Filing at a Glance

Company: State Farm Fire and Casualty Company

Product Name: ML-26043

State: Mississippi

TOI: 35.0 Interline Filings

Sub-TOI: 35.0000 Personal/Commercial Interline Filings

Filing Type: Rate/Rule

Date Submitted: 01/28/2010

SERFF Tr Num: SFMA-126475027

SERFF Status: Closed-Approved

State Tr Num: ML-26043

State Status: Closed/Approved

Co Tr Num: ML-26043

Effective Date

Requested (New):

05/01/2010

Effective Date

Requested (Renewal):

05/01/2010

Author(s): Jim Gallagher, Robin Dunagan

Reviewer(s): Will Arnold (primary), Mark Brannon, Derek Chapman, Deb Hamilton, Barbara Marshall, Ryan

Purdy

Disposition Date: 04/05/2010

Disposition Status: Approved

Effective Date (New): 05/01/2010

Effective Date (Renewal): 05/01/2010

State Filing Description:

SERFF Tracking #: SFMA-126475027 State Tracking #: ML-26043 Company Tracking #: ML-26043

State: Mississippi Filing Company: State Farm Fire and Casualty Company

TOI/Sub-TOI: 35.0 Interline Filings/35.0000 Personal/Commercial Interline Filings

Product Name: ML-26043

Project Name/Number: ML-26043/ML-26043

PDF Pipeline for SERFF Tracking Number SFMA-126475027 Generated 08/01/2012 04:22 PM

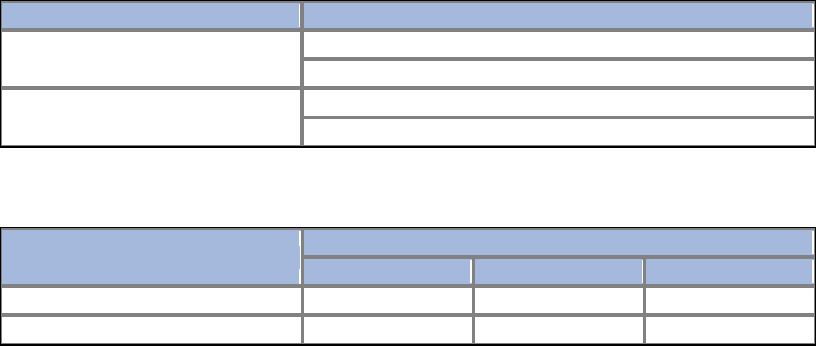

General Information

Company and Contact

Filing Fees

Project Name: ML-26043 Status of Filing in Domicile: Not Filed

Project Number: ML-26043 Domicile Status Comments:

Reference Organization: Reference Number:

Reference Title: Advisory Org. Circular:

Filing Status Changed: 04/05/2010

State Status Changed: 04/05/2010 Deemer Date:

Created By: Robin Dunagan Submitted By: Robin Dunagan

Corresponding Filing Tracking Number:

Filing Description:

Attached is our proposed wind mitigation discount plan for Homeowners and Rental Dwelling Programs. The proposed

effective date for this plan is 5/1/2010 for both new and renewal business.

Sincerely,

Robert J. Kelley, F.C.A.S., MAAA

Actuary and Assistant Secretary-Treasurer

(309) 766-6561

Sara Frankowiak

Pricing Manager

(309) 766-5902

Filing Contact Information

Sara Frankowiak, F.C.A.S., MAAA, [email protected]

One State Farm Plaza

Bloomington, IL 61710

309-766-5902 [Phone]

309-766-0225 [FAX]

Filing Company Information

State Farm Fire and Casualty

Company

1 State Farm Plaza

Bloomington, IL 61710

(309) 735-0649 ext. [Phone]

CoCode: 25143

Group Code: 176

Group Name:

FEIN Number: 37-0533080

State of Domicile: Illinois

Company Type:

State ID Number:

Fee Required?

Yes

Fee Amount:

$16.00

Retaliatory?

No

Fee Explanation:

$15 per filing X 1 filing + $1 EFT Fee = $16.

SERFF Tracking #: SFMA-126475027 State Tracking #: ML-26043 Company Tracking #: ML-26043

State: Mississippi Filing Company: State Farm Fire and Casualty Company

TOI/Sub-TOI: 35.0 Interline Filings/35.0000 Personal/Commercial Interline Filings

Product Name: ML-26043

Project Name/Number: ML-26043/ML-26043

PDF Pipeline for SERFF Tracking Number SFMA-126475027 Generated 08/01/2012 04:22 PM

State Specific

Per Company:

Yes

Company Amount Date Processed Transaction #

State Farm Fire and Casualty Company $16.00 01/28/2010 33851794

Largest cumulative effect of all rate and rule changes: 0.0

Smallest cumulative effect of all rate and rule changes: 0.0

What percentage of insureds will receive an increase of 25% or more?: 0

Make up of all changes which effect insureds with largest cumulative rate effect.: N/A

SERFF Tracking #: SFMA-126475027 State Tracking #: ML-26043 Company Tracking #: ML-26043

State: Mississippi Filing Company: State Farm Fire and Casualty Company

TOI/Sub-TOI: 35.0 Interline Filings/35.0000 Personal/Commercial Interline Filings

Product Name: ML-26043

Project Name/Number: ML-26043/ML-26043

PDF Pipeline for SERFF Tracking Number SFMA-126475027 Generated 08/01/2012 04:22 PM

Amendment Letter

Submitted Date: 03/04/2010

Comments:

Attached are rate manual pages reflecting the filed wind mitigation credits.

Sincerely,

Sara Frankowiak

Pricing Manager

Changed Items:

Rate/Rule Schedule Item Changes:

Exhibit Name: Rule # or Rate Previous State Attach

Page #: Action: Filing Number: Document:

Manual Pages See Attached Replacement MS HO Eff 05-01-10.pdf

MS ML-26043 RDP MANUAL

PAGES.PDF

SERFF Tracking #: SFMA-126475027 State Tracking #: ML-26043 Company Tracking #: ML-26043

State: Mississippi Filing Company: State Farm Fire and Casualty Company

TOI/Sub-TOI: 35.0 Interline Filings/35.0000 Personal/Commercial Interline Filings

Product Name: ML-26043

Project Name/Number: ML-26043/ML-26043

PDF Pipeline for SERFF Tracking Number SFMA-126475027 Generated 08/01/2012 04:22 PM

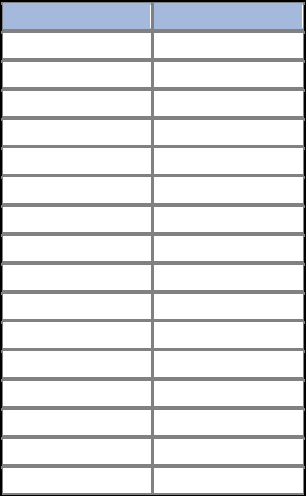

Rate/Rule Schedule

Item

No.

Schedule Item

Status Exhibit Name Rule # or Page # Rate Action Previous State

Filing Number

Attachments

1 Approved 04/05/2010 Manual Pages See Attached Replacement MS HO Eff 05-01-10.pdf

MS ML-26043 RDP MANUAL

PAGES.PDF

SERFF Tracking #: SFMA-126475027 State Tracking #: ML-26043 Company Tracking #: ML-26043

State: Mississippi Filing Company: State Farm Fire and Casualty Company

TOI/Sub-TOI: 35.0 Interline Filings/35.0000 Personal/Commercial Interline Filings

Product Name: ML-26043

Project Name/Number: ML-26043/ML-26043

PDF Pipeline for SERFF Tracking Number SFMA-126475027 Generated 08/01/2012 04:22 PM

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

1 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

SUMMARY OF REVISIONS

The following table summarizes the changes contained in this revision.

Item

Description

Wind Mitigation Discount

Introduced Wind Mitigation Discounts.

Throughout this manual, bold italics font indicates information that is not displayed in the Agents manual.

RULES

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

2 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

RULES

The rules, rates, and premiums in this manual govern the writing of all Homeowners policies. The rules and rates filed by

or on behalf of the Company for each coverage shall govern in all cases not specifically provided for in these rules.

CANCELLATION

When a policy is cancelled, the annual premium that applies to the policy period multiplied by the pro rata factor is

returned to the insured.

