Federal Communications Commission FCC 20-120

Before the

Federal Communications Commission

Washington, D.C. 20554

In the Matter of

Assessment and Collection of Regulatory Fees for

Fiscal Year 2020

)

)

)

)

)

MD Docket No. 20-105

REPORT AND ORDER AND FURTHER NOTICE OF PROPOSED RULEMAKING

Adopted: August 31, 2020 Released: August 31, 2020

Comment Date: [[30]] days after date of publication in the Federal Register

Reply Comment Date: [[45]] days after date of publication in the Federal Register

By the Commission:

TABLE OF CONTENTS

I. INTRODUCTION .................................................................................................................................. 1

II. BACKGROUND .................................................................................................................................... 2

III. REPORT AND ORDER ........................................................................................................................ 5

A. Allocating FTEs ............................................................................................................................... 6

B. Direct Broadcast Satellite Regulatory Fees ................................................................................... 12

C. Television Broadcaster Regulatory Fees........................................................................................ 18

D. Radio Broadcaster Regulatory Fees ............................................................................................... 24

E. Toll Free Numbering Regulatory Fees........................................................................................... 28

F. Market Access Space Station Regulatory Fees .............................................................................. 30

G. Non-Geostationary Orbit Space Station Regulatory Fees .............................................................. 48

H. International Bearer Circuit Regulatory Fees ................................................................................ 53

1. Using Capacity to Assess IBC Regulatory Fees ...................................................................... 56

2. Division of IBC Regulatory Fees ............................................................................................ 61

3. IBC Regulatory Fee Tiers ........................................................................................................ 64

4. Submarine Cable IBC Regulatory Fees ................................................................................... 68

I. Flexibility for Regulatory Payors Given the COVID-19 Pandemic .............................................. 76

IV. FURTHER NOTICE OF PROPOSED RULEMAKING ..................................................................... 88

V. PROCEDURAL MATTERS ................................................................................................................ 94

VI. ORDERING CLAUSES ..................................................................................................................... 113

APPENDIX A—LIST OF COMMENTERS

APPENDIX B—CALCULATION OF FY 2020 REVENUE REQUIREMENTS AND PRO-RATA FEES

APPENDIX C—FY 2020 REGULATORY FEES

APPENDIX D—SOURCES OF PAYMENT UNIT ESTIMATES FOR FY 2020

APPENDIX E—FACTORS, MEASUREMENTS, AND CALCULATIONS THAT DETERMINE

SIGNAL CONTOURS AND ASSOCIATED POPULATION COVERAGES

APPENDIX F—SATELLITE CHARTS

APPENDIX G—FY 2020 FULL-SERVICE BROADCAST TELEVISION STATIONS, BY CALL SIGN

APPENDIX H—FY 2019 REGULATORY FEES

APPENDIX I—FINAL REGULATORY FLEXIBILITY ANALYSIS

APPENDIX J—INITIAL REGULATORY FLEXIBILITY ANALYSIS

APPENDIX K—RULE CHANGES

Federal Communications Commission FCC 20-120

2

I. INTRODUCTION

1. Each year, the Commission must adopt a new schedule of regulatory fees for regulatory

payors, i.e., those entities required to fund the Commission’s activities. In this Report and Order, we

adopt a schedule to collect the $339,000,000 in congressionally required regulatory fees for fiscal year

(FY) 2020.

1

The regulatory fees for all payors are due in September 2020. In the attached Further Notice

of Proposed Rulemaking, we seek comment on regulatory fee subcategories for FY 2021, for

nongeostationary orbit (NGSO) satellites, as proposed by several commenters.

II. BACKGROUND

2. The Commission is required by Congress to assess regulatory fees each year in an

amount that can reasonably be expected to equal the amount of its appropriation.

2

Regulatory fees

recover direct costs, such as salary and expenses; indirect costs, such as overhead functions; and support

costs, such as rent, utilities, and equipment.

3

Regulatory fees also cover the costs incurred in regulating

entities that are statutorily exempt from paying regulatory fees (i.e., governmental and nonprofit entities,

amateur radio operators, and noncommercial radio and television stations),

4

de minimis entities,

5

and

entities whose regulatory fees are waived.

6

3. The Commission’s methodology for assessing regulatory fees must “reflect the full-time

equivalent number of employees within the bureaus and offices of the Commission, adjusted to take into

account factors that are reasonably related to the benefits provided to the payor of the fee by the

Commission’s activities.”

7

Since 2012, the Commission has assessed the allocation of full-time

equivalents (FTEs)

8

by first determining the number of FTEs in each core bureau that carries out licensing

activities (i.e., the Wireless Telecommunications Bureau, Media Bureau, Wireline Competition Bureau,

and International Bureau) and then attributing all other FTEs to payor categories based on these core FTE

allocations.

9

4. Since 2013, the Commission has adopted numerous reforms to the regulatory fee

schedule.

10

Earlier this year, in the 2020 Regulatory Fee Reform Order, we adopted several reforms

regarding non-U.S. licensed space stations with U.S. market access grants, the apportionment of FTEs

1

Consolidated Appropriations Act, 2020, Pub. L. No. 116-93 (appropriating $339,000,000 to the Commission for

salaries and expenses and directing the Commission to assess and collect the same amount in offsetting collections)

(FY 2020 Appropriation).

2

47 U.S.C. § 159(a), (b); FY 2020 Appropriation.

3

Assessment and Collection of Regulatory Fees for Fiscal Year 2004, Report and Order, 19 FCC Rcd 11662, 11666,

para. 11 (2004) (FY 2004 Report and Order).

4

47 U.S.C. § 159(e)(1).

5

47 U.S.C. § 159(e)(2).

6

47 CFR § 1.1166.

7

47 U.S.C. § 159(d).

8

One FTE, a “Full Time Equivalent” or “Full Time Employee,” is a unit of measure equal to the work performed

annually by a full time person (working a 40-hour workweek for a full year) assigned to the particular job, and

subject to agency personnel staffing limitations established by the U.S. Office of Management and Budget.

9

Procedures for Assessment and Collection of Regulatory Fees, Notice of Proposed Rulemaking, 27 FCC Rcd 8458,

8460, para. 5 & n.5 (2012) (FY 2012 NPRM).

10

For a summary of the regulatory fee reforms, see Assessment and Collection of Regulatory Fees for Fiscal Year

2019, Report and Order and Further Notice of Proposed Rulemaking, 34 FCC Rcd 8189, 8191, para. 4 (2019) (FY

2019 Report and Order).

(continued….)

Federal Communications Commission FCC 20-120

3

within the International Bureau for international bearer circuits and satellite issues, the apportionment of

FTEs within the Satellite Division of the International Bureau for geostationary orbit (GSO) and NGSO

space station regulatory fee, and we adopted a limitation on population counts for certain VHF television

broadcast stations.

11

In the accompanying FY 2020 NPRM, we sought comment on a proposed fee

schedule and also on certain issues for International Bureau and Media Bureau regulatees.

12

Specifically,

we sought comment on a schedule of proposed regulatory fees as well as certain issues: adjusting the

allocation of international bearer circuit (IBC) fees between submarine cable and terrestrial and satellite

IBCs from 87.6%-12.4% to 95%-5%; combining the submarine cable regulatory fee tiers with new tiers

for terrestrial and satellite IBCs in a unified tier structure; basing full-power broadcast television fees on

the population covered by the station’s contour; and continuing to increase the direct broadcast satellite

(DBS) regulatory fees by 12 cents, to 72 cents, per subscriber, per year.

13

In addition, we sought

comment on economic effects due to the COVID-19 pandemic on regulatory fee payors.

14

III. REPORT AND ORDER

5. Pursuant to section 9 of the Communications Act of 1934, as amended (Communications

Act or Act), in this Report and Order we adopt the regulatory fee schedule proposed in the FY 2020

NPRM for FY 2020, as modified herein, to collect $339,000,000 in regulatory fees as required by

Congress.

15

A. Allocating FTEs

6. In the FY 2020 NPRM, the Commission proposed that non-auctions funded FTEs will be

classified as direct only if in one of the four core bureaus, i.e., in the Wireline Competition Bureau, the

Wireless Telecommunications Bureau, the Media Bureau, or the International Bureau.

16

The indirect

FTEs are from the following bureaus and offices: Enforcement Bureau, Consumer and Governmental

Affairs Bureau, Public Safety and Homeland Security Bureau, Chairman and Commissioners’ offices,

Office of the Managing Director, Office of General Counsel, Office of the Inspector General, Office of

Communications Business Opportunities, Office of Engineering and Technology, Office of Legislative

Affairs, Office of Workplace Diversity, Office of Media Relations, Office of Economics and Analytics,

and Office of Administrative Law Judges, along with some employees in the Wireline Competition

Bureau and the International Bureau that the Commission previously classified as indirect.

