury Financial Manual, Volume 1, USSGL Supplements, Section II for Account Definitions of new lease accounts.

RIGHT-TO-USE LEASES GUIDANCE: BUDGETARY CAPITAL

Effective Fiscal 2024

Page 8 of 69 November 2022

Key Assumptions Driving Proprietary Accounting Entries:

Lease Term

A federal reporting entity (Lessee) signs a 5-year lease with a non-federal entity (Lessor) for the right to control/right to use equipment. (For

illustration purposes, the scenario also shows posting logic under a separate heading for a federal Lessor working with a non-federal Lessee.)

For illustration purposes, the lease is assumed to begin at the start of the fiscal year, 10/01/2023.

No purchase option probable of being exercised exists.

The Lessor already has equipment on its Balance Sheet valued at $300,000 with $150,000 Accumulated Depreciation.

The Present Value of all expected fixed payments is $100,000.

The Lessor charges the Lessee the Interest Rate on marketable Treasury securities as of the commencement of the lease term, per SFFAS 61

Paragraph 6 guidance, which for purposes of this scenario is assumed to be 10.00%.

All monthly payments are made at the last business day of the month – This scenario assumes payments are made directly to vendor and that

there is no lag time between disbursement, authorization, and receipt.

Lease Asset/Liability Calculation

The contract amount is $120,000 ($2,000 monthly payments x 60 months.)

Management calculates the Present Value of all expected fixed payments to be $94,131. The Lessor charges the Lessee the Treasury Rate of

10.00%.

The Lessor already has equipment on its Balance Sheet valued at $300,000 with $150,000 Accumulated Depreciation.

Fixed & Variable Payments

Management determines the lease contains only fixed payments. Fixed payments include a minimum annual payment required by the lease

contract, and lease payments (including interest) are paid at the start of the year.

Management determines there are no variable payments based on lessee performance or future usage of the underlying asset in the contract, per

SFFAS 54, Par. 41. (Also See Technical Release 20, Lease Implementation Guidance, Par. 48 for more information on Variable Payments.)

Management determines that the fixed lease payments are “contractually required payments" per OMB Circular A-11, Appendix B.

RIGHT-TO-USE LEASES GUIDANCE: BUDGETARY CAPITAL

Effective Fiscal 2024

Page 9 of 69 November 2022

Key Assumptions Driving Budgetary Accounting Entries:

Budgetary Authority

For illustration purposes, the lease is assumed to begin at the start of the fiscal year, 10/01/2023.

The Lessee received a direct appropriation and is working from a multi-year appropriated TAFS from a general fund expenditure account.

Agency management has concluded that appropriations language allows the budget authority to remain available for the lease and other

contractually required payments over the full term of the lease.

It is the responsibility of agencies to determine the correct discount rate and do their own calculations when determining budget authority for

capital leases. Per OMB Circular No. A-11, Appendix B, all assumptions required to perform the lease analysis are subject to OMB approval.

(The differential cost of financing has to be paid upfront by the agency as part of their asset cost calculation.)

The Lessor charges the Lessee the Interest Rate from OMB Circular No. A-94, Appendix C guidance, which for purposes of this scenarios is

assumed to be 10.00%. Per OMB Circular No. A-11, Appendix B, all assumptions required to perform the lease analysis are subject to OMB

approval.

Management determines that the fixed payments are "contractually required payments" per OMB Circular A-11, Appendix B.

Note – For budgetary purposes, agencies will need to develop amortization tables to calculate the asset cost of capital leases.

Budgetary Lease Capital/Operating Determination

Management determines the lease to be a “Capital lease” for budgetary purposes. Therefore, the asset cost (up-front budget authority required)

is the present value of the minimum lease and other contractually required payments. (Note that the differential cost of financing has to be paid

upfront by the agency as part of their asset cost calculation.)

Additional budget authority equal to the cost of financing (imputed interest cost) is recorded on an annual basis over the lease term. Imputed

interest cost is calculated pursuant to the guidance in OMB Circular No. A-11, Appendix B using the Treasury interest rates published in the

most recent update to Appendix C of OMB Circular No. A-94. It is equal to the difference between the minimum lease and other contractually

required payments under the full term of the lease and the estimated net present value of those payments (asset cost) that is recorded upfront.

For this example, assume the appropriate discount rate is 10.0%.

There are no other payments for identifiable annual operating expenses (utilities, minor maintenance, and insurance, etc.)

Budgetary Outlays

Outlays are scored annually equal to the annual lease and contractually required payments. Over the life of the lease:

o Outlays for the asset cost comes from the balances obligated when the lease agreement was signed; and

o Outlays for the imputed interest cost comes from new budget authority.

Cancellation Clauses

The lease does not contain renewal/purchase options or cancellation clauses, and is not associated with government land.

RIGHT-TO-USE LEASES GUIDANCE: BUDGETARY CAPITAL

Effective Fiscal 2024

Page 10 of 69 November 2022

Proprietary Amortization Table

Contract Amount $120,000

5-Year Lease, 60 monthly payments of $2,000 each

Interest Rate of 10.0% for Proprietary Accounting

Present Value of Payments = $94,131

Lessee Right-To-Use- Asset & Lease Liability amount: $94,131

For illustration purposes, the lease begins at the start of the fiscal year, 10/01/23

Monthly payments are considered to be disbursed on the last business day of each month.

Schedule of Budgetary Resources

Year 1 Budget Authority = Up-front Budget Authority (Present value of the minimum lease and other contractually required payments over the

full term of the lease), as well as the imputed interest accrued on the debt in Year 1.

$94,131 Lease Principal Payments over 5 years, plus Year 1 Interest Expense of $8,726 = $102,857

Year 2 Budget Authority = Year 2 Interest Expense of $7,126 = $7,126

Interest Rate of 10.0% for Budgetary Accounting.

Budget Outlays correspond to the monthly fixed payments over the lease term.

Disclaimer

The below guidance is intended to serve as a reference only based on a finite number of underlying assumptions. It is in no way intended to provide comprehensive

posting logic for every leasing activity. Agencies should have a thorough understanding of authoritative standards SFFAS 54, SFFAS 60, and SFFAS 61, and apply

other factors, including but not limited to certain prepayments, accruals, etc. As stated above, agency management must exercise professional judgement and

collaborate within their agency to reach determinations of lease activities on a lease-by-lease basis, before establishing accounting treatment.

Budgetary and/or legal staff should ascertain the applicability of certain budgetary accounting terms from OMB Circular No. A-11, Appendix B, including but not

limited to “contractually required payments.”

Entity management should document these decisions and incorporate them into management’s existing OMB Circular No. A-123, “Management's Responsibility

for Enterprise Risk Management and Internal Control,” Appendix A, procedures.

RIGHT-TO-USE LEASES GUIDANCE: BUDGETARY CAPITAL

Effective Fiscal 2024

Page 11 of 69 November 2022

RIGHT-TO-USE LEASES GUIDANCE: BUDGETARY CAPITAL

Effective Fiscal 2024

Page 12 of 69 November 2022

RIGHT-TO-USE LEASES GUIDANCE: BUDGETARY CAPITAL

Effective Fiscal 2024

Page 13 of 69 November 2022

FISCAL YEAR 1 - Right-To-Use Leases; “Capital” for Budgetary Treatment

Lessee Accounting

1. The Lessee records the enactment of appropriations in Year 1 of the 5-year lease agreement. Per OMB Circular No. A-11, Appendix B, this upfront Budget

Authority includes the present value of the minimum lease and other contractually required payments over the full term of the lease, as well as the imputed

interest accrued on the debt in Year 1. The Present Value of expected payments is $94,131, and interest accrued during the first year is $8,726 = Total

upfront Budget Authority = $102,857. (Imputed interest cost is recorded annually over the lease term.)

Lessee Debit Credit TC

Budgetary Entry

411900 Other Appropriations Realized

445000 Unapportioned - Unexpired Authority

Proprietary Entry

101000 (G) Fund Balance With Treasury

310100 (G) Unexpended Appropriations – Appropriations Received

102,857

102,857

102,857

102,857

A104

A104

2. The Lessee records budgetary authority apportioned by the Office of Management and Budget and available for allotment in Year 1.

