UK

Commercial

Property

Monitor

Q1 2023

ECONOMICS

ECONOMICS

Headline occupier demand metric stabilises as the

weaker trend in investor activity eases

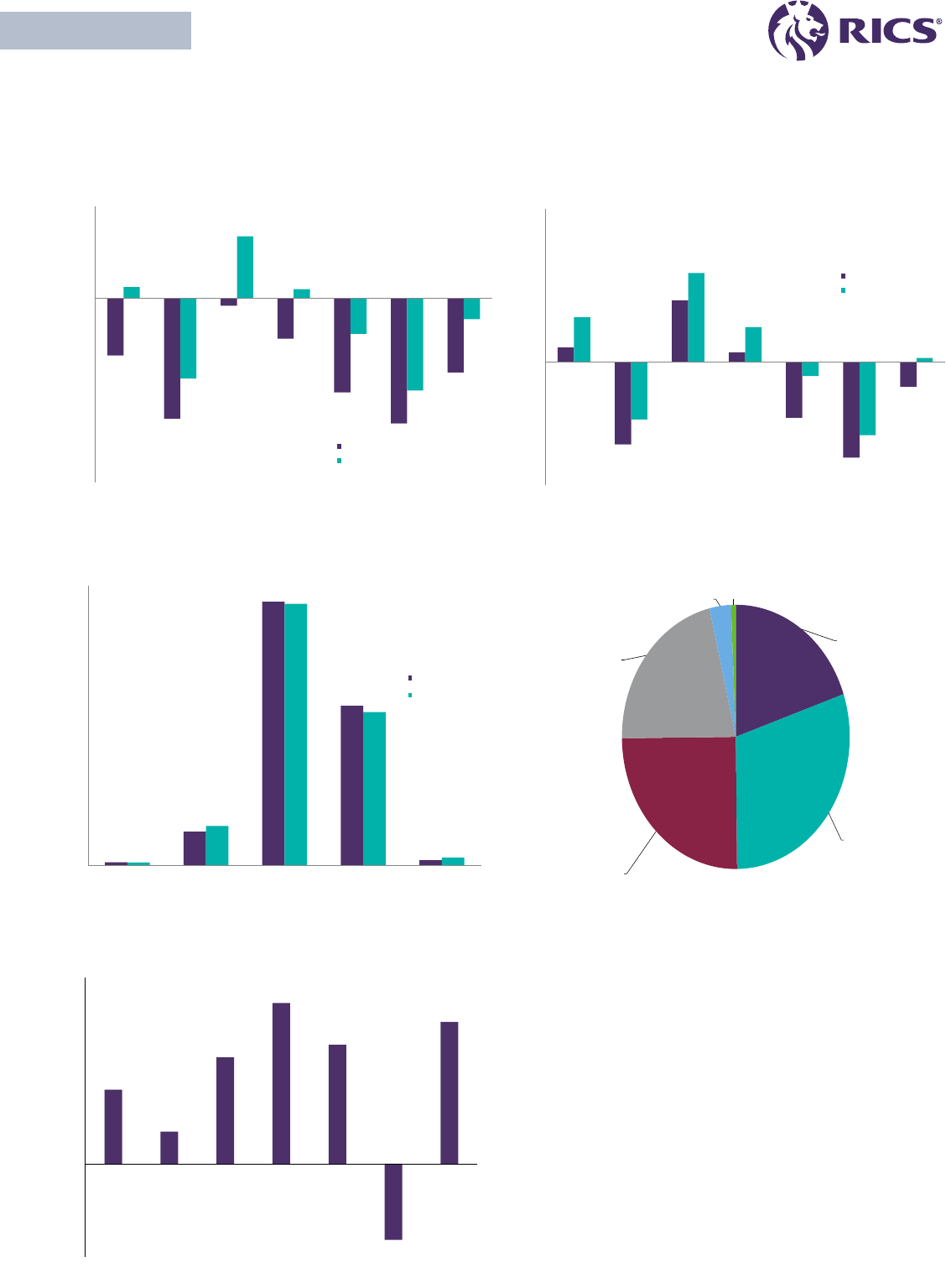

The results of the Q1 2023 RICS UK Commercial Property

Monitor remain generally subdued as the market continues

to contend with higher borrowing costs and a sluggish

economic growth outlook. That said, the overall tone to

the latest feedback is not as downbeat as last quarter.

Indeed, the industrial sector in particular has shown

renewed momentum, evidenced by near-term capital value

expectations turning marginally positive following the sharp

downward adjustment seen at the end of last year as bond

yields jumped higher. Overall, although 50% of respondents

feel conditions are consistent with a downturn phase of the

property cycle, respective shares of 25% and 21% now feel

the market has either reached a oor or has begun to turn

up (9% and 5% in Q4).

Starting with the occupier backdrop, the headline net balance

for tenant demand came in at -3% in Q1. Although indicative

of a largely at picture, this marks an improvement on a

reading of -20% posted last time. Within this, the industrial

sector saw a pick-up in occupier demand, registering a

net balance of +16% vs +6% in Q4. Meanwhile, tenant

demand was at to marginally negative for oce space (net

balance -6%) and continued to fall across the retail sector

(net balance -23%). Even so, in both instances, this was

less negative than in the previous quarter. Alongside this

however, vacant space continued to edge higher within the

oce and retail segments, prompting landlords to increase

to value of incentive packages. Conversely, availability dipped

marginally for industrials.

Looking at the prospects for rental growth, the net balance

of respondents anticipating an increase in prime industrial

rents over the next twelve months rose from +40% in Q4 to

+58% in Q1, and from +6% to +23% for secondary industrial

rents. By way of contrast, the outlook for rents remains

negative for prime and secondary retail outlets, although

the net balance of respondents expecting falls did moderate

compared to Q4. For the oce sector, there remains a stark

contrast between prime and secondary, with the former

expected to see solid rental gains (net balance +29%) while

rents are seen falling across the latter (net balance -37%).

Anecdotal remarks continue to cite ESG factors as an

important driver of demand for some oces.

When disaggregated by broad region, a net balance of +38%

of respondents foresee prime oce rents in London rising

in the year to come (up from a gure of +19% beforehand).

Although growth in prime oce rents is also seen across the

South, Midlands and the North, expectations are not quite

as elevated as those in London (in net balance terms). On

the same basis, industrial rental growth expectations are

particularly buoyant across the Midlands, albeit all parts of

the country are expected to deliver a solid uptick in industrial

rents. At the weaker end of the spectrum, both prime and

• Industrial capital value expectations recover slightly, with occupier fundamentals still solid

• Secondary oces and retail continue to struggle but prime oces post rmer expectations

• Majority of respondents still view the market to be in a downturn although a rising share

now feel conditions are stabilising (or beginning to improve) relative to last quarter

rics.org/economics

secondary retail rents are projected to fall across most parts

of the UK. Interestingly however, rents are now anticipated to

pick-up marginally for prime retail space in London.