17

11

Assessment and Collection of Regulatory Rees for Fiscal Year 2020, Report and Order and Notice of Proposed

Rulemaking, 35 FCC Rcd 4976, 4978-4997, paras. 6-52 (2020) (2020 Regulatory Fee Reform Order and FY 2020

NPRM), pet. for review pending, Telesat Canada, Eutelsat S.A., Kineis, Hiber, Inc., and Immarsat Group Holdings

Ltd. v FCC & USA, No. 20-1234 (D.C. Cir.) (Telesat Petition for Review) (Petition for Review filed on July 2,

2020). In the Telesat Petition for Review, petitioners challenge the FCC’s decision to assess regulatory fees on

operators of non-U.S. licensed space stations granted access to the market in the United States under the space

station fee categories.

12

FY 2020 NPRM, 35 FCC Rcd at 4997-5005, paras. 53-76.

13

Id..

14

The list of commenters is in Appendix A.

15

FY 2020 NPRM, 35 FCC Rcd at 5015, Appendix C.

16

Id. at 4998, paras. 56-58.

17

In 2013, the Commission allocated all FTEs except for 28 in the International Bureau as indirect. Assessment and

Collection of Regulatory Fees for Fiscal Year 2013, Report and Order, 28 FCC Rcd 12351, 12355-356, para. 14

(2013) (FY 2013 Report and Order). Subsequently, the Commission allocated an additional four FTEs, working on

market access requests for non-U.S. licensed space stations, as indirect, Assessment and Collection of Regulatory

Fees for Fiscal Year 2015, Report and Order and Further Notice of Proposed Rulemaking, 30 FCC Rcd 10268,

10278, para. 24 (2015) (FY 2015 Report and Order); however, those have since been reclassified as direct. In 2017,

the Commission allocated 38 FTEs in the Wireline Competition Bureau who work on non-high cost programs of the

(continued….)

Federal Communications Commission FCC 20-120

4

7. We will continue to apportion regulatory fees across fee categories based on the number

of direct FTEs in each core bureau and the proportionate number of indirect FTEs and to take into account

factors that are reasonably related to the payor’s benefits.

18

As a general matter, we expect that the work

of the FTEs in the four core bureaus will remain focused on the industry segment regulated by each of

those bureaus. The first step in this process is to allocate appropriated amounts to be recovered

proportionally based on the number of direct FTEs within each core bureau (with indirect FTEs allocated

in proportion to the direct FTEs).

19

Those proportions are then subdivided within each core bureau into

fee categories among the regulatees served by the core bureau. Finally, within each fee category, the

amount to be collected is divided by a unit that allocates the regulatee’s proportionate share based on an

objective measure, such as subscribers or revenue.

8. In sum, there were 311 direct FTEs for FY 2020, distributed among the core bureaus as

follows: International Bureau (28), Wireless Telecommunications Bureau (73), Wireline Competition

Bureau (94), and the Media Bureau (116). This results in 9.00% of the FTE allocation for International

Bureau regulatees; 23.47% of the FTE allocation for Wireless Telecommunications Bureau regulatees;

30.23% of the FTE allocation for Wireline Competition Bureau regulatees; and 37.30% of FTE allocation

for Media Bureau regulatees. There are 911 indirect FTEs that are allocated proportionally to the 311

direct FTEs: Enforcement Bureau (181), Consumer and Governmental Affairs Bureau (113), Public

Safety and Homeland Security Bureau (89), part of the International Bureau (56), part of the Wireline

Competition Bureau (38), Chairman and Commissioners’ offices (23), Office of the Managing Director

(132), Office of General Counsel (70), Office of the Inspector General (45), Office of Communications

Business Opportunities (8), Office of Engineering and Technology (72), Office of Legislative Affairs (8),

Office of Workforce Diversity (6), Office of Media Relations (14), Office of Economics and Analytics

(53), and Office of Administrative Law Judges (3). Allocating these indirect FTEs based on the direct

FTE allocations yields an additional 82.0 FTEs attributable to International Bureau regulatees, 213.8

FTEs attributable to Wireless Telecommunications Bureau regulatees, 275.4 FTEs attributable to

Wireline Competition Bureau regulatees, and 339.8 FTEs attributable to Media Bureau regulatees.

9. As in prior years, broadcasters take issue with the Commission’s practice of allocating

costs associated with indirect FTEs in proportion to each core bureau’s direct FTEs. Broadcasters suggest

that the methodology should instead consider whether the functions of specific indirect FTEs benefit

specific regulatory fee payors.

20

We affirm the findings in our FY 2019 regulatory fee proceeding, where

we explained in detail our existing methodology for assessing fees, noted the changes in the statute, and

sought comment on what changes to our regulatory fee methodology, if any, were necessary to implement

Universal Service Fund as indirect. Assessment and Collection of Regulatory Fees for Fiscal Year 2017, Report and

Order and Further Notice of Proposed Rulemaking, 32 FCC Rcd 7057, 7061-64, paras. 10-15 (2017) (FY 2017

Report and Order).

18

The phrase core bureaus was first adopted in the FY 2012 NPRM where the Commission explained that under

(prior) section 9(b)(1)(A), the Commission was instructed to calculate the regulatory fees by determining the FTEs

performing the activities enumerated in section 9(a)(1) within the Private Radio Bureau, Mass Media Bureau, and

Common Carrier Bureau, and other offices of the Commission, and those bureaus had subsequently been renamed as

the Wireless Telecommunications Bureau, Media Bureau, and Wireline Competition Bureau, and a new

International Bureau had been formed. FY 2012 NPRM, 27 FCC Rcd at 8460, para. 5 & n.5. The Commission

explained that “[f]or simplicity and ease of reference, in this Notice we will refer to these four bureaus as the ‘core’

bureaus or the ‘core licensing’ bureaus.” Id.

19

The Commission observed in the FY 2013 Report and Order that “the high percentage of the indirect FTEs is

indicative of the fact that many Commission activities and costs are not limited to a particular fee category and

instead benefit the Commission as a whole.” See FY 2013 Report and Order, 28 FCC Rcd at 12357, para. 17.

20

NAB Comments at 4-6 and Reply at 2-5; Letter from Rick Kaplan, General Counsel and Executive Vice

President, Legal and Regulatory Affairs, National Association of Broadcasters, to Marlene H. Dortch, Secretary,

Federal Communications Commission (Aug. 14, 2020) (NAB Ex Parte) at 2-3; State Broadcaster Comments at 6-18.

(continued….)

Federal Communications Commission FCC 20-120

5

the RAY BAUM’S Act amendments to our regulatory fee authority.

21

After review of the comments

received, we determined in the FY 2019 Report and Order that because the new section 9 closely aligned

to how the Commission assessed and collected fees under the prior section 9, we would hew closely to the

existing methodology.

22

In particular, we expressly rejected any suggestion that the Commission should

abandon the step in our process whereby we designate FTEs as either direct or indirect and allocate

indirect FTEs in proportion to the direct FTEs in each of the core bureaus.

23

As the FY 2019 Report and

Order stated, “we must allocate indirect FTEs among regulatees somehow (per Congress’s direction), and

relying on the allocation of direct FTEs gives us an objective, easily administrable measure to do just that.

[The broadcasters do not] identify an objective, easily administrable alternative…. We have long relied

on direct FTE allocations because the Commission has found those allocations because the Commission

has found those allocations best reflect the ‘benefits provided to the payor of the fee by the Commission’s

activities.’”

24

10. We affirm those conclusions here. As we stated in 2019, direct FTE allocations best

reflect “the benefits provided to the payor” – in the case of broadcast licensees, the work Media Bureau

FTEs do to grant licenses and oversee and regulate their operation. As the Commission explained in both

the FY 2015 Report and Order

25

and in the FY 2019 Report and Order,

26

FTEs work on a wide range of

issues and it is difficult to attribute their work to a specific category. Moreover, the wide variety of issues

handled in non-core bureaus may also include services that are not specifically correlated with one core

bureau, let alone one category of regulatees. In addition, most Commission attorneys, engineers, analysts,

and other staff work on a variety of issues even during a single fiscal year. A snapshot of staff

assignments in a single division in any bureau, for example, may misrepresent the work being done six

months or even six weeks later. Thus, even if we could calculate staff assignments at this granular level

with accuracy, such assignments would not be accurate for the entire fiscal year and would result in

significant unplanned shifts in regulatory fees as assignments change over time. And finally, much of the

work that could be assigned to a single category of regulatees is likely to be interspersed with the work

that our staff does on behalf of many entities that do not pay regulatory fees, e.g., governmental entities,

non-profit organizations, and other exempt regulatees.

11. NAB also asserts after evaluating the FTE allocations within the bureaus and offices, the

Commission failed to also consider other factors that reasonably related to the benefits provided to the

21

Assessment and Collection of Regulatory Fees for Fiscal Year 2019, Notice of Proposed Rulemaking, 34 FCC

Rcd 3272, 3275-79, paras. 6-15 (2019) (FY 2019 NPRM).

22

FY 2019 Report and Order, 34 FCC Rcd at 8192-93, para. 7.

23

Id. at 8193, para. 8.