Lessee Debit Credit TC

Budgetary Entry

445000 Unapportioned - Unexpired Authority

451000 Apportionments

Proprietary Entry

None

102,857

102,857

A116

RIGHT-TO-USE LEASES GUIDANCE: BUDGETARY CAPITAL

Effective Fiscal 2024

Page 14 of 69 November 2022

3. The Lessee records the allotment of authority in Year 1.

Lessee Debit Credit TC

Budgetary Entry

451000 Apportionments

461000 Allotments – Realized Resources

Proprietary Entry

None

102,857

102,857

A120

4. The lease contract is signed by both parties. The Lessee records current-year undelivered orders without an advance (Equal to only the $94,131 Present

Value of expected payments, plus $8,726 Year 1 Interest- Additional budget authority equal to the cost of financing (imputed interest cost) is recorded

on an annual basis over the lease term.

)

Lessee Debit Credit TC

Budgetary Entry

461000 Allotments – Realized Resources

480100 Undelivered Orders – Obligations, Unpaid

Proprietary Entry

None

102,857

102,857

B306

5. The Lessee takes control over the use of the equipment; The lease term is 5 years. A Lease Asset and Lease Liability are recorded per SFFAS 54, Par. 40 &

Par. 49. The entire amount of the lease liability (principle) is covered from the Year 1 appropriation.

Lessee Debit Credit TC

Budgetary Entry

480100 Undelivered Orders – Obligations, Unpaid

490100 Delivered Orders – Obligations, Unpaid

Proprietary Entry

195000 Lessee Right-To-Use Lease Asset

293000 Lessee Lease Liability

310700 Unexpended Appropriations - Used - Accrued

570000 Expended Appropriations - Accrued

94,131

94,131

94,131

94,131

94,131

94,131

B145

B437

B134

RIGHT-TO-USE LEASES GUIDANCE: BUDGETARY CAPITAL

Effective Fiscal 2024

Page 15 of 69 November 2022

6a. The lessee records accrued interest for month 1, per the proprietary amortization schedule. The lessee should calculate the amortization of the discount on the lease liability

and recognize that amount as interest expense for the period. (SFFAS 54, Par. 43)

Lessee - Accrual of Interest Expense for Month 1. Debit Credit TC

Budgetary Entry

480100 Undelivered Orders – Obligations, Unpaid

490100 Delivered Orders – Obligations, Unpaid

Proprietary Entry

633000 Other Interest Expense

214000 Accrued Interest Payable – Not Otherwise Classified

310700 Unexpended Appropriations - Used - Accrued

570000 Expended Appropriations

-

Accrued

784

784

784

784

784

784

B117

B117

B134

7a. The Lessee makes the monthly lease payment to Lessor and records the disbursement of appropriations for the fiscal year.

Lessee - Disbursement of Monthly Lease Payment (Budget Authority received up-front in Year 1.) Debit Credit TC

Budgetary Entry

490100 Delivered Orders – Obligations, Unpaid

490200 Delivered Orders – Obligations, Paid

Proprietary Entry

293000 Lessee Lease Liability

214000 Accrued Interest Payable - Not Otherwise Classified

101000 (G) Fund Balance With Treasury

310710 Unexpended Appropriations - Used – Disbursed

570000 Expended Appropriations - Accrued

310700 Unexpended Appropriations - Used - Accrued

570010 Expended Appropriations - Disbursed

2,000

1,216

784

2,000

2,000

2,000

2,000

2,000

2,000

B110

B110

B235

Ending Lease Liability Balance (USSGL 293000) = $92,915

8a. The Lessee records amortization of the right-to-use Lease Asset. ($94,131 / 5 Year Life of Lease / 12 months = $1,569 Straight-line Amortization per month.) A lease

asset should be amortized in a systematic and rational manner over the shorter of: The lease term; OR the useful life of the underlying asset. (SFFAS 54, Par. 50)

Lessee - Amortization of Lease Asset for Month 1. Debit Credit TC

Budgetary Entry

None

Proprietary Entry

671300 Lessee Lease Amortization

195900 Accumulated Amortization on Lessee Lease Assets

1,569

1,569

E127

Ending Lease Asset Balance (USSGL 195000 - 195900) = $92,562

RIGHT-TO-USE LEASES GUIDANCE: BUDGETARY CAPITAL

Effective Fiscal 2024

Page 16 of 69 November 2022

6b. The lessee records accrued interest for month 2, per the proprietary amortization schedule. The lessee should calculate the amortization of the discount on the lease liability

and recognize that amount as interest expense for the period. (SFFAS 54, Par. 43)

Lessee - Accrual of Interest Expense for Month 2. Debit Credit TC

Budgetary Entry

480100 Undelivered Orders – Obligations, Unpaid

490100 Delivered Orders – Obligations, Unpaid

Proprietary Entry

633000 Other Interest Expense

214000 Accrued Interest Payable – Not Otherwise Classified

310700 Unexpended Appropriations - Used - Accrued

570000 Expended Appropriations

-

Accrued

774

774

774

774

774

7

7

4

B117

B117

B134

7b. The Lessee makes the monthly lease payment to Lessor and records the disbursement of appropriations for the fiscal year.

Lessee - Disbursement of Monthly Lease Payment (Budget Authority received up-front in Year 1.) Debit Credit TC

Budgetary Entry

490100 Delivered Orders – Obligations, Unpaid

490200 Delivered Orders – Obligations, Paid

Proprietary Entry

293000 Lessee Lease Liability

214000 Accrued Interest Payable - Not Otherwise Classified

101000 (G) Fund Balance With Treasury

310710 Unexpended Appropriations - Used – Disbursed

570000 Expended Appropriations - Accrued

310700 Unexpended Appropriations - Used - Accrued

570010 Expended Appropriations - Disbursed

2,000

1,226

774

2,000

2,000

2,000

2,000

2,000

2,000

B110

B110

B235

Ending Lease Liability Balance (USSGL 293000) = $91,689

8b. The Lessee records amortization of the right-to-use Lease Asset. ($94,131 / 5 Year Life of Lease / 12 months = $1,569 Straight-line Amortization per month.) A lease

asset should be amortized in a systematic and rational manner over the shorter of: The lease term; OR the useful life of the underlying asset. (SFFAS 54, Par. 50)

Lessee - Amortization of Lease Asset for Month 2. Debit Credit TC

Budgetary Entry

None

Proprietary Entry

671300 Lessee Lease Amortization

195900 Accumulated Amortization on Lessee Lease Assets

1,569

1,569

E127

Ending Lease Asset Balance (USSGL 195000 - 195900) = $90,993

RIGHT-TO-USE LEASES GUIDANCE: BUDGETARY CAPITAL

Effective Fiscal 2024

Page 17 of 69 November 2022

6c. The lessee records accrued interest for month 3, per the proprietary amortization schedule. The lessee should calculate the amortization of the discount on the lease liability

and recognize that amount as interest expense for the period. (SFFAS 54, Par. 43)

Lessee - Accrual of Interest Expense for Month 3. Debit Credit TC

Budgetary Entry

480100 Undelivered Orders – Obligations, Unpaid

490100 Delivered Orders – Obligations, Unpaid

Proprietary Entry

633000 Other Interest Expense

214000 Accrued Interest Payable – Not Otherwise Classified

310700 Unexpended Appropriations - Used - Accrued

570000 Expended Appropriations

-

Accrued

764

764

764

764

764

7

6

4

B117

B117

B134

7c. The Lessee makes the monthly lease payment to Lessor and records the disbursement of appropriations for the fiscal year.

