A

guide

Chapter 6:

Finance

Cover photo: A vendor at a market near the town of Benguela, Angola. Photo by

Melita Sawyer/CRS.

© 2011 Catholic Relief Services – United States Conference of Catholic Bishops

228 West Lexington Street

Baltimore, MD 21201 – USA

Download this and other CRS publications at www.crsprogramquality.org.

I

TABLE OF CONTENTS

Chapter 6: Finance ........................................................................................... 1

Finance Process Map ....................................................................................... 2

Purpose of This Guide ....................................................................................... 3

What Function Does Finance Serve? .............................................................. 3

Summary............................................................................................................ 3

Key Principles .................................................................................................... 6

Finance Business Process 6.1 – Basic Accounting Requirements .............. 8

Step 6.1.1 – Create Chart of Accounts ..............................................................10

Step 6.1.2 – Set Up General Ledger .................................................................. 12

Step 6.1.3 – Document Financial Transactions ................................................14

Finance Business Process 6.2 – Budgeting ................................................. 17

Step 6.2.1 – Budgeting ....................................................................................... 19

Finance Business Process 6.3 – Cash Management .................................. 24

Step 6.3.1 - Cash Reciepts .................................................................................25

Step 6.3.2 – Cash Disbursements.....................................................................26

Step 6.3.3 – Cash Flow Forecasting ..................................................................29

Step 6.3.4 – Bank Reconciliation ......................................................................30

Step 6.3.5 – Petty Cash ...................................................................................... 32

Step 6.3.6 – Operating in a Cash Environment ................................................34

Finance Business Process 6.4 – Receivables Management ...................... 38

Step 6.4.1 – Receivables Management ............................................................39

Finance Business Process 6.5 – Fixed Asset Accounting .......................... 42

Step 6.5.1 – Set Up and Maintain a Fixed Asset Register ...............................44

Step 6.5.2 – Calculate and Record Depreciation Expense ..............................45

Step 6.5.3 – Record Fixed Asset Disposals ......................................................47

Step 6.5.4 – Conduct Counts of Fixed Assets ................................................... 50

Finance Business Process 6.6 – Accounting for Prepaid

Expenses and Security Deposits ................................................................ 52

Step 6.6.1 – Record Prepaid Expenses and

Maintain a Detailed Supporting Record ............................................................53

Step 6.6.2 – Amortize Prepaid Expenses .......................................................... 55

Step 6.6.3 – Record Security Deposits and

Maintain a Detailed Supporting Record ............................................................56

Finance Business Process 6.7 – Accounts Payable Processing ................ 57

Step 6.7.1 – Accounts Payable Processing .......................................................58

Finance Business Process 6.8 – Accounting for Accrued Liabilities ......... 60

Step 6.8.1 – Record Accrued Liabilities ............................................................61

II

Step 6.8.2 – Adjust Accrued Liabilities..............................................................63

Step 6.8.3 – Prepare and Maintain Detailed

Analyses of Accrued Liabilities ........................................................................64

Finance Business Process 6.9 – Recording Revenues ............................... 65

Step 6.9.1 – Record Cash Contributions ...........................................................66

Step 6.9.2 – Record Grant Revenue ..................................................................67

Step 6.9.3 – Record In-Kind Contributions .......................................................69

Finance Business Process 6.10 – Payroll Processing ................................. 71

Step 6.10.1 – Update the Payroll Master File ...................................................73

Step 6.10.2 – Update the Tax Rates and

Other Deductions from Salaries and Wages .................................................. 74

Step 6.10.3 – Process Time and Attendance Data ..........................................75

Step 6.10.4 – Prepare and Record the Payroll .................................................77

Step 6.10.5 – Disburse the Payroll ....................................................................78

Finance Business Process 6.11 – Cost Allocation ...................................... 80

Step 6.11.1 – Dene and Develop Cost Allocation Methodology ....................81

Step 6.11.2 –Processing of Cost Allocation for Pooled Costs .......................... 83

Finance Business Process 6.12 – Grant Accounting .................................. 89

Step 6.12.1 – Grant Accounting.........................................................................90

Finance Business Process 6.13 – Financial Reporting .............................. 93

Step 6.13.1 – Internal Financial Reporting .......................................................94

Step 6.13.2 – External Financial Reporting ......................................................96

Compliance Checklist for Finance ................................................................ 98

Glossary ......................................................................................................... 127

References ....................................................................................................134

1

CHAPTER 6:

FINANCE

1

MIKE SPINGLER/CRS

A microcredit group

meets in Cambodia.

2

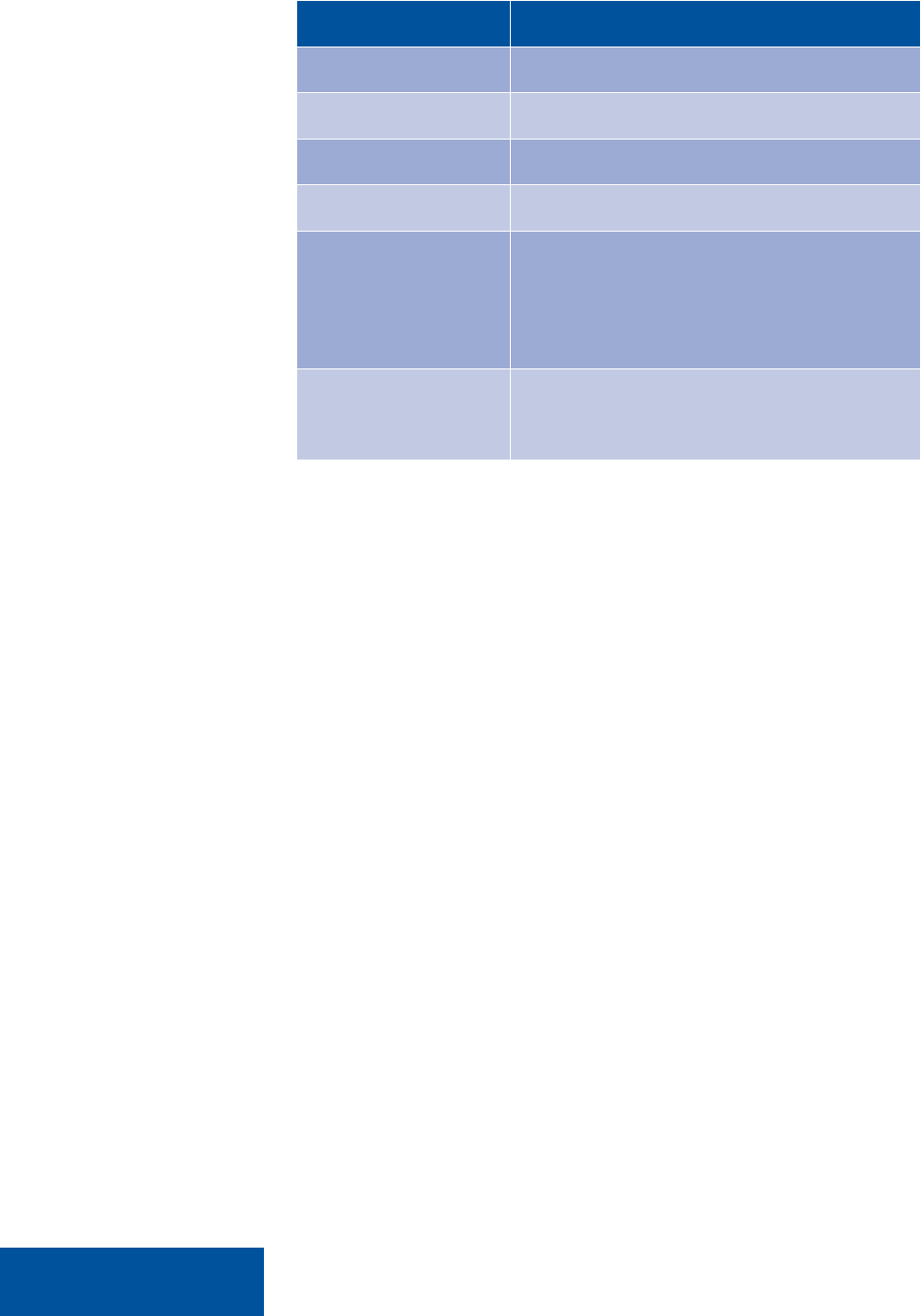

FINANCE PROCESS MAP

Basic

Accounting

Requirements

Process 6.1

Do you have a basic

accounting structure

in place?