24

Id. at 8194-95, para. 14. NAB suggests that all indirect FTEs in the Office of Engineering and Technology should

be excluded from the calculation of the radio industry’s allocation percentage claiming that the industry “receives no

benefits whatsoever from OET.” NAB Ex Parte at 3-4. NAB’s contention misses the mark, given that the

Commission has engaged in numerous proceedings in FY 2020 involving the radio industry, which involve a large

number of employees generally in the indirect FTE categories, including employees in the Office of General

Counsel, Office of Economics and Analytics, Office of Communications Business Opportunities, and Office of the

Secretary. See, e.g., Amendment of Section 73.3556 of the Commission’s Rules Regarding Duplication of

Programming on Commonly Owned Radio Stations, MB Docket No. 19-310, Report and Order, FCC 20-109,

Statement of Chairman Pai; see also generally MB Docket No. 17-105 (Modernization of Media Regulation

Initiative). The Enforcement Bureau’s portfolio also includes a substantial amount of work on broadcaster issues.

Furthermore, it is undisputed that Media Bureau regulatees as a whole benefit from the work of the Office of

Engineering and Technology. NAB’s attempt to cherry-pick the work of a particular office only demonstrates the

wisdom of our prior conclusion that the current methodology provides the most objective, administrative method of

allocating indirect FTE costs.

25

FY 2015 Report and Order, 30 FCC Rcd at 10274-76, paras. 15-17.

26

FY 2019 Report and Order, 34 FCC Rcd at 8196, para. 18.

(continued….)

Federal Communications Commission FCC 20-120

6

payors, particularly the radio industry. But as noted above, it has been the Commission’s longstanding

methodology to use direct FTEs as a measure of the benefits provided, and the Commission engages in a

fresh review of the FTE allocations each year as part of its annual proceeding.

27

Furthermore, in

establishing the apportionment of fees between regulatees within the same core bureau and/or within

regulatory fee classes, the Commission is continuously refining its methodology to capture the benefits

afforded the payor. For example, in many regulatory fee categories, the Commission uses an

apportionment methodology that is tied to the benefits of oversight and regulation received by the license

as measured by different criteria.

28

We reject NAB’s suggestion that the Commission should ignore the

statutory requirement to consider full-time employees and provide the radio industry with a downward

adjustment based on its unsubstantiated assertion that there have been no changes in the benefits received

by the radio industry. The methodology described above accounts for those benefits, which are further

reflected in the numerous proceedings the Commission has conducted this year that benefit radio

broadcasters.

29

B. Direct Broadcast Satellite Regulatory Fees

12. Direct broadcast satellite service is a nationally distributed subscription service that

delivers video and audio programming via satellite to a small parabolic dish antenna at the subscriber’s

location. The two DBS providers, AT&T and DISH Network, are multichannel video programming

distributors (MVPDs).

30

In 2015, the Commission adopted an initial regulatory fee for DBS, as a

subcategory in the cable television and IPTV category.

31

In lieu of directly including DBS providers in

the cable television/IPTV category at the same regulatory fee rate, the Commission phased in the new

Media Bureau-based regulatory fee for DBS, starting at 12 cents per subscriber per year.

32

Each year, the

Commission has increased the DBS regulatory fee, bringing it closer to the per-subscriber rate paid by

cable television/IPTV. Accordingly, the Commission increased the regulatory fee for DBS operators

from 12 cents to 24 cents (plus a three cent moving fee), then 36 cents (plus a two cent moving fee), 48

cents,

33

and to 60 cents for FY 2019.

34

For FY 2020, the Commission proposed to increase the fee to 72

cents per subscriber, per year.

35

13. AT&T and DISH—the two DBS operators in the United States—claim that the proposed

fee increase of 12 cents is not “because the nation’s two DBS providers have caused the Commission to

27

See, e.g., FY 2017 Report and Order, 32 FCC Rcd at 7061-7064, paras. 9-15 (the Commission reallocated as

indirect 38 FTEs in the Wireline Competition Bureau assigned to work on non-high cost programs of the Universal

Service Fund); id. at 7064-65, paras. 16-17 (the Commission reallocated for regulatory fee purposes four FTEs

assigned to work on numbering issues from the Wireline Competition Bureau to the Wireless Telecommunications

Bureau).

28

FY 2019 Report and Order, 34 FCC Rcd at 8205, para 43 (“[t]he Commission has long assessed regulatory

fees—larger licensees receive greater benefits from the license and hence should (and are able to) pay a larger

proportion of the costs. That is as true in the context of submarine cables as it is where wireless providers, ITSPs,

and broadcasters are concerned.”).

29

NAB Ex Parte at 4.

30

MVPD is defined in section 602(13) of the Act, 47 U.S.C. § 522(13).

31

FY 2015 Report and Order, 30 FCC Rcd at 10276-77, paras. 19-20.

32

FY 2017 Report and Order, 32 FCC Rcd at 7066, para. 19.

33

Assessment and Collection of Regulatory Fees for Fiscal Year 2018, Report and Order and Order, 33 FCC Rcd

8497, 8500, para. 10 (2018) (FY 2018 Report and Order); FY 2017 Report and Order, 32 FCC Rcd at 7067, para.

20; Assessment and Collection of Regulatory Fees for Fiscal Year 2016, Report and Order, 31 FCC Rcd 10339,

10350, para. 30 (2016) (FY 2016 Report and Order).

34

FY 2019 Report and Order, 34 FCC Rcd at 8198, para. 24.

35

FY 2020 NPRM, 35 FCC Rcd at 5004, para. 72.

(continued….)

Federal Communications Commission FCC 20-120

7

incur significant full-time equivalent (‘FTE’) employee costs commensurate with this calculation, but

rather because the Commission apparently desires regulatory fee parity between cable operators and DBS

providers.”

36

These commenters contend that the appropriate level of regulatory fee parity was reached

several years ago and any further increase is unfairly shifting cable-caused FTE costs to the DBS

providers.

37

AT&T and DISH contend that MVPD issues are predominantly cable-specific with no

applicability to DBS providers.

38

14. We reject AT&T’s and DISH’s claim that we should not adopt a fee increase and that

such an increase would result in shifting cable-caused costs to DBS providers. The Media Bureau relies

on a common pool of FTEs to carry out its oversight of MVPDs and other video distribution providers.

When the Commission initially adopted a Media Bureau based regulatory fee for DBS providers of 12

cents, the Commission concluded there was no reasonable basis to continue to exclude DBS providers

from sharing in the cost of MVPD oversight and regulation with cable television/IPTV.

39

15. NCTA and ACA contend that the proposed DBS fee places an unfair burden on

cable/IPTV providers by increasing the DBS fee to 72 cents and the cable/IPTV fee to 89 cents.

40

These

commenters state that this will only marginally close the gap between DBS and the cable/IPTV

providers.

41

A significant number of Media Bureau FTEs work on MVPD issues such as market

modifications, must-carry and retransmission consent disputes, program carriage complaints, media

modernization efforts, and proposed transactions, that affect all MVPDs.

42

For example, NCTA and ACA

observe that AT&T filed lengthy compliance reports regarding merger conditions, AT&T engaged in an

ongoing retransmission consent complaint proceeding, AT&T and DISH filed joint comments in the

Media Modernization docket, DISH has ongoing carriage disputes, and AT&T and/or DISH have

numerous market modification proceedings.

43

In addition, other Media Bureau dockets impact all

MVPDs, including DBS providers.

44

NCTA and ACA also argue that the DBS providers have failed to

demonstrate that the regulatory fees would result in rate shock and there is no justification for the

continued phase-in of the regulatory fee.

45

16. We adopt the proposal in the FY 2020 NPRM to continue to phase in the DBS regulatory

fee by 12 cents, to 72 cents per subscriber, per year. This increase will result in a regulatory fee of 89

cents per subscriber, per year, for cable television/IPTV, and bring DBS closer to parity with cable

television/IPTV. Media Bureau employees dedicate substantially similar amounts of time and resources

to the regulation of DBS as they do to cable television and IPTV and DBS providers participate in

numerous Media Bureau dockets. We find that it is reasonable, based on the record, to continue to phase

in this fee. We do not agree with the DBS providers’ argument that MVPD issues are predominantly

cable specific and that we should not continue to move closer to parity.

17. Finally, the DBS providers contend that the Commission should use an MVPD subscriber

36

AT&T and DISH Comments at 1-2.

37

Id. at 2.

38

Id. at 3.

39

FY 2015 NPRM, 30 FCC Rcd at 5364-68, paras. 28-31.

40

NCTA and ACA Comments at 3; ACA and NCTA Reply at 3-6.

41

NCTA and ACA Comments at 3.

42

NCTA and ACA Comments at 4 (citing FY 2018 Report and Order, 33 FCC Rcd at 7057, para. 8); ACA and

NCTA Reply at 6.

43

NCTA and ACA Comments at 4-5.

44

Id. at 5-6.

45

Id. at 6-7.

(continued….)

Federal Communications Commission FCC 20-120

8

snapshot closer in time to the regulatory fee order release date due to declining subscriber counts.

46

The

Commission has a number of quantity-based regulatory fees (e.g., Commercial Mobile Radio Service

(CMRS) cell phones, Cable, Paging, Interstate Telecommunications Service Provider (ITSP), Toll Free

Numbers, Submarine Cable, and Terrestrial and Satellite IBCs), and for each of them the fee is based on a

quantity count as of December of the prior year. Thus, using a DBS count in December of the previous

year is consistent with how the Commission measures all of its other quantity-based fees. Furthermore,

many companies use end of calendar year subscriber or customer counts for their year-end official

reports, and this provides the Commission sufficient time to obtain this data and use it to calculate fees at

the time the Notice of Proposed Rulemaking is drafted. Use of a more recent customer data, such as in

June or July, would preclude the Commission from retrieving, reviewing, and using the information while

drafting the Notice of Proposed Rulemaking and seeking comment on proposed fees, a critical step in the

annual regulatory fee process. Accordingly, we decline to adjust the date of the MVPD subscriber count

snapshot.