Lessee - Disbursement of Monthly Lease Payment (Budget Authority received up-front in Year 1.) Debit Credit TC

Budgetary Entry

490100 Delivered Orders – Obligations, Unpaid

490200 Delivered Orders – Obligations, Paid

Proprietary Entry

293000 Lessee Lease Liability

214000 Accrued Interest Payable - Not Otherwise Classified

101000 (G) Fund Balance With Treasury

310710 Unexpended Appropriations - Used – Disbursed

570000 Expended Appropriations - Accrued

310700 Unexpended Appropriations - Used - Accrued

570010 Expended Appropriations - Disbursed

2,000

1,236

764

2,000

2,000

2,000

2,000

2,000

2,000

B110

B110

B235

Ending Lease Liability Balance (USSGL 293000) = $90,454

8c. The Lessee records amortization of the right-to-use Lease Asset. ($94,131 / 5 Year Life of Lease / 12 months = $1,569 Straight-line Amortization per month.) A lease

asset should be amortized in a systematic and rational manner over the shorter of: The lease term; OR the useful life of the underlying asset. (SFFAS 54, Par. 50)

Lessee - Amortization of Lease Asset for Month 3. Debit Credit TC

Budgetary Entry

None

Proprietary Entry

671300 Lessee Lease Amortization

195900 Accumulated Amortization on Lessee Lease Assets

1,569

1,569

E127

Ending Lease Asset Balance (USSGL 195000 - 195900) = $89,424

RIGHT-TO-USE LEASES GUIDANCE: BUDGETARY CAPITAL

Effective Fiscal 2024

Page 18 of 69 November 2022

6d. The lessee records accrued interest for month 4, per the proprietary amortization schedule. The lessee should calculate the amortization of the discount on the lease liability

and recognize that amount as interest expense for the period. (SFFAS 54, Par. 43)

Lessee - Accrual of Interest Expense for Month 4. Debit Credit TC

Budgetary Entry

480100 Undelivered Orders – Obligations, Unpaid

490100 Delivered Orders – Obligations, Unpaid

Proprietary Entry

633000 Other Interest Expense

214000 Accrued Interest Payable – Not Otherwise Classified

310700 Unexpended Appropriations - Used - Accrued

570000 Expended Appropriations

-

Accrued

754

754

754

754

754

7

5

4

B117

B117

B134

7d. The Lessee makes the monthly lease payment to Lessor and records the disbursement of appropriations for the fiscal year.

Lessee - Disbursement of Monthly Lease Payment (Budget Authority received up-front in Year 1.) Debit Credit TC

Budgetary Entry

490100 Delivered Orders – Obligations, Unpaid

490200 Delivered Orders – Obligations, Paid

Proprietary Entry

293000 Lessee Lease Liability

214000 Accrued Interest Payable - Not Otherwise Classified

101000 (G) Fund Balance With Treasury

310710 Unexpended Appropriations - Used – Disbursed

570000 Expended Appropriations - Accrued

310700 Unexpended Appropriations - Used - Accrued

570010 Expended Appropriations - Disbursed

2,000

1,246

754

2,000

2,000

2,000

2,000

2,000

2,000

B110

B110

B235

Ending Lease Liability Balance (USSGL 293000) = $89,207

8d. The Lessee records amortization of the right-to-use Lease Asset. ($94,131 / 5 Year Life of Lease / 12 months = $1,569 Straight-line Amortization per month.) A lease

asset should be amortized in a systematic and rational manner over the shorter of: The lease term; OR the useful life of the underlying asset. (SFFAS 54, Par. 50)

Lessee - Amortization of Lease Asset for Month 4. Debit Credit TC

Budgetary Entry

None

Proprietary Entry

671300 Lessee Lease Amortization

195900 Accumulated Amortization on Lessee Lease Assets

1,569

1,569

E127

Ending Lease Asset Balance (USSGL 195000 - 195900) = $87,855

RIGHT-TO-USE LEASES GUIDANCE: BUDGETARY CAPITAL

Effective Fiscal 2024

Page 19 of 69 November 2022

6e. The lessee records accrued interest for month 5, per the proprietary amortization schedule. The lessee should calculate the amortization of the discount on the lease liability

and recognize that amount as interest expense for the period. (SFFAS 54, Par. 43)

Lessee - Accrual of Interest Expense for Month 5. Debit Credit TC

Budgetary Entry

480100 Undelivered Orders – Obligations, Unpaid

490100 Delivered Orders – Obligations, Unpaid

Proprietary Entry

633000 Other Interest Expense

214000 Accrued Interest Payable – Not Otherwise Classified

310700 Unexpended Appropriations - Used - Accrued

570000 Expended Appropriations

-

Accrued

743

743

743

743

743

7

43

B117

B117

B134

7e. The Lessee makes the monthly lease payment to Lessor and records the disbursement of appropriations for the fiscal year.

Lessee - Disbursement of Monthly Lease Payment (Budget Authority received up-front in Year 1.) Debit Credit TC

Budgetary Entry

490100 Delivered Orders – Obligations, Unpaid

490200 Delivered Orders – Obligations, Paid

Proprietary Entry

293000 Lessee Lease Liability

214000 Accrued Interest Payable - Not Otherwise Classified

101000 (G) Fund Balance With Treasury

310710 Unexpended Appropriations - Used – Disbursed

570000 Expended Appropriations - Accrued

310700 Unexpended Appropriations - Used - Accrued

570010 Expended Appropriations - Disbursed

2,000

1,257

743

2,000

2,000

2,000

2,000

2,000

2,000

B110

B110

B235

Ending Lease Liability Balance (USSGL 293000) = $87,951

8e. The Lessee records amortization of the right-to-use Lease Asset. ($94,131 / 5 Year Life of Lease / 12 months = $1,569 Straight-line Amortization per month.) A lease

asset should be amortized in a systematic and rational manner over the shorter of: The lease term; OR the useful life of the underlying asset. (SFFAS 54, Par. 50)

Lessee - Amortization of Lease Asset for Month 5. Debit Credit TC

Budgetary Entry

None

Proprietary Entry

671300 Lessee Lease Amortization

195900 Accumulated Amortization on Lessee Lease Assets

1,569

1,569

E127

Ending Lease Asset Balance (USSGL 195000 - 195900) = $86,287

RIGHT-TO-USE LEASES GUIDANCE: BUDGETARY CAPITAL

Effective Fiscal 2024

Page 20 of 69 November 2022

6f. The lessee records accrued interest for month 6, per the proprietary amortization schedule. The lessee should calculate the amortization of the discount on the lease liability

and recognize that amount as interest expense for the period. (SFFAS 54, Par. 43)

Lessee - Accrual of Interest Expense for Month 6. Debit Credit TC

Budgetary Entry

480100 Undelivered Orders – Obligations, Unpaid

490100 Delivered Orders – Obligations, Unpaid

Proprietary Entry

633000 Other Interest Expense

214000 Accrued Interest Payable – Not Otherwise Classified

310700 Unexpended Appropriations - Used - Accrued

570000 Expended Appropriations

-

Accrued

733

733

733

733

733

733

B117

B117

B134

7f. The Lessee makes the monthly lease payment to Lessor and records the disbursement of appropriations for the fiscal year.

Lessee - Disbursement of Monthly Lease Payment (Budget Authority received up-front in Year 1.) Debit Credit TC

Budgetary Entry

490100 Delivered Orders – Obligations, Unpaid

490200 Delivered Orders – Obligations, Paid

Proprietary Entry

293000 Lessee Lease Liability

214000 Accrued Interest Payable - Not Otherwise Classified

101000 (G) Fund Balance With Treasury

310710 Unexpended Appropriations - Used – Disbursed

570000 Expended Appropriations - Accrued

310700 Unexpended Appropriations - Used - Accrued

570010 Expended Appropriations - Disbursed

2,000

1,267

733

2,000

2,000

2,000

2,000

2,000

2,000

B110

B110

B235

Ending Lease Liability Balance (USSGL 293000) = $86,684

8f. The Lessee records amortization of the right-to-use Lease Asset. ($94,131 / 5 Year Life of Lease / 12 months = $1,569 Straight-line Amortization per month.) A lease

asset should be amortized in a systematic and rational manner over the shorter of: The lease term; OR the useful life of the underlying asset. (SFFAS 54, Par. 50)

Lessee - Amortization of Lease Asset for Month 6. Debit Credit TC

Budgetary Entry

None

Proprietary Entry

671300 Lessee Lease Amortization

195900 Accumulated Amortization on Lessee Lease Assets

1,569

1,569

E127

Ending Lease Asset Balance (USSGL 195000 - 195900) = $84,718

RIGHT-TO-USE LEASES GUIDANCE: BUDGETARY CAPITAL

Effective Fiscal 2024

Page 21 of 69 November 2022

6g. The lessee records accrued interest for month 7, per the proprietary amortization schedule. The lessee should calculate the amortization of the discount on the lease liability

and recognize that amount as interest expense for the period. (SFFAS 54, Par. 43)

Lessee - Accrual of Interest Expense for Month 7. Debit Credit TC

Budgetary Entry

480100 Undelivered Orders – Obligations, Unpaid

490100 Delivered Orders – Obligations, Unpaid

Proprietary Entry

633000 Other Interest Expense

214000 Accrued Interest Payable – Not Otherwise Classified

310700 Unexpended Appropriations - Used - Accrued

570000 Expended Appropriations

-

Accrued

722

722

722

722

722

722

B117

B117

B134

7g. The Lessee makes the monthly lease payment to Lessor and records the disbursement of appropriations for the fiscal year.