Turning to the investment market, the headline metric

capturing investor demand posted a net balance of -14%

in Q1. Although still indicative of a weakening in investor

enquiries (for a third straight quarter), the latest gure is

less downcast than the reading of -30% seen in Q4. A tighter

lending environment continues to present a headwind to

investor activity, with the survey’s series gauging changes

in credit conditions pointing to a fth successive quarterly

deterioration. Even so, the Q1 net balance of -37%, while still

signalling a tougher lending backdrop, is the least negative

reading seen since Q1 2022.

At the sector level, the latest net balances regarding

investment demand for oces and retail assets came in

at -26% and -27% respectively. Alongside this, industrial

buyer demand appeared to stabilise, returning a net

balance reading of +4% (compared to -9% last quarter).

Notwithstanding this, indicators tracking overseas

investment demand remained in negative territory across all

three traditional market sectors.

Regarding the twelve-month outlook for capital values,

the all-property expectations net balance moved to

-10% following a reading of -40% previously. Moreover,

expectations turned from negative to slightly positive in

both the prime and secondary portions of the industrial

market. Across the prime oce sector, values are now seen

holding steady over the year ahead (net balance +6% vs -31%

in Q4), although expectations remain deeply negative for

secondary oce values (net balance -44% compared to -65%

previously). Alongside this, respondents still foresee further

falls in retail values, both prime and secondary, posting net

balances of -19% ad -50% respectively.

Away from the mainstream sectors, respondents do envisage

some positive growth over the year ahead in capital values

across aged care facilities, life sciences, student housing and

multifamily residential. For hotels, the outlook appears at

to marginally positive. At the other end of the scale, leisure

capital values are expected to fall according to a net balance

of -24% of respondents.

In response to a set of extra questions included in the

Q1 survey, just over 50% of respondents stated that they

currently assess the extent of potentially ‘stranded’ assets

in the portfolios they are involved with. Furthermore, close

to three-quarters of respondents feel that between 10%

and 30% of these assets could potentially be ‘stranded’ if no

investment at all is made to enhance them to meet legislative

and market requirements.

UK COMMERCIAL PROPERTY MONITOR

ECONOMICS

rics.org/economics

Commercial property all-sector average

-80

-60

-40

-20

0

20

40

60

1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 2020 2022

Net balance %

-60

-40

-20

0

20

40

60

80

1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 2020 2022

Net balance %

-80

-60

-40

-20

0

20

40

60

1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 2020 2022

Net balance %

-40

-20

0

20

40

60

80

100

1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 2020 2022

Net balance %

Occupier demand Availability

Rent expectations

Inducements

-100

-80

-60

-40

-20

0

20

40

60

2006 2008 2010 2012 2014 2016 2018 2020 2022

Net balance %

-100

-80

-60

-40

-20

0

20

40

60

2008 2010 2012 2014 2016 2018 2020 2022

Net balance %

Investment enquiries Capital value expectations

UK COMMERCIAL PROPERTY MONITOR

ECONOMICS

rics.org/economics

-100

-80

-60

-40

-20

0

20

40

60

80

1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 2020 2022

Office

Industrial

Retail

Net balance %

-60

-40

-20

0

20

40

60

80

1999 2001 2003 2005 2007 2009 2011 2013 2015 2017 2019 2021 2023

Office

Industrial

Retail

Net balance %

Occupier demand

Availability

Commercial property - sector breakdown

-100

-80

-60

-40

-20

0

20

40

60

80

1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 2020 2022

Office

Industrial

Retail

Net balance %

Rent Expectations by Sector

-60

-40

-20

0

20

40

60

80

100

1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 2020 2022

Office

Industrial

Retail

Net balance %

-100

-80

-60

-40

-20

0

20

40

60

80

2006 2008 2010 2012 2014 2016 2018 2020 2022

Office

Industrial

Retail

Net balance %

-100

-80

-60

-40

-20

0

20

40

60

80

2008 2010 2012 2014 2016 2018 2020 2022

Office

Industrial

Retail

Net balance %

Rent expectations Inducements

Investment enquiries

Capital value expectations

UK COMMERCIAL PROPERTY MONITOR

ECONOMICS

rics.org/economics

-100

-85

-70

-55

-40

-25

-10

5

20

35

50

Prime Office Secondary

Office

Prime

Industrial

Secondary

Industrial

Prime Retail Secondary

Retail

Average

Q4 2022

Q1 2023

Net balance %

-80

-65

-50

-35

-20

-5

10

25

40

55

70

85

100

Prime Office Secondary

Office

Prime

Industrial

Secondary

Industrial

Prime Retail Secondary

Retail

Average

Q4 2022

Q1 2023

Net balance %

0

10

20

30

40

50

60

Very Cheap Cheap Fair Value Expensive Very Expensive

Q4 2022

Q1 2023

% of Respondents

Early Downturn, 20%

Mid-Downturn, 30%

Bottom, 25%

Early Upturn, 21%

Mid-

Upturn,

3%

Peak, 1%

% of Respondents

12-month capital value expectations 12-month rent expectations

Market valuations

Property cycle

Commercial property - additional charts

-30

-20

-10

0

10

20

30

40

50

60

Multifamily Hotels Data centres Aged care

facilities

Student

housing

Leisure Life Sciences

Net balance %

12-month capital value expecations alternatives

UK COMMERCIAL PROPERTY MONITOR

ECONOMICS

rics.org/economics

East Midlands

Helen Pearson, Northampton, GXO, helen.pearson@gxo.com

- Industrial rents seem to be going up between agreeing HOTs

and signing up, which is very dicult in a market as a logistics

provider.

Nigel Carnall, Sutton in Asheld, W.A.Barnes LLP, njbc@

wabarmes.co.uk - There is a very limited supply of small to

medium sized industrial units in the area.

Stephen Salloway, Derby, Salloway Property Consultants,

ssalloway@salloway.com - Some concern about the economy but

generally, in the appropriate sectors, real estate is still performing

well.

Eastern

Alan Richards, Southend-On-Sea, Southend-on-Sea Borough

Counci, [email protected] - There are sub-sectors

which will perform better/worse and great unknowns like future

energy costs and full impact of MEES, LURB, other operational

and business cost issues which all have notable impacts.

Julian Haywood Smith, Ipswich, Beane Wass & Box, jhsmith@

bw-b.co.uk - Market very quiet.

Mike Storey, St Neots Cambridgeshire, Brown & Co, St Neots,

mike.storey@brown-co.com - We are operating in a dicult

market where there is a good degree of uncertainty.

Nigel Morgan, North Walsham, Managed Property Supply

Ltd, nigeldmorgan13@gmail.com - Residential and secondary

commercial markets weaker than the press seem to recognise

currently - especially older properties with poor EPCs.

