By Danyell A. Punelli, 651-296-5058

Cash Assistance in

Minnesota

December 2022

Overview

Cash assistance is a form of welfare and provides income for eligible families and individuals.

Two government-administered programs provide cash assistance in Minnesota. They are the

Minnesota Family Investment Program and General Assistance.

This publication provides basic information regarding cash assistance in Minnesota, including

information on federal, state, and county roles in cash assistance; funding levels;

requirements states and recipients must meet; the number of people receiving cash

assistance benefits in Minnesota; the average length of time a person receives cash

assistance in Minnesota; and the amount of cash assistance benefits.

Contents

Program Administration and Requirements ........................................................... 2

Funding for Cash Assistance ................................................................................... 6

Program Recipients ................................................................................................. 8

Other Program Eligibility ....................................................................................... 11

The Difference Between Cash Assistance and Welfare

In general, welfare is support for families and individuals who do not have the means to provide

for their basic needs. Welfare can be broadly defined to include programs such as cash

assistance, subsidized health care, unemployment insurance, and in-kind support or more

narrowly defined to include only cash assistance for basic needs. Welfare can be provided by

government entities, charities, or religious organizations among others. Cash assistance is a

more narrowly defined term and provides income for eligible families and individuals.

This publication focuses on government-administered programs that provide cash assistance,

1

including the Minnesota Family Investment Program (MFIP) and General Assistance (GA). MFIP

is a jointly funded, federal-state program designed to provide cash assistance to eligible low-

income families. GA is a state program to provide cash assistance to needy persons who fall into

specified statutory categories and who meet GA requirements, including income and asset

standards.

1

There are other federal and state cash assistance programs that are not included here such as Supplemental

Security Income and Minnesota Supplemental Aid that assist specific populations (i.e., the elderly and persons

with disabilities).

Cash Assistance in Minnesota

Minnesota House Research Department Page 2

Program Administration and Requirements

Federal, State, and County Roles

Minnesota Family Investment Program

The Temporary Assistance for Needy Families (TANF) block grant was created under the 1996

federal welfare reform law. Under TANF, each state receives a fixed block grant of federal funds

and may design its own program to assist needy families. The state program must meet federal

statutory and regulatory guidelines, and the U.S. Department of Health and Human Services

(DHHS) monitors states’ compliance with the requirements of the federal law.

The Minnesota Legislature authorized MFIP in the 1997 session. MFIP is Minnesota’s TANF

program; it is Minnesota’s response to the welfare reform authority granted by Congress. The

program uses the state’s annual federal TANF block grant and state appropriations to provide

cash assistance, employment and training services, and support services to eligible Minnesota

families.

The Minnesota Department of Human Services (DHS) directs the operation of MFIP throughout

the state by issuing implementation instructions to counties, providing training for county staff,

providing other technical support to counties, and assisting in eligibility and benefits

determination through its centralized MAXIS computer system.

Counties administer MFIP. The county agency conducts intake and eligibility screenings,

including orientations to the program. The county agency also provides case management and

assists MFIP participants in their employment and training efforts and meeting the other

program requirements.

In addition, the federal TANF law authorizes American Indian Tribes to apply for federal TANF

funds to operate a Tribal TANF family assistance program that is separate from the state’s

program. Two Minnesota Tribes, the Mille Lacs Band of Ojibwe and the Red Lake Band of

Chippewa Indians, applied for and received federal approval to operate separate Tribal TANF

programs. The programs serve TANF-eligible families where one or more of the eligible adults is

a member of the Band (or in the case of the Mille Lacs Band of Ojibwe Tribal TANF program in

the counties of Anoka, Hennepin, and Ramsey, a member of the Minnesota Chippewa Tribe).

General Assistance

GA is a state program that was established by the 1973 Legislature when county “Poor Relief”

programs and the “Township Relief System” were abolished. The original GA program provided

assistance to needy persons who did not qualify for federal programs. In 1985, the legislature

changed the GA program to allow assistance only for those people who meet certain standards

of “unemployability.” The state law includes: minimum statewide standards for assistance,

general eligibility requirements (including resource limitations), provisions for program funding

and administration, and guidelines for determining the county financially responsible for GA

grants.

Cash Assistance in Minnesota

Minnesota House Research Department Page 3

DHS supervises program administration, and DHS rules govern GA administration in Minnesota.

DHS also issues a detailed program manual for county caseworkers, which includes specific

eligibility criteria and schedules for determining benefits.

The counties administer GA. The county human services agency, with the assistance of the state

agency through the MAXIS computer system, determines if an applicant meets the state’s

eligibility requirements and determines the amount of assistance.

Requirements for State TANF Programs

State programs must meet several requirements, described below, in order to receive the

federal TANF block grant.

First, each state must spend its own resources to provide assistance to needy families. The

federal law includes a maintenance of effort (MOE) provision that requires a state to spend a

specified percentage of the amount it spent in federal fiscal year 1994 under its old AFDC and

related programs, including child care assistance to eligible families. (42 U.S.C. § 609 (a) (7).)

States must meet the MOE requirements in order to receive their full block grants. The MOE

percentage is set at 75 percent for states that meet the federal work participation requirement,

and 80 percent for those that do not. (Minnesota’s MOE percentage is currently set at 75

percent.)

Second, each state must use TANF and MOE funds on the four goals of the federal program,

which are to: (1) provide assistance to needy families so that children may be cared for in their

own homes or in the homes of relatives; (2) end the dependence of needy parents on

government benefits by promoting job preparation, work, and marriage; (3) prevent and

reduce the incidence of out-of-wedlock pregnancies and establish annual numerical goals for

preventing and reducing the incidence of these pregnancies; and (4) encourage the formation

and maintenance of two-parent families. (45 C.F.R. § 260.20.)

Third, each state must meet