A successful loan originator

should follow some type of

standard checklist so you can

ensure that each customer has

the same experience.

This is extremely important to

properly and equally serve all

borrowers, including serving

minority borrowers and those

from underserved markets.

Traditionally underserved

borrowers may require more

follow-up, education and

resources than those in

traditional markets in order

to successfully navigate the

homebuying process.

Underwriters have a checklist, processors have a checklist and loan

originators/assistants should have one too, for the items that take

place prior to and aer processing/underwriting.

This ten-step checklist makes it easy for an assistant to work with you,

with very little training. Just put the checklist on the le-hand side of

each file and make sure the origination assistant is following the steps

you assign to him/her.

A sample file checklist follows. You may have to modify it somewhat

depending on your automated underwriting system (AUS) or other

internal procedures, but it should generally be the same from one

loan originator to the next.

This is critical to your growth and to maintaining and sustaining a

world class business with customers for life.

Freddie Mac Single-Family

A SEAT AT THE CLOSING TABLE

Origination Systems

SM

for Serving the

Underserved

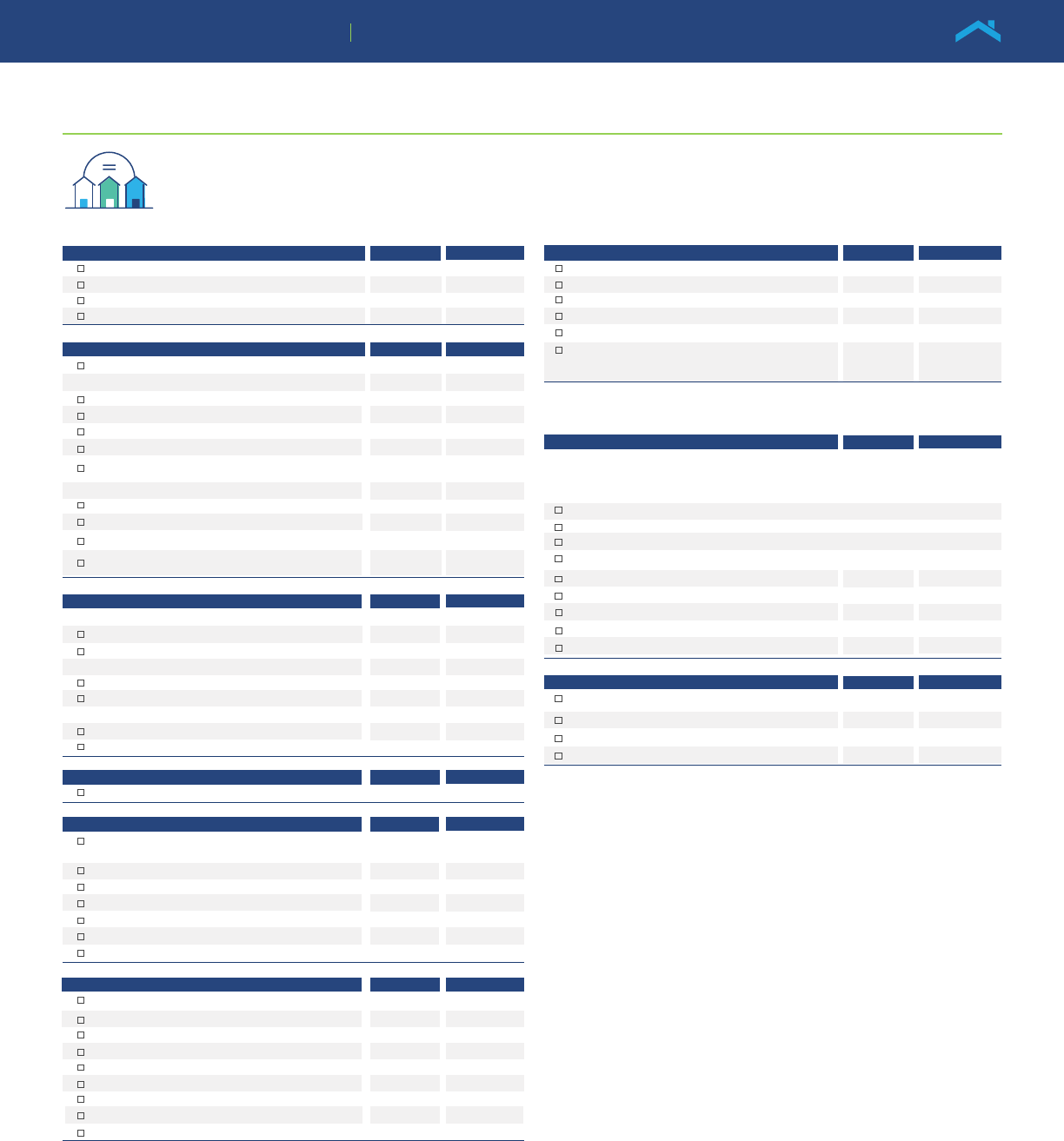

Ten-Step Origination & Client-for-Life Checklist

TEN STEPS TO ORIGINATING A LOAN & CREATING

A CUSTOMER FOR LIFE

PART A (STEPS 1-9)

STEP 1:

STEP 7:

STEP 8:

STEP 9:

STEP 2:

STEP 3:

STEP 4:

STEP 5:

STEP 6:

Gather Information

Loan Submission Procedures: Get Ready to Close!