Will Jones, Norwich, Bidwells, william.jones@bidwells.co.uk -

Challenging.

London

Adrian Sancroft, London, Southwark Council, adrian.sancroftt@

southwark.gov.uk - Still much uncertainty but nevertheless

occupier businesses continue to seek growth and change with a

ight to quality accommodation to recruit and retain sta.

Andy Frisby, London, Fleurets, andy.frisby@eurets.com - The

last six months have been very tough in terms of low transaction

volumes and buyer condence. We seem to have turned the

corner with certainty beginning to return to the market

Chris Jago, London, Houston Lawrence, chris.jago@

houstonlawrence.co.uk - Random levels of occupational enquiries

- very few in oce sector. Medical and tness enquiries up. Follow

on contact extremely dicult.

David Brogan, London, Agile Real Estate, David@agilerealestate.

co.uk - Central London prime oce rentals continue to y.

Secondary is a dierent story. Sales-wise, a gulf still exists

between vendors’ and purchasers’ price expectations.

David Frank Kerr, Alhampton, Nr Shepton Mallet,

Cushman&Wakeeld., [email protected] - Healthcare

holding up and CV’s at lining.

David Harper, Coulsdon, Leisure Property Services, dharper@

leisurepropertyservices.com - The hotel market is seeing very

high prices, but trading is improving so hopefully “real values” will

catch up with sellers’ asking prices.

David Toogood, London, Harding Chartered Surveyors,

dtoogood@hardingsurveyors.co.uk - Dicult market conditions,

about to be more aected by the chaos with Banks, SVB, Credit

Suisse, Deutsche Bank and rising interest rates.

Giles Worrall, London, Emerson Heath Ltd / Aurum Real Estate

Partners, giloemerson@yahoo.com - Poor and deteriorating in

the majority of sectors, both occupationally and in the capital

markets aside from some specialist sectors and geographies.

John King, Merton Lb, Andrew Scott Robertson, jking@as-r.co.uk -

Having survived the pandemic, the oce market in South London

and North East Surrey appears to be the principle casualty with

rents having slipped further back on grade B/C oce stock,

while Grade A and retro tted buildings are nding tenants but

with limited success. Companies are adapting to a new working

environment as landlords are having to be more imaginative

to retain income. Its an economic cycle that is slowly turning

adjusting to these new circumstances.

John Stacey, London, Blue Coast Capital, Jstacey@bccap.com -

Period of pricing discovery. My view is that values will need to fall.

Jon Dedekind, London, Capital Industrial LLP, jdedekind@gmail.

com - I feel like the industrial market has bottomed out in terms

of valuations, however there is still a fair amount of tenant risk

and we’ll see more tenants in administration. There are new

occupiers in the market looking to replace them though.

Jon Pishiri, London, Jon Christopher Ltd, jon@jonchristopher.com

- Challenging, with variations depending on which sector of the

property market is being analysed.

Jonathan Wong, London, Cushman and wakeeld, Jonathan.

wong@cushwake.com - Main trends aecting value and demand

in the short term is the new MEES regulations and making

buildings compliant. Occupiers are looking for quality as opposed

to quantity in terms of space.

Julian Woolgar, London, Knight Frank, julian.woolgar@

knightfrank.com - I work with oce occupiers in Central London

Oce. Whilst the start of this year was positive, the news re SVB

and Credit Suisse has caused some uncertainty and we are noting

a more cautious approach from some clients prior to committing

to take space. A limited number of occupier clients have put their

searches on hold and some others have changed the focus of

the search to short term pre-tted options due to the economic

uncertainty. There is still a marked lack of Grade A supply.

Julie Kaye, London, Platinum Associates Ltd, julie.kaye@

platinumassociates.co.uk - Client will need to completely

refurbish their vacant oce premises (with furniture, art and IT

included) in order to get them to shift.

Mac Lal, London, macneel, maclal66@gmail.com - Secondary

market holding up in high value areas.

Mark Owen, London, Urban Vision Real Estate, mark.owen@

urbanvision.uk - Generally investment and rental for prime oces

remains fairly good however investor activity has dropped. The

BTR sector including PBSA / Student remains very strong across

the UK for both rental growth and investor activity, however the

supply of product to the investment market remains limited and

new site opportunities scarce. Science Lab opportunities seem to

be the current on trend sought after opportunities in the East and

London.

Martin Roberts, London, Addington Capital, martin@

addingtoncapital.com - Commercial market has got markedly

more dicult since SVB and Credit Suisse failures.

Michael Zucker, London, Jeremy Leaf & Co., michael@jeremyleaf.

co.uk - General condence in the economy is still low.

Mr Ian J Rose, London, M&A Associates, ianjrose1@gmail.com -

Weaker because of the increased cost of money.

Chartered surveyor comments

UK COMMERCIAL PROPERTY MONITOR

ECONOMICS

rics.org/economics

Neil Miller, London, Lawrence Vacher LLP, neil.miller@

lvpsurveyors.co.uk - Presently volatile, with little consistency

between individual sales and lettings. Investors are cautious.

Nicholas Haywood, London, sbh Page Read, nick@sbhpageread.

co.uk - We specialize in the industrial warehouse market.

Occupier demand from Q3 2022 has slowed particularly for units

over 20,000 sq. ft. This continues to be the case. There is some

upturn in demand for units under 10,000 sq. ft. Tenants are very

rent sensitive which is holding back commitment.

Nick Pemberton, London, Allsop LLP, nick.pemberton@allsop.

co.uk - Allsop London West End Q1 2023 Key Investment

Transactions - In a subdued quarter, we recorded just 13

commercial transactions totalling £375M of volume either

exchanged or exchanged and completed in the rst three

months of 2023. For the same period last year, there was

£1.4Bn of transactions in 17 deals, and the 10 year Q1 average

is also £1.4Bn with 25 transactions.* All 13 Purchases by private

investors *Retail was 50% of the volume *95% were Freehold *7

of the 13 were under £15M - liquid.

Nigel Harrison, London, Harrison Leggett, nh@harrisonleggett.

co.uk - London west end oces have polarised into 2 distinct

markets. New best in class are in short supply and thus inated

rents .All other oces are over supplied and seeing very little

activity. Clerkenwell and Shoreditch is now badly oversupplied as

Tech industries are now cutting back and failing to mature. City

oces are also only seeing activity in the very top of the market

everything else is not shifting even at discount of 75% rental cost

compared to the West End.

Nigel Penso, London, Metrus Ltd, np938@hotmail.com - There

seem to be occupiers looking for space but for oces at least

there is a trend to downsize and preference for their own front

door. There seems to be less appetite for retail though.

Patrick Cryer, London, Squarebrook, patrick.cryer@squarebrook.

com - The market is increasingly polarised between Grade A and

Grade B stock both capital and rental.