Lessee - Disbursement of Monthly Lease Payment (Budget Authority received up-front in Year 1.) Debit Credit TC

Budgetary Entry

490100 Delivered Orders – Obligations, Unpaid

490200 Delivered Orders – Obligations, Paid

Proprietary Entry

293000 Lessee Lease Liability

214000 Accrued Interest Payable - Not Otherwise Classified

101000 (G) Fund Balance With Treasury

310710 Unexpended Appropriations - Used – Disbursed

570000 Expended Appropriations - Accrued

310700 Unexpended Appropriations - Used - Accrued

570010 Expended Appropriations - Disbursed

2,000

1,278

722

2,000

2,000

2,000

2,000

2,000

2,000

B110

B110

B235

Ending Lease Liability Balance (USSGL 293000) = $85,406

8g. The Lessee records amortization of the right-to-use Lease Asset. ($94,131 / 5 Year Life of Lease / 12 months = $1,569 Straight-line Amortization per month.) A lease

asset should be amortized in a systematic and rational manner over the shorter of: The lease term; OR the useful life of the underlying asset. (SFFAS 54, Par. 50)

Lessee - Amortization of Lease Asset for Month 7. Debit Credit TC

Budgetary Entry

None

Proprietary Entry

671300 Lessee Lease Amortization

195900 Accumulated Amortization on Lessee Lease Assets

1,569

1,569

E127

Ending Lease Asset Balance (USSGL 195000 - 195900) = $83,149

RIGHT-TO-USE LEASES GUIDANCE: BUDGETARY CAPITAL

Effective Fiscal 2024

Page 22 of 69 November 2022

6h. The lessee records accrued interest for month 8, per the proprietary amortization schedule. The lessee should calculate the amortization of the discount on the lease liability

and recognize that amount as interest expense for the period. (SFFAS 54, Par. 43)

Lessee - Accrual of Interest Expense for Month 8. Debit Credit TC

Budgetary Entry

480100 Undelivered Orders – Obligations, Unpaid

490100 Delivered Orders – Obligations, Unpaid

Proprietary Entry

633000 Other Interest Expense

214000 Accrued Interest Payable – Not Otherwise Classified

310700 Unexpended Appropriations - Used - Accrued

570000 Expended Appropriations

-

Accrued

712

712

712

712

712

712

B117

B117

B134

7h. The Lessee makes the monthly lease payment to Lessor and records the disbursement of appropriations for the fiscal year.

Lessee - Disbursement of Monthly Lease Payment (Budget Authority received up-front in Year 1.) Debit Credit TC

Budgetary Entry

490100 Delivered Orders – Obligations, Unpaid

490200 Delivered Orders – Obligations, Paid

Proprietary Entry

293000 Lessee Lease Liability

214000 Accrued Interest Payable - Not Otherwise Classified

101000 (G) Fund Balance With Treasury

310710 Unexpended Appropriations - Used – Disbursed

570000 Expended Appropriations - Accrued

310700 Unexpended Appropriations - Used - Accrued

570010 Expended Appropriations - Disbursed

2,000

1,288

712

2,000

2,000

2,000

2,000

2,000

2,000

B110

B110

B235

Ending Lease Liability Balance (USSGL 293000) = $84,118

8h. The Lessee records amortization of the right-to-use Lease Asset. ($94,131 / 5 Year Life of Lease / 12 months = $1,569 Straight-line Amortization per month.) A lease

asset should be amortized in a systematic and rational manner over the shorter of: The lease term; OR the useful life of the underlying asset. (SFFAS 54, Par. 50)

Lessee - Amortization of Lease Asset for Month 8. Debit Credit TC

Budgetary Entry

None

Proprietary Entry

671300 Lessee Lease Amortization

195900 Accumulated Amortization on Lessee Lease Assets

1,569

1,569

E127

Ending Lease Asset Balance (USSGL 195000 - 195900) = $81,580

RIGHT-TO-USE LEASES GUIDANCE: BUDGETARY CAPITAL

Effective Fiscal 2024

Page 23 of 69 November 2022

6i. The lessee records accrued interest for month 9, per the proprietary amortization schedule. The lessee should calculate the amortization of the discount on the lease liability

and recognize that amount as interest expense for the period. (SFFAS 54, Par. 43)

Lessee - Accrual of Interest Expense for Month 9. Debit Credit TC

Budgetary Entry

480100 Undelivered Orders – Obligations, Unpaid

490100 Delivered Orders – Obligations, Unpaid

Proprietary Entry

633000 Other Interest Expense

214000 Accrued Interest Payable – Not Otherwise Classified

310700 Unexpended Appropriations - Used - Accrued

570000 Expended Appropriations

-

Accrued

701

701

701

701

701

701

B117

B117

B134

7i. The Lessee makes the monthly lease payment to Lessor and records the disbursement of appropriations for the fiscal year.

Lessee - Disbursement of Monthly Lease Payment (Budget Authority received up-front in Year 1.) Debit Credit TC

Budgetary Entry

490100 Delivered Orders – Obligations, Unpaid

490200 Delivered Orders – Obligations, Paid

Proprietary Entry

293000 Lessee Lease Liability

214000 Accrued Interest Payable - Not Otherwise Classified

101000 (G) Fund Balance With Treasury

310710 Unexpended Appropriations - Used – Disbursed

570000 Expended Appropriations - Accrued

310700 Unexpended Appropriations - Used - Accrued

570010 Expended Appropriations - Disbursed

2,000

1,299

701

2,000

2,000

2,000

2,000

2,000

2,000

B110

B110

B235

Ending Lease Liability Balance (USSGL 293000) = $82,819

8i. The Lessee records amortization of the right-to-use Lease Asset. ($94,131 / 5 Year Life of Lease / 12 months = $1,569 Straight-line Amortization per month.) A lease

asset should be amortized in a systematic and rational manner over the shorter of: The lease term; OR the useful life of the underlying asset. (SFFAS 54, Par. 50)

Lessee - Amortization of Lease Asset for Month 9. Debit Credit TC

Budgetary Entry

None

Proprietary Entry

671300 Lessee Lease Amortization

195900 Accumulated Amortization on Lessee Lease Assets

1,569

1,569

E127

Ending Lease Asset Balance (USSGL 195000 - 195900) = $80,011

RIGHT-TO-USE LEASES GUIDANCE: BUDGETARY CAPITAL

Effective Fiscal 2024

Page 24 of 69 November 2022

6j. The lessee records accrued interest for month 10, per the proprietary amortization schedule. The lessee should calculate the amortization of the discount on the lease liability

and recognize that amount as interest expense for the period. (SFFAS 54, Par. 43)

Lessee - Accrual of Interest Expense for Month 10. Debit Credit TC

Budgetary Entry

480100 Undelivered Orders – Obligations, Unpaid

490100 Delivered Orders – Obligations, Unpaid

Proprietary Entry

633000 Other Interest Expense

214000 Accrued Interest Payable – Not Otherwise Classified

310700 Unexpended Appropriations - Used - Accrued

570000 Expended Appropriations

-

Accrued

690

690

690

690

690

690

B117

B117

B134

7j. The Lessee makes the monthly lease payment to Lessor and records the disbursement of appropriations for the fiscal year.