C. Television Broadcaster Regulatory Fees

18. Historically, regulatory fees for full-power television stations were based on the Nielsen

Designated Market Area (DMA) groupings 1-10, 11-25, 26-50, 51-100, and remaining markets (DMAs

101-210). In the FY 2018 NPRM, we sought comment on whether using the actual population covered by

the station’s contours instead of DMAs would more accurately reflect the market served by a full-power

broadcast television station for purposes of assessing regulatory fees.

47

In the FY 2018 Report and Order,

we adopted the new methodology. We determined that we would fully transition to the new methodology

by FY 2020, and in the interim, for FY 2019, we adopted a blended fee based partly on the historical

DMA methodology and partly on the new population-based methodology.

48

19. In the FY 2020 NPRM, we proposed to complete the transition to a population-based full-

power broadcast television regulatory fee.

49

We proposed the population-based methodology and began

to phase it in because, on balance, it is more equitable and avoids the numerous problems associated with

stations located at the edge of a DMA. Accordingly, we now adopt FY 2020 fees for full-power

broadcast television stations based on the population covered by a full-power broadcast television

station’s contour, as we proposed in the FY 2020 NPRM. We also adopt a factor of .78 of one cent

($.007837) for FY 2020 full-power broadcast television station fees.

50

The population data for

broadcasters’ service areas are extracted from the TVStudy database, based on a station’s projected noise-

limited service contour.

51

Appendix G lists this population data for each licensee and the population-

based fee (population multiplied by $.007837) for each full-power broadcast television station, including

each satellite station. And we accordingly disagree with NJBA’s attempt to relitigate this issue,

contending that the DMA approach is a more accurate way to assess fees correlating with how a station

derives revenue.

52

We recognize that the adoption of the population-based methodology increases fees

for some licensees and reduces fees for others but in the end the population-based metric better conforms

with the actual service authorized here—broadcasting television to the American people.

46

AT&T and DISH Comments at 4.

47

Assessment and Collection of Regulatory Fees for Fiscal Year 2018, Report and Order and Notice of Proposed

Rulemaking, 33 FCC Rcd 5091, 5102, para. 28 (2018) (FY 2018 NPRM).

48

FY 2018 Report and Order, 33 FCC Rcd at para.14.

49

FY 2020 NPRM, 35 FCC Rcd at 5002, paras. 66-67.

50

The factor of .78 of one cent ($.007837) was derived by taking the revenue amount required from all television

fee categories and dividing it by the total population count of all feeable call signs.

51

47 CFR § 73.622(e).

52

NJBA Comments at 3.

(continued….)

Federal Communications Commission FCC 20-120

9

20. In the FY 2020 NPRM, we also proposed to adjust the fees of Puerto Rico broadcasters in

two discrete ways. First, we proposed to account for the objectively measurable reduction in population

by reducing the population counts used in TVStudy by 16.9%, which reflects the decline between the last

census in 2010 and the current population estimate.

53

Second, we proposed to limit the market served by

a primary television stations and commonly owned satellite broadcast stations in Puerto Rico to no more

than 3.10 million people, the latest population estimate.

54

Under this scenario, the fee for television

broadcasters and commonly owned satellites, using the proposed population fee of $.007837, would not

exceed $24,300.

21. Commenter ACV agrees that the proposed adjustments in the FY 2020 NPRM will

mitigate the burdens of the population decline and the severe and rugged terrain.

55

The Joint Puerto Rico

Commenters also agree with the proposed adjustments.

56

Accordingly, we adopt those adjustments and

the proposed regulatory fees for these television broadcasters.

22. We disagree with arguments attempting to relitigate our treatment of VHF stations.

NJBA, for example, contends that UHF stations should pay a higher fee than VHF stations because VHF

stations have to overcome additional background interference that is prevalent in large cities.

57

In the

2020 Regulatory Fee Reform Order, we declined to categorically lower regulatory fees for VHF stations

to account for signal limitations.

58

We concluded that there is nothing inherent in VHF transmission that

creates signal deficiencies but that environmental noise issues can affect reception in certain areas and

situations.

59

As such, we recognized that the Media Bureau had granted waivers to allow VHF stations

that demonstrate signal disruptions to exceed the maximum power level specified for channels 2-6 in

73.622(f)(6) and for channels 7-13 in 73.622(f)(7)—and that we would not “penalize” such stations by

assessing them at their higher power levels needed to overcome such interference but instead at the power

levels authorized by our rules.

60

Such an approach, we find, more narrowly targets the issue that NJBA

complains about by ensuring that VHF broadcasters that actually experience increased interference can

get the relief they need to reach consumers without sweeping other broadcasters into the mix.

23. We also reject the arguments of PMCM TV, operator of WJLP Channel 3 serving

Middletown Township, NJ and surrounding areas that appear to seek a carve-out for that one station from

our proposed regulatory fees. Its arguments, that it experiences a high degree of interference from

environmental noise and signal blockage from tall buildings near its transmitter and that it had relatively

low revenues compared to major network stations in New York City,

61

lead it to propose a reduction in its

own regulatory fee by 75%, to $41,378.

62

PCPM’s arguments appear to seek a waiver of a portion of their

fee based on its individual financial circumstances and we decline to grant this request—adjudicating the

circumstances of every station in the context of a cross-industrywide rulemaking would be

53

FY 2020 NPRM, 35 FCC Rcd at 5003, para. 69.

54

Id. at 5003, para. 70; see United States Census, Quick Facts, Puerto Rico, https://www.census.gov/quickfacts/PR

(last visited Aug. 5, 2020).

55

ACV Comments at 3-5.

56

Joint Puerto Rico Comments at 4-5.

57

NJBA Comments at 3-4. NJBA also contends that UHF stations can offer a variety of ATSC 3.0 services in the

future that traditional VHF stations cannot offer. Id. Whatever the merits of that contention, such an argument does

not go to the present benefits that VHF stations enjoy vis-à-vis UHF stations.

58

FY 2020 NPRM, 35 FCC Rcd at 4997, para. 52.

59

Id.

60

Id.

61

PMCM TV Comments at 3-5.

62

Id. at 7-8.

(continued….)

Federal Communications Commission FCC 20-120

10

administratively impractical, and the Commission’s rule already provide a more appropriate venue for

relief: Parties can seek a waiver, reduction, or deferment, on a case-by-case basis of the fee, interest

charge, or penalty “in any specific instance for good cause shown, where such action would promote the

public interest.”

63

D. Radio Broadcaster Regulatory Fees

24. The FY 2020 NPRM proposed the same methodology for assessing radio broadcasters as

in prior years.

64

This methodology involves first identifying the FTEs doing work directly benefitting

regulatees.

65

Because the work of the FTEs in the indirect bureaus and offices benefits the Commission

and the telecommunications industry generally and is not specifically focused on the regulatees and

licensees of one core bureau, the FY 2020 NPRM proposed that, consistent with past practices, the total

FTEs for each fee category include an allocation of indirect FTEs proportional to the direct FTEs

associated with that category.

66

The total collection target is then allocated across all regulatory fee

categories based on the number of total FTEs. Each regulatee within a fee category then pays its

proportionate share based on an objective measure of size (e.g., revenues or number of subscribers).

67

The Commission adjusted the methodology for assessing regulatory fees on radio stations in FY 2016.

68

The methodology, as is the case with many regulatees, uses both population and type of license as a

metric for benefit afforded the payor.

69

25. Use of this methodology results in net increases in the amount of regulatory fees assessed

to radio broadcast categories compared to FY 2019.