Calculate the pro rata factor as follows:

A. Compute the number of days left in the annual term until the policy expires (for example, 122 days).

B. Divide the number of days by 365 (days in a year) and round to 3 decimal places. This produces the pro rata

factor. A few examples may help:

Number of Days

Divided By

Pro Rata Factor

360

365

0.986

240

365

0.658

122

365

0.334

73

365

0.200

34

365

0.093

RULES

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

3 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

CONSTRUCTION CLASSIFICATIONS

A. Frame

A dwelling with exterior walls of combustible construction (including walls with metal, stucco, or metal lath and

plaster on combustible supports) is classified as frame.

B. Masonry

A dwelling with exterior walls of brick, concrete, concrete block, adobe, tile, or other masonry materials is

classified as masonry.

C. Masonry Veneer

A dwelling with walls of combustible construction veneered with masonry materials is classified as masonry

veneer.

D. Fire Resistive

A building with walls, floor, and roof constructed entirely of masonry or fire resistive materials with a Fire

Resistance rating of not less than one hour is classified as fire resistive.

E. Mixed Construction

A dwelling shall be classified as frame construction when the wall area of frame construction (excluding gables)

exceeds 50% of the total wall area.

F. Log Construction

A dwelling with walls - and in some cases, structural framing members used to support multiple stories or the roof

- made of logs, i.e. have not been milled into conventional lumber.

RULES

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

4 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

ELIGIBILITY

A. Homeowners Policy

1. A dwelling occupied by the owner and used principally for private residential purposes. The dwelling can

have one or two families, but cannot have more than five roomers or boarders per family.

2. A single family unit within a row house, town house, condominium or cooperative occupied by the owner

and used principally for private residential purposes.

3. A new dwelling that is under construction for one or two families to be occupied by the owner.

4. A secondary dwelling, including seasonal dwellings, occupied by the owner and used principally for

private residential purposes.

B. Renters Policy

1. The tenant of any dwelling, apartment, condominium or cooperative unit.

2. The owner, who is also an occupant, of a dwelling or building containing an apartment that is not eligible

for another Homeowners form.

3. The owner of a cooperative unit, provided:

a. The portion of the premises occupied as living quarters is used principally for private residential

purposes.

b. This portion is not occupied by more than one additional family or more than two roomers or

boarders.

c. This portion is designated by an apartment number or other positive identification.

C. Condominium Unitowners Policy

1. Owner occupied units, including seasonal units, which are part of a community association organized

under condominium, cooperative, town house or planned development form of ownership and where

provision has been made for a master policy covering the residential building(s) real property

exposure. The unit must be used principally for private residential purposes.

2. Rental or investment units in an association as described in 1. if occasionally occupied by the owner. The

named insured must be an individual. Partnerships, corporations or similar legal entities are not eligible

for Homeowners coverage.

Note: The term "owner" includes persons purchasing a dwelling, such as under a mortgage agreement or contract of sale.

RULES

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

5 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

MID-TERM CHANGES

Changes that affect coverage or a risk characteristic used in rating the policy may be made during the policy term, unless

otherwise stated in this manual. Mid-term changes to take advantage of a new discount or charge or a rate or

classification change implemented by the company during the policy term are not permitted.

If a different premium is required for the remainder of the current policy term, the additional or return premium is to be

computed pro rata unless otherwise stated in this manual.

RULES

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

6 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

MINIMUM PREMIUMS

The annual minimum premium is shown below.

Policy Form

Minimum

Premium

Homeowners

$200

Renters

$100

Condominium Unitowners

$100

RULES

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

7 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

OTHER INSURANCE

Other insurance covering the same property is permitted only when the other insurance is for perils not covered by the

policy (for example, Flood Insurance).

RULES

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

8 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

POLICY PERIOD AND PREMIUM PAYMENT

All premiums and rates shown in this manual are on an annual term basis. All policies are initially written for a one year

term and are then automatically renewed annually. The rates on renewals will be those rates in effect at that time.

RULES

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

9 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

RESTRICTION OF COVERAGE

The named insured can request a restriction on an individual policy. The circumstances or exposure must be so unusual

that without the restriction the policy would not be issued. No reduction from the prescribed rate and minimum premium is

allowed. Refer each request to the Company.

RULES

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

10 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

ROUNDING OF PREMIUMS

Any computations for additional coverages or additional amounts of insurance are to be rounded separately to the nearest

dollar. Fifty cents or more is to be considered as a dollar.

RULES

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

11 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

TRANSFER

Transfer of the policy to another location within the state is allowed provided the new location meets eligibility

requirements. Transfers are subject to any necessary adjustment of premium.

ZONES

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

12 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

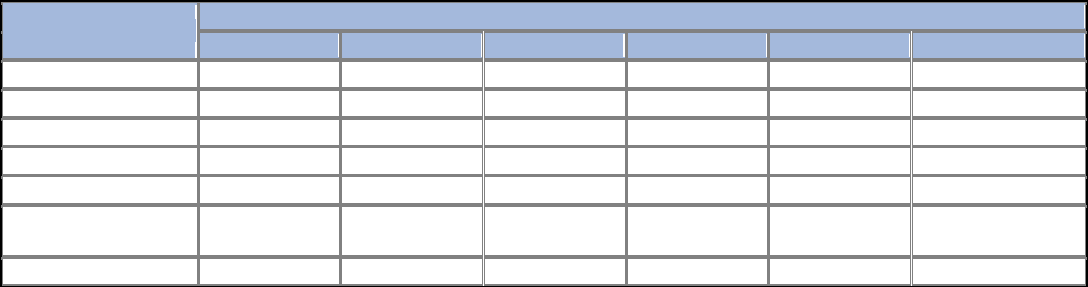

ZONES

This section provides the rules for the assignment of the zone and subzone.

ZONE DEFINITIONS

Refer to Company for ZIP Codes not listed.