Lessee - Disbursement of Monthly Lease Payment (Budget Authority received up-front in Year 1.) Debit Credit TC

Budgetary Entry

490100 Delivered Orders – Obligations, Unpaid

490200 Delivered Orders – Obligations, Paid

Proprietary Entry

293000 Lessee Lease Liability

214000 Accrued Interest Payable - Not Otherwise Classified

101000 (G) Fund Balance With Treasury

310710 Unexpended Appropriations - Used – Disbursed

570000 Expended Appropriations - Accrued

310700 Unexpended Appropriations - Used - Accrued

570010 Expended Appropriations - Disbursed

2,000

1,310

690

2,000

2,000

2,000

2,000

2,000

2,000

B110

B110

B235

Ending Lease Liability Balance (USSGL 293000) = $81,509

8j. The Lessee records amortization of the right-to-use Lease Asset. ($94,131 / 5 Year Life of Lease / 12 months = $1,569 Straight-line Amortization per month.) A lease

asset should be amortized in a systematic and rational manner over the shorter of: The lease term; OR the useful life of the underlying asset. (SFFAS 54, Par. 50)

Lessee - Amortization of Lease Asset for Month 10. Debit Credit TC

Budgetary Entry

None

Proprietary Entry

671300 Lessee Lease Amortization

195900 Accumulated Amortization on Lessee Lease Assets

1,569

1,569

E127

Ending Lease Asset Balance (USSGL 195000 - 195900) = $78,442

RIGHT-TO-USE LEASES GUIDANCE: BUDGETARY CAPITAL

Effective Fiscal 2024

Page 25 of 69 November 2022

6k. The lessee records accrued interest for month 11, per the proprietary amortization schedule. The lessee should calculate the amortization of the discount on the lease

liability and recognize that amount as interest expense for the period. (SFFAS 54, Par. 43)

Lessee - Accrual of Interest Expense for Month 11. Debit Credit TC

Budgetary Entry

480100 Undelivered Orders – Obligations, Unpaid

490100 Delivered Orders – Obligations, Unpaid

Proprietary Entry

633000 Other Interest Expense

214000 Accrued Interest Payable – Not Otherwise Classified

310700 Unexpended Appropriations - Used - Accrued

570000 Expended Appropriations

-

Accrued

679

679

679

679

679

679

B117

B117

B134

7k. The Lessee makes the monthly lease payment to Lessor and records the disbursement of appropriations for the fiscal year.

Lessee - Disbursement of Monthly Lease Payment (Budget Authority received up-front in Year 1.) Debit Credit TC

Budgetary Entry

490100 Delivered Orders – Obligations, Unpaid

490200 Delivered Orders – Obligations, Paid

Proprietary Entry

293000 Lessee Lease Liability

214000 Accrued Interest Payable - Not Otherwise Classified

101000 (G) Fund Balance With Treasury

310710 Unexpended Appropriations - Used – Disbursed

570000 Expended Appropriations - Accrued

310700 Unexpended Appropriations - Used - Accrued

570010 Expended Appropriations - Disbursed

2,000

1,321

679

2,000

2,000

2,000

2,000

2,000

2,000

B110

B110

B235

Ending Lease Liability Balance (USSGL 293000) = $80,188

8k. The Lessee records amortization of the right-to-use Lease Asset. ($94,131 / 5 Year Life of Lease / 12 months = $1,569 Straight-line Amortization per month.) A lease

asset should be amortized in a systematic and rational manner over the shorter of: The lease term; OR the useful life of the underlying asset. (SFFAS 54, Par. 50)

Lessee - Amortization of Lease Asset for Month 11. Debit Credit TC

Budgetary Entry

None

Proprietary Entry

671300 Lessee Lease Amortization

195900 Accumulated Amortization on Lessee Lease Assets

1,569

1,569

E127

Ending Lease Asset Balance (USSGL 195000 - 195900) = $76,873

RIGHT-TO-USE LEASES GUIDANCE: BUDGETARY CAPITAL

Effective Fiscal 2024

Page 26 of 69 November 2022

6l. The lessee records accrued interest for month 12, per the proprietary amortization schedule. The lessee should calculate the amortization of the discount on the lease liability

and recognize that amount as interest expense for the period. (SFFAS 54, Par. 43)

Lessee - Accrual of Interest Expense for Month 12. Debit Credit TC

Budgetary Entry

480100 Undelivered Orders – Obligations, Unpaid

490100 Delivered Orders – Obligations, Unpaid

Proprietary Entry

633000 Other Interest Expense

214000 Accrued Interest Payable – Not Otherwise Classified

310700 Unexpended Appropriations - Used - Accrued

570000 Expended Appropriations

-

Accrued

668

668

668

668

668

668

B117

B117

B134

7l. The Lessee makes the monthly lease payment to Lessor and records the disbursement of appropriations for the fiscal year.

Lessee - Disbursement of Monthly Lease Payment (Budget Authority received up-front in Year 1.) Debit Credit TC

Budgetary Entry

490100 Delivered Orders – Obligations, Unpaid

490200 Delivered Orders – Obligations, Paid

Proprietary Entry

293000 Lessee Lease Liability

214000 Accrued Interest Payable - Not Otherwise Classified

101000 (G) Fund Balance With Treasury

310710 Unexpended Appropriations - Used – Disbursed

570000 Expended Appropriations - Accrued

310700 Unexpended Appropriations - Used - Accrued

570010 Expended Appropriations - Disbursed

2,000

1,332

668

2,000

2,000

2,000

2,000

2,000

2,000

B110

B110

B235

Ending Lease Liability Balance (USSGL 293000) = $78,856

8l. The Lessee records amortization of the right-to-use Lease Asset. ($94,131 / 5 Year Life of Lease / 12 months = $1,569 Straight-line Amortization per month.) A lease

asset should be amortized in a systematic and rational manner over the shorter of: The lease term; OR the useful life of the underlying asset. (SFFAS 54, Par. 50)

Lessee - Amortization of Lease Asset for Month 12. Debit Credit TC

Budgetary Entry

None

Proprietary Entry

671300 Lessee Lease Amortization

195900 Accumulated Amortization on Lessee Lease Assets

1,569

1,569

E127

Ending Lease Asset Balance (USSGL 195000 - 195900) = $75,305

RIGHT-TO-USE LEASES GUIDANCE: BUDGETARY CAPITAL

Effective Fiscal 2024

Page 27 of 69 November 2022

9. The Lessee records the closing of lease and interest expenses to cumulative results of operations.

Lessee Debit Credit TC

Budgetary Entry

None

Proprietary Entry

331000 Cumulative Results of Operations

671300 Lessee Lease Amortization

633000 (N) Other Interest Expense

27,552

18,826

8,726

F336

10. The Lessee records the closing of expended appropriation to cumulative results of operations, along with the closing of fiscal-year activity to unexpended

appropriations.

Lessee Debit Credit TC

Budgetary Entry

None

Proprietary Entry

570000 Expended Appropriations – Accrued

570010 Expended Appropriations – Disbursed

331000 Cumulative Results of Operations

310000 Unexpended Appropriations – Cumulative

310700 Unexpended Appropriations - Used – Accrued

310710 Unexpended Appropriations - Used – Disbursed

310100 (G) Unexpended Appropriations – Appropriations Received

310000 Unexpended Appropriations - Cumulative

78,857

24,000

102,857

102,857

102,857

78,857

24,000

102,857

F336

F342

F342

RIGHT-TO-USE LEASES GUIDANCE: BUDGETARY CAPITAL

Effective Fiscal 2024

Page 28 of 69 November 2022

11. The Lessee records the closing of paid delivered orders to total actual resources.

Lessee Debit Credit TC

Budgetary Entry

490200 Delivered Orders – Obligations, Paid

420100 Total Actual Resources, Collected

Proprietary Entry

None

24,000

24,000

F314

12. The Lessee records the consolidation of actual net-funded resources.

Lessee Debit Credit TC

Budgetary Entry

420100 Total Actual Resources, Collected

411900 Other Appropriations Realized

Proprietary Entry

None

102,857

102,857

F302

RIGHT-TO-USE LEASES GUIDANCE: BUDGETARY CAPITAL

Effective Fiscal 2024

Page 29 of 69 November 2022

Lessor Accounting – FY 1

1. In Year 1, the Lessor records anticipated collections. (The amount of expected Year 1 monthly payments is $24,000.)

Lessor Debit Credit TC

Budgetary Entry

406000 Anticipated Collections From Non-Federal Sources

449000 Anticipated Resources - Unapportioned Authority

Proprietary Entry

None

24,000

24,000

A140

2. In Year 1, the Lessor records the apportionment approval by OMB of anticipated authority.

Lessor Debit Credit TC

Budgetary Entry

449000 Anticipated Resources - Unapportioned Authority

459000 Apportionments - Anticipated Resources - Programs Subject to Apportionment

Proprietary Entry

None

24,000

24,000

A118

3. The Lessee takes control over the use of the equipment; The lease term is 5 years. A Lease Receivable and Unearned Revenue are recorded per SFFAS 54.