Peter Balfour, London, La Francaise Group UK Limited, pbalfour@

la-francaise.com - Debt market costs are a signicant factor in

the London oce market and so is construction cost ination.

The former is pushing down capital market pricing, the latter

is restricting future supply and so likely to inate rents in the

medium term if tenant demand remains broadly similar.

Philip Thompson, London, Soho Estates, Philipt@sohoestates.

Co.uk - Soho remains very strong for leisure and prime oce

assets. Secondary oce and retail are harder work than in 2022.

Professor Graham F Chase, London, Chase Sinclair Clark LLP, gfc@

chasesinclairclark.co.uk - Uncertainty in the market with pressure

on ability to secure lending/mortgaging and costs of such activity.

This, coupled with rising costs of materials, is adversely aecting

viability with many schemes now on hold or abandoned.

Richard Auterac, London, Acuitus, Richard.auterac@acuitus.

co.uk - High street retail and leisure bumping along the bottom

waiting for better news. Still cash available for fair valued assets

and mixed use opportunities, underpinned by residential

development. Finance has tightened and this could put strain on

current borrowers.

Richard Goldin, London, Gleeds, [email protected]

- Retrot vs rebuild is very much the debate on everyone’s lips

at the moment, with the changes to Minimum Energy Eciency

Standards (MEES) Regulations front and centre. An estimated 75%

of commercial oce stock in Westminster and City is below an

EPC B rating and will need investment to bring performance up to

standard by April 2030.

Richard Stanley, London, Stanley Capital Advisers, richard.

stanley@stanleycapitaladvisers.com - There is a lag between

expected realisations and real evidence because of a shortage

of trading stock in the market. Whilst interest rates are

clearly putting pressure on yields, there is a lot of conjecture,

not yet evidenced as the lenders have manageable liquidity

requirements, unlike 2010.

Richard Swan, London, Panther Securities PLC, richard.swan@

pantherplc.com - Whilst we are still seeing demand across the

oce and industrial sectors, retail remains very challenging with

little tenant demand.

Richard Wood, London, Beacon Wood RES Ltd, RWood@

beaconwood.co.uk - Weaker occupational and investment market,

except for prime assets, the denition of which is sharpening

Ronan Stack, London, EY, rstack@uk.ey.com - Bottom of cycle.

Rudolf Fattal, London, RD&D Associates, rudy@rddassociates.

co.uk - Dicult market and dicult to anticipate future

movements.

Russell Francis, London, Colliers, Russell.francis@btinternet.

com - Capital markets worldwide are very nervous with increases

in interest rates being compounded by Bank failures. Volatility

is preeminent there is a feeling that we are on a knife edge with

there being an equal chance of nancial markets moving up or

downwards over the coming months.

Sam Kingston, Norwich, Roche Chartered Surveyors, samk@

rochecs.co.uk - The industrial market remains buoyant, mainly

due to lack of supply and as a consequence rents and freehold

values continue to rise. The oce market remains challenging,

but there has been greater occupier demand since the start of the

year for space below 3500 sq. ft.

Sean Dempsey, London, Boultbee LDN Capital Limited, sean@

boultbeeldn.co.uk - The oce occupational market continues

to be characterised by tenant indecision and a continuation of

substantial homeworking. The lack of any incentive to return to

oce risks damaging city centres. On the retail front, national

tenants with capacity to expand are now opportunistically

looking at acquisition, again.

Selwyn Midgen, London, Achilles Investments Ltd, s.midgen@

doningtoninvestments.com - The recent bank collapse in the

US and Switzerland will have a signicant aect on all UK and

International Real Estate. Business will enter recession and the

supply of property to let will increase driving down rents across

the board.

Steve Chandler, Surrey, Castle Wildish Surveyors Limited,

stevechandler@castlewildish.net - The rising service costs and

general expenditure is having a telling eect on demand. The

demand for oces is particularly weak at present.

Thomas David Whirledge, London, Smith Price RRG,

davidwhir[email protected] - Fragile.

Tim Morgan, London, Fountain Properties Ltd, tjm@hsmuk.com -

Still to see worsening / deteriorating market.

Tim Powell-Harper, London, GN2 Ltd, tim.powellharper@gn2.

uk.com - Market correction required to facilitate transactional

platform.

Tom Deacy, London, Tom Deacy Consultancy Ltd, tom.

tomdeacyconsult.co.uk - Quite at but some signs of life.

Tony Parrack, London, TP Consult, tonyparrack@tpconsult.

co.uk - Prime / super prime, squeaky clean new space is in short

supply. Too much second-hand ‘grey’ space may have been tted

out relatively recently pre-Pandemic, but it does not have zoom

rooms or allow for collaborative spaces, which is why many

people come into the oce.

UK COMMERCIAL PROPERTY MONITOR

ECONOMICS

rics.org/economics

Christian Lawrence, Liverpool, Resourcery Group, christianlozza@

gmail.com - Good levels of market optimism but hampered by

the availability of surveying talent to undertake tasks and the

increase in developments and property activity. Likely to be an

ongoing problem if young talent is not being attracted to our

industry.

David Cameron Watts, Manchester, G&T, d.watts@gardiner.com -

Plateauing.

David Wadsworth, Chester, Modular500 Ltd, dw@modular500.

com - Increasing demand for modular o-site retail.

Henry Prescott, Liverpool, Prescott & Partners, henry@

pandpartners.co.uk - I believe the number of transactions will be

limited as there is much uncertainty in the market as a whole.

Jason Rawson, Manchester, trevor dawson limited, jason@

tdawson.co.uk - Industrial very strong, oce slow, retail very

slow.

Martyn John Garner, Stockport, Cheshire, Garner + Sons,

martyngarner@garnerandsons.co.uk - General market conditions

remain fairly static, but there is sustained investment demand

throughout the South Manchester area, which I expect to be

maintained, with modest potential growth in capital values as a

consequence.

Michael Cunlie, Manchester, Peter Cunlie & Co,

michaelcunlie@gmail.com - I didn’t agree with the various

‘experts’ who predicted between 5% and 30% value falls in the

lockdown year of 2020 and I haven’t seen what the cognoscenti

are saying right now but look back at Lehman Brothers and

Northern Rock in 2007 and compare the SVBank collapse, with

the back drop of Ukraine and energy/living/borrowing costs, not

just in UK but around the world, and I would suggest we are on

the edge of a similar sharp decline to 2008.

Michael J Fisher, Lancaster, Fisher Wrathall Commercial, mike@

fwcommercial.co.uk - Lack of industrial space is hindering

economic growth, exacerbated by lack of land for development

and lagging Local Authority policy.

Nick Swift, Bolton, Lamb and swift commercial, Nswift@

lambandswift.com - Slow reduction across the board in demand

across all sectors - lower rental end space is in demand.