ZIP Code

City

County

Zone

Description

All

ADAMS

50

All

ALCORN

68

All

AMITE

50

All

ATTALA

60

All

BENTON

68

All

BOLIVAR

64

All

CALHOUN

65

All

CARROLL

60

All

CHICKASAW

66

All

CHOCTAW

60

All

CLAIBORNE

69

All

CLARKE

54

All

CLAY

66

All

COAHOMA

64

All

COPIAH

51

All

COVINGTON

51

All

DE SOTO

67

All

FORREST

45

All

FRANKLIN

50

All

GEORGE

32

All

GREENE

45

All

GRENADA

65

All

HANCOCK

10

AREA SOUTH OF INTERSTATE 10

All

HANCOCK

20

AREAS NORTH OF INTERSTATE 10

All

HARRISON

10

AREA SOUTH OF INTERSTATE 10

All

HARRISON

20

AREAS NORTH OF INTERSTATE 10

All

JACKSON

HINDS

61

All

HINDS

69

EXCLUDING CITY OF JACKSON

All

HOLMES

60

All

HUMPHREYS

64

All

ISSAQUENA

60

All

ITAWAMBA

68

All

JACKSON

10

AREA SOUTH OF INTERSTATE 10

ZONES

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

13 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

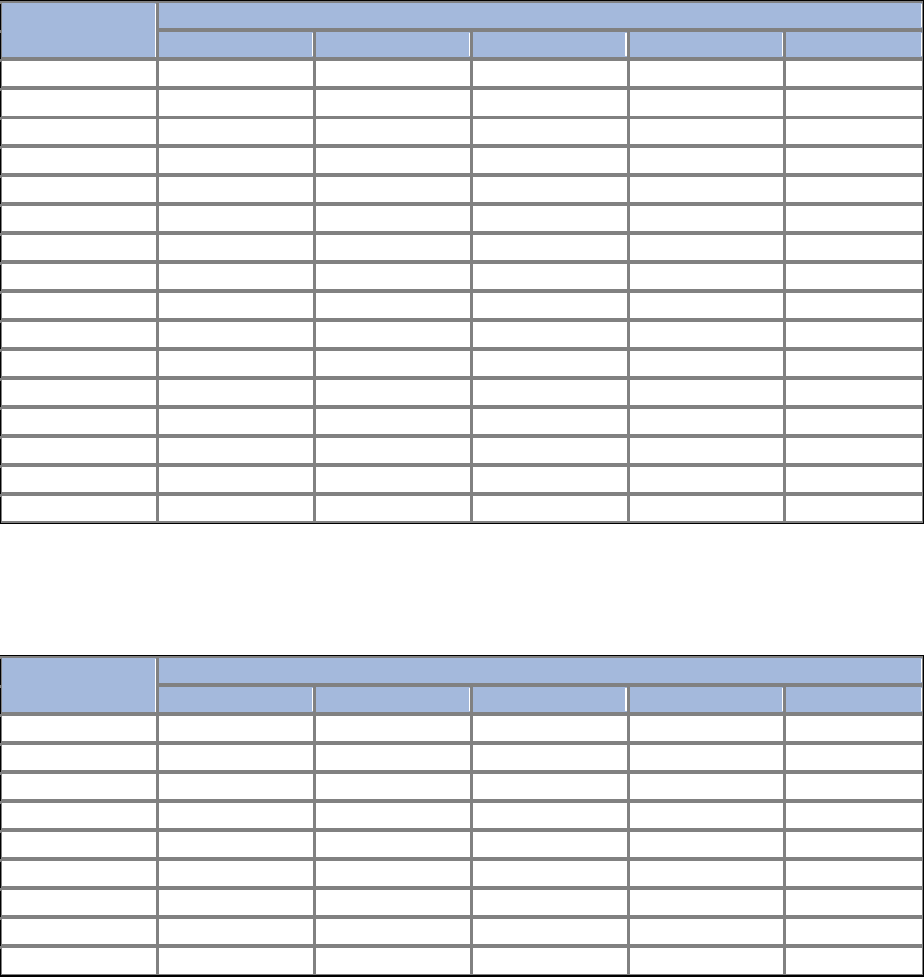

ZIP Code

City

County

Zone

Description

All

JACKSON

20

AREAS NORTH OF INTERSTATE 10

All

JASPER

54

All

JEFFERSON

50

All

JEFFERSON

DAVIS

51

All

JONES

54

All

KEMPER

63

All

LAFAYETTE

66

All

LAMAR

45

All

LAUDERDALE

63

All

LAWRENCE

51

All

LEAKE

60

All

LEE

67

All

LEFLORE

65

All

LINCOLN

51

All

LOWNDES

60

All

MADISON

60

All

MARION

45

All

MARSHALL

67

All

MONROE

66

All

MONTGOMERY

65

All

NESHOBA

63

All

NEWTON

63

All

NOXUBEE

60

All

OKTIBBEHA

60

All

PANOLA

66

All

PEARL RIVER

32

All

PERRY

45

All

PIKE

45

All

PONTOTOC

66

All

PRENTISS

67

All

QUITMAN

65

All

JACKSON

RANKIN

61

All

RANKIN

69

EXCLUDING CITY OF JACKSON

All

SCOTT

60

All

SHARKEY

64

All

SIMPSON

51

All

SMITH

54

All

STONE

32

All

SUNFLOWER

64

All

TALLAHATCHIE

65

ZONES

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

14 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

ZIP Code

City

County

Zone

Description

All

TATE

67

All

TIPPAH

68

All

TISHOMINGO

68

All

TUNICA

67

All

UNION

67

All

WALTHALL

45

All

WARREN

60

All

WASHINGTON

64

All

WAYNE

54

All

WEBSTER

65

All

WILKINSON

50

All

WINSTON

60

All

YALOBUSHA

65

All

YAZOO

60

HOMEOWNERS

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

15 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

HOMEOWNERS

This section provides details on coverages and rating for the Homeowners policy form, including the information

necessary to develop the basic premiums.

COVERAGES - HOMEOWNERS

The policy contains two sections, each with various coverages.

1. Section I - Physical Damage Coverages

Coverages

Details

Minimums or Amounts

Coverage A - Dwelling

Applies to the described dwelling

100% of Replacement Cost is suggested *

Dwelling Extension

Applies to other structures on premises

10% of Coverage A amount

Coverage B - Personal Property

Applies to personal property

75% of Coverage A amount *

Types of Personal Property

Computers and Equipment

$5,000

Money, Bank Notes, and Coins

$200

Property used in a business

$1,000 on premises ($250 off premises)

Securities, Accounts, and Deeds

$1,000

Watercraft and Equipment

$1,000

Trailers not used with Watercraft

$1,000

Jewelry and Furs (Theft)

$2,500 ($1,500 per item) *

Stamps, Trading Cards, and Comic Books

$2,500

Firearms (Theft)

$2,500

Area Rugs (Theft)

$10,000 ($5,000 per item)

Silverware and Goldware (Theft)

$2,500

Coverage C - Loss of Use

Additional Living Expense

Actual loss sustained within 24 months

Fair Rental Value

Actual loss sustained within 12 months

Additional Coverages

Arson Reward

$1,000

Building Ordinance or Law

10% of Coverage A amount

Collapse

Credit Card and Forgery

$1,000

Debris Removal

Fire Department Service Charge

$500

Lock Rekeying

Power Interruption

Property Removed

Refrigerated Products

Coverage B Limit

Temporary Repairs

Trees, Shrubs, and Other Plants

$500

Volcanic Action

HOMEOWNERS

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

16 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

* If the dwelling is insured for less than 80% of Replacement Cost, the basic Coverage B limit is 55% of Coverage A and

the Special Theft limit on Jewelry and Furs is $1,000.

Coverage A and B limits are subject to Inflation Coverage. For available options, see the Options section.

2. Section II - Liability Coverages

Coverages

Details

Minimums or Amounts

Coverage L - Personal Liability

Includes Comprehensive Personal Liability

$100,000 minimum

Coverage M - Medical Payments

Medical Payments to Others

$1,000 minimum

Additional Coverages

Damage to Property of Others

$500

Claim Expenses

First Aid Expenses

For available options, see the Options section.

HOMEOWNERS

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

17 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

LOSSES INSURED - HOMEOWNERS

1. Section I

Damage to insured's property is covered under Section I of the policy. As indicated in Item 1, there are three

coverages under Section I.

• Coverage A - Dwelling

• Coverage B - Personal Property

• Coverage C - Loss of Use

Listed below are the losses that are insured:

Losses Insured

Protection Provided

Coverage A & C

Coverage B

Fire or Lightning

Accidental Direct

Physical Loss

(with certain

exclusions)

Yes

Windstorm or Hail Yes

Explosion Yes

Riot or Civil Commotion Yes

Aircraft Yes

Vehicles Yes

Smoke Yes

Vandalism or Malicious Mischief Yes

Breakage of Glass Yes

Theft Yes

Falling Objects Yes

Weight of Ice, Snow or Sleet Yes

Accidental Discharge of Water or Steam Yes

HOMEOWNERS

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

18 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

Losses Insured

Protection Provided

Coverage A & C

Coverage B

Sudden, Accidental tearing etc. of Water

Heating Systems or Appliances

Yes

Freezing of Plumbing Yes

Damage from Artificially Generated

Electricity

Yes

2. Section II

Section II Liability includes coverage for bodily injury or property damage and defense costs associated with a suit

brought against an insured.

HOMEOWNERS

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

19 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

LOSS SETTLEMENT (SECTION I) - HOMEOWNERS

The loss settlement provision for Coverage A - Dwelling and Coverage B - Personal Property varies depending on the

insured's coverage selections. The available options are:

Coverage

Loss Settlement Provision

Coverage A - Dwelling

A1 Replacement Cost - Similar Construction

A2 Replacement Cost - Common Construction

Coverage B - Personal Property

B1 Limited Replacement Cost

B2 Depreciated Loss Settlement

The following chart illustrates the basic coverages provided by the policy.

Coverage

Dwelling Coverage as a % of Replacement Cost

100% or more

80 - 99%

<80%

Coverage A - Dwelling

A1 *

A1

A2

Coverage B - Personal Property

B1

B1

B2

* Option ID, Increased Dwelling Coverage is also automatically provided.

A. Coverage A - Dwelling

Losses to the dwelling are settled on a replacement cost basis without deduction for depreciation up to the limit

shown on the Declarations Page. The loss settlement provision is based on the insured's coverage selections as

indicated below:

1. Replacement Cost - Similar Construction

If the dwelling is insured to at least 80% of the dwelling replacement cost, the loss settlement provision for

Coverage A is repair or replacement with similar materials and construction techniques. The basic rates

reflect this loss settlement provision.