70

In continuing to review our unit numbers, however,

we discovered a computational error and correct it here by increasing the number of units used in the

calculation from 9,636 to 9,831 which results in lower fees than proposed in the FY 2020 NPRM. Below

is a chart showing the regulatory fees by category of radio broadcaster for FY 2020 adjusted to account

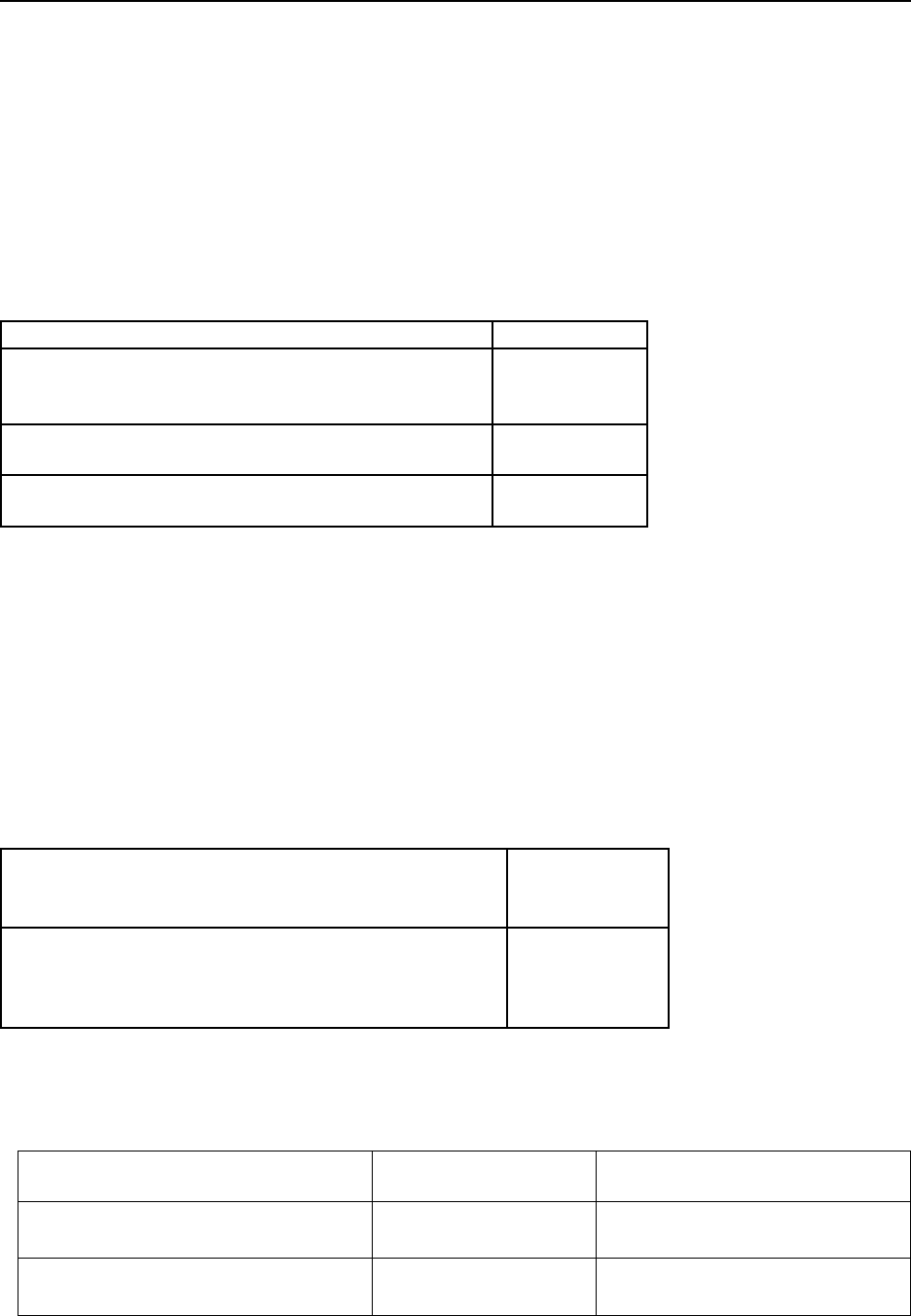

for the correction:

63

47 U.S.C. § 159A(d).

64

FY 2020 NPRM, 35 FCC Rcd at 4497-87, paras. 53-58.

65

Id. at 4498, para. 56.

66

Id.

67

Id. at 4998, para. 57. The categories and calculations used in assessing regulatory fees were also provided. Id. at

Appendices B, D, and E.

68

FY 2016 Report and Order, 31 FCC Rcd at 10351, para. 33.

69

See FY 2020 NPRM, 35 FCC Rcd at 5015-17, Appendix C.

70

NAB states that radio broadcasters’ proposed regulatory fees would increase by an average of 4 percent for FY

2020. NAB Comments at 4 (further stating that, under the Commission’s proposal, regulatory fees for AM Class A

stations with the smallest reach would increase 5.3 percent, and some FM stations in the largest markets would

increase 4.3 percent increase.”).

Federal Communications Commission FCC 20-120

11

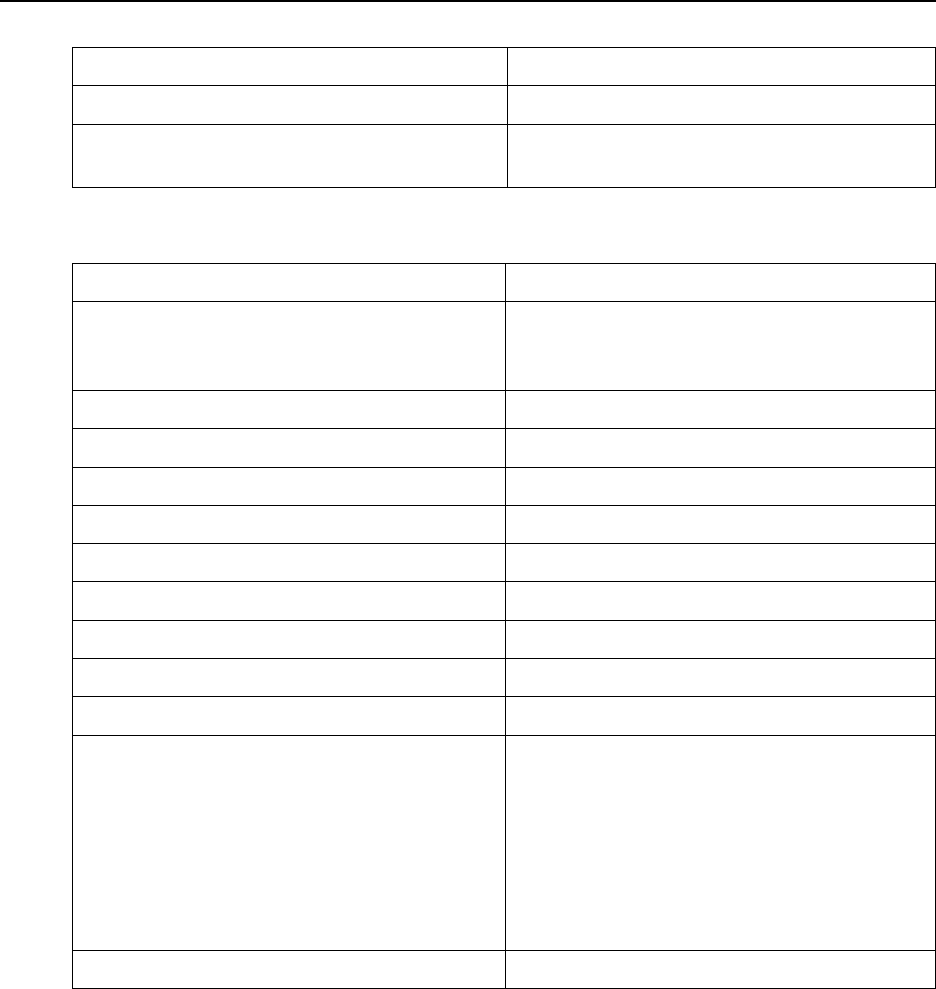

FY 2020 RADIO STATION REGULATORY FEES

Population

Served

AM Class

A

AM Class

B

AM

Class C

AM

Class D

FM Classes

A, B1 & C3

FM Classes

B, C, C0, C1

& C2

<=25,000

$975 $700 $610 $670 $1,075 $1,225

25,001 – 75,000

$1,475 $1,050 $915 $1,000 $1,625 $1,850

75,001 – 150,000

$2,200 $1,575 $1,375 $1,500 $2,425 $2,750

150,001 – 500,000

$3,300 $2,375 $2,050 $2,275 $3,625 $4,150

500,001 – 1,200,000 $4,925

$3,550 $3,075 $3,400 $5,450 $6,200

1,200,001 –

3,000,000

$7,400 $5,325 $4,625 $5,100 $8,175 $9,300

3,000,001 –

6,000,000

$11,100 $7,975 $6,950 $7,625 $12,250 $13,950

>6,000,000

$16,675 $11,975 $10,425 $11,450 $18,375 $20,925

26. Radio broadcasters argue that any increases to their regulatory fees for FY 2020 are

unreasonable because the total amount appropriated to the Commission for FY 2020 did not increase from

FY 2019, and the number of FTEs in the Media Bureau increased by only one from FY 2019.

71

Accordingly, they claim that the regulatory fees for radio broadcast categories for FY 2020 should be

frozen at their FY 2019 levels.

72

The radio broadcasters’ arguments, however, reflect an incomplete

understanding of the methodology that the Commission has used for years. As described above and in the

FY 2020 NPRM, the long-standing methodology for assessing regulatory fees involves multiple factors

besides the amount of appropriation to be recovered and the number of direct FTEs. Specifically, two

factors affecting calculation of radio broadcasters’ fees changed significantly between FY 2019 and FY

2020, and resulted in the increase in regulatory fees for radio broadcasters. First, the Media Bureau’s

allocation percentage increased from 35.9% in FY 2019 to 37.3% in FY 2020.

73

(Mathematically, the

year-to-year change in the absolute number of direct FTEs in a core bureau does not by itself determine

the share of overall regulatory fees that should be borne by regulatees of that bureau, because the bureau’s

allocation percentage also depends on the overall number of Commission direct FTEs, which changes

year to year.) Furthermore, because indirect FTEs are proportionately allocated by a bureau’s share of

direct FTEs, this increase in the percentage of direct FTEs also resulted in an increase in the amount of

indirect FTEs being allocated to Media Bureau fee categories.