Russell Cain, Bolton, wigan council, russell37cain@live.co.uk -

Moderate growth in certain areas, steady in others.

Northern Ireland

Walter Mcfarland, Enniskillen, Eadie Mcfarland and Co Ltd,

mcfarlandw1955@gmail.com - Residential market still very

buoyant, retail and other commercial is static.

Scotland

Alastair Kay, Dundee, Dundee City Council, alastair.kay@

dundeecity.gov.uk - Market remains challenging but with

opportunities remaining for good quality oce and industrial.

Demand steady for good quality student accommodation.

Alex Robb, Aberdeen, a b robb ltd, Alex@abrobb.com - Aberdeen

City Council have decided to charge vacant rates on listed

buildings which will have a signicant detrimental impact of

property values.

Denis Batts, Edinburgh, denid batts property consultants, denis@

chl.uk.com - At best we would expect the market to be pretty at

in 2023 in the absence of any unexpected good news.

Douglas M Macrae, Edinburgh, Jackson Criss, douglasm@

jacksoncriss.co.uk - Increasing utility bills and the hike in interest

rates following the mini budget last autumn continue to hamper

occupier condence in making long term commitments.

Tristram Frost, London, Atlas Property Advisors Ltd, twtfrost@

googlemail.com - In the main, still waiting for vendors’ and buyers’

price expectations to align better, especially in Western Europe.

William Nicol-Gent, Richmond, Surrey, Killochan & Co, louanna@

blueyonder.co.uk - Eect of EPC up-dates is now better

understood, but still hard to justify in terms of letting value.

William Spencer, London, Vectis Property Group, william_

spencer@live.com - With uncertainty in the cost of borrowing,

many people are waiting to see if reductions in ination bring

more stability to the market. International money is also slowing

down as the pound rallies against foreign money.

North East

Barry Nelson, Newcastle Upon Tyne, Northern Trust Company

Limited, bnelson@whittlejones.co.uk - The industrial multi-let

market remains robust in terms of tenant enquiries, viewings and

lettings, with void rates remaining consistently low, despite the

turmoil of the wider economy. Smaller unit oces present more

of a challenge to secure tenants for vacant space.

Kevan Carrick, Newcastle Upon Tyne, JK Property Consultants

LLP, kevan@jkpropertyconsultants.com - Whilst there is an

apparent general slowdown in demand, there remains activity

from local businesses to seek ownership of mainly industrial, but

some smaller oce buildings, as investment for occupation and

trading. There remains activity from developers seeking sites for

industrial and road side retail development sites.

Mark Mckelvey, Newcastle Upon Tyne, Bellway Plc, mark.

mckelvey@bellway.co.uk - In the housing sector, prices are

holding steady but volume of transactions has dropped. The

housing sector is underpinned by commercial and there is

concern over the condence level in the commercial and

residential market.

Peter Blackett, Bedlington, Davison Blackett Ltd, peter.blackett@

btconnect.com - Food retail sector very competitive at present.

Simon Haggie, Newcastle, Knight Frank, Simon.haggie@

knightfrank.com - Enquiry levels denitely dropping but supply of

grade A oce and industrial space still limited.

Tim Aisbitt, Newcastle Upon Tyne, Devais Property Limited,

tim@devaisproperty.co.uk - Certain sectors are outperforming

expectations, PRS and Student in particular. There is still a

disconnect between the sellers of land and developers on pricing,

factoring in increased build costs, interest rate rises and at

capital values. Availability of sites still a major issue fuelled by

the problems in the planning sector, an overhaul is needed to

maintain required new housing numbers.

North West

Andrew Higson, Manchester, Capita, Andrewhigson77@gmail.

com - Lack of available stock and gap between sellers and buyers

aspirations and with no real distress yet is constraining the

market.

Andrew Leah, Burnley, Burnley Borough Council, aleah@burnley.

gov.uk - Generally depressed.

Charles B Maunsell Mrics, Liverpool, Maunsell Valuation

Consultancy, NW England, charliemaunsell@aim.com - There is a

general slight upturn in the local economy and property market

- development land, especially in & around the new Everton FC

football stadium, is in high demand & is quickly snapped up - the

corridor from north city centre to formerly deprived & derelict

north docks are a new hub of activity with many entrepreneurial

start-ups, including local craft beer breweries & associated

licenced outlets.

UK COMMERCIAL PROPERTY MONITOR

ECONOMICS

rics.org/economics

Kevin Taylor, South East, Kevin Taylor Associates, kevin.taylor9@

btconnect.com - The more auent the town or city, the more

chance of recovery. Towns/Cities with poor catchment will

continue to fall.

Mark Hillier, South East / London, DMR, mhillier@dmrproperty.

co.uk - The cost of borrowing is going up with yet another

interest rate increase today to 4.25%. Leisure and restaurants

occupational demand is strong in certain regions and weak

in others. There are more national Chains looking to dispose

compared with expansion. The general outlook is concerning and

not likely to improve in 2023.

Mark Mcfadden, Eastbourne, SHW, mmcfadden@shw.co.uk - Still

a lot of activity, but market is adjusting to after-eects of Covid,

Brexit and increasing energy costs, ination and changes in work

patterns.

Martin George Slade, Christchurch, Wren Lettings, martin@

wrenlettings.co.uk - Impact on values and demand has been less

evident in the South East than reported elsewhere in the UK.

Michael Rowlands, South East / London, Rowlands Real Estate.,

mrowlands828@gmail.com - Property values have dropped

signicantly since the beginning of this year. The overall

commercial property outlook is very challenging for the next 12

months.

Michael Rowlands, South East / London, CBRE, mrowlands828@

gmail.com - The general market in all sectors is very dicult at the

moment.

Nick Hanson, Farnham, VOSPERS FRIEND & FLACKE, nick.

hanson@vospers.net - All areas of the market have been

generally subdued over the last 6 months, however, signicant

demand, particularly in startup and smaller oce/commercial

units, is now being noted with supply in some areas likely to be

exhausted soon.

Paul Wolfenden, South East, Paul Wolfenden & Associates, paul@

paulwolfenden.com - There are too many uncertainties over the

horizon and no historic examples of the current market dynamics

to forecast with any certainty as to what might or might not

happen. Every day seems to bring a new event.

Peter Memmott Frics, Reading, Peter Memmott Consulting

Limited, pm@pmconsultingltd.com - Market condence has

wobbled due to the Banking crisis. Decisions are taking longer.

Robert Hoadley, Reading, TCN Uk Ltd, robert.hoadley@tcnuk.

co.uk - We operate in the smaller occupier oce sector, and it is

very patchy. Reading is Ok, Birmingham is dreadful, Norwich is

ying.

Robert Primmer, Southampton, Primmer Olds BAS, rprimmer@

primmeroldsbas.co.uk - Industrial sectors remain strong from

both occupiers and private investors. This has seen capital and

rental growth.