see page 8

Budgeting

Process 6.2

Do you have a detailed

nancial estimate for

anticipated future activities?

see page 17

Cash

Management

Process 6.3

Have you implemented

procedures for effective

management of cash receipts

and disbursements?

see page 24

Receivables

Management

Process 6.4

Are policies in place to

enforce and manage

collection of receivables?

see page 38

Fixed Asset

Management

Process 6.5

Are guidelines in place to

govern recording and

accounting for xed assets?

see page 42

Account for

Prepaid Expenses

Process 6.6

Can you manage expenses paid

before the accounting period

which will benet from them?

see page 52

Accounts

Payable

Processing 6.7

Are your expenses and

acquisitions are recorded in

the proper period?

see page 57

Accounting

for Accrued

Liabilities

Process 6.8

Do you record a liability for

any debt incurred but not

settled that period?

see page 60

Recording

Revenue

Process 6.9

Are guidelines in place to

manage different sources

of revenue under varying

donor conditions?

see page 65

Payroll

Processing

Process 6.10

Do you have a payroll

function that is independent

of your HR function?

see page 71

Cost Allocation

Process 6.11

Do you have a process to

distribute shared costs

between multiple projects?

see page 80

Grant

Accounting

Process 6.12

Do you have guidelines to

ensure compliance with terms

and conditions of grants?

see page 89

Financial

Reporting

Process 6.13

Do you consolidate nancial

information to allow

for benchmarking and

stakeholder reporting?

see page 93

3

PURPOSE OF THIS GUIDE

Adoption of these policies and procedures will lay the foundation for a

controlled and formalized environment for the accurate recording and timely

reporting of nancial transactions. It will also help to establish effective

management of and accountability for funding received and expenditures

made against that funding. This section is designed to aid in enhancing an

organization’s nancial management systems and also provides guidelines for

development of nancial policies and procedures.

WHAT FUNCTION DOES

FINANCE SERVE?

Finance performs the following functions for an organization:

• Processes the organization’s nancial transactions and keeps the books

of account in which those transactions are recorded

• Provides nancial information needed by management to plan and

control the organization’s activities

• Develops and enforces nancial policies, procedures, and systems

designed to establish and maintain effective and efcient controls over

the organization’s resources

A well-run Finance department produces reliable and timely nancial reporting

that enables management to quickly assess whether the organization’s

objectives are being achieved. Financial systems that are properly maintained

aid in improving controls to safeguard assets with the reduced likelihood of

errors, loss, misuse, and fraud.

SUMMARY

This chapter is intended to provide a summation of most key accounting

processes and concepts that apply to not-for-prot organizations. It is not

intended to serve as a detailed treatise of accounting theory on the subjects

covered, nor is it intended to cover all accounting concepts.

The chapter has been prepared on the assumption that the readers of this guide

will use the accrual basis of accounting for recording their nancial transactions.

The chapter’s authors recognize that many not-for-prot organizations continue

to use a “strict cash basis” or a “modied cash basis” of accounting. From

institutional-strengthening and capacity-building perspectives, Catholic

Relief Services strongly recommends adoption of accrual basis accounting

concepts for organizations presently on the cash basis. Doing so will help

4

such organizations to successfully compete with others for donor funding and

increase their chances of long-term sustainability.

An organization that keeps its books on a cash basis records revenues when

cash is received and expenses when cash is disbursed. Under accrual

basis accounting, revenues are recorded in the periods they are earned

and expenses are booked in the periods they are incurred. Accrual basis

accounting is a more accurate method since it follows the matching concept.

Under accrual basis accounting, revenues are booked in the same accounting

period in which the expenses that generate the revenues are incurred.

Under strict cash basis accounting, assets, such as receivables and

prepayments, and liabilities are not recognized. For example, an organization

using this method would not record severance expense until it was paid,

possibly resulting in a signicant understatement of the expenses attributable

to a grant or project at a given point in time.

Organizations that maintain their accounting on a cash basis should ensure

that their donor agreements address how prepayments and expenses incurred

but not paid as of the award expiration dates should be treated. Normally,

grant donors will not allow recipients to charge their awards for the portions

of prepayments that pertain to post-award periods. Cash basis organizations

should seek to negotiate terms with donors that will allow them to be

reimbursed for expenses incurred but not paid as of the award expiration dates.

Thirteen topics are covered in this chapter as follows:

1. Basic Accounting Requirements – Addresses setting up the chart

of accounts and the general ledger and documenting nancial

transactions.

2. Budgeting – Contains information on budgeting principles such

as approvals, clarity, structuring the budget, estimating costs, and

amending the budget. Also deals with grant budgeting and the concept

of line item exibility.

3. Cash Management – Focuses on receipts, disbursements, forecasting,

bank reconciliations, and maintaining petty cash funds.

4. Receivables Management – Describes the various types of

receivables and reviews standard pertinent disciplines, including

the need for Finance to provide receivables “aging” reports to

management monthly.

5. Fixed Assets Accounting – Stresses the need to set up and maintain

a xed assets register. Explains the concept of depreciation expense.

Goes over the accounting entries needed to record xed assets

5

disposals. Underscores the requirement to conduct xed asset counts

and to reconcile them to the general ledger balances.

6. Accounting for Prepaid Expenses and Security Deposits –

Differentiates between prepayments and security deposits and the

accounting treatments to be used for each.

7. Accounts Payable Processing – Gives the various steps for handling

accounts payable transactions. (Accounts Payable processing is used by

those organizations that set up their pending payments as liabilities before

paying them. This process does not apply to those organizations that use a

single-step approach, whereby expenses are recorded when paid.)

8. Accounting for Accrued Liabilities – Provides guidance on setting

up and adjusting accruals for liabilities, including those that involve

estimates or those that are not expected to be settled in the short-term.

9. Revenue – Distinguishes among cash contributions, grants, and

in-kind contributions. Depicts the special accounting treatment

needed for grants, for which revenue is recorded when earned, not

when received.

10. Payroll Processing – Emphasizes the need to segregate the

Human Resources department’s responsibilities for overseeing

stafng changes from timekeeping and payroll functions, which

should be performed by the Finance department. Cites key relevant

responsibilities, such as maintaining a payroll master le, updating

payroll deductions, processing time and attendance data, preparing

and recording the payroll, and disbursing the payroll.

11. Cost Allocation – Explains the process whereby shared expenses can

be distributed to beneting cost centers. Introduces the concept of

capturing shared expenses in various pools and allocating expenses

from those pools based on various cost “drivers.” Offers examples of

pool types and allocation methods.

12. Grant Accounting – Furnishes an overview of the grant cycle.

Concentrates on the nancial responsibilities associated with

grant administration, most importantly those relating to grant

implementation, reporting, and closure.

13. Financial Reporting – Lists the various types of nancial reports

that should be provided to internal and external audiences and the

frequency at which those reports should be made available.