74

This then resulted in an increase in the

71

NAB Comments at 1-2, 4.

72

Colorado Broadcasters Comments at 3-6; NAB Comments at 4-6.

73

FY 2020 NPRM, 35 FCC Rcd at 4998, para. 58; FY 2019 Report and Order, 34 FCC Rcd at 8194, para. 12.

74

As discussed in paragraphs 9-10 above, we reject arguments that the Commission should change its longstanding

methodology for allocating indirect FTEs in proportion to the allocation of direct FTEs, which provides an

(continued….)

Federal Communications Commission FCC 20-120

12

overall fees for radio broadcasters as a group. Second, the total number of radio broadcasters (projected

fee-paying units) unexpectedly dropped by 180 from FY 2019 to FY 2020.

75

The net effect of these two

changes resulted in increased regulatory fees for individual radio broadcaster fee paying units for FY

2020.

27. We disagree with the radio broadcasters that we should ignore our long-standing

methodology in order to freeze regulatory fees for (and thus benefit) radio broadcasters at the expense of

other regulatees (such as television broadcasters). Because the Commission is statutorily obligated to

recover the amount of its appropriation through regulatory fees, these fees are a zero-sum situation. Thus,

if the Commission freezes one set of regulatees’ fees, it would need to increase another set of regulatees’

fees to make up for any resulting shortfall in a way that is inconsistent with the longstanding methodology

described in the FY 2020 NPRM. Such an outcome would be arbitrary and not in the public interest as a

whole, particularly when compared to the alternative of following our long-standing methodology for

assessing regulatory fees. We accordingly decline to freeze the radio broadcaster regulatory fees at their

FY 2019 levels and instead, we adopt the radio broadcaster fees as adjusted in this Report and Order.

76

E. Toll Free Numbering Regulatory Fees

28. Toll free numbers allow callers to reach the called party without being charged for the

call.

77

With toll free calls, the charge for the call is paid by the called party (the toll free subscriber)

instead.

78

For reasons discussed in the FY 2014 Report and Order

79

and the FY 2015 Report and Order,

80

the Commission established a regulatory fee obligation for Responsible Organizations (RespOrgs)

81

that

manage toll free numbers, beginning in FY 2015.

82

These reasons include empowering the Commission

to ensure that toll free numbers, a valuable national public resource, are allocated in an equitable and

objective, administrable standard for implementing the statutory directive that regulatory fees reflect the benefits

provided to the payor of the fee by the Commission’s activities. 47 U.S.C. § 159(d).

75

FY 2019 Report and Order, 34 FCC Rcd at 8223, Appendix B; FY 2020 NPRM, 35 FCC Rcd at 5012, Appendix

B.

76

FY 2020 NPRM, 35 FCC Rcd at Appendix C.

77

Toll free numbers are telephone numbers for which the toll charges for completed calls are paid by the toll free

subscriber. See 47 CFR § 52.101(f). These are 800, 888, 877, 866, 855, and 844 numbers. SMS/800 (or the 800

Service Management System) is a centralized system that performs toll free number management. For a list of

RespOrgs on the SMS/800, Inc. website, see http://www.sms800.com/Controls/NAC/Serviceprovider.aspx.

78

47 U.S.C. §§ 52.101 (e), (f).

79

Assessment and Collection of Regulatory Fees for Fiscal Year 2014, Report and Order and Further Notice of

Proposed Rulemaking, MD Docket No. 14-92, 29 FCC Rcd 10767, 10777-79, paras. 25-28 (2014) (FY 2014 Report

and Order).

80

FY 2015 Report and Order, 30 FCC Rcd at 5362-64, paras. 23-27.

81

A Responsible Organization (RespOrg) is a company that manages toll free telephone numbers for subscribers.

RespOrgs use the SMS/800 data base to verify the availability of specific numbers and to reserve the numbers for

subscribers. See 47 CFR § 52.101(b).

82

Prior to the FY 2014 Report and Order, the Commission did not assess regulatory fees on toll free numbers based

on the assumption that the entities controlling the numbers—wireline and wireless common carriers—were paying

regulatory fees based on either revenues or subscribers. See FY 2014 Report and Order, 29 FCC Rcd at 10777,

para. 25, note 74 (citing Universal Service Contribution Methodology, Further Notice of Proposed Rulemaking, 27

FCC Rcd 5357, 5463-64, para. 306 (2012)). In the FY 2014 NPRM, the Commission observed this was no longer

the case because many toll free numbers were controlled or managed by RespOrgs that were not common carriers.

Assessment and Collection of Regulatory Fees for Fiscal Year 2014, Notice of Proposed Rulemaking, Second

Further Notice of Proposed Rulemaking, and Order, MD Docket Nos. 14-92, 13-140, and 12-201, 29 FCC Rcd

6417, 6435, para 51 (2014) (FY 2014 NPRM).

(continued….)

Federal Communications Commission FCC 20-120

13

orderly manner that serves the public interest, a fundamental purpose of section 251(e)(1) of the Act.

83

29. On May 20, 2020, ATL Communications, a RespOrg, filed comments to the

Commission’s proposed regulatory fees for fiscal year 2020. In its comments, ATL does not address the

issues that are the subject of this proceeding, but instead raises specific questions related to international

toll free calls involving Canada, tracking fee exemptions, control and ownership of toll free numbers, and

the consequences for failure to pay assessed regulatory fees.

84

Upon review, we find no convincing

evidence in ATL’s comments that warrants a change to the regulatory fee obligation, as it applies to toll

free numbers.

F. Market Access Space Station Regulatory Fees

30. In the 2020 Regulatory Fee Reform Order, we concluded that non-U.S. licensed space

stations granted access to the market in the United States (market access grants) will be included in the

FY 2020 GSO and NGSO space station regulatory fees.

85

In the FY 2020 NPRM, we accordingly

proposed to collect regulatory fees from most, but not all, non-U.S. licensed space stations granted U.S.

market access,

86

and we follow through and adopt such fees here.

31. We disagree with the two commenters that assert that we do not have such authority.

87

We will not repeat the lengthy analysis from the 2020 Regulatory Fee Reform Order here, but will

summarize the issues.

83

FY 2014 Report and Order, 29 FCC Rcd at 10776, para. 26.

84

Although it is outside the scope of this proceeding, we provide the following answers in response to ATL’s

questions. Regarding identification and shared use of Canadian numbers, the Commission clarified in the FY 2014

Report and Order that the regulatory fee, assessed on RespOrgs for toll free numbers is limited to toll free numbers

that are accessible within the United States. See FY 2014 Report and Order, 29 FCC Rcd at 10778, para. 27.

Further, the FY 2015 Report and Order notes that the regulatory fee assessed on RespOrgs for toll free numbers

managed by a RespOrg, is payable for all toll free numbers unless calls from only other countries can be completed

using those toll free numbers. FY 2015 Report and Order, 30 FCC Rcd at 5364, para. 24. Regarding ATL’s

questions about tracking numbers for exemptions and determining control and ownership, as discussed in the FY15

Report and Order, the basis for identifying the toll free number count upon which the regulatory fee is assessed is

derived from data available as of or around December 31st of each year that is provided by SMS/800, Inc, the entity

which provides administration and routing for all toll free numbers in North America. FY 2015 Report and Order,

30 FCC Rcd at 5364, para. 26. Regarding ATL’s question about failure to pay for assessed fees, the Commission

held in the FY 2015 Report and Order that a RespOrg that fails to pay the regulatory fee assessed by the FCC will be

subject to penalties. FY 2015 Report and Order, 30 FCC Rcd at 5363, para. 24. We also note that the FY 2015

Report and Order required the Managing Director to coordinate with the Toll Free Numbering Administrator to

ensure that all RespOrgs owing regulatory fees had sufficient information about the regulatory fee process and

opportunity to pay the regulatory fee before the RespOrg is placed in red light status and enforcement procedures are

initiated. FY 2015 Report and Order, 30 FCC Rcd at 5364, para. 25.

85

FY 2020 NPRM, 35 FCC Rcd at 4979-91, paras. 7-34.

86

The Commission adopted this new fee category in 2020 Regulatory Fee Reform Order, 35 FCC Rcd at 4979-91,

paras. 7-34; the proposed fees were listed in Appendix C.

87

See, e.g., Telesat Comments at 1-2; Kineis Comments at 2-3. Kineis, who did not participate in the proceeding

below, but is participating in the Petition for Review of the 2020 Regulatory Fee Reform Order pending in the Court

of Appeals for the D.C. Circuit, generally repeats arguments previously made by commenters to the Further Notice

of Proposed Rulemaking attached to the FY 2019 Report and Order. See Kineis Comments at 2-3 (arguing that the

FCC lacks authority to include market access grants in space station regulatory fees and also arguing that the

benefits afforded market grants are different from those afforded U.S. licensees for purposes of regulatory fee

assessments). Compare 2020 Regulatory Fee Reform Order, 35 FCC Rcd at 4982, para. 13 (commenters argued that

based on legislative history, the Commission does not have the authority to impose such a fee, citing to Telesat

Comments at 2; Eutelsat Comments at 4-5; Inmarsat Reply at 2-3).