Stephen Ray, Redhill and Reigate, SHW, sray@shw.co.uk - The

uncertainty that ination brings is complicating deals. If it falls as

predicted later this year, some condence and momentum will

hopefully return to the property market.

Will Staniland, South East / London, Rumsey and Partners, will@

rumseyandpartners.co.uk - Pricing gap between vendors and

purchasers still to be closed and when it is it will be in favour of

purchasers.

South West

A Jestyn Coke, Blandford Forum, chartered surveyors, ajc@

ajestyncoke.co.uk - In the secondary market, falling rents in retail

and oces is yet to be reected in the capital values due to the

limited number of comparable and actual sales. Once the new

levels have been shown to be the actuality, capital values will be

shown to fall which will have signicant impact on portfolios held

by individuals and pension investors.

Euan Cameron, Forfar, Tayside Valuation Joint Board, Euan.

Cameron@Tayside-vjb.gov.uk - The market for retail and oce

rents continues to fall, but industrial rents are holding up -

especially so for small industrial units. Hospitality continues to

struggle.

John Brown, Edinburgh, john brown and company, john.brown@

jb-uk.com - Interest rates are key, worry about bank stability is

now a factor, and the EPC requirements in older stock will mean

secondary property commercial cost absorption for landlords.

Kevin Robertson, Edinburgh, K R Developments Group Ltd,

kevin@kr-developments.co.uk - All market commentators we

have engaged with expect market conditions to improve after Q2

when ination and interest rates start to fall.

Shaun Crosby, Fifewide, Fife Council, shaun.crosby@fe.gov.

uk - Market is sensitive due to ination and macroeconomic

conditions.

Stuart Hall, Glasgow, Kingsmead Developments Ltd, stuart@

kingsmeaddevelopments.co.uk - There are sub sectors such as

convenience retail, trade counter and social housing that are

performing well despite market downturn and are still attracting

strong occupier and investor interest.

South East

Catherine Alleyne, Kent, SBHG, Ktease71@hotmail.co.uk - There

appears to be greater condence in rentals and SME’s.

Colin Brades, Brighton & Hove, Avison Young, colin.brades@

avisonyoung.com - The prime retail sector in Brighton has seen

an increased level of demand, with competitive albeit limited

rental uplifts and similar concessions being granted as previous.

David Honeyman, South East, David Honeyman Associates,

david@dh-a.co.uk - Very low supply of new accommodation and

increased demand will result in rental increases.

Edward Ikie, Yattendon, Marina Developments limited, Edward.

ilie@yattendon.Co.uk - Generally condent as low gearing.

Gregory Park, Chichester, ParkSteele, gregory@parksteele.com

- The fall in Red Book market value for buildings and land since

September 2022 due to increased interest rates and yields are yet

to be crystalised in transactions.

Iain Steele, Farnham, Park Steele, iain@parksteele.com - The

market has been steady with particular activity in the industrial

sector. Transactions are taking longer through the legal process.

James Groves, Lewes, Cliord Dann LLP, jgroves@cliorddann.

co.uk - More nervousness and tighter lending.

Jim Culverwell, Alresford, Culverwell Consulting, jim@

culverwellconsulting.co.uk - My focus is exclusively for occupiers

large and small and in the industrial sector activity is high and

supply not that great. Small businesses though are reluctant to

do anything they are not forced to do and even then, insolvency

rates are rising rapidly. Flexible or hybrid working is beginning to

bed in and settle to a norm, which seems to be in the oce three

days a week or not at all.

John, Dover, Caxtons Commercial Limited, Jgrimes@caxtons.com

- Very quiet.

John Taylor, Tonbridge/Maidstone/Medway, Hen and Duckhurst

Professional Services Ltd, jmt@henandduckhurst.com -

Industrial/warehousing very buoyant. Retail continues to be

depressed.

Jonathan Pugh, South East / London, Baker Pugh McLean,

jonathan@bakerpughmclean.com - Signicant historic ination in

build costs and legacy land values holding back development and

repurposing redundant commercial stock.

UK COMMERCIAL PROPERTY MONITOR

ECONOMICS

rics.org/economics

Martyn Jones, Bristol, Alder King LLP, mjones@alderking.com -

We are in a better place than anticipated in Nov/Dec 2022. The

recent banking failures have rocked the market. The ination rate

increasing today will not help. The Bank of England need to hold

rather than increase the base rate. Supply/demand dynamics will

help the South West together with an economy that is diverse and

growing.

Oliver Workman, Cheltenham, THP Chartered Surveyors, oliver@

thponline.co.uk - Market conditions have stabilised under Sunak’s

leadership, however there remains uncertainty as to whether we

have passed the bottom of the market or whether that will come

later this year.

Paul, Wells, Tamlyns, Pnrmilleld@icloud.com - Better.

Peter Woodley, Cheltenham, Cheltenham Borough Council,

peter[email protected] - Tricky times not helped by

increasing net zero and other environmental and ecological

legislation. MEES is likely to take out a whole raft of relatively

cheap secondary and tertiary property from the market, stiing

new small and start up business opportunities.

Robert Durie, Bristol, Duries Property Consultants, bob@whrd.

co.uk - The property market has the distinct feel of 1975-1978.

The question is whether the recent rise in Bank Rate will arrest

ination. If not, we are in for a very uncomfortable period. There

is too little focus and thus resource to enable our planning system

to work properly-this is a vital element we have to deliver if the

market is to be made stable and then able to grow.

Simon Bennett, Bristol, Bennett Consulting (South West) Ltd,

simonjbennett856@gmail.comB - Secondary oces require

further valuation adjustment, and a true realisation of the cap ex

required.

Tim Wright, Dorchester, Greenslade Taylor Hunt, tim.wright@

gth.net - Generally commercial property enquires are slightly

down although the ones we are receiving are a better quality. As

usual the industrial sector is outperforming the oce and retail

sectors.

Wales

Chris Sutton, Cardi, Sutton Consulting Limited, chris.sutton@

suttonconsulting.co.uk - Whilst the real estate forecast is not as

bleak as during last autumn’s Trussonomics roller-coaster, there

is general caution from both investors and developers, who are

awaiting the right time to step back into the market. The Cardi

oce market continues to adjust to post-Covid working patterns

with a focus upon Grade A oorspace that oers both formal and

informal meeting space.

Haydn Thomas, Newport, Hutchings & Thomas, ht@hutchings-

thomas.co.uk - Freehold and leasehold demand for industrial

strong with lack of supply and very little industrial land

availability. Some oce demand for smaller units 1000-5000 sq.

ft, little supply of smaller freehold oce space. Increasing supply

of large oor plate oces with falling demand. Lease lengths

reducing or tenant breaks essential (3-5 years or less). Demand

for local and small town retail quite strong. Low demand and

increasing supply of town/city centre space.