Also per SFFAS 54, Par. 56, the Lessor reduces the lease receivable by a provision for uncollectible amounts based on adjustments/allowances/refunds.

Lessor Debit Credit TC

Budgetary Entry

None

Proprietary Entry

193000 Lessor Lease Receivable

233000 Lessor Lease Unearned Revenue

593900 Contra Revenue for Lessor Lease Revenue

193900 Allowance for Loss on Lease Receivable

94,131

2,000

94,131

2,000

C129

D402

Initial Lease Receivable Balance of USSGL 193000 = $94,131

RIGHT-TO-USE LEASES GUIDANCE: BUDGETARY CAPITAL

Effective Fiscal 2024

Page 30 of 69 November 2022

4a. The Lessor recognizes interest revenue for the amortization of the discount on the lease receivable for month 1. (SFFAS 54, Par. 60)

Lessor - Accrual of Interest Revenue for Year 1, Month 1 Debit Credit TC

Budgetary Entry

None

Proprietary Entry

134000 Interest Receivable - Not Otherwise Classified

531000 Interest Revenue - Other

784

784

5a. In month 1, the Lessee pays monthly lease payment to Lessor, and the Lessor records the receipt of payment. The Lessor allots the funds.

Lessor - Receipt of first Monthly Lease Payment Debit Credit TC

Budgetary Entry

426600 Other Actual Business-Type Collections From Non-Federal Sources*

406000 Anticipated Collections From Non-Federal Sources

459000 Apportionments - Anticipated Resources - Programs Subject to Apportionment

451000 Apportionments

451000 Apportionments

461000 Allotments – Realized Resources

Proprietary Entry

101000 (G) Fund Balance With Treasury

134000 Interest Receivable - Not Otherwise Classified

193000 Lessor Lease Receivable

2,000

2,000

2,000

2,000

2,000

2,000

2,000

784

1,216

C109

A123

A120

C109

*Note- Lessors may elect to record USSGL 426400 “Actual Collections of Rent” rather than 426600, based on management’s judgement of the nature of collections.

Ending Lease Receivable Balance of USSGL 193000 = $92,915

6a. The Lessor recognizes revenue from the measurement of the lease receivable as earned revenue for the reporting period via straight-line amortization. A Lessor should

amortize the unearned revenue (recognizing it as earned revenue) in a systematic and rational manner of life of the lease. (SFFAS 60, Par. 26)

Lessor - Recognition of Unearned Revenue for Year 1, Month 1 Debit Credit TC

Budgetary Entry

None

Proprietary Entry

233000 Lessor Lease Unearned Revenue

593300 Amortization of Unearned Lessor Revenue

1,569

1,569

C460

RIGHT-TO-USE LEASES GUIDANCE: BUDGETARY CAPITAL

Effective Fiscal 2024

Page 31 of 69 November 2022

4b. The Lessor recognizes interest revenue for the amortization of the discount on the lease receivable for month 2. (SFFAS 54, Par. 60)

Lessor - Accrual of Interest Revenue for Year 1, Month 2 Debit Credit TC

Budgetary Entry

None

Proprietary Entry

134000 Interest Receivable - Not Otherwise Classified

531000 Interest Revenue - Other

774

774

5b. In month 2, the Lessee pays monthly lease payment to Lessor, and the Lessor records the receipt of payment. The Lessor allots the funds.

Lessor - Receipt of second Monthly Lease Payment Debit Credit TC

Budgetary Entry

426600 Other Actual Business-Type Collections From Non-Federal Sources

406000 Anticipated Collections From Non-Federal Sources

459000 Apportionments - Anticipated Resources - Programs Subject to Apportionment

451000 Apportionments

451000 Apportionments

461000 Allotments – Realized Resources

Proprietary Entry

101000 (G) Fund Balance With Treasury

134000 Interest Receivable - Not Otherwise Classified

193000 Lessor Lease Receivable

2,000

2,000

2,000

2,000

2,000

2,000

2,000

774

1,226

C109

A123

A120

C109

Ending Lease Receivable Balance of USSGL 193000 = $91,689

6b. The Lessor recognizes revenue from the measurement of the lease receivable as earned revenue for the reporting period via straight-line amortization. A Lessor should

amortize the unearned revenue (recognizing it as earned revenue) in a systematic and rational manner of life of the lease. (SFFAS 60, Par. 26)

Lessor - Recognition of Unearned Revenue for Year 1, Month 2 Debit Credit TC

Budgetary Entry

None

Proprietary Entry

233000 Lessor Lease Unearned Revenue

593300 Amortization of Unearned Lessor Revenue

1,569

1,569

C460

RIGHT-TO-USE LEASES GUIDANCE: BUDGETARY CAPITAL

Effective Fiscal 2024

Page 32 of 69 November 2022

4c. The Lessor recognizes interest revenue for the amortization of the discount on the lease receivable for month 3. (SFFAS 54, Par. 60)

Lessor - Accrual of Interest Revenue for Year 1, Month 3 Debit Credit TC

Budgetary Entry

None

Proprietary Entry

134000 Interest Receivable - Not Otherwise Classified

531000 Interest Revenue - Other

764

764

5c. In month 3, the Lessee pays monthly lease payment to Lessor, and the Lessor records the receipt of payment. The Lessor allots the funds.

Lessor - Receipt of third Monthly Lease Payment Debit Credit TC

Budgetary Entry

426600 Other Actual Business-Type Collections From Non-Federal Sources

406000 Anticipated Collections From Non-Federal Sources

459000 Apportionments - Anticipated Resources - Programs Subject to Apportionment

451000 Apportionments

451000 Apportionments

461000 Allotments – Realized Resources

Proprietary Entry

101000 (G) Fund Balance With Treasury

134000 Interest Receivable - Not Otherwise Classified

193000 Lessor Lease Receivable

2,000

2,000

2,000

2,000

2,000

2,000

2,000

764

1,236

C109

A123

A120

C109

Ending Lease Receivable Balance of USSGL 193000 = $90,454

6c. The Lessor recognizes revenue from the measurement of the lease receivable as earned revenue for the reporting period via straight-line amortization. A Lessor should

amortize the unearned revenue (recognizing it as earned revenue) in a systematic and rational manner of life of the lease. (SFFAS 60, Par. 26)

Lessor - Recognition of Unearned Revenue for Year 1, Month 3 Debit Credit TC

Budgetary Entry

None

Proprietary Entry

233000 Lessor Lease Unearned Revenue

593300 Amortization of Unearned Lessor Revenue

1,569

1,569

C460

RIGHT-TO-USE LEASES GUIDANCE: BUDGETARY CAPITAL

Effective Fiscal 2024

Page 33 of 69 November 2022

4d. The Lessor recognizes interest revenue for the amortization of the discount on the lease receivable for month 4. (SFFAS 54, Par. 60)

Lessor - Accrual of Interest Revenue for Year 1, Month 4 Debit Credit TC

Budgetary Entry

None

Proprietary Entry

134000 Interest Receivable - Not Otherwise Classified

531000 Interest Revenue - Other

764

764

5d. In month 4, the Lessee pays monthly lease payment to Lessor, and the Lessor records the receipt of payment. The Lessor allots the funds.