6

KEY PRINCIPLES

The following are ten key nancial principles:

1. Record all acquisitions of goods and services at their historical costs

(original purchase prices or, for in-kind donations, fair market values

on the dates received).

2. Financial reporting must be reasonably accurate, supported by the

appropriate evidentiary matter, and pertinent.

3. Revenue is recorded in the scal month in which the organization

distributes goods or performs a service.

4. Expenses incurred to generate revenues must be recorded in the

same scal month in which the revenues are recorded. Expense is

recorded in the scal month in which the organization has received

(taken title) to goods or received a service.

5. All signicant items should be disclosed in nancial statements if

they are likely to inuence the decisions of users of the nancial

statements. Financial statements and the accompanying notes must

include all signicant, relevant accounting information to enable

users of the nancial statements to make informed decisions.

6. The organization must follow the same accounting policies and

practices in the comparative periods reported in its nancial

statements. If an accounting change has taken place that

signicantly impacts the activities or nancial condition of the

organization, that change must be disclosed in the notes that

accompany the nancial statements.

7. When faced with uncertainties, accountants must make accounting

decisions that neither materially overstate nor understate the

nancial results or balances reported. If there is uncertainty, the

bias should be to accelerate recording a loss or expense and to

postpone recording an income or revenue. The organization should

exercise similar caution in reporting its assets and liabilities.

8. The organization should have in place a system of authorizations,

approvals, and verications. Authorization is the principal means

of ensuring that only valid transactions and events are initiated as

intended by management. Authorization and approval procedures

should be documented and clearly communicated to all staff.

Transactions should be veried before and after processing.

Access to resources and records should be restricted to authorized

individuals who are accountable for their custody and/or use.

7

9. Reconciliations should be performed on a monthly basis. General

ledger balance sheet account balances should be reconciled

to the appropriate supporting internal documents or external

information (such as bank statements) to allow for prompt

corrective action if warranted.

10. Management should compare information about current nancial

performance to budgets, forecasts, prior period reported results,

or other benchmarks to measure the extent to which goals and

objectives are being achieved and to address unexpected results or

unusual conditions that require follow-up.

Steven Chege, a

community nurse

with Kenya’s Kijabe

Hospital, consults with

a fellow care provider

during a home visit in

the nearby community.

Steven monitors 60

home care patients, an

invaluable function in

this rural area.

DAVID SNYDER/CRS

8

FINANCE BUSINESS PROCESS 6.1 –

BASIC ACCOUNTING REQUIREMENTS

PROCESS DESCRIPTION

To properly fulll its recordkeeping and reporting responsibilities, it is

important that the organization’s Finance staff maintain an accounting

record, known as a general ledger, for capturing all nancial transactions.

Financial transactions are recorded using general ledger accounts that

indicate the nature of the expense incurred, good or service received, or

revenue generated.

Before setting up a general ledger, management must decide how it wants its

accounting transactions to be structured. It is critical that the organization set

up its accounting structure to provide for reporting that meets all concerned

parties’ needs and that is in compliance with the professional accounting

standards that prevail in the organization’s home country. Cost centers

typically used by nonprot organizations are those that group nancial

activities by project, ofce, operating department, geographic region, and/or

donor funding source.

It is of equal importance that all transactions be supported with the proper

documentation. The organization’s Head of Finance should establish

standards that indicate which types of documentary internal and external

evidence are needed to support each type of nancial transaction. The Head

of Finance should also indicate the length of time that the organization’s

various nancial documents should be retained on le.

9

PROCESS FLOW

PROCESS 6.1 BASIC ACCOUNTING

REQUIREMENTS

Create Chart of

Accounts

6.1.1

Create General

Ledger

6.1.2

Document

Transactions

6.1.3

Start

Process

End

Process

10

STEP 6.1.1 – CREATE CHART OF ACCOUNTS

STEP NAME CREATE CHART OF ACCOUNTS

Step Number 6.1.1

Organizational Role Management team

Inputs Organization’s accounting needs

Organization’s reporting needs

Outputs Chart of accounts

Integration Points N/A

Summary Most nonprot organizations satisfy their reporting

needs through the use of cost centers and general

ledger account codes. Cost centers should be aligned

with management objectives and responsibilities.

Account codes identify the nature of the items affected by accounting transactions.

General ledger accounts are usually grouped into the following major categories:

• Assets

• Liabilities

• Net Assets (formerly known as Fund Balances)

• Revenues

• Expenses

Assets may be subdivided into two main groups depending on their degrees

of liquidity and their expected asset lives. The most liquid assets are generally

expected to be used up in the normal course of business in the short term and are

normally grouped into one range, often called “Current Assets.” Those assets with

less liquidity, longer anticipated useful lives, and long-term benet are placed into

a range usually called “Fixed Assets” or “Property, Plant, and Equipment.”

Each of the major account groups should appear in a specially designated

range. The following are a possible set of ranges:

• (Current or Short-Term) Assets – Account ranges from 1000 to 1999

• Fixed Assets – Account ranges from 2001 to 2999

• Liabilities – 3000 to 3999

• Net Assets (Fund Balances) – 4000 to 4999

• Revenues – 5000 to 5999

• Expenses – 6000 to 6999

11

Organizations should tailor the ranges to meet their specic needs. The

accounts should be set up in a logical sequence. The accounts should

be assigned in a way that will allow the organization to add accounts or

account ranges in the event of future growth or increased reporting needs.

The organization may wish to add minor account codes to provide more detailed

information to nancial report users. Minor account codes usually follow the

major account codes and typically are three to four characters in length. They

can be longer if deemed necessary by the organization, subject to accounting

software limitations. Minor account codes can be used for various reasons, such

as to denote bank accounts, project materials, or salary categories.

The following are some examples of minor account codes:

1. Bank accounts – assuming that General Ledger (G/L) Account (A/C)

1010 is used to denote checking accounts.

a. A/C 1010.101 – Main Ofce General Purpose Checking Account

b. A/C 1010.102 – Main Ofce Grant Checking Account – Donor A

c. A/C 1010.103 – Subofce General Purpose Checking Account

d. A/C 1010.104 – Subofce Grant Checking Account – Donor A

2. Salaries and Wages – assuming that G/L A/C 6010 is used for salaries.

a. A/C 6010.101 – Base Salaries

b. A/C 6010.102 – Overtime Salaries

c. A/C 6010.103 – Sick Time

d. A/C 6010.104 – Vacation Salaries

e. A/C 6010.105 – Holiday Salaries

3. Project Materials – assuming that G/L A/C 6100 is used for project materials

a. A/C 6100.101 – Construction Materials

b. A/C 6100.102 – Seeds

c. A/C 6100.103 – Agricultural Tools

d. A/C 6100.104 – Medicine

It is recommended that another eld or code be used to identify vendors,

employees, donors, and subrecipient partners. Minor account codes are

not recommended for identifying those parties.

An authorized nance ofcer should control the issuance of account numbers,

and additions should be kept to the minimum number needed. All active

account numbers should be made available to all employees in a listing

known as the chart of accounts. The chart of accounts should be updated and

reissued for each change. Accounts that are no longer to be used should be

deactivated and the organization’s employees should be notied accordingly.

To minimize misunderstanding as to the use of each account, organizations

should consider adding full explanations for each account to the chart. This

type of chart is known as an annotated chart of accounts.

12

STEP 6.1.2 – SET UP GENERAL LEDGER

STEP NAME SET UP GENERAL LEDGER

Step Number 6.1.2

Organizational Role Head of Finance

Inputs Chart of accounts

Accounting structure based upon the organization’s

accounting and reporting needs

Outputs Financial reports

Integration Points Management

Summary All nancial transactions of an organization must

be recorded in an accounting record known as the

general ledger.