Richard Baddeley, Conwy, RICHARD BADDELEY & COMPANY,

richardbaddeleyco@gmail.com - The market across all sectors

is fairly languid but the budget proposals for Anglesey with

additional funding for Welsh Government is welcomed.

Richard J Ormond, Pembroke, Guy Thomas & Co, guy1thomas@

btconnect.com - Apprehensive.

Andrew Charles Hardwick, Bristol, Cartere Jonas, andrew.

hardwick@carterjonas.co.uk - Very dicult to read market signals

at the moment. Investment market activity is subdued.

Andrew Dixon, Bristol, Bristol Airport, andrew.dixon@

bristolairport.com - The Airport Estates market is very buoyant

as the Airline industry comes out of recession following the Covid

epidemic.

Andrew Kilpatrick, Swindon Wilts, Kilpatrick & Co, a.kilpatrick@

kilpatrick-cpc.co.uk - Market bumping along but deals are

happening, albeit slowly. Industrial/warehousing sector starting

to be aected by occupier’s appreciation of rates rises from the

2023 Rating Revaluation.

Anthony Whiting, Quarley, Andover, Gencort, whiting@andover.

co.uk - Market conditions very uncertain.

Bryan Galan, Poole, Mellawood Properties Ltd, bryan.

galan@outlook.com - The High Street is under pressure from

e-commerce, the high rates scenario plus increased utility

charges and sta wages.

Christopher Clu, Taunton, Clu Commercial, chris@clu.co.uk -

Many old oce buildings have planning applications to change to

residential use, but this is being held up by a local planning policy.

There is still good demand for small industrial units.

David Edwards, Exeter, Hudson & Co., david@hudsoncom.co.uk -

We consider that the EPC regime is becoming unworkable. Many

buildings are just not going to make the minimum requirements.

Tenants do not want to go 100% electric as it is too expensive.

Much industrial property of older stock that requires an EPC

just cannot meet the minimum. Electricity cannot heat the large

spaces, large spec heat pumps are prohibitively expensive, and

no-one wants the hassle of bio-mass, a discredited renewable.

The recent Savills report on shop EPC’s is worrying!

David Hart, Plymouth, Hart Consult, Dihart@hartconsult.net -

Disappointing, slow.

Graham Thorne, East Dorset, Thornes, graham@thornes.org.uk

- The market has recovered a little following the mini budget but

remains quite fragile and risk averse.

Huw Thomas, Chippenham, Huw Thomas Commercial, huw@

huwthomascommercial.com - Industrial remains the strongest

sector though demand has dropped slightly in the last quarter.

Very few oce enquiries for traditional oce use, but more for

conversion to residential or for leisure orientated uses such as

gyms, martial arts schools etc. Retail sector is improving though

still driven by “hair, health & beauty” and “food & drink”. Lower

end retail (sub £15,000 pa rent) is very active for both prime and

secondary units.

Ifan Rhys-Jones, Plymouth, Listers, irj@listers.uk.com - Supply

still very limited. Demand is steady and more cautious than 12

months ago.

J P Stone, Exmouth, Jon Stone Surveyors Ltd, jon@jonstone.co.uk -

Condence reducing in all sectors.

Jamie Mcneil, Bath, McNeil Commercial Limited, info@

mcneilcommercial.co.uk - Business oce occupiers are working

smarter and more eciently than ever. Demand for oce space

will always exist due to lease events and changes in working

practices. Demand from occupiers is for new build oces or

oces with excellent environmental credentials.

Katharine Bryant, Bournemouth, Goadsby, Katharine.Bryant@

Goadsby.com - Slow planning decisions are aecting retail. Lack

of blue sky thinking by planners.

UK COMMERCIAL PROPERTY MONITOR

ECONOMICS

rics.org/economics

Yorkshire & the Humber

Alison Stewart, Leeds, Moorgarth Group, alison.stewart@

moorgarth.com - There remains oversupply of retail space. Retail,

leisure & hospitality sectors ghting economic turmoil, business

recovery, material supply issues, stang challenges & utilities.

All of these impact both property owners & occupiers. All CVBil &

post business growth support directed to trading costs. Propco

left out in the cold! New EPC legislation is yet to bite!

Benjamin Oldeld, Sheeld Based But We Cover The Whole

Country Mainland As A Niche Sector In Healthcare, BW Healthcare

Surveyors, ben.oldeld@bwhsurveyors.co.uk - We operate in the

Primary Care Healthcare which has been historically less volatile

to wider economic factors. Rents have continued to rise over the

last few years and up to present, albeit modest but consistent

growth. We expect this to continue. Investment transaction are

fairly infrequent but we are involved in transactions. I am sure

that the shock of 2022 would have aected transactions then, but

only modestly.

Carl Freeland, Beverley, East Riding or Yorkshire Council,

[email protected] - Slowing.

Jill Gittus, York, Bringelly Limited, jill.gittus@bringelly.com -

Continued increases in interest rates are squeezing funding

availability. As occupier costs increase and funding costs increase,

investors holding property with marginal returns are under more

pressure to renance or sell. In turn, this is likely to increase the

number of distressed assets hitting the market. Coupled with the

UBS takeover of Credit Suisse and issues with Silicon Valley Bank,

are we heading to another credit crunch and property crash?

John Hornsby, York, John R Hornsby Chartered Surveyors, info@

johnrhornsby.co.uk - I deal mostly with secondary retail, oce

and industrial units. Demand for retail, in suburban locations

remains at a relatively high level and lettings are being achieved

within a few weeks of marketing.

Jonathan Duck, Harrogate, Bramall Properties Limited, jonathan.

duck@bramallproperties.co.uk - Very patchy.

Michael Hughes, York, MJDHUGHES Ltd, info@mjdhughes.com

- The commercial market is inconsistent in many sectors with

condence from buyers and investors constantly changing. With

so many factors changing on what seems like a daily basis, the

market is reluctant to conrm its intentions and this leads to

ongoing uncertainty.

Mr P A Brandreth, Doncaster, The Conservation Volunteers, phil.

brandreth@tcv.org.uk - Hard times.

Richard Corby, Leeds, Lambert Smith Hampton, rcorby@lsh.

co.uk - A general malaise is being seen in some core sectors, with

a reduction in enquiries and immense caution where deals are

proceeding. Occupational deals are being done though, and at

levels which are not much depressed from the peak in values or

rents seen in the rst half of last year. Land values are hard to

assess due to lack of viability halting acquisitions by developers,

but this presents an opportunity to occupiers.

Richard James Heslop, Ilkley, DE Commercial, richard@de-

commercial.co.uk - Interest rate rises, uncertainty in the economy

and general outlook has put the brakes on occupier demand and

new development starts. We expect this situation to continue

throughout quarters 2 and 3 , with a slight improvement in

quarter 4.