Final Approval

Final Approval

Date

Date

Date

Date

Date

Date

Date

Date

Date

Initials

Initials

Initials

Initials

Initials

Initials

Initials

Initials

Initials

Analyze Credit

Notify Borrower And/Or Realtor

Call Customer – One Week Aer Step 3

Complete Application Received

Review Program, Loan Estimate And Lock

Client is On A MAP

Prequalified for Loan

Map Clients

Prequalified Clients (Already Found Property)

Prequalified Future Clients

Information Gathered Completely Loan Submission Form Complete

Approval Received and reviewed with lender

Conditions reviewed with borrower

Status Changed to Approved in Soware

Approval congrats card mailed

Appraisal Notification to Client Mailed / Faxed

Appraisal Notification to Realtor/Attorney Faxed

Copy of Appraisal Mailed / Emailed

Title Received & Reviewed

Cleared To Close emailed / faxed to

Final Loan Closing Estimate Confirmed

Closing Disclosure Confirmed

Closing interview completed

Status changed to in Closing in Software

Credit Analyzed

Map: Credit Report Highlighted

Client Referral Acknowledgement sent to Realtor

Customer notified of Status dir / vm / em

Notify Real Estate Agent dir / vm / em

Docs Needed Checklist Complete

Map sent to client mail / fax

Prequal Packet to realtor faxed

Future Packet to Client Mailed / Faxed

Customer notified of Status dir / vm / em

Client Referral Acknowledgment to realtor

Prequal/ Loan Packet to borrower sent Fax / Mail

Future Prequal to Realtor Faxed

Call or email red and yellow flags

Complete sales application received

Email / Mail / fax / face-to-face

Verify paystubs, income, credit docs

Complete sales contract received

Contract Received Form faxed to all parties

Program Review & Options Sent to client

Loan Estimate Discussed with Borrower

Loan Locked / Registered

1003 & Discl. to Client fax / email / mail

Updated Docs Needed Checklist fax/mail/email

Appraisal Ordered C.O.D.

Insurance Quote sent to Partner

Run through automated underwriting

Updated docs needed checklist

$______application fee received

Conditional Approval & checklist sent

Cond Approval & Checklist sent to Insurance Agent

Notify Real Estate Agent dir / vm / em

Phone and email added to CRM systems

(Text, Email, Free Education Database)

Phone and email added to CRM systems

(Text, Email, Free Education Database)

Credit Report Fee Received Stacking Checklist Complete

Filed Copied

Copy of Loan Submission to Originator

Complete Original File sent to Processor

Loan Commitment Delay, If Necessary

Reason:

Fee Sheet Copied and Original to Asst

Credit Pulled

Any documents that come in from this point

forward GO TO PROCESSING!

Any documents that come in from this point forward need to be faxed / emailed

to________________________ You may also fax / email a copy to the lender if it

has been approved! NOTIFY PROCESSOR!

Notes:

Freddie Mac Single-Family

A SEAT AT THE CLOSING TABLE

Origination Systems for Serving the Underserved

SM

TEN STEPS TO ORIGINATING A LOAN & CREATING

A CUSTOMER FOR LIFE

PART B (STEPS 10-12)

Visit Freddie Mac's loan officer training series, A Seat at the Closing Table, for more resources

on how to close the homeownership gap for minority borrowers.

Client for Life

Closing Checklist Attached

Final Settlement Reviewed and filed

Mailing Address and Phone Updated

Status Changed to Closed in Software

Remove Color Flag in Software

Commission Sheet to Originator / Manager

Loan filed in closed area

Insurance Referral Letter mailed / emailed

Estate Planing Letter mailed/ emailed

Inspection Letter mailed / emailed

Annual Review Packet mailed/emailed

Annual Review Telephone Call

Annual Review Form Received

Sent to ______________ for market analysis

Phone and email added to CRM system (Text, Email,

Follow-up & Free Education Database)

STEP 10:

3 MONTH

6 MONTH

9 MONTH

12 MONTH

Date

D

ate

Date

Date

Date

Initials

Initials

Initials

Initials

Initials

Post Closing

Post Closing

Post Closing

Post Closing

Post Closing

Notes:

Freddie Mac Single-Family

A SEAT AT THE CLOSING TABLE

Origination Systems for Serving the Underserved

SM

ONE WEEK Post Closing