Access to the general ledger should be rmly controlled and the general ledger

should be in balance at all times. Transactions are recorded in the general

ledger on a daily basis and should be summarized, at a minimum, monthly.

The summarized totals are called “general ledger balances.” These are

used as the bases for nancial reporting to management, donors, the board

of directors, prime recipients, government regulatory agencies, and other

interested parties. At the end of the organization’s business year (known as a

scal year), the general ledger is closed and the nal reporting to management

for the year is prepared.

The general ledger may be a manual (hand-prepared) ledger or a computerized

version that uses software specically designed for that purpose. The

computerized general ledger has proven to be the better choice for most

organizations for the following reasons:

• Access to the computerized general ledger can be restricted to

authorized individuals.

• General ledger software provides a complete audit trail. It can indicate

who entered and/or posted each transaction.

• Computerized general ledger systems can be backed up to minimize the

loss of data in the event of a theft or a catastrophic event.

• Computerized general ledger systems require all transactions to balance,

eliminating the out-of-balance conditions that frequently result when

manual ledgers are used.

• Computerized general ledger databases store a large amount of data for

13

extended periods of time, enabling the organization’s Finance department

to provide a wide variety of reports that can include historical data.

• Computerized general ledgers generate nancial reports more quickly

and accurately than manual ledgers.

• Computerized general ledgers can collect and process data from

multiple input sources. Only one employee can post to a manual ledger

at a given time.

A computerized spreadsheet application such as Excel does not have the

necessary built-in controls to prevent unauthorized changes or to provide a

complete audit trail and is therefore not recommended as a substitute for a

computerized general ledger system. If Excel is used, on each posting day the

spreadsheet containing that day’s transactions should be printed, signed by

the designated approver, and retained on le.

If an organization uses a manual ledger and has a high volume of activity

for certain types of transactions, those transactions may be recorded in a

subsidiary ledger and then summarized for posting into the general ledger. If

subsidiary ledgers are used as books of original entry, care must be exercised

to ensure that all balances from the subsidiary ledgers are properly carried

forward into the general ledger. Some examples of subsidiary ledgers are cash

receipts journals, cash disbursement journals, accounts receivable ledgers,

voucher registers (accounts payable), and xed assets ledgers.

General ledger transactions can be grouped into three basic types, namely

the following:

• Cash receipts, which are recorded on cash receipts vouchers

• Cash disbursements, which are recorded on cash disbursement vouchers

• All other transactions, which are recorded on general journal vouchers or

variations thereof, such as an accounts payable voucher

• “Other” transactions, which typically include those types of activities that

do not involve the receipt or outlay of cash. Accruals, write-offs or write-

downs, depreciation, amortization, adjustments, and reclassications are

among the more common types of general journal entries. These terms

are explained in the glossary section of this chapter.

14

STEP 6.1.3 – DOCUMENT FINANCIAL TRANSACTIONS

STEP NAME DOCUMENT FINANCIAL TRANSACTIONS

Step Number 6.1.3

Organizational Role Finance staff

Inputs Source documentation

Outputs Completed vouchers

Integration Points Procurement

Administration/Human Resources

Vendors

Partners

Management

Summary All nancial transactions must be fully documented

to the extent that is appropriate for the type of

transaction.

Every accounting transaction should be recorded on a separate accounting

voucher, also known as an entry. A fundamental accounting rule is that each

voucher must balance, that is, its debits must equal its credits so that the

general ledger remains in balance at all times. Debits increase assets and

expenses and reduce liabilities and revenue. Credits increase liabilities and

revenue and reduce assets and expenses.

Each accounting voucher must meet the following requirements:

• Sequentially numbered

• Appropriately documented

• Properly approved

• Carefully led to allow for easy retrieval

All vouchers should be signed by the employees who prepared, entered,

approved, and posted them. If the organization assigns the responsibility of

data entry verication to an additional employee, that employee should also

sign the voucher. Immediately after approval and before ling, each voucher

and its supporting documents must be canceled to prevent their reuse.

Cancellation usually entails marking, stamping, or perforating each document

as “paid” or “processed,” as applicable.

The appropriate supporting documentation for a cash receipts voucher

includes the following:

15

• Bank deposit slip or cash receipt form, as applicable

• Cash receipt form

• Photocopy of each check deposited (the payer’s check number should

also be shown in the description eld for that line item on the cash

receipts voucher.)

• Any other material, such as a remittance advice, submitted by the paying

party with its payment

The appropriate supporting documents for a cash disbursement voucher

normally include the following:

• Approved purchase requisition form

• Price quotations or pro-forma invoices

• Bid comparison reports with explanation for vendor selection or why a

sole source vendor was chosen

• Purchase order and/or vendor contract (for consultants, landlords, etc.)

• Goods received note (receiving report)

• When warranted, a memo justifying variance between quantities or

descriptions of items ordered versus those received

• Vendor’s original invoice

• Approved Payment/Advance Request form

The appropriate supporting documents for a general journal voucher vary

depending on the nature of the transaction. These can include the following:

• For accruals – Internal analyses and external documents such as

correspondence, legal notices, or copies of disputed billings

• For write-offs – Management authorization memoranda and copies of all

correspondence with the debtor documenting collection efforts

• For liquidations of amounts advanced by the organization – Travel

expense reports (from employees), nancial liquidation reports (from

subrecipients), invoices, plus purchasing and receiving documentation

(from vendors)

• For correcting entries or reclassications – The original accounting entry

and the correcting or reclassication entry should be cross-referenced.

If the amounts corrected or reclassied are the sum of multiple

transactions, a complete list of the transactions or balances impacted by

the change should be attached to the correcting or reclassication entry

as support. A full explanation should be attached to the entry explaining

the reason why the correction or reclassication was necessary.

16

If the source documents are condential in nature, such as those for a payroll

entry or a legal accrual, a reference should be made on the entry as to

where the supporting documents are located. A complete description of the

transaction should be attached to each general journal entry.

The organization should establish and enforce rm record retention policies.

All documents should be protected while in storage both onsite and (if

applicable) offsite. Donor requirements and local statutes should be taken

into consideration when determining the length of the record retention

period needed. (For project activities funded by U.S. government awards, it is

recommended that all nancial supporting documentation be retained for a

minimum of 10 years.)

17

FINANCE BUSINESS PROCESS 6.2 –

BUDGETING

PROCESS DESCRIPTION

A budget is a detailed nancial estimate of anticipated activities for a specied

period of time. The following are several types of budgets:

• Annual Operating budget – an estimate of an organization’s total revenues

and expenses for a scal year

• Cash budget – the cash an organization expects to receive and disburse

• Capital budget – the total costs to acquire xed assets (capital additions)

• Project Budget – the estimated cost of a specic project

• Grant Budget – the estimated cost to conduct project activities funded

by a grant

Planning – A budget is necessary for planning upcoming activities so that an

organization can reasonably estimate the cost of those activities. This allows the

organization to determine if it has the resources needed to perform activities and

if it is making the best use of the resources.

Fundraising – The budget can be used as a major tool for fundraising. The budget

sets out in detail what the organization plans to do with the funds raised, including

on what the funds will be spent and what results will be achieved.

Project Implementation – A realistic budget is needed to control an activity once

it has started. The most important tool for ongoing monitoring is comparing

the actual costs against the budgeted costs. Without a realistic budget, this is

impossible. Given that plans may change, it is necessary for department heads

to review the budget after an activity has started and to amend the budget, if

warranted. Approval may be needed from designated ofcials if changes to the

budget require additional funding.

Monitoring and Evaluation – The budget is used as a tool for evaluating

the success of the activity during its project life and when it is completed.

It helps to determine whether the planned objectives were met and within

the cost parameters.