Lessor - Receipt of fourth Monthly Lease Payment Debit Credit TC

Budgetary Entry

426600 Other Actual Business-Type Collections From Non-Federal Sources

406000 Anticipated Collections From Non-Federal Sources

459000 Apportionments - Anticipated Resources - Programs Subject to Apportionment

451000 Apportionments

451000 Apportionments

461000 Allotments – Realized Resources

Proprietary Entry

101000 (G) Fund Balance With Treasury

134000 Interest Receivable - Not Otherwise Classified

193000 Lessor Lease Receivable

2,000

2,000

2,000

2,000

2,000

2,000

2,000

764

1,236

C109

A123

A120

C109

Ending Lease Receivable Balance of USSGL 193000 = $89,207

6d. The Lessor recognizes revenue from the measurement of the lease receivable as earned revenue for the reporting period via straight-line amortization. A Lessor should

amortize the unearned revenue (recognizing it as earned revenue) in a systematic and rational manner of life of the lease. (SFFAS 60, Par. 26)

Lessor - Recognition of Unearned Revenue for Year 1, Month 4 Debit Credit TC

Budgetary Entry

None

Proprietary Entry

233000 Lessor Lease Unearned Revenue

593300 Amortization of Unearned Lessor Revenue

1,569

1,569

C460

RIGHT-TO-USE LEASES GUIDANCE: BUDGETARY CAPITAL

Effective Fiscal 2024

Page 34 of 69 November 2022

4e. The Lessor recognizes interest revenue for the amortization of the discount on the lease receivable for month 5. (SFFAS 54, Par. 60)

Lessor - Accrual of Interest Revenue for Year 1, Month 5 Debit Credit TC

Budgetary Entry

None

Proprietary Entry

134000 Interest Receivable - Not Otherwise Classified

531000 Interest Revenue - Other

743

743

5e. In month 5, the Lessee pays monthly lease payment to Lessor, and the Lessor records the receipt of payment. The Lessor allots the funds.

Lessor - Receipt of fifth Monthly Lease Payment Debit Credit TC

Budgetary Entry

426600 Other Actual Business-Type Collections From Non-Federal Sources

406000 Anticipated Collections From Non-Federal Sources

459000 Apportionments - Anticipated Resources - Programs Subject to Apportionment

451000 Apportionments

451000 Apportionments

461000 Allotments – Realized Resources

Proprietary Entry

101000 (G) Fund Balance With Treasury

134000 Interest Receivable - Not Otherwise Classified

193000 Lessor Lease Receivable

2,000

2,000

2,000

2,000

2,000

2,000

2,000

743

1,257

C109

A123

A120

C109

Ending Lease Receivable Balance of USSGL 193000 = $

87,951

6e. The Lessor recognizes revenue from the measurement of the lease receivable as earned revenue for the reporting period via straight-line amortization. A Lessor should

amortize the unearned revenue (recognizing it as earned revenue) in a systematic and rational manner of life of the lease. (SFFAS 60, Par. 26)

Lessor - Recognition of Unearned Revenue for Year 1, Month 5 Debit Credit TC

Budgetary Entry

None

Proprietary Entry

233000 Lessor Lease Unearned Revenue

593300 Amortization of Unearned Lessor Revenue

1,569

1,569

C460

RIGHT-TO-USE LEASES GUIDANCE: BUDGETARY CAPITAL

Effective Fiscal 2024

Page 35 of 69 November 2022

4f. The Lessor recognizes interest revenue for the amortization of the discount on the lease receivable for month 6. (SFFAS 54, Par. 60)

Lessor - Accrual of Interest Revenue for Year 1, Month 6 Debit Credit TC

Budgetary Entry

None

Proprietary Entry

134000 Interest Receivable - Not Otherwise Classified

531000 Interest Revenue - Other

733

733

5f. In month 6, the Lessee pays monthly lease payment to Lessor, and the Lessor records the receipt of payment. The Lessor allots the funds.

Lessor - Receipt of sixth Monthly Lease Payment Debit Credit TC

Budgetary Entry

426600 Other Actual Business-Type Collections From Non-Federal Sources

406000 Anticipated Collections From Non-Federal Sources

459000 Apportionments - Anticipated Resources - Programs Subject to Apportionment

451000 Apportionments

451000 Apportionments

461000 Allotments – Realized Resources

Proprietary Entry

101000 (G) Fund Balance With Treasury

134000 Interest Receivable - Not Otherwise Classified

193000 Lessor Lease Receivable

2,000

2,000

2,000

2,000

2,000

2,000

2,000

733

1,267

C109

A123

A120

C109

Ending Lease Receivable Balance of USSGL 193000 = $86,684

6f. The Lessor recognizes revenue from the measurement of the lease receivable as earned revenue for the reporting period via straight-line amortization. A Lessor should

amortize the unearned revenue (recognizing it as earned revenue) in a systematic and rational manner of life of the lease. (SFFAS 60, Par. 26)

Lessor - Recognition of Unearned Revenue for Year 1, Month 6 Debit Credit TC

Budgetary Entry

None

Proprietary Entry

233000 Lessor Lease Unearned Revenue

593300 Amortization of Unearned Lessor Revenue

1,569

1,569

C460

RIGHT-TO-USE LEASES GUIDANCE: BUDGETARY CAPITAL

Effective Fiscal 2024

Page 36 of 69 November 2022

*(For simplicity, the recurring entries of Lessor Receipts for Months 7-12 are not illustrated, but amounts can be seen in the amortization table.)*

7. In Year 1, the Lessor records depreciation expense on equipment it owns (the underlying asset within the lease.) $300,000 cost / 20-year useful life = $15,000.

Lessor Debit Credit TC

Budgetary Entry

None

Proprietary Entry

671000 (N) Depreciation, Amortization, and Depletion

175900 Accumulated Depreciation on Equipment

15,000

15,000

E120

8. The Lessor records the closing of revenue to cumulative results of operations.

Lessor Debit Credit TC

Budgetary Entry

None

Proprietary Entry

593300 Amortization of Unearned Lessor Revenue

531000 Interest Revenue – Other

593900 Contra Revenue for Lessor Lease Revenue

331000 Cumulative Results of Operations

18,826

8,726

2,000

25,552

F336

9. The Lessor records the closing of depreciation expense to cumulative results of operations.

Lessor Debit Credit TC

Budgetary Entry

None

Proprietary Entry

331000 Cumulative Results of Operations

671000 Depreciation, Amortization, and Depletion

15,000

15,000

F336

RIGHT-TO-USE LEASES GUIDANCE: BUDGETARY CAPITAL

Effective Fiscal 2024

Page 37 of 69 November 2022

10. The Lessor records the closing of unobligated balances in programs subject to apportionment to unapportioned authority.