Robert Austin, Leeds, Robert Austin and Co, robert.austin@

robert-austin.co.uk - The markets are watching base rates closely.

If they have peaked, sentiment and activity will increase.

Richard Ryan, Cardi, Fletcher Morgan, richard.ryan@

etchermorgan.co.uk - With occupier demand in both the retail

warehouse and industrial sectors proving resilient, this, combined

with limited available space and few new developments under

construction, should lead to rental growth, provided other

occupational costs remain aordable. Similarly, given the recent

ination in construction costs, together with the softening of

investment yields, it is unlikely new developments will be viable

unless occupiers are prepared to pay higher rents.

Roger Poolman, Swansea, BP2 Property Consultants, roger@

bp2property.com - General market activity levels are noticeably

down with increasing supply. Market is showing distinct signs

of change and the big question is how much distress stock will

be released? We perceive good value opportunities for cash

purchasers over the next 12 months.

West Midlands

Andrew Benson, Birmingham, Wright Silverwood, andrew.

benson@wrightsilverwood.co.uk - It’s tough out there but

perhaps not as bad as people said it was going to be pre

Christmas.

Arthur Connell Nugent, Newry, Young -Nugent, achn488@

outlook.com - Agricultural land is the only asset which has shown

resilience to all major world disasters over the past few years.

David Clews, Birmingham, Clews&Co Chartered Surveyors,

davidclews@clewsandco.co.uk - My main market, logistics, has

been surprisingly robust. Current economic global outlook is

weak and will begin to take eect. Others markets seem to be

fairing worse but no sign of a crash.

Jo Salmon, Birmingham, Oval, josalmon@digbeth.com - Apparent

over commitment during lockdown to support resulted in a

number of failures particularly in hospitality and retail. Return to

the oce dicult, but ensures stock has to improve in secondary

space to compete. Expect a dicult year, but green shoots by late

summer... hopefully!

John Andrews Frics, Kidderminster, Doolitle & Dalley Holdings Ltd,

johnandrews@doolittle-dalley.co.uk - Industrial property in this

area is popular whereas oce and retails very limited demand.

John Emms, Dudley, John Emms Commercial, john@

johnemmscommercial.co.uk - Economic headwinds, rises in Bank

of England base rates, rising ination and cost of living mean

town centre retailing has suered in Q1 2023. Demand for oces

is down with many either working from home or ‘hot desking’

and sharing space. Demand for industrial freeholds, both prime

& secondary, still seems buoyant. Investors are more cautious in

view of Base Rate rises and recent bank stability problems.

John Graham, Birmingham, Douglas Advisory Ltd, j.graham12@

icloud.com - HMOs good investment & retro tting existing

housing stock to increase energy eciency.

John Shepherds, Birmingham, Shepherd Commercial, john@

shepcom.com - General market conditions are stable but lack of

condence and uncertainty is beginning to ‘creep’ in.

Mr Michael Jones And Mrs Ursula Jones, Bromyard, Michael

D Jones Ltd, info@michaeldjones-charteredsurveyors.co.uk -

Mixed use portfolio valuations becoming increasingly dicult to

formulate with Industrial /warehouse uses as usual in my long

career holding up well but with increasing uncertainty over what

to do with retail/oce uses.

Tony Rowland, Evesham, Sheldon Bosley Knight, trowland@

sheldonbosleyknight.co.uk - Wealth is always stored in property,

there is a slight check in values, caused by the rise in interest

rates, but this is a short term blip. If you want to invest capital, it

is either in property or gold for safety.

UK COMMERCIAL PROPERTY MONITOR

ECONOMICS

rics.org/economics

Simon Ives, Market Rasen, Simon Ives Ltd, simon@simonives.

co.uk - I operate nationally in logistics and freight. Demand is

driven mainly by consumer condence, hence the plethora of

new-build space in the last ve or seven years. Covid, Brexit,

rising interest rates and the war in Ukraine have all undermined

that condence so occupier demand is a lot less acute. The UK is

seen as damaged so overseas investors - many of whom still have

massive capacity - are much more cautious too. 2023 will be a

steady year.

Steven Alan Goode, Harrogate, Steven Goode & Company,

stevenagoode@gmail.com - Demand is dampened by non related

property issues such as ination, reduced consumer spend and

utility costs. That said, there is continued interest from new start-

up operations with landlords becoming increasingly exible as to

commencing terms.

UK COMMERCIAL PROPERTY MONITOR

ECONOMICS

rics.org/economics

UK Commercial Property Monitor

RICS UK Commercial Property Monitor is a quarterly guide

to the trends in the commercial property investment

and occupier markets. The report is available from the

RICS website www.rics.org/economics along with other

surveys covering the housing market, residential lettings,

commercial property, construction activity and the

facilities management market.

Methodology

Survey questionnaires were sent out on 7 March 2023 with

responses received until 13 April 2023. Respondents were

asked to compare conditions over the latest three months

with the previous three months as well as their views as

to the outlook. A total of 629 company responses were

received.

Responses have been amalgamated across the three

real estate sub-sectors (oces, retail and industrial) at a

country level, to form a net balance reading for the market

as a whole.

Net balance = proportion of respondents reporting a rise

in a variable (e.g. occupier demand) minus those reporting

a fall (if 30% reported a rise and 5% reported a fall, the net

balance will be 25%). Net balance data can range from -100

to +100.

A positive net balance reading indicates an overall increase

while a negative reading indicates an overall decline.

Contact details

This publication has been produced by RICS. For all

economic enquiries, including participation in the monitor

please contact: economics@rics.org

Disclaimer

This document is intended as a means for debate

and discussion and should not be relied on as legal or

professional advice. While every reasonable eort has

been made to ensure the accuracy of the contents, no

warranty is made with regard to that content. Data,

information or any other material may not be accurate and

there may be other more recent material elsewhere. RICS

will have no responsibility for any errors or omissions.

RICS recommends you seek professional, legal or technical

advice where necessary. RICS cannot accept any liability

for any loss or damage suered by any person as a

result of the editorial content, or by any person acting or

refraining to act as a result of the material included.

Economics Team

Simon Rubinsohn

Chief Economist

srubinsohn@rics.org

Tarrant Parsons

Senior Economist

tparsons@rics.org

Dong Lai Luo

Senior Economist

dluo@rics.org

Lauren Hunter

Economist

lhunter@rics.org

Delivering confidence

We are RICS. Everything we do is designed to effect positive

change in the built and natural environments. Through our

respected global standards, leading professional progression

and our trusted data and insight, we promote and enforce

the highest professional standards in the development

and management of land, real estate, construction and

infrastructure. Our work with others provides a foundation for

confident markets, pioneers better places to live and work and

is a force for positive social impact.

rics.org

Americas, Europe, Middle East & Africa

Asia Pacic

United Kingdom & Ireland

contactrics@rics.org