18

PROCESS FLOW

PROCESS 6.2 BUDGETING

FINANCE

TEAM

Budgeting

6.2.1

19

STEP 6.2.1 – BUDGETING

STEP NAME BUDGETING

Step Number 10.2.1

Organizational Role Head of Finance

Project ofcer/project director – For each individual

project

Board of directors – For the organization’s total

annual budget

Inputs Organization’s annual funding needs

Organization’s available resources

Outputs Approved budget

Budget comparison reports

Integration Points Collaboration with donors, project ofcers

Summary Effective budgets can only be produced as a result

of good underlying plans. Financial planning lies at

the heart of effective nancial management. The

organization must have a clear idea about what it

intends to do and how it intends to do it.

The Budgeting Process

The process of preparing a meaningful and useful budget is best undertaken

as an organized and structured group exercise. The budget process involves

asking a number of questions including the following:

• What activities will be involved in achieving the planned objectives?

• What resources will be needed to perform these activities?

• What will these resources cost?

• What will be the sources of the funds?

• Are the anticipated results realistic?

• What approvals are required to accept budget variances?

• Do the various departments within the organization have budgets?

Once the budget has been agreed upon and the activity implemented, the

process is completed by comparing the plan (budget) with the eventual

outcome (actual).

20

Budgeting Principles

Approval – The board of directors will need to approve the organization’s budget

at the start of the scal year. Anticipated unfavorable budgetary variances over the

stipulated threshold require written prior approval from a designated ofcial (often

the Head of Finance) and, when applicable, from grant donors.

Budget Accountability - A budget manager should be designated for each of the

organization’s cost centers or projects. The budget manager has the following

responsibilities for the assigned cost center or project:

• Developing the budget

• Effective and timely programmatic and nancial monitoring

• Managing and anticipating the needs of the cost center or project

• Preparing and justifying requests for amendments when necessary

• Ensuring that the actual costs are in line with the budgeted costs

• Taking the necessary steps to prevent material cost overruns

• Achieving the stated objectives

• Providing regular programmatic reporting

• Complying with donor requirements where applicable

• Closing projects/grants timely, effectively, and completely

Clarity – Since many different people will need to use the budget for different

purposes, the budget should be sufciently clear and detailed to allow all potential

users to understand it. Clarity and accuracy are critical, so it is important to keep

notes on budgeting assumptions and how estimates have been determined.

Budget Structure – When setting a budget for the rst time or when reviewing a

budget, it is important to refer to the organization’s chart of accounts to determine

whether it feeds into the reporting requirements from a donor. This is because

the budget line items also appear in the accounting records and on management

reports. If the budget items and accounting records are not consistent, then it will

be very difcult to produce monitoring reports once the project implementation

stage is reached.

Estimating Costs – It is important to be able to justify calculations when

estimating costs. The Finance department should work closely with other

department heads to identify types of activities and related costs. Do not

be tempted to simply take the previous year’s budget and add a percentage

amount for ination. While the previous year’s budget could be very helpful

as a starting point, it could also be very misleading and contain historical

inaccuracies. Expenses to be distributed to various cost centers and projects via

21

a cost allocation process should be considered during the budgeting phase and

included in the total estimated cost for each cost center and project. (See the

cost allocation section of this chapter for guidance.)

Budget Amendments – If during the course of the year, a department head

determines that a change is needed due to an anticipated additional need

for resources from the organization’s unrestricted funds, the approval of the

organization’s Executive Director may be required. If additional funding is needed

for a grant-funded project, the organization will need to seek approval from the

donor for a modication of the grant agreement. If the grant donor agrees to the

change, a revised budget should be prepared and submitted to the grant donor.

Once approved, the amended budget becomes the new operating budget for that

agreement. If internal approval is given, the department head will be required to

prepare a budget amendment form, obtain the necessary approval(s), and forward

the approved form to the Finance department. The Finance department should

use the new approved budget for budget comparison reporting purposes.

The best approach is to make a list of all the inputs required and specify the

quantity and estimated unit cost of each item. From this detailed working sheet it

is a simple matter to produce a summarized budget for each line item and is very

easy to update if units or costs change.

SAMPLE BUDGET WORKSHEET

LINE ITEM

DESCRIPTION

UNIT

COST

UNIT OF

MEASURE QUANTITY

TOTAL

ANNUAL

BUDGET

REQUESTED NOTES

Salary 10,000 Month 2 240,000 Salaries

for project

accountants

Rent 500 Month 1 6,000 Rent for

leasing ofce

building

Overlooked Costs – Many failed projects are based on an underestimated

budget. The most common of the overlooked costs are the indirect or support

costs. The following are some of the most often overlooked costs:

• Staff-related costs (e.g., recruitment costs, training, benets, and

statutory payments)

• Project start-up costs (e.g., publicity)

22

• Allocated costs (e.g., rent, insurance, and utilities)

• Vehicle operating costs

• Equipment maintenance (e.g., for photocopiers and computers)

Budget Categories for Project Management

Budget line items are specic budget headings or account classications

that match project proposal budgets. Each line item should be identied by

a specic account code. Some grant donors will ask their grantees to use

specic budget templates with standard cost categories and line items when

requesting and reporting on the use of funds.

When a donor requires reporting by cost categories, which is a grouping of

several account line items, the organization must start the budget process by

each individual line item and roll up to a cost category.

Line Item Flexibility for Project Management

Within a grant agreement, the donor will specify the line item exibility that is

applicable to the award. If donor approval is needed prior to incurring certain

types of expenses, follow donor regulations for seeking approval. For example,

a donor can grant line item exibility of up to 10 percent of the amount

budgeted per line item.

The following is an example of acceptable exibility that does not need prior

approval from donor:

DESCRIPTION BUDGET

ACTUAL

SPENT

DIFFERENCE – ACTUAL

OVER/(UNDER) BUDGET

Salaries 300 330 10%

Domestic travel 100 90 (10%)

Ofce expenses 200 180 (10%)

Total 600 600 0%

Actual spending

did not exceed

the budget

Difference must

not be more

than 10 percent

of the budgeted

line item

23

The following is an example of unacceptable exibility:

DESCRIPTION BUDGET

ACTUAL

SPENT

DIFFERENCE –

ACTUAL OVER/(UNDER)

BUDGET

Salaries 300 450 50%

Domestic travel 100 90 (10%)

Ofce expenses 200 180 (10%)

Total 600 720 20%

The following is an additional example of unacceptable exibility:

DESCRIPTION BUDGET

ACTUAL

SPENT

DIFFERENCE-ACTUAL

OVER/(UNDER) BUDGET

Salaries 300 360 20%

Project materials 600 580 (3%)

Domestic travel 100 80 (20%)

Ofce expenses 200 180 (10%)

Total 1,200 1,200 0%

With regard to line item exibility, the organization should always refer to the

terms of the specic agreement with each grant donor since line item exibility

can change from donor to donor and for various agreements with a given

donor. In the examples shown above, the restriction was on a line item basis.

For certain U.S. government donors, there is a cumulative limitation of 10

percent of the total budget. For other donor awards the exibility restrictions

are on a program category or component basis, not by line item.

Actual spending

exceeded the budget

Difference

is more than

10 percent of

the budgeted

line item

Actual spending

exceeded the budget

Even though the total budget was not

exceeded, the Salaries expense was

exceeded by more than 10 percent

Difference

is more than

10 percent of

the budgeted

line item

24

FINANCE BUSINESS PROCESS 6.3 –

CASH MANAGEMENT

PROCESS DESCRIPTION

Cash management is an important function in any organization. In order

to maximize its cash position, an organization should implement cash

procedures for effective management of cash receipts and disbursements.