(continued….)

Federal Communications Commission FCC 20-120

14

32. In our order, the Commission provided a history of section 9 of the Communications Act,

the legislative history text associated with the original statute enacted in 1993, the subsequent

Commission proceedings

88

discussing the question of assessing regulatory fees on market access grants,

and the recent amendments to the statute.

89

33.

The core of our analysis started with our review of the language of section 9 and our

conclusion that it supported adoption of regulatory fees for non-U.S. licensed space stations with U.S.

market access. We explained that the Act contemplates that we impose fees on regulatees that reflect the

“benefits provided to the payor of the fee by the Commission’s activities.”

90

As part of such review, we

explained that the text of the statute did not support an exemption or exclusion for non-U.S. licensed

space stations granted market access.

91

And we concluded that holders of market access grants clearly

benefit from the activities of the Commission—and nothing in the language of the Act suggests Congress

intended to preclude such entities from the ambit of regulatory fees. We also addressed arguments that

the 1991 legislative history associated with the statute precluded assessing regulatory fees on market

access grants and concluded that it did not.

92

We provided historical context of the 1991 legislative

history language explaining that when viewed in context this legislative history referred to entities such as

INTELSAT and INMARSAT, which were international governmental organizations formed as a result of

international treaties and with explicit support by the United States through statutory and regulatory

mechanisms, and as such did not preclude adopting our proposal.

93

We concluded that the legislative

88

2020 Regulatory Fee Reform Order, 35 FCC Rcd at 4979-4991, paras. 7-34.

89

Id. at 4980-4981, para. 10.

90

Id. (explaining 47 U.S.C. § 159(d).

91

Id. at 4980-4981, paras. 10-11. Our conclusions are in line with prior review of the statute in PanAmSat Corp. v.

F.C.C., 198 F.3d 890, 895 (D.C. Cir. 1999) (explaining if Congress intended an exemption for an entity one might

find it in the section of the statute devoted to exemptions).

92

2020 Regulatory Fee Reform Order, 35 FCC Rcd at 4982-4985, paras. 14-18. The legislative history is found in

the House and Senate Reports, Committee on Energy and Commerce, 102 H. Rpt. 207, September 17, 1991, in

which the Committee stated: “The Committee intends that fees in this category be assessed on operators of U.S.

facilities, consistent with FCC jurisdiction. Therefore, these fees will apply only to space stations directly licensed

by the Commission under Title III of the Communications Act. Fees will not be applied to space stations operated

by international organizations subject to the International Organizations Immunities Act, 22 U.S.C. Section 288 et

seq.” House and Senate Reports, Committee on Energy and Commerce, 102 H. Rpt. 207, at 33 (Sept. 17, 1991).

The language of the 1991 House and Senate Report was incorporated by reference in the Conference Report

accompanying the 1993 Budget Reconciliation Act, which included the regulatory fee program. See Conference

Report H. Rept. No. 213, 103d Cong., 1st Sess. 499 (1993). The 1991 language related to a comparable bill that

passed the House in 1991 but was not passed into law. See PanAmSat Corp. v. FCC, 198 F.3d 890, 895 (D.C. Cir.

1999).

93

INTELSAT and INMARSAT, however, were fully privatized and now operate as commercial enterprises

INTELSAT became a private company in 2001, Intelsat, Ltd., after 37 years as an International Governmental

Organization, it has corporate headquarters are in Luxembourg and the United States, and a fleet of more than 50

satellites. See Application of Intelsat LLC for Authority to Operate, and to Further Construct, Launch, and Operate

C-band and Ku-band Satellites that Form a Global Communications System in Geostationary Orbit, Memorandum

Opinion, Order and Authorization, 15 FCC Rcd 15460, recon. denied, 15 FCC Rcd 25234 (2000), further

proceedings, 16 FCC Rcd 12280 (2001). INMARSAT, now Inmarsat, Inc., is headquartered in London, England,

has offices in over 40 countries, and owns and operates 13 satellites. See Comsat Corporation et al., Memorandum

Opinion, Order and Authorization, 16 FCC Rcd 21661 (2001); Inmarsat Group Holdings Limited Petition for

Declaratory Ruling Pursuant to Section 621(5)(F) of the ORBIT Act, Memorandum Opinion and Order, 20 FCC Rcd

11366 (2005).

(continued….)

Federal Communications Commission FCC 20-120

15

history of the Act posed no bar to assessing regulatory fees on non-U.S. licensed space stations granted

U.S. market access

94

via the formal process first adopted by the Commission in 1997.

95

34. Kineis, which did not previously participate in the proceeding, presents two variations on

arguments raised by other commenters in the underlying proceeding. For procedural reasons we conclude

that we are not required to address these additional arguments. Kineis admits that in challenging (for the

first time here) the Commission’s May 2020 decision assessing regulatory fees on non-U.S. market

grants, it is not responding to anything in the 2020 Regulatory Fee Reform Order.

96

And while we might

nevertheless treat its arguments as a petition for reconsideration of the 2020 Regulatory Fee Reform

Order, Kineis has not sought such treatment nor has it met the procedural requirements for a petition for

reconsideration.

97

Thus, we dismiss the Kineis filing to the extent it challenges the basis for our decision

to assess regulatory fees on non-U.S. market grant or seeks reconsideration of that decision.

35.

Turning to comments received in response to the FY 2020 NPRM, on separate and

independent grounds, we reject Kineis’s arguments on their merits. We address the two arguments that

might be considered new under a generous analysis, but we will not rehash the other aspects of our prior

decision. First, Kineis argues that the Commission “conflates ancillary generalized benefits that may

arguably arise from FCC activities with the status of actually being an FCC-regulated entity.”

98

This

argument shows that Kineis misunderstands the focus of the annual regulatory fee proceeding. The

Commission is required by Congress to assess regulatory fees each year in an amount that can reasonably

be expected to equal the amount of its appropriation.

99

The Commission’s methodology for assessing

regulatory fees must “reflect the full-time equivalent number of employees within the bureaus and offices

of the Commission, adjusted to take into account factors that are reasonably related to the benefits

provided to the payor of the fee by the Commission’s activities.”

100

Our order amply explained how

requests for market access have become a significant portion of the applications processed by the

Commission and that holders of market access grants regularly participate in Commission activities.

101

94

2020 Regulatory Fee Reform Order, 35 FCC Rcd at 4983, para. 17.

95

Id. at 4982-4983, paras. 14-16 (explaining the history of surrounding the Commission’s adoption in 1997 of a

framework under which to consider requests for access by non-U.S. licensed satellites into the United States known

as DISCO II with many granular details described in note 46, 47, and 49). Under the DISCO II process, requests for

market access include all the same information as operators seeking a Commission license and also information

addressing whether operators are licensed by WTO member nations, with respect to covered services, and if not

sufficient information to determine whether the ECO-SAT analysis is satisfied. Amendment of the Commission's

Regulatory Policies to Allow Non–U.S. Licensed Space Stations to Provide Domestic and International Satellite

Service in the United States, Report and Order, 12 FCC Rcd 24094 (1997) (DISCO II).

96

Kineis Comments at 1.

97

See, e.g., 47 CFR 1.429(b) (requirement to explain why arguments on reconsideration could not have been raised

previously). We also note that Kineis has joined with other parties in filing a petition for judicial review of the 2020

Regulatory Fee Reform Order.

98

Kineis Comments at 4-5.

99

2020 Regulatory Fee Reform Order, 35 FCC Rcd at 4977-4978, paras. 2-3; 47 U.S.C. §§ 159(a) (“shall assess and

collect regulatory fees”), 159(b) (“Commission shall assess and collect regulatory fees at such rates as the

Commission shall establish in a schedule of regulatory fees that will result in the collection, in each fiscal year, of an

amount that can reasonably be expected to equal the amounts described in subsection (a) with respect to such fiscal

year.”); see also 47 U.S.C. § 156(b).

100

47 U.S.C. § 159(d).

101

2020 Regulatory Fee Reform Order, 35 FCC Rcd at 4983-4986, paras 17, 19, 20, & 21. Space X Comments at 2-

3 (noting that in other proceedings, the non-U.S. operators stress the similarities between grants of market access

and Commission space-station licenses). We also address this point below wherein we discuss the rationale for

assessing the same fee on market access grants as space station licenses.

(continued….)

Federal Communications Commission FCC 20-120

16

Thus, such entities derive many benefits from the activities of Commission staff. Adding market access

grants to the space station regulatory fee category thus will fulfill Congress’s mandate that the

Commission recover through regulatory fees the FTE resources costs associated with its activities.

102

In

this regard, we note that the Commission generally measures the benefits provided to regulatory fee

payors in section 9 through analysis of FTE time devoted to the activities of the Commission funded by

our salaries and expense appropriation.

103

Additionally, Kineis argues that non-U.S.-licensed space

stations are not subject to regulatory fees because they provide “nonregulated services.”

104

The argument

ignores the fact that operators of non-U.S.-licensed space stations granted market access are subject to the

same service rules and operating conditions as those that apply to U.S. licensed operators.