Lessor Debit Credit TC

Budgetary Entry

461000 Allotments – Realized Resources

445000 Unapportioned – Unexpired Authority

Proprietary Entry

None

24,000

24,000

F308

11. The Lessor records the consolidation of actual net-funded resources.

Lessor Debit Credit TC

Budgetary Entry

420100 Total Actual Resources, Collected

426600 Other Actual Business-Type Collections From Non-Federal Sources

Proprietary Entry

None

24,000

24,000

F302

RIGHT-TO-USE LEASES GUIDANCE: BUDGETARY CAPITAL

Effective Fiscal 2024

Page 38 of 69 November 2022

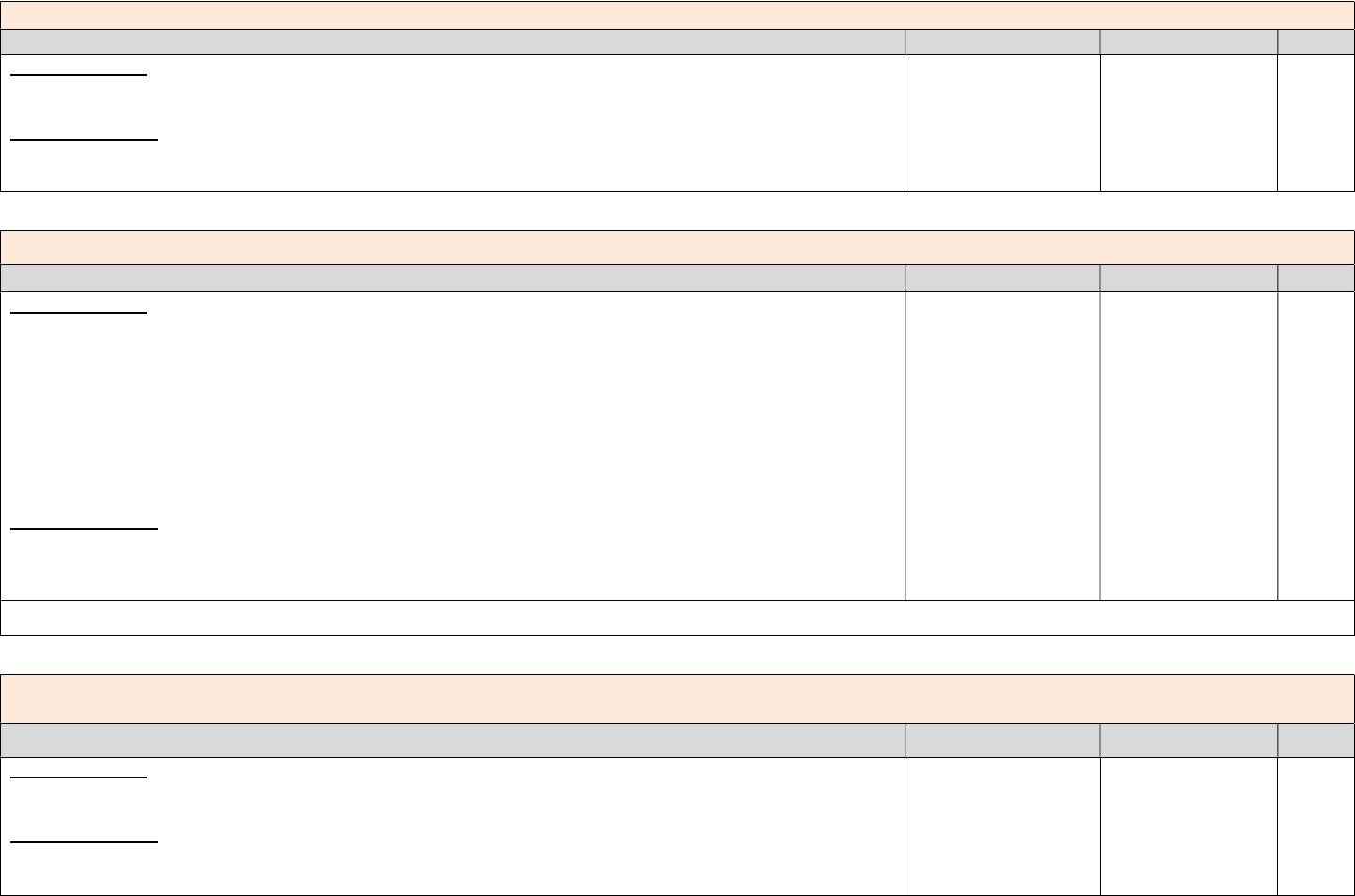

Fiscal Year 1 Post-Closing Adjusted Trial Balance:

FISCAL YEAR 1 POST-CLOSING LESSEE LESSOR

Account Description Debit Credit Debit Credit

Budgetary

420100

Total Actual Resources, Collected

78,857

-

24,000

-

445000

Unapportioned

–

Unexpired Authority

-

-

-

24,000

490100

Delivered Orders, Obligations Unpaid

-

78,857

-

-

Total 78,857

78,857 24,000

24,000

Proprietary

101000 (G)

Fund Balance With Treasury

78,857

-

24,000

-

134000

(N)

Interest Receivable

-

Not Otherwise Classified

-

-

-

-

175000

Equipment

-

-

300

,000

-

175900

Acc. Depreciation on Equipment

-

-

-

16

5,000

193000

Lessor Lease Receivable

-

-

76,

857

-

193900

Allowance for Loss on Lease Receivable

-

-

-

2,000

195000

Lessee Right

-

To

-

Use Lease Asset

94,131

-

-

-

195900

Accumulated Amortization on Lessee Lease Assets

-

18,826

-

-

214000

(N)

Accrued Interest Payable

-

Not Otherwise Classified

-

-

-

-

233000

Unearned Lessor Revenue

-

-

-

7

5

,305

293000

Lessee Lease Liability

-

78,857

-

-

310000

Unexpended Appropriations

-

Cumulative

-

-

-

-

331000 Cumulative Results of Operations -

75,305 -

160,552

Total 172,988

172,988 402,857

402,857

RIGHT-TO-USE LEASES GUIDANCE: BUDGETARY CAPITAL

Effective Fiscal 2024

Page 39 of 69 November 2022

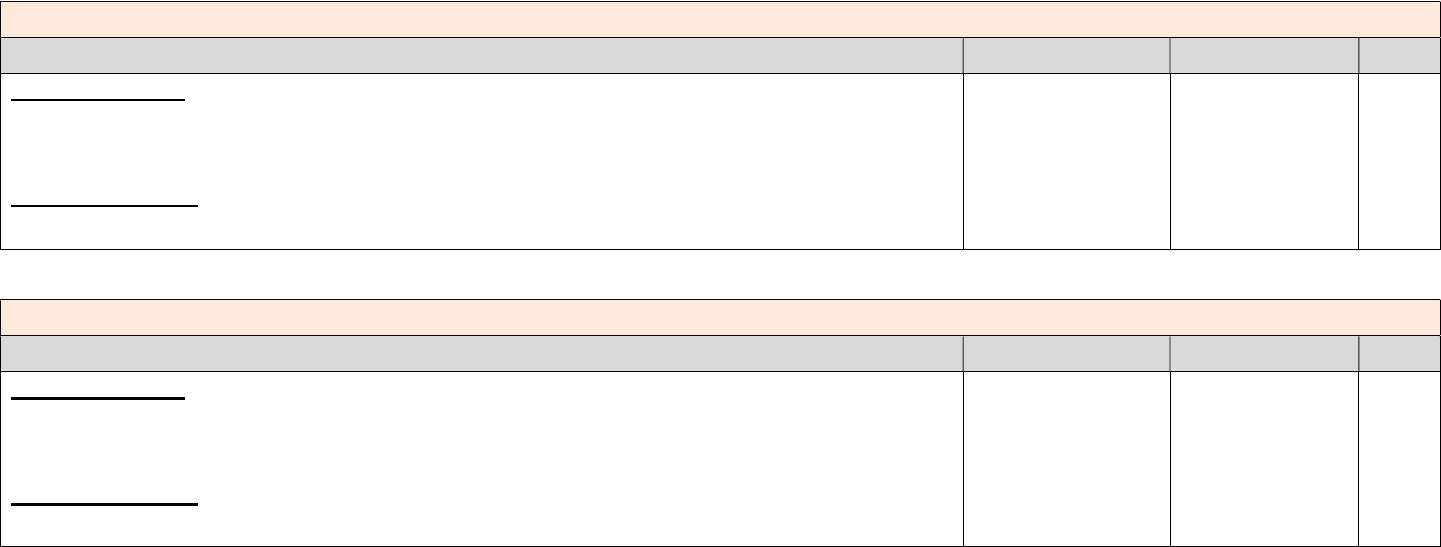

Year 1 Financial Statements:

STANDARDIZED BALANCE SHEET – YEAR 1

Line No. YEAR 1 LESSEE LESSOR

Assets (Note 2)

Intra-governmental

1

Fund Balance with Treasury (Note 3) (101000)

78,857

24,000

7 Total intra-governmental assets 78,857 24,000

Other than intra-governmental

12 General and right-to-use property, plant, and equipment, net (Note 10) (175000E, 175900E, 195000E,

195900E)

75,305

1

3

5,000

17

Other assets (Note 12) (193000E, 193900E)

-

76,857

18 Total other than intra-governmental 75,305 213,357

19 Total assets 154,162 235,857

Liabilities (Note 13)

Other than intra-governmental

36

Advances from others and deferred revenue (233000

N

)

-

7

5

,305

37

Other liabilities (Notes 18, 19, and 20)

(2930

0

0E)

78,857

-