ACTIVATE: Loss Settlement Provision A1 - Replacement Cost - Similar Construction

If the following conditions are met, then an additional coverage amount equal to 20% of the

Coverage A limit will be provided for loss payment above the stated limits for no additional

premium.

a. The dwelling building and other building structures on premises are insured for at least

100% of Replacement Cost and

b. The insured agrees to notify the company within 90 days of any additions or other

physical changes which increase the value of either the dwelling or other buildings on the

premises by $5,000 or more and pay the appropriate premium.

ACTIVATE: Option ID in the Policy

HOMEOWNERS

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

20 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

2. Replacement Cost - Common Construction

When the dwelling is insured for an amount less than 80% of replacement cost, the loss settlement

provision for Coverage A is repair or replacement with commonly used materials and construction

techniques. An adjustment to the basic rates is required. Refer to the Basic Premium Adjustment

section.

ACTIVATE: Loss Settlement Provision A2 - Replacement Cost - Common Construction

B. Coverage B - Personal Property

1. Limited Replacement Cost

If the dwelling is insured for at least 80% of replacement cost, the loss settlement provision is limited

replacement cost without deduction for depreciation. The Coverage B limit is equal to 75% of the

Coverage A limit. The basic rates reflect this coverage.

ACTIVATE: Loss Settlement Provision B1 - Limited Replacement Cost

2. Depreciated Loss Settlement

If the dwelling is insured for less than 80% of replacement cost, the loss settlement provision is limited

replacement cost with deduction for depreciation. The Coverage B limit is equal to 55% of the Coverage

A limit. An adjustment to the basic rates is required. Refer to the Basic Premium Adjustment

section.

ACTIVATE: Loss Settlement Provision B2 - Depreciated Loss Settlement

Refer to the Options section for available options.

HOMEOWNERS

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

21 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

RATING - HOMEOWNERS

A. Determine the basic premium.

1. Select the correct ZONE, PROTECTION CLASS, and CONSTRUCTION.

2. Determine the COVERAGE A AMOUNT and the RISK AMOUNT.

a. Determine the Replacement Cost of the dwelling.

b. Multiply the Replacement Cost by 0.80.

c. Select the desired amount of insurance.

• If the desired amount is equal to or greater than the amount determined in Step 2.b., then

this is the COVERAGE A AMOUNT and the RISK AMOUNT. Skip to Step 3.

• If the desired amount is less than the amount determined in Step 2.b., then continue

with Step 2.d.

d. Divide the desired amount of insurance (Step 2.c.) by the replacement cost of the dwelling (Step

2.a.). The COVERAGE A AMOUNT is determined by the following:

If Step 2.d. is:

Then the Coverage A Amount is: *

At Least

But Less Than

0.70

0.80

0.80 X Replacement Cost minus $100

0.60

0.70

0.70 X Replacement Cost minus $100

0.50

0.60

0.60 X Replacement Cost minus $100

0.40

0.50

0.50 X Replacement Cost minus $100

0.30

0.40

0.40 X Replacement Cost minus $100

0.20

0.30

0.30 X Replacement Cost minus $100

0.00

0.20

0.20 X Replacement Cost minus $100

* This amount is rounded up to the nearest $100.

The RISK AMOUNT equals the amount determined in Step 2.b. (Replacement Cost X 0.80).

3. From the basic rate pages, determine the premium based on the ZONE, PROTECTION CLASS, and

CONSTRUCTION from Step 1 and the RISK AMOUNT as determined in Step 2.c. or 2.d.

Premium = Zone Base Rate X Protection Class X Construction Factor X Amount Factor X Risk Amount /

Base Amount *

* The Base Amount is the Risk Amount which has a factor of 1.000.

Note: For amounts greater than the largest risk amount shown, calculate the premium for the additional

amount and add it to the premium for the largest risk amount shown.

HOMEOWNERS

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

22 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

4. Apply all applicable basic premium adjustments from the Basic Premium Adjustment section sequentially

in the order presented in that section to derive the basic premium.

B. Apply any remaining percentage adjustments for optional coverages to the basic premium.

C. Add any flat dollar adjustments for optional coverages to the basic premium.

D. Premium Calculation Examples - Homeowners Policy

The following two examples show the sequence for applying optional discounts, charges, and options (actual

premiums/rates were chosen arbitrarily for illustration purposes only).

Example 1

Replacement Cost of Dwelling = $121,900

Replacement Cost X 0.80 = $97,520

Desired Amount of Insurance = $110,000

Coverage A Amount = Risk Amount = $110,000

1. Homeowners Basic Premium

a. $110,000 Risk Amount premium

$450 X 1.050 X 0.950 X 0.945 X $110,000 / $100,000 = $466.61

Rounded

=

$467

b. CRI Adjustment Factor (0.961)

$467 X 0.961 = $448.79

Rounded

=

$449

c. Claim Record Rating Adjustment (-10%)

$449 X 0.10 = $44.90

Rounded

=

- $45

Subtotal

=

$404

d. Home/Auto Discount (-15%)

$404 X 0.15 = $60.60

Rounded

=

- $61

Subtotal

=

$343

e. Newer Utilities Adjustment (-9%)

$343 X 0.09 = $30.87

Rounded

=

- $31

Subtotal

=

$312

f. 2% Deductible Adjustment (-19%)

$312 X 0.19 = $59.28

Rounded

=

- $59

Basic Premium

=

$253

HOMEOWNERS

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

23 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

2. Charge for $5,000 Jewelry and Furs = +$27

3. Charge for $12,500 Additional Coverage B Limits

$0.40 X 12.5 = $5.00

Rounded

=

+$5

4. Charge for $500,000/$1,000 Section II = +$25

5. Final Premium (subject to policy minimum premium) = $310

Note: Each discount and charge is to be rounded to the nearest dollar before being subtracted from or added to

the basic premium.

Example 2

Replacement Cost of Dwelling = $121,900

Replacement Cost X 0.80 = $97,520

Desired Amount of Insurance = $70,000 ($70,000 / $121,900 = 0.57)

Coverage A Amount = $121,900 X 0.60 - $100 = $73,040 Rounded to next higher $100 = $73,100

Risk Amount = $97,520 ($121,900 X 0.80)

1. Homeowners Basic Premium

a. $97,520 Risk Amount premium

$450 X 1.050 X 0.950 X 1.063 X $97,520 / $100,000 = $465.32

Rounded

=

$465

b. CRI Adjustment Factor (0.961)

$465 X 0.961 = $446.86

Rounded

=

$447

c. Replacement Cost - Common Construction

Premium Adjustment Factor corresponding to 0.59 ($73,100 / $121,900) = 0.85

d. Adjusted Premium

$447 X 0.85 = $379.95

Rounded

=

$380

e. Depreciated Loss Settlement - Contents (-7%)

$380 X 0.07 = $26.60

Rounded

=

- $27

Subtotal

=

$353

HOMEOWNERS

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

24 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

f.

$1,000 Jewelry and Furs Adjustment

=

- $16

Subtotal

=

$337

g. Home Alert Adjustment (-5%)

$337 X 0.05 = $16.85

Rounded

=

- $17

Subtotal

=

$320

h. Charge for Limited Replacement Cost - Contents (9% $25 minimum)

$320 X 0.09 = $28.80

Rounded

=

+$29

Subtotal

=

$349

i. $1,000 Deductible Adjustment (-10%)

$349 X 0.10 = $34.90

Rounded

=

- $35

Basic Premium

=

$314

2. Charge for $500,000/$1,000 Section II = +$25

3. Final Premium (subject to policy minimum premium) = $339

Note: Each discount and charge is to be rounded to the nearest dollar before being subtracted from or added to

the basic premium.

HOMEOWNERS

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

25 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

HOMEOWNERS

ZONE 10 & 20 - 2% HURRICANE DEDUCTIBLE/1% ALL OTHER PERIL; REMAINDER - 1% ALL-

PERIL DEDUCTIBLE

$100,000 LIABILITY; $1,000 MEDICAL PAYMENTS

Premium = Zone Base Rate X Protection Class Factor X Construction Factor X Amount Factor X Risk Amount / $100,000

ZONE BASE RATES

Zone

Rate

10

$3,864.00

20

$2,442.00

32

$1,540.00

45

$1,219.00

50

$981.00

51

$954.00

54

$946.00

60

$805.00

61

$1,167.00

63

$850.00

64

$930.00

65

$998.00

66

$756.00

67

$761.00

68

$867.00

69

$910.00

HOMEOWNERS

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

26 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

HOMEOWNERS

ZONE 10 & 20 - 2% HURRICANE DEDUCTIBLE/1% ALL OTHER PERIL; REMAINDER - 1% ALL-

PERIL DEDUCTIBLE

$100,000 LIABILITY; $1,000 MEDICAL PAYMENTS

Premium = Zone Base Rate X Protection Class Factor X Construction Factor X Amount Factor X Risk Amount / $100,000

PROTECTION CLASS FACTORS

Zone Group

Protection Class

3

4 - 7

8

9

10

10C

10, 20, 32, 45, 50,

51, 54, 60, 63, 64,

65, 66, 67, 68, 69

1.000 1.000 1.280 1.710 2.070 2.010

61

1.000

N/A

N/A

N/A

N/A

N/A

For Protection Class 10C:

ATTACH: Certified Fire Department Endorsement, FE-7511

HOMEOWNERS

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

27 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

HOMEOWNERS

ZONE 10 & 20 - 2% HURRICANE DEDUCTIBLE/1% ALL OTHER PERIL; REMAINDER - 1% ALL-

PERIL DEDUCTIBLE

$100,000 LIABILITY; $1,000 MEDICAL PAYMENTS

Premium = Zone Base Rate X Protection Class Factor X Construction Factor X Amount Factor X Risk Amount / $100,000

CONSTRUCTION FACTORS

Construction

Protection

Class

Factor

Frame

03 - 06

1.110

Frame

07

1.280

Frame

08

1.250

Frame

09

1.340

Frame

10 - 10C

1.440

Construction

Protection

Class

Factor

Log

03 - 06

1.140

Log

07

1.280

Log

08

1.250

Log

09

1.340

Log

10 - 10C

1.440

Construction

Protection

Class

Factor

Masonry

03 - 06

1.000

Masonry

07

1.000

Masonry

08

1.000

Masonry

09

1.000

Masonry

10 - 10C

1.000

Construction

Protection

Class

Factor

Fire Resistive

03 - 06

0.820

Fire Resistive

07

0.820

Fire Resistive

08

0.820

HOMEOWNERS

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

28 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

Construction

Protection

Class

Factor

Fire Resistive

09

0.820

Fire Resistive

10 - 10C

0.820

Construction

Protection

Class

Factor

Masonry

Veneer

03 - 06 1.000

Masonry

Veneer

07 1.000

Masonry

Veneer

08 1.000

Masonry

Veneer

09 1.000

Masonry

Veneer

10 - 10C 1.000

HOMEOWNERS

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

29 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

HOMEOWNERS

ZONE 10 & 20 - 2% HURRICANE DEDUCTIBLE/1% ALL OTHER PERIL; REMAINDER - 1% ALL-

PERIL DEDUCTIBLE

$100,000 LIABILITY; $1,000 MEDICAL PAYMENTS

Premium = Zone Base Rate X Protection Class Factor X Construction Factor X Amount Factor X Risk Amount / $100,000

RISK AMOUNT FACTORS

Risk Amount

Factor

$5,000

6.000

$10,000

3.650

$20,000

2.391

$30,000

2.100

$40,000

1.720

$50,000

1.500

$60,000

1.350

$70,000

1.240

$80,000

1.150

$90,000

1.070

$100,000

1.000

$110,000

0.950

$120,000

0.910

$130,000

0.870

$140,000

0.840

$150,000

0.810

$160,000

0.780

$170,000

0.753

$180,000

0.730

$190,000

0.707

$200,000

0.688

$250,000

0.634

$300,000

0.607

$350,000

0.589

$400,000

0.570

$450,000

0.558

$500,000

0.544

$550,000

0.533

$600,000

0.524

$650,000

0.515

$700,000

0.506

$750,000

0.498

HOMEOWNERS

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

30 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

Each

Additional

Factor

$1,000

0.429

If insured for a risk amount less than 80% of the replacement cost, refer to the Rating Rule. For risk amounts

between those shown above, interpolate to derive the appropriate factor.

RENTERS

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

31 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

RENTERS

This section provides details on coverages and rating for the Renters policy form, including the information necessary to

develop the basic premiums.

COVERAGES - RENTERS

The policy contains two sections, each with various coverages.

A. Section I - Physical Damage Coverages

Coverages

Details

Minimums or Amounts

Coverage B - Personal Property

Applies to personal property

Based on personal property value

Types of Personal Property

Computers and Equipment

$5,000

Money, Bank Notes, and Coins

$200

Property used in a business

$1,000 on premises ($250 off premises)

Securities, Accounts, and Deeds

$1,000

Watercraft and Equipment

$1,000

Trailers not used with Watercraft

$1,000

Jewelry and Furs (Theft)

$1,000

Stamps, Trading Cards, and Comic Books

$2,500

Firearms (Theft)

$2,500

Area Rugs (Theft)

$10,000 ($5,000 per item)

Silverware and Goldware (Theft)

$2,500

Coverage C - Loss of Use

Additional Living Expense

Actual loss sustained within 24 months

Fair Rental Value

Actual loss sustained within 12 months

Additional Coverages

Arson Reward

$1,000

Building Additions and Alterations

15% of Coverage B amount

Collapse

Credit Card and Forgery

$1,000

Debris Removal

Fire Department Service Charge

$500

Lock Rekeying

Power Interruption

Property Removed

Refrigerated Products

Coverage B Limit

Temporary Repairs

Trees, Shrubs, and Other Plants

$500

Volcanic Action

Coverage B limits are subject to Inflation Coverage. For available options, see the Options section.

RENTERS

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

32 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

B. Section II - Liability Coverages

Coverages

Details

Minimums or Amounts

Coverage L - Personal Liability

Includes Comprehensive Personal Liability

$100,000 minimum

Coverage M - Medical Payments

Medical Payments to Others

$1,000 minimum

Additional Coverages

Damage to Property of Others

$500

Claim Expenses

First Aid Expenses

For available options, see the Options section.

RENTERS

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

33 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

LOSSES INSURED - RENTERS

Damage to insured's property is covered under Section I of the policy. As indicated in Item 1, there are two coverages

under Section I.

• Coverage B - Personal Property

• Coverage C - Loss of Use

Listed below are the losses that are insured:

• Fire or Lightning

• Windstorm or Hail

• Explosion

• Riot or Civil Commotion

• Aircraft

• Vehicles

• Smoke

• Vandalism or Malicious Mischief

• Breakage of Glass

• Theft

• Falling Objects

• Weight of Ice, Snow or Sleet

• Accidental Discharge of Water or Steam

• Sudden and Accidental Tearing Asunder, Cracking, Bursting or Bulging of Water Heating Systems or Appliances

• Freezing of Plumbing

• Damage from Artificially Generated Electricity

RENTERS

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

34 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

LOSS SETTLEMENT (SECTION I) - RENTERS

Losses for Coverage B are settled on a limited replacement cost less depreciation basis (Loss Settlement Provision

B2). Refer to the Options section for available options.

RENTERS

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

35 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

RATING - RENTERS

A. Determine the basic premium.

1. Select the correct ZONE, PROTECTION CLASS, and CONSTRUCTION.

2. Develop the value of the property by calculating the Replacement Cost Value of the personal property if

Replacement Cost on Personal Property Coverage will be purchased or the Replacement Cost less

Depreciation value if not. This value will be the Coverage B amount and the RISK AMOUNT.

3. From the basic rate pages, determine the premium based on the ZONE, PROTECTION CLASS, and

CONSTRUCTION from Step 1 and the RISK AMOUNT as determined in Step 2.

Premium = Zone Base Rate X Protection Class X Construction Factor X Amount Factor X Risk Amount /

Base Amount *

* The Base Amount is the Risk Amount which has a factor of 1.000.

Note: For amounts greater than the largest risk amount shown, calculate the premium for the additional

amount and add it to the premium for the largest risk amount shown.

4. Apply all applicable basic premium adjustments from the Basic Premium Adjustment section sequentially

in the order presented in that section to derive the basic premium.

B. Apply any remaining percentage adjustments for optional coverages to the basic premium.

C. Add any flat dollar adjustments for optional coverages to the basic premium.

D. Premium Calculation Example - Renters Policy

The following example shows the sequence for applying optional discounts, charges, and options (actual

premiums/rates were chosen arbitrarily for illustration purposes only).

1. Renters Basic Premium

a. Premium

$120 X 1.000 X 1.000 X 1.732 X $40,000 / $50,000 = $166.27

Rounded

=

$166

b. CRI Adjustment Factor (0.985)

$166 X 0.985 = $163.51

Rounded

=

$164

c. Claim Record Rating Adjustment (-10%)

$164 X 0.10 = $16.40

Rounded

=

- $16

Subtotal

=

$148

d. Limited Replacement Cost - Contents Charge (26% $18 minimum)

$148 X 0.26 = $38.48

Rounded

=

+$38

RENTERS

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

36 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

Subtotal

=

$186

e. $1,000 Deductible Adjustment (-18%)

$186 X 0.18 = $33.48

Rounded

=

- $33

Basic Premium

=

$153

2. Charge for $2,500 Jewelry and Furs = +$17

3. Charge for $500,000/$1,000 Section II = +$25

4. Final Premium (subject to policy minimum premium) = $195

Note: Each discount and charge is to be rounded to the nearest dollar before being subtracted from or added to

the basic premium.

RENTERS

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

37 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

RENTERS

ZONE 10 & 20 - 2% HURRICANE DEDUCTIBLE/$500 ALL OTHER PERIL; REMAINDER -

$500 ALL-PERIL DEDUCTIBLE

$100,000 LIABILITY; $1,000 MEDICAL PAYMENTS

Premium = Zone Base Rate X Protection Class Factor X Construction Factor X Amount Factor X Risk Amount / $20,000

ZONE BASE RATES

Zone

Rate

10

$306.50

20

$212.50

32

$161.50

45

$150.50

50

$144.00

51

$144.00

54

$144.00

60

$135.50

61

$172.50

63

$135.50

64

$135.50

65

$135.50

66

$135.50

67

$135.50

68

$135.50

69

$135.50

RENTERS

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

38 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

RENTERS

ZONE 10 & 20 - 2% HURRICANE DEDUCTIBLE/$500 ALL OTHER PERIL; REMAINDER -

$500 ALL-PERIL DEDUCTIBLE

$100,000 LIABILITY; $1,000 MEDICAL PAYMENTS

Premium = Zone Base Rate X Protection Class Factor X Construction Factor X Amount Factor X Risk Amount / $20,000

PROTECTION CLASS FACTORS

Zone Group

Protection Class

3

4 - 7

8

9

10

10C

10

1.000

1.000

1.125

1.441

1.654

1.600

20

1.000

1.000

1.126

1.444

1.657

1.610

32

1.000

1.000

1.118

1.435

1.646

1.600

45

1.000

1.000

1.116

1.432

1.639

1.590

50, 51, 54

1.000

1.000

1.116

1.435

1.646

1.600

60, 63, 64, 65, 66,

67, 68, 69

1.000 1.000 1.121 1.447 1.660 1.610

61

1.000

N/A

N/A

N/A

N/A

N/A

For Protection Class 10C:

ATTACH: Certified Fire Department Endorsement, FE-7511

RENTERS

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

39 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

RENTERS

ZONE 10 & 20 - 2% HURRICANE DEDUCTIBLE/$500 ALL OTHER PERIL; REMAINDER -

$500 ALL-PERIL DEDUCTIBLE

$100,000 LIABILITY; $1,000 MEDICAL PAYMENTS

Premium = Zone Base Rate X Protection Class Factor X Construction Factor X Amount Factor X Risk Amount / $20,000

CONSTRUCTION FACTORS

Construction

Protection

Class

Zone Group

10

20, 32, 45, 50,

51, 54, 60, 63,

64, 65, 66, 67,

68, 69

61

Frame

03

1.210

1.120

1.090

Log

03

1.210

1.120

1.090

Masonry

03

1.000

1.000

1.000

Fire Resistive

03

1.000

1.000

1.000

Masonry Veneer

03

1.000

1.000

1.000

Construction

Protection

Class

Zone Group

10

20, 32, 45, 50,

51, 54, 60, 63,

64, 65, 66, 67,

68, 69

61

Frame

04 - 07

1.210

1.120

N/A

Log

04 - 07

1.210

1.120

N/A

Masonry

04 - 07

1.000

1.000

N/A

Masonry Veneer

04 - 07

1.000

1.000

N/A

Fire Resistive

04 - 07

1.000

1.000

N/A

Construction

Protection

Class

Zone Group

10

20, 32, 45, 50,

51, 54, 60, 63,

64, 65, 66, 67,

68, 69

61

Frame

08

1.240

1.150

N/A

Log

08

1.240

1.150

N/A

Masonry

08

1.000

1.000

N/A

Masonry Veneer

08

1.000

1.000

N/A

Fire Resistive

08

1.000

1.000

N/A

RENTERS

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

40 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

Construction

Protection

Class

Zone Group

10

20, 32, 45, 50,

51, 54, 60, 63,

64, 65, 66, 67,

68, 69

61

Frame

09

1.200

1.110

N/A

Log

09

1.200

1.110

N/A

Masonry

09

1.000

1.000

N/A

Masonry Veneer

09

1.000

1.000

N/A

Fire Resistive

09

1.000

1.000

N/A

Construction

Protection

Class

Zone Group

10

20, 32, 45, 50,

51, 54, 60, 63,

64, 65, 66, 67,

68, 69

61

Frame

10 - 10C

1.330

1.230

N/A

Log

10 - 10C

1.330

1.230

N/A

Masonry

10 - 10C

1.000

1.000

N/A

Masonry Veneer

10 - 10C

1.000

1.000

N/A

Fire Resistive

10 - 10C

1.000

1.000

N/A

RENTERS

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

41 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

RENTERS

ZONE 10 & 20 - 2% HURRICANE DEDUCTIBLE/$500 ALL OTHER PERIL; REMAINDER -

$500 ALL-PERIL DEDUCTIBLE

$100,000 LIABILITY; $1,000 MEDICAL PAYMENTS

Premium = Zone Base Rate X Protection Class Factor X Construction Factor X Amount Factor X Risk Amount / $20,000

RISK AMOUNT FACTORS

Risk Amount

Factor

$6,000

1.540

$7,000

1.440

$8,000

1.365

$9,000

1.345

$10,000

1.295

$11,000

1.250

$12,000

1.215

$13,000

1.170

$14,000

1.160

$15,000

1.100

$20,000

1.000

$25,000

0.950

$30,000

0.880

$35,000

0.855

$40,000

0.835

$45,000

0.820

$50,000

0.810

$75,000

0.780

$100,000

0.765

$150,000

0.750

Each

Additional

Factor

$1,000

0.670

For risk amounts between those shown above, interpolate to derive the appropriate factor.

CONDOMINIUM UNITOWNERS

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

42 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

CONDOMINIUM UNITOWNERS

This section provides details on coverages and rating for the Condominium Unitowners policy form, including the

information necessary to develop the basic premiums.

COVERAGES - CONDOMINIUM UNITOWNERS

The policy contains two sections, each with various coverages.

A. Section I - Physical Damage Coverages

Coverages

Details

Minimums or Amounts

Coverage A - Dwelling

Applies to building property

30% of Coverage B amount ($1,000 min.)

Coverage B - Personal Property

Applies to personal property

Based on personal property value

Types of Personal Property

Computers and Equipment

$5,000

Money, Bank Notes, and Coins

$200

Property used in a business

$1,000 on premises ($250 off premises)

Securities, Accounts, and Deeds

$1,000

Watercraft and Equipment

$1,000

Trailers not used with Watercraft

$1,000

Jewelry and Furs (Theft)

$1,000

Stamps, Trading Cards, and Comic Books

$2,500

Firearms (Theft)

$2,500

Area Rugs (Theft)

$10,000 ($5,000 per item)

Silverware and Goldware (Theft)

$2,500

Coverage C - Loss of Use

Additional Living Expense

Actual loss sustained within 24 months

Fair Rental Value

Actual loss sustained within 12 months

Coverage D - Loss Assessments

$1,000

Additional Coverages

Arson Reward

$1,000

Collapse

Credit Card and Forgery

$1,000

Debris Removal

Fire Department Service Charge

$500

Lock Rekeying

Power Interruption

Property Removed

Refrigerated Products

Coverage B Limit

Temporary Repairs

Trees, Shrubs, and Other Plants

$500

Volcanic Action

Coverage A and B limits are subject to Inflation Coverage. For available options, see the Options section.

CONDOMINIUM UNITOWNERS

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

43 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

B. Section II - Liability Coverages

Coverages

Details

Minimums or Amounts

Coverage L - Personal Liability

Includes Comprehensive Personal Liability

$100,000 minimum

Coverage M - Medical Payments

Medical Payments to Others

$1,000 minimum

Additional Coverages

Damage to Property of Others

$500

Claim Expenses

First Aid Expenses

For available options, see the Options section.

CONDOMINIUM UNITOWNERS

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

44 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

LOSSES INSURED - CONDOMINIUM UNITOWNERS

Damage to insured's property is covered under Section I of the policy. As indicated in Item 1, there are four coverages

under Section I.

• Coverage A - Dwelling

• Coverage B - Personal Property

• Coverage C - Loss of Use

• Coverage D - Loss Assessments

Listed below are the losses that are insured:

• Fire or Lightning

• Windstorm or Hail

• Explosion

• Riot or Civil Commotion

• Aircraft

• Vehicles

• Smoke

• Vandalism or Malicious Mischief

• Breakage of Glass

• Theft

• Falling Objects

• Weight of Ice, Snow or Sleet

• Accidental Discharge of Water or Steam

• Sudden and Accidental Tearing Asunder, Cracking, Bursting or Bulging of Water Heating Systems or Appliances

• Freezing of Plumbing

• Damage from Artificially Generated Electricity

Condominium Unitowners theft coverage on seasonals or units rented or held for rental more than 180 days is limited to

burglary coverage. Section II coverage applies on premises only.

CONDOMINIUM UNITOWNERS

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

45 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

Coverages A and D on Condominium Unitowners policies are provided for accidental direct physical loss subject to

certain exclusions.

CONDOMINIUM UNITOWNERS

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

46 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

LOSS SETTLEMENT (SECTION I) - CONDOMINIUM UNITOWNERS

Losses for Coverage B are settled on a limited replacement cost less depreciation basis (Loss Settlement Provision

B2). Refer to the Options section for available options.

CONDOMINIUM UNITOWNERS

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

47 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

RATING - CONDOMINIUM UNITOWNERS

A. Determine the basic premium.

1. Select the correct ZONE, PROTECTION CLASS, and CONSTRUCTION.

2. Develop the value of the property by calculating the Replacement Cost Value of the personal property if

Replacement Cost on Personal Property Coverage will be purchased or the Replacement Cost less

Depreciation value if not. This value will be the Coverage B amount and the RISK AMOUNT.

3. From the basic rate pages, determine the premium based on the ZONE, PROTECTION CLASS, and

CONSTRUCTION from Step 1 and the RISK AMOUNT as determined in Step 2.

Premium = Zone Base Rate X Protection Class X Construction Factor X Amount Factor X Risk Amount /

Base Amount *

* The Base Amount is the Risk Amount which has a factor of 1.000.

Note: For amounts greater than the largest risk amount shown, calculate the premium for the additional

amount and add it to the premium for the largest risk amount shown.

4. Apply all applicable basic premium adjustments from the Basic Premium Adjustment section sequentially

in the order presented in that section to derive the basic premium.

B. Apply any remaining percentage adjustments for optional coverages to the basic premium.

C. Add any flat dollar adjustments for optional coverages to the basic premium.

D. Premium Calculation Example - Condominium Unitowners Policy

The following example shows the sequence for applying optional discounts, charges, and options (actual

premiums/rates were chosen arbitrarily for illustration purposes only).

1. Condominium Unitowners Basic Premium

a. Premium

$120 X 1.000 X 1.000 X 1.732 X $40,000 / $50,000 = $166.27

Rounded

=

$166

b. CRI Adjustment Factor (0.985)

$166 X 0.985 = $163.51

Rounded

=

$164

c. Adjustment for 1-56 days rental (10%)

$164 X 0.10 = $16.40

Rounded

=

+$16

Subtotal

=

$180

d. Limited Replacement Cost - Contents Charge (26% $18 minimum)

$180 X 0.26 = $46.80

Rounded

=

+$47

CONDOMINIUM UNITOWNERS

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

48 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

Subtotal

=

$227

e. $1,000 Deductible Adjustment (-18%)

$227 X 0.18 = $40.86

Rounded

=

- $41

Basic Premium

=

$186

2. Charge for $2,500 Jewelry and Furs = +$17

3. Charge for $7,500 Additional Loss Assessments Coverage

a. First $1,000 ($10.00 per $1,000)

$10.00 X 1.0 = $10.00

Rounded

=

+$10

b. Next $6,500 ($0.15 per $1,000)

$0.15 X 6.5 = $0.98

Rounded

=

+$1

4. Charge for $500,000/$1,000 Section II = +$25

5. Final Premium (subject to policy minimum premium) = $239

Note: Each discount and charge is to be rounded to the nearest dollar before being subtracted from or added to

the basic premium.

CONDOMINIUM UNITOWNERS

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

49 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

CONDOMINIUM UNITOWNERS

ZONE 10 & 20 - 2% HURRICANE DEDUCTIBLE/$500 ALL OTHER PERIL; REMAINDER -

$500 ALL-PERIL DEDUCTIBLE

$100,000 LIABILITY; $1,000 MEDICAL PAYMENTS

Premium = Zone Base Rate X Protection Class Factor X Construction Factor X Amount Factor X Risk Amount / $20,000

ZONE BASE RATES

Zone

Rate

10

$560.00

20

$229.50

32

$180.50

45

$161.50

50

$150.50

51

$150.50

54

$150.50

60

$123.50

61

$153.50

63

$123.50

64

$123.50

65

$123.50

66

$123.50

67

$123.50

68

$123.50

69

$123.50

CONDOMINIUM UNITOWNERS

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

50 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

CONDOMINIUM UNITOWNERS

ZONE 10 & 20 - 2% HURRICANE DEDUCTIBLE/$500 ALL OTHER PERIL; REMAINDER -

$500 ALL-PERIL DEDUCTIBLE

$100,000 LIABILITY; $1,000 MEDICAL PAYMENTS

Premium = Zone Base Rate X Protection Class Factor X Construction Factor X Amount Factor X Risk Amount / $20,000

PROTECTION CLASS FACTORS

Zone Group

Protection Class

3

4 - 7

8

9

10

10C

10

1.000

1.000

1.120

1.443

1.651

1.600

20

1.000

1.000

1.120

1.443

1.650

1.600

32

1.000

1.000

1.117

1.439

1.643

1.590

45

1.000

1.000

1.124

1.444

1.651

1.600

50, 51, 54

1.000

1.000

1.123

1.444

1.654

1.600

60, 63, 64, 65, 66,

67, 68, 69

1.000 1.000 1.122 1.449 1.653 1.600

61

1.000

N/A

N/A

N/A

N/A

N/A

For Protection Class 10C:

ATTACH: Certified Fire Department Endorsement, FE-7511

CONDOMINIUM UNITOWNERS

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

51 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

CONDOMINIUM UNITOWNERS

ZONE 10 & 20 - 2% HURRICANE DEDUCTIBLE/$500 ALL OTHER PERIL; REMAINDER -

$500 ALL-PERIL DEDUCTIBLE

$100,000 LIABILITY; $1,000 MEDICAL PAYMENTS

Premium = Zone Base Rate X Protection Class Factor X Construction Factor X Amount Factor X Risk Amount / $20,000

CONSTRUCTION FACTORS

Construction

Protection

Class

Zone Group

10

20, 32, 45, 50,

51, 54, 60, 63,

64, 65, 66, 67,

68, 69

61

Frame

03

1.210

1.120

1.090

Log

03

1.210

1.120

1.090

Masonry

03

1.000

1.000

1.000

Fire Resistive

03

1.000

1.000

1.000

Masonry Veneer

03

1.000

1.000

1.000

Construction

Protection

Class

Zone Group

10

20, 32, 45, 50,

51, 54, 60, 63,

64, 65, 66, 67,

68, 69

61

Frame

04 - 07

1.210

1.120

N/A

Log

04 - 07

1.210

1.120

N/A

Masonry

04 - 07

1.000

1.000

N/A

Masonry Veneer

04 - 07

1.000

1.000

N/A

Fire Resistive

04 - 07

1.000

1.000

N/A

Construction

Protection

Class

Zone Group

10

20, 32, 45, 50,

51, 54, 60, 63,

64, 65, 66, 67,

68, 69

61

Frame

08

1.240

1.150

N/A

Log

08

1.240

1.150

N/A

Masonry

08

1.000

1.000

N/A

Masonry Veneer

08

1.000

1.000

N/A

Fire Resistive

08

1.000

1.000

N/A

CONDOMINIUM UNITOWNERS

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

52 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

Construction

Protection

Class

Zone Group

10

20, 32, 45, 50,

51, 54, 60, 63,

64, 65, 66, 67,

68, 69

61

Frame

09

1.200

1.110

N/A

Log

09

1.200

1.110

N/A

Masonry

09

1.000

1.000

N/A

Masonry Veneer

09

1.000

1.000

N/A

Fire Resistive

09

1.000

1.000

N/A

Construction

Protection

Class

Zone Group

10

20, 32, 45, 50,

51, 54, 60, 63,

64, 65, 66, 67,

68, 69

61

Frame

10 - 10C

1.330

1.230

N/A

Log

10 - 10C

1.330

1.230

N/A

Masonry

10 - 10C

1.000

1.000

N/A

Masonry Veneer

10 - 10C

1.000

1.000

N/A

Fire Resistive

10 - 10C

1.000

1.000

N/A

CONDOMINIUM UNITOWNERS

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

53 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

CONDOMINIUM UNITOWNERS

ZONE 10 & 20 - 2% HURRICANE DEDUCTIBLE/$500 ALL OTHER PERIL; REMAINDER -

$500 ALL-PERIL DEDUCTIBLE

$100,000 LIABILITY; $1,000 MEDICAL PAYMENTS

Premium = Zone Base Rate X Protection Class Factor X Construction Factor X Amount Factor X Risk Amount / $20,000

RISK AMOUNT FACTORS

Risk Amount

Factor

$2,000

2.770

$6,000

1.540

$7,000

1.440

$8,000

1.365

$9,000

1.345

$10,000

1.295

$11,000

1.250

$12,000

1.215

$13,000

1.170

$14,000

1.160

$15,000

1.100

$20,000

1.000

$25,000

0.950

$30,000

0.880

$35,000

0.855

$40,000

0.835

$45,000

0.820

$50,000

0.810

$75,000

0.780

$100,000

0.765

$125,000

0.755

$150,000

0.750

$175,000

0.740

$200,000

0.730

$225,000

0.720

$250,000

0.710

$275,000

0.705

$300,000

0.700

Each

Additional

Factor

CONDOMINIUM UNITOWNERS

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

54 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

Each

Additional

Factor

$1,000

0.670

For risk amounts between those shown above, interpolate to derive the appropriate factor.

BASIC PREMIUM ADJUSTMENTS

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

55 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

BASIC PREMIUM ADJUSTMENTS

The following adjustments apply to develop the basic premium. If applicable, these basic premium adjustments must be

applied prior to adjustment for discounts, charges, or options.

The basic premium adjustments shall apply sequentially as presented in this section. Each subsequent adjustment is

applied to the previously adjusted premium.

CUSTOMER RATING INDEX (CRI) FACTOR

The basic premium shall be adjusted by the CRI Factor in accordance with the following provisions:

A. New Business Rating

A New Business CRI will be used to determine the CRI Factor when a policy is initially written (see Section D

below). The New Business CRI will continue to be used at each renewal in determining the CRI Factor for at

least two years after the policy is initially written.

B. Subsequent Rating

At each renewal, beginning at most three years from the initial effective date of the New Business CRI, a Renewal

CRI will be used to determine the CRI Factor.

C. CRI Factor

The CRI Factor is determined using the formulas below. The CRI Factor shall be rounded to 3 decimal places

and is subject to the specified minimum and maximum factors.

NEW BUSINESS RATING

Formula

Minimum

Factor

Maximum

Factor

CRI Factor = 1.003

(5600 - CRI)

0.850

2.500

SUBSEQUENT RATING

Formula

Minimum

Factor

Maximum

Factor

CRI Factor = 1.003

(5600 - CRI)

0.850

2.500

D. Miscellaneous Provision

If a policy is issued to a named insured to replace a State Farm policy on property currently insured by that

person, e.g. due to refinancing of the home, due to a change of effective dates, or due to a Renter's policy

address change, the CRI from the former policy will apply. If this was a Renewal CRI, the time requirements in

Sections A and B of this rule are waived and Subsequent Rating applies. If this was a New Business CRI, the

time requirements in Sections A and B are measured from when the New Business CRI was used initially.

BASIC PREMIUM ADJUSTMENTS

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

56 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

E. Reinstatements

Policies reinstated within 30 days of the date on which coverage ceases will use the CRI applicable when

coverage ceased.

BASIC PREMIUM ADJUSTMENTS

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

57 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

INSURANCE TO REPLACEMENT COST (Homeowners Only)

If the dwelling is insured for an amount less than 80% of replacement cost, then the following three adjustments are

required:

A. Replacement Cost - Common Construction

Apply the appropriate factor below to the premium for the amount equal to 80% of the dwelling replacement cost

(adjusted for preceding basic premium adjustments):

Coverage A/Replacement Cost

Basic Premium

Adjustment

At Least

But Less Than

0.70

0.80

0.89

0.60

0.70

0.87

0.50

0.60

0.85

0.40

0.50

0.82

0.30

0.40

0.79

0.20

0.30

0.75

0.00

0.20

0.70

B. Depreciated Loss Settlement - Contents

The following adjustment applies to the premium developed in A.:

Basic Premium

Adjustment

-6%

C. Jewelry and Furs Limitation

Subtract the following from the premium developed above:

Basic Premium

Adjustment

-$7

ACTIVATE: Loss Settlement Provision A2 - Replacement Cost - Common Construction

ACTIVATE: Loss Settlement Provision B2 - Depreciated Loss Settlement (Contents)

ATTACH: Special Limits Endorsement, FE-5258

BASIC PREMIUM ADJUSTMENTS

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

58 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

CONDOMINIUM UNITOWNERS OCCUPANCY

If the condominium unit has any rental exposure, then the following adjustment applies to the Condominium Unitowners

premium:

Number of Days Rented

or Held for Rental

Basic Premium

Adjustment

1 - 56 days per year

10%

57 - 90 days per year

35%

91 - 180 days per year

35%

Over 180 days per year but less than 100%

35%

ATTACH: FE-5252, Unitowners Rental to Others Endorsement, if rental is 1-180 days

ATTACH: FE-5253, Unitowners Rental/Seasonal Occupancy Endorsement, if rental is over 180 days

For seasonal condominium units, rate in accordance with above occupancy and attach FE-5253.

BASIC PREMIUM ADJUSTMENTS

State Farm Fire and Casualty Company

Homeowners

New: 5/1/2010

Mississippi

59 of 120

Renewal: 5/1/2010

©, Copyright, State Farm Mutual Automobile Insurance Company 2010

CLAIM FREE DISCOUNT

If the policy is claim free, a premium credit will apply. A policy will be considered claim free in the following situations:

A. Policies that have been in-force with State Farm 0-2 consecutive years will be considered claim free if both the

following criteria are met:

1. The named insureds/applicants have had no losses pertaining to the personal residence or claims

covered under personal residence insurance (Homeowners, Condominium Unitowners, Renters,

Manufactured Home, or Farm/Ranch) in the last 5 years prior to being insured with State Farm. A claim

during the 5 year period prior to being insured with State Farm will not be considered so long as the claim

arose from an incident in which there was no damage or injury.

2. There are no Qualified Claims while being insured with State Farm.

B. Policies that have been in-force 3 or more consecutive years with State Farm that have no Qualified Claims

during the last 3 years (ending 3 months prior to the current renewal effective date).

Consecutive Years

Insured with State Farm

Basic Premium

Adjustment

0 - 2

-7%

3 - 5

-13%

6 - 8

-15%

9 +

-20%

Consecutive Years Insured with State Farm

The years with State Farm are determined by the number of consecutive years (ending with the current renewal date) the

named insured or spouse has had a State Farm Homeowners, Manufactured Home, or Farm/Ranch policy covering their

primary dwelling or contents. Although the number of consecutive years is based on the policy on the primary dwelling or

contents, it will also be used for any non-primary residence insured by State Farm.

If an applicant returns within three years of cancellation or expiration, and has had no losses or claims in the last five

years, then use the consecutive years insured with State Farm which applied at the time of cancellation or expiration.