105

Moreover,

as explained in detail in our 2020 Regulatory Fee Reform Order, we have re-evaluated our prior

conclusions stemming from the legislative history.

106

36. Finally, turning to the suggestion that the Commission should adopt a contingency plan in

the event our decision is reversed on appeal, we decline to do so. In the event of reversal on appeal, a

remand or other similar possibilities, the FCC would review the decision and abide by any court order as

well as its statutory duties.

37. We also disagree with arguments that the proposed regulatory fees for non-U.S licensed

space stations with U.S. market access grants are too high because we set the same regulatory fee for U.S.

licensed and non-U.S. licensed space stations.

107

As we discussed in the FY 2020 NPRM, the number of

space stations seeking U.S. market access has continued to increase each year; in 2019 there were more

market access petitions than U.S. space station applications.

108

In addition, as we noted, foreign-licensed

space station operators participate actively in Commission rulemaking proceedings and benefit from

Commission monitoring and enforcement activities.

109

We concluded that the Commission devotes

significant resources to processing the growing number of market access petitions of non-U.S. licensed

satellites and that those foreign licensed satellites with U.S. market access benefit from much of the same

102

2020 Regulatory Fee Reform Order, 35 FCC Rcd at 4988, para. 26. In discussion of the benefit conferred on

regulatory fee payors, it is important to note that the benefit in this context is measured in FTE time, the burden

imposed on the FCC in order to exercising its statutory responsibilities. FY 2007 Report and Order, 22 FCC Rcd at

15719-15720, para. 19.

103

47 U.S.C. §§ 156 (a) (b) (authorizes appropriations to carry out the functions of the Commission to be derived

from fees authorized by section 159); 159(a)(“Commission shall assess and collect regulatory fees to recover the

costs of carrying out the activities described in section 156(a) of this title only to the extent, and in the total amounts,

provided for in Appropriations Acts.”); 159(b) (“The Commission shall assess and collect regulatory fees at such

rates as the Commission shall establish in a schedule of regulatory fees that will result in the collection, in each

fiscal year, of an amount that can reasonably be expected to equal the amounts described in subsection (a) with

respect to such fiscal year.”); FY 2020 Appropriation (providing a salaries and expenses appropriation and further

providing “…, That the sum herein appropriated shall be reduced as such offsetting collections are received during

fiscal year 2020 so as to result in a final fiscal year 2020 appropriation estimated at $0:”).

104

Kineis Comments at 3 (citing Assessment and Collection of Regulatory Fees for Fiscal Year 2013, Report and

Order, 28 FCC Rcd 12351, 12352-53, para. 6 & n.10 (2013)).

105

The request for U.S. market access requires the submission and review of the same legal and technical

information for the non-U.S. licensed space station as would be required in a license application for that space

station. 47 CFR § 25.137; DISCO II.

106

2020 Regulatory Fee Reform Order, 35 FCC Rcd at 4982-4985, at paras. 14-18.

107

Eutelsat Comments at 7; Myriota Comments at 8; Kineis Reply at 4-5.

108

FY 2020 NPRM, 35 FCC Rcd at 4985, para. 19 & note 67.

109

Id. at 4986, para. 21.

(continued….)

Federal Communications Commission FCC 20-120

17

oversight and regulation by the Commission as the U.S. licensed satellites.

110

For that reason, we

concluded that assessing the same regulatory fees on non-U.S. licensed space stations with market access

grants as we assess on U.S. licensed space stations will better reflect the benefits received by these

operators through the Commission’s adjudicatory, enforcement, regulatory, and international coordination

activities and will promote regulatory parity and fairness among space station operators by evenly

distributing the regulatory cost recovery. And we disagree that the recategorization of four FTEs five

years ago from direct to indirect should determine the space station regulatory fee for FY 2020.

111

Whatever the relative apportionment of work between U.S. licensees and non-U.S. licensed space stations

with market access, our current assessment of the work performed by FTEs leads us to find that equal

treatment is in order.

38. Finally, the non-U.S. licensed satellite operators argue that they should not pay the same

amount of indirect costs as the U.S. licensed satellite operators because they receive fewer benefits from

the Commission.

112

They contend that the Commission’s regulatory activity at international organizations

is designed to promote and protect the interests of U.S. satellite operators and that the indirect FTEs

across the agency largely support U.S. telecommunications policy.

113

Commenters contend that FTE-

based costs associated with non-U.S. licensed space stations are a fraction of those associated with U.S.

licensed space stations, imposing the same regulatory fee would require the foreign-licensed space

stations to subsidize U.S. licensed satellite operators.

114

39. U.S. licensed satellite operators disagree and observe that the non-U.S. licensed satellite

operators receive the same or more benefits from the Commission as do U.S. licensed satellite

operators.

115

They observe that in another proceeding the non-U.S. licensed operators in the C-Band

Alliance have stressed the practical similarities between the market access grants and U.S. licensed space

stations.

116

SpaceX contends that the foreign licensed operators overlook the tremendous benefit of

access to the U.S market and that the Commission’s regulatory activities maximize the value of the

market access.

117

40. We find that the non-U.S. licensed operators are ignoring the fact that the Commission

devotes significant resources to processing the growing number of market access petitions of foreign

licensed satellites and that the foreign licensed satellite operators benefit from much of the same oversight

and regulation by the Commission as the U.S. licensed satellites. For example, processing a petition for

market access requires evaluation of the same legal and technical information as required of U.S. licensed

applicants. The operators of non-U.S. licensed space stations also benefit from the Commission’s

oversight efforts regarding all space and earth station operations in the U.S. market, since enforcement of

Commission rules and policies in connection with all operators provides a fair and safe environment for

all participants in the U.S. marketplace. The Commission’s adjudication, rulemaking, and international

coordination efforts benefit all U.S. marketplace participants by evaluating and minimizing the risks of

radiofrequency interference, increasing the number of participants in the U.S. satellite market, opening up

additional frequency bands for use by satellite services, providing a level and uniform regime for

mitigating the danger of orbital debris, and streamlining Commission rules that apply to all providers of

110

Id.

111

Eutelsat Comments at 7; Myriota Comments at 8; Kineis Reply at 4-5.

112

Eutelsat Comments at 11; Myriota Reply at 6-7.

113

Eutelsat Comments at 11-12; Myriota Reply at 6.

114

Eutelsat Comments at 10; Myriota Comments at 9.

115

SpaceX Reply at 2-5.

116

Id. at 2-3 (citing the C-Band Alliance Comments in GN Docket No. 18-122, filed July 3, 2019).

117

Id. at 3-5.

(continued….)

Federal Communications Commission FCC 20-120

18

satellite services in the United States.

118

The active participation of operators of non-U.S. licensed space

stations in these adjudications and rulemakings demonstrates that they recognize benefits from

Commission action to their operations within the U.S. market.

119

Thus, the significant benefits to non-

U.S. licensed satellites with U.S. market access support including them in the GSO and NGSO regulatory

fee categories for U.S. licensed space stations.

41. To the extent some commenters argue that foreign licensed space stations do not benefit

from Commission regulatory activity after the space station is operational,

120

and that compliance with

market access conditions are pre-operational assessments that occur before the licensee is subject to any

regulatory fees, we disagree. Both U.S. licensed space stations and non-U.S. licensed space stations often

make changes to their operations after they have been brought into service, through modification

applications or petitions.

121

Ongoing U.S. licensed and non-U.S. licensed space station operations are

subject to, and benefit from, the rulemaking and other regulatory activities described above during the

entire service period of the space station. In addition, we do not agree that the relevant processing costs

incurred should only be assessed in the country where the space station is licensed, and that assessing fees

in the United States for the same processing costs would be duplicative.

122

The processing costs assessed

by the licensing country correspond to work that is independent to that performed by the Commission.

Moreover, the Commission’s substantial regulatory efforts for satellite services benefit non-U.S. licensed

space station operators with market access and it would be inequitable to continue charging only U.S.

licensees for these benefits to foreign operators.

42. Commenters also argue that we should exempt or adopt a reduced fee for non-U.S.

licensed GSO satellites in certain circumstances. We adopt one of these proposals and reject the others.

43. Eutelsat argues that U.S. licensed earth stations onboard vessels (ESVs) operating outside

U.S. territorial waters and communicating with foreign licensed satellites should not be subject to

118

FY 2019 Report and Order, 34 FCC Rcd at 8212-13, para. 63 (citing Mitigation of Orbital Debris in the New

Space Age, IB Docket No. 18-313, Notice of Proposed Rulemaking and Order on Reconsideration, 33 FCC Rcd

11352 (2018) (Orbital Debris NPRM); Amendment of Parts 2 and 25 of the Commission’s Rules to Facilitate the

Use of Earth Stations in Motion Communicating with Non-Geostationary Orbit Space Stations in Frequency Bands

Allocated to the Fixed-Satellite Service, IB Docket No. 18-315, Notice of Proposed Rulemaking, 33 FCC Rcd 11416

(2018) (ESIM NPRM); Amendment of the Commission’s Policies and Rules for Processing Applications in the

Direct Broadcast Satellite Service, IB Docket No. 06-160, Second Notice of Proposed Rulemaking, 33 FCC Rcd