Forecasting and budgeting are important aspects of cash management. The

organization should try to plan in as much detail and as far ahead as possible

what receipts can be expected and what disbursements will be required. Cash

management functions revolve around receipts, disbursements, forecasting,

and reconciliation.

PROCESS FLOW

PROCESS 6.3 CASH MANAGEMENT

Start

Process

End

Process

Cash Flow

Forecasting

6.3.3

Cash

Receipts

6.3.1

Cash

Disbursements

6.3.2

Operating in a

Cash Environment

6.3.6

Petty Cash

Operations

6.3.5

Bank

Reconciliation

6.3.4

25

STEP 6.3.1 – CASH RECEIPTS

STEP NAME CASH RECEIPTS

Step Number 6.3.1

Organizational Role Head of Finance

Cashier

Management

Inputs Grant agreements

Contributions

Remittance advices

Outputs Cash receipt slips

Cash receipts voucher

Bank deposit slips

Integration Points Collaboration with donors

Collaboration with project ofcers and

department heads

Summary The organization’s cash receipts are from various

sources such as donations, grants, sales, fees

for services rendered, and collection of accounts

receivable. All cash receipts must be accounted for

in a timely manner.

All cash receipts should be dated upon receipt and pre-numbered to facilitate

checking of the numerical sequence for missing documents. The following

procedures should be followed:

• Cash should be banked upon receipt.

• Cash receipts should be properly classied as donations, grant funding,

cash from sales, accounts receivable collections, service delivery,

disposal of assets, or borrowing. Reconciliation must be done in the

respective accounts to determine whether all entries were made to show

all cash received by the organization.

• Bank reconciliations should be done monthly by someone independent

of cash custody or record keeping responsibility. Cash receipts journal

entries should be regularly compared to the remittance lists and

deposits.

26

STEP 6.3.2 – CASH DISBURSEMENTS

STEP NAME CASH DISBURSEMENTS

Step Number 6.3.2

Organizational Role Head of Finance

Accounts payable ofcer

Inputs Required cash disbursement documentation

Outputs Approved cash disbursement voucher

Vendor receipts issued

Integration Points Collaboration with project ofcers

Collaboration with suppliers

Summary Cash disbursements should be authorized and

supported with proper documentation.

1. Designated ofcials should authorize cash disbursement. Proper

documentation for cash disbursements includes, but is not limited to,

the following:

• Approved purchase requisition form

• Price quotations or pro-forma invoices

• Bid comparison reports with explanation for vendor selection or why a

sole source vendor was chosen

• Purchase order and/or vendor contract

• Goods-received note (receiving report)

• When warranted, a memo justifying variance between quantities or

descriptions of items ordered versus those received

• Vendor’s original invoice

• Approved Payment/Advance Request form

2. Cash disbursements information should be summarized on a cash

disbursement (CD) voucher. The voucher should contain the date of

transaction, account code, and reason for payment. The voucher should

balance, i.e., the debits should equal the credits. Segregation of duties

dictates that the cash disbursement voucher must be veried by a

person other than the one who prepared it and must be approved by a

senior ofcial. This approval is sufcient to make payment and post the

transaction to the general ledger.

27

3. The organization should ensure that all payments, with the exception

of petty cash disbursements, are made using pre-numbered checks

to provide independent identication by the bank. It is more difcult to

manipulate check payments because of the increased audit trail, whereas

cash cannot be traced. All check disbursements have to be approved by

authorized signatories.

4. Check signatories/wire approvers should be clearly designated. These

should be as few as possible to narrow down the responsibility. Checks

should require at least two signatures.

5. A copy of the signed check should be attached to the cash disbursement

voucher. The organization should always obtain acknowledgment of receipt

from the supplier in the form of a supplier-issued receipt form. If the supplier

cannot furnish such a form, the supplier should sign a copy of the check.

An organization employee who is independent of the cash and procurement

functions should prepare a goods-received note (receiving report).

6. Ensure that individuals who prepare checks have no access to cash

receipts. (If the organization cannot segregate these duties because of a

limited staff, that control weakness should be documented along with the

compensating controls put into place to offset it.) Access to blank checks

should be restricted to authorized persons. The numerical sequence

should be veried when new checks are received, and missing checks

should be listed.

7. Checks should be dated when issued. Pre-dating or post-dating checks

should be strictly prohibited. The date of the check should be shown on

the cash disbursement voucher and recorded in the cash disbursement

journal/general ledger.

8. Signing of blank checks should be prohibited. Checks should not be

written until a payment request voucher has been prepared and approved.

9. Before a check is signed, all relevant documents supporting the payment

should be attached to a cash disbursement voucher to show that the

expenditure is genuine. All supporting documents must be canceled with

a “PAID” stamp immediately after approval to prevent the documents from

being presented again for payments.

10. To avoid alteration, signed checks should be dispatched directly to the

designated payees without having to go back to the check preparer. If

stafng limitations dictate that checks need to be routed back to the

check preparer, compensating controls must be put into place. Such

controls include having an employee other than the check preparer/

distributor perform the bank reconciliation and the voucher postings.

Two young boys in

Laguna Patzijon,

Guatemala. There are

few opportunities for

young men in rural

areas, with low literacy

rates and few jobs

outside of farming.

DAVID SNYDER/CRS

28

11. To prevent duplicate payments or recordings, check numbers should be

used as transaction references when posting to the cash disbursement

journal or general ledger. Original copies of voided cash disbursements

and voided checks must be kept on le.

12. Checks should be made to order. Checks should be crossed with

“Account Payee Only” and “Not negotiable,” if that is the standard

practice in the country.

13. It is recommended that a check dispatch (disbursement) register, which

accounts for the sequence of checks issued, be maintained.

14. Voided checks will be marked prominently with the stamp “Canceled” and

kept securely for reference. It is recommended that each voided check be

attached to a blank cash disbursement voucher and entered into the cash

ledger system as “voided” for tracking purposes.

15. Bank transfers from other accounts should be posted in the cash

disbursements journal when the transfer has been initiated and to

the cash receipts journal when the transfer has been completed. It is

recommended that a cash-in-transit account be used to track and monitor

the transfer of cash between bank accounts.

a. When funds are transferred from account A to account B

i. Debit Cash in transit account

ii. Credit Bank A account

b. When funds are reected as received in account B

i. Debit Bank B account

ii. Credit Cash in transit

Note: Cash-in-transit is the general ledger account used to track cash

that is being transferred from one bank account to another. Since the cash

disbursement is recorded on a separate accounting voucher than the cash

receipt, the cash-in-transit account is needed to balance each of the two

entries. When the cash receipt is recorded, the balance in the cash-in-transit

account should zero out.

29

STEP 6.3.3 – CASH FLOW FORECASTING

STEP NAME CASH FLOW FORECASTING

Step Number 6.3.3

Organizational Role Head of Finance

Inputs Approved budget

Activity plans

Outputs Approved cash ow forecast

Integration Points Collaboration with donors

Collaboration with project ofcers

Summary The cash ow forecast allows the organization’s

managers to predict periods when cash balances

are likely to be insufcient to meet spending needs

and periods when there are surplus funds.

Effective cash ow management is vital to organizations. It is a key element in

planning and in efcient operational management. If cash inows and outows

are not successfully planned and monitored, organizations may encounter cash

shortfalls and may not be able to serve beneciaries or pay employees and vendors

in a timely manner. A cash ow forecast is often required by external parties to

enable them to plan the timing of issuance of funding to the organization.

The cash ow forecast is linked with budget planning and involves, at a

minimum, the following steps:

1. Determine the cash position at the beginning of a given period from

the organization’s accounting records.

2. Plan the timing of anticipated future cash receipts, approved sources

of grant funding, and other projected sources of income. The main

sources of cash inows for an organization include contributions,

donors’ advances or reimbursements, collection of accounts receivable

balances, and cash receipts from income-generating activities.

3. Estimate the timing of cash disbursements, taking into consideration

the organization’s planned activities. Organizations that maintain their

accounting on an accrual basis should keep in mind that payments to

vendors may be needed to decrease previously recorded liabilities.

4. Summarize the information above in a spreadsheet showing forecasted

cash balances by period.

5. Provide the forecast to the executive director or other applicable ofcial

for use in projecting cash surpluses or needs.

30

STEP 6.3.4 – BANK RECONCILIATION

STEP NAME BANK RECONCILIATION

Step Number 6.3.4

Organizational Role Head of Finance

Authorizing ofcial

Inputs Ofcial bank statement

Ledger transactions

Outputs Bank reconciliation statement

Integration Points Collaboration with bank

Summary Bank reconciliations are performed at least monthly

to reconcile differences between bank records and

the organization’s records.

The following are items that may cause differences between an organization’s

accounting ledger and a bank statement from the bank:

• Incoming transfers

• Bank charges and interest booked by the bank but not by the

organization

• Checks issued by the organization but not presented to the bank

• Deposits in transit, dened as deposits made and recorded by the

organization toward the end of the month but not booked by the bank

as of the ending bank statement date. This difference may be due to

processing delays or to posting errors.

Bank reconciliation best practices include the following:

1. Bank reconciliations should be prepared monthly to verify that the

accounting records are correct. The bank account mirrors cash book

activity. Therefore, the preparer should look for possible discrepancies

that could be caused by either error or misuse. Bank account

reconciliation responsibility should be vested in persons not involved in

handling receipts or disbursements. Otherwise, possible discrepancies

can be covered up. A designated responsible ofcial should review

reconciliations. Bank reconciliations should be retained on le in the

event of audit or other internal reviews.

2. Documents that support the reconciling items need to be attached to

the related bank reconciliation. Such documents might include a list of

outstanding checks, deposits in transit, and other relevant documents.

31

3. When appropriate, a general journal entry should be made to record

the reconciling of items that appear on the bank statement but are not

recorded in the organization’s general ledger.

4. Bank reconciliation preparation should always start with the opening

balance brought forward from the previous reconciliation and end at

an adjusted balance that reconciles with the ending balance per the

bank’s statement.

5. Reconciling items identied during the bank reconciliation process

should be cleared by the subsequent month. The Head of Finance

should follow up if a reconciling item appears two months in a row.

6. Management action is required for irreconcilable or unidentied

variances identied during the bank reconciliation process.

7. All disbursement checks that have been outstanding for more than a

stated period of time (such as three or six months) should be voided

and replaced.

32

STEP 6.3.5 – PETTY CASH

STEP NAME PETTY CASH

Step Number 6.3.5

Organizational Role Petty cash ofcer/custodian

Head of Finance

Inputs Petty cash vouchers

Outputs Petty cash ledger

Integration Points Requisitioners and approvers

Summary The purpose of setting up a petty cash fund

is to allow access to cash on demand for

small payments. It is the responsibility of the

organization’s management to set the maximum

petty cash balance, establish a limit of individual

disbursement from the petty cash, and designate

a petty cash custodian. Petty cash should be

maintained on an imprest basis. The recommended

level of the petty cash fund should range from two

weeks’ to one month’s cash needs.

1. Organizations should establish a petty cash policy and procedures.

The procedures should describe the petty cash location, maximum

petty cash fund balance, roles and responsibilities of staff involved

in the custodianship, petty cash voucher preparation, approval

levels, maximum disbursement amount, and the petty cash

replenishment process.

2. A custodian should be designated and trained to handle the petty cash.

3. The petty cash custodian should not perform any other cash function.

4. The petty cash fund must be kept in a locked safe and access to the

safe must be limited to the custodian.

5. All petty cash payments must be made only for authorized payments using

a petty cash request form and pre-numbered petty cash slip, and must be

supported by evidence for payment such as customer invoices and payee

signatures. The petty cash custodian should never authorize payment.

6. The petty cash custodian must record all payments in a petty cash

ledger, which may be a formal register (preferred) or worksheet. The

petty cash ledger captures information on the date and purpose of the

payment, the payee, the amount paid, and the running balance of the

petty cash fund.

33

7. The custodian must reconcile the petty cash fund on a daily basis. The

cash remaining in the petty cash box plus the sum of payments made

from the date of the fund’s last replenishment must agree to the petty

cash fund imprest balance. Any difference should be brought to the

attention of the Head of Finance for action.

8. Whenever there is a change of custodial responsibility, a cash count must

be performed and an ofcial handover of cash and documents must be

made. A third person must witness and sign the handover process.

9. There should be an unannounced cash count conducted by a person

other than the petty cash custodian at least once a month. It is

recommended that additional independent counts be performed at

regular intervals during the month.

Petty Cash Reimbursement/Replenishment

1. When the petty cash fund balance reaches a pre-dened minimum

balance, the custodian prepares a replenishment statement. The

replenishment statement is a list of payments categorized by general

ledger account.

2. A designated Finance ofcer should review the replenishment

statement for accuracy and validity of the supporting documentation.

3. When conrmed by Finance and approved by the organization’s

designated ofcial, a check should be issued for the amount of

the replenishment submitted. It is recommended to issue the

replenishment check in the name of the custodian.

4. At this point, the petty cash custodian receives reimbursement for the

replenishment submitted, which brings the cash in the fund back to

the imprest balance.

Recording Petty Cash

1. When the initial petty cash fund is set up, a cash disbursement journal

voucher will be prepared to debit the imprest account and credit the

bank account.

2. Whenever there is need to replenish the petty cash account, a cash

disbursement journal voucher will be prepared with the amount needed

to adjust the petty cash to the oat amount. The accountant will record a

debit to the expense account and a credit to the bank account.

34

STEP 6.3.6 – OPERATING IN A CASH ENVIRONMENT

STEP NAME OPERATING IN A CASH ENVIRONMENT

Step Number 6.3.6

Organizational Role Cash custodian

Head of Finance

Inputs Cash transfers and related documents

Remittance advices

Grant agreements

Purchasing documentation

Receiving documentation

Vendor invoices

Outputs Cash receipt slips

Cash disbursement slips

Cash receipt vouchers

Cash disbursement vouchers

Cash ledger

General ledger

Integration Points Requisitioners and approvers

Suppliers

Project ofcers

Summary Organizations may operate in a location or operating

environment in which no formal banking options are

available. In those situations, all transactions may be

conducted in cash (currency), with an increased need

for effective internal control throughout the cash cycle.

When an organization is operating in a cash environment, the following

measures are recommended to ensure that cash is properly safeguarded:

1. The organization should establish rm policies and procedures that

clearly indicate the roles and responsibilities of staff members involved

in cash custodianship, the documentation required for each step of the

cash cycle, and the approvals needed to disburse funds.

2. A custodian should be designated and trained to handle the cash.

3. To the extent possible, all cash-related functions should be clearly

segregated. There should established checks and balances for each

cash process. If stafng limitations prevent a full segregation of

duties, those weaknesses must be documented and compensating

controls must be put into place in order to minimize the

organization’s exposure.

4. When not in use, the cash must be kept in a locked safe; access to the

safe must be limited to the custodian.

35

5. If possible, the organization’s executive director and the Head of

Finance should establish a maximum level for cash-on-hand. Any cash

in excess of the prescribed on-hand level should be kept at a secure

banking location elsewhere; funds should be drawn from that bank

when needed.

6. Each cash receipt should be documented by the following:

a. Cash remittance advice or cash transfer advice (when applicable)

b. Pre-numbered, multi-part cash receipt slip, signed and dated by the

custodian and by the payer or cash courier. The original slip should

be returned to the payer or courier and a copy should be attached

to the cash receipts voucher. The custodian should retain another

copy in a separate le for sequential control purposes.

c. Cash receipts voucher signed by the voucher’s preparer and

approver, with copies of the cash receipt slip and remittance or

transfer advice (when applicable) also attached. (Note multiple

cash receipts can be included on a single cash receipts voucher

as long as they are shown separately on the voucher.)

7. Each cash payment must be made only for an authorized purpose

and should be supported by a combination of the following

documents, as applicable:

a. Approved purchase requisition

b. Price quotations or pro-forma invoices

c. Bid comparison reports with explanation for basis of vendor

selection

d. Approved purchase order and/or contract

e. Goods-received note

f. When warranted, explanatory memo justifying any signicant

variance between items and quantities ordered versus those

received

g. Vendor’s original invoice or employee’s travel expense report

h. Approved payment/advance request

i. Pre-numbered, multi-part cash disbursement slip (required for

all cash disbursements). The cash disbursement slip should be

signed and dated by the custodian disbursing the cash and the

payee. The original cash disbursement slip should be attached

to the cash disbursement voucher and a copy should be given

to the payee. The custodian should retain another copy for

sequential control purposes.

j. Cash disbursement voucher that includes all of the supporting

documentation cited above, signed by the voucher’s preparer

and approver. A separate voucher should be prepared for each

36

cash disbursement. No two disbursements should be combined

on a single voucher.

8. The custodian should be prohibited from authorizing payments.

9. The custodian must record all payments in a formal cash ledger. The

ledger should show the date of and brief explanation for the purpose

of the payment, the payee, amount paid, account(s) charged, and the

running balance of the fund.

10. All cash transactions should be posted immediately to the cash ledger.

11. In addition to the cash ledger, the organization must maintain a

general ledger that includes all of the cash transactions plus all journal

entries such as those to record liquidation of receivables balances,

depreciation, reclassication, or correcting entries. Someone other

than the cash custodian should maintain the general ledger. The

journal entries should be recorded on standard documents known as

General Journal Vouchers. The voucher’s preparer and approver and

the person who entered the transaction in the general ledger should

sign the vouchers.

12. The custodian should count the cash-on-hand daily. The cash

remaining in the petty cash box plus the sum of payments made from

the date of the fund’s last replenishment, less any cash received

during the period, must agree to the total authorized cash level. Any

difference should be brought to the attention of the Head of Finance or

site manager for action.

13. Whenever there is a change of custodial responsibility, the cash count

must be performed and an ofcial handover of cash and documents

must be made. A third person must witness and sign the handover

process.

14. A designated employee should conduct an independent cash count at

least once a week. The results of that count should be documented

and reported to the Head of Finance or site manager.

15. At least once a month, a designated employee who is independent of

the other cash functions should conduct an unannounced cash count.

That cash count should be documented and reported to the Head of

Finance or site manager.

16. All cash disbursement vouchers should be canceled to prevent their

reuse.

17. All vouchers should be systematically led in a lockable cabinet or

locked room; access to those les should be restricted to designated

employees.

18. Similarly, access to the cashbook and the general ledger should be

restricted. If the cashbook and/or general ledger are/is prepared

37

manually, it should be stored in a locked safe during non-working

hours. If the cashbook and/or general ledger are/is kept on a

computer, the les or computer should be password protected and

backed up, at a minimum, weekly. Daily back-ups are recommended, if

possible.

38

FINANCE BUSINESS PROCESS 6.4 –

RECEIVABLES MANAGEMENT

PROCESS DESCRIPTION

Amounts owed to the organization are assets and should be classied in the

asset category “receivables.” The liquidation of trade receivables generally

results in future cash inows. However, other types of receivables, such as

amounts advanced to employees for business-related travel or to subrecipient

organizations to perform project-related tasks, when liquidated, will usually

result in expense charges.

The organization needs to establish rm deadlines for receivables collection.

For receivables that arise from transactions with external parties, the

deadlines for cash remittances and/or liquidation reporting should be

clearly spelled out in the contracts or agreements between the parties. For

receivables due from the organization’s employees, the cash remittance

and/or liquidation report submission deadlines should be made clear in the

organization’s policies and procedures and consistently enforced.

Effective management of receivables requires that all accounts receivable

balances be analyzed at least on a monthly basis. The most common and

effective receivables analysis is the aging report, in which the various individual

open balances are listed along with the dates of the nancial transactions that

gave rise to those balances and the accounting voucher references. The reports

should be distributed monthly to the respective organization ofcials responsible

for collection and/or liquidation of the balances.

PROCESS FLOW

PROCESS 6.4 RECEIVABLES MANAGEMENT

FINANCE

TEAM

Receivables

Management

6.4.1

39

STEP 6.4.1 – RECEIVABLES MANAGEMENT

STEP NAME RECEIVABLES MANAGEMENT

Step Number 6.4.1

Organizational Role Head of Finance

Accountant

Inputs Approved advance requests

Outputs Aging reports

Integration Points Collaboration with management as well as

Purchasing and Programming departments

Summary Amounts owed to the organization should be

recorded as receivables, which are assets of the

organization. They should be closely monitored to

ensure timely collection or liquidation and should be

accurately stated and appropriately classied.

Types of Receivables

A separate general ledger account should be set up for each type of receivable

that the organization expects to administer. Types of receivables that are

common to many organizations include the following:

1. Trade Receivables – Balances arising from trade sales, where

applicable. Balances in this account are cleared through cash/

check/wire remittances.

2. Travel Advances – Amounts advanced to employees for business

travel purposes. Balances in this account are normally cleared by the

submission of approved travel expense reports and or cash receipts,

supported by the appropriate documentation. Such advances are to

be fully liquidated at the end of each trip. New advances should not be

issued before an old advance is fully liquidated.

3. Employee Receivables – Amounts owed by employees for payments

made on their behalf. These balances are cleared by collection of

cash/checks or by payroll deductions where allowed by law.

4. Project Advances – Advances to subrecipient organizations to conduct

approved project activities. Balances in this account are normally

cleared through the submission of liquidation reports. The amounts

reported should be veried by the organization through the inspection

of the subrecipient’s supporting documentation.

5. Salary Advances – Amounts advanced to employees with the

understanding that the amounts advanced will be repaid by the

40

employee within the period dictated by local labor law as deductions

against wages to be paid. The organization should have a policy that

will be applicable with local laws regarding the repayment of salary

advances.

6. Advances to Suppliers – Amounts paid to suppliers prior to the

receipt of goods or services. This account is cleared when the goods

purchased are delivered or the service is rendered by netting the

advance against the amount due.

Standard Receivables Management Disciplines

The following are standard disciplines that aid in managing receivable balances:

1. The organization’s policies should clearly indicate when each type of

receivable is due. The collection or liquidation deadlines should be

communicated in writing to the other parties. When appropriate, a

deadline should be incorporated into the terms of an agreement with

the party to whom funds will be advanced.

1. One or more organization ofcials should be assigned the responsibility

of monitoring open balances and for following up on delinquencies.

2. Advances should not be issued to parties that have delinquent balances.

3. Each balance should clearly indicate the party that owes the funds.

a. If the organization uses a computerized general ledger system,

each owing party should be assigned an identifying number

(vendor code) that is entered into the general ledger or a subledger

every time a receivable transaction with the owing party takes

place.

b. If the organization uses a manual general ledger, it is

recommended that the receivable transactions with the various

debtors be also recorded in a separate subsidiary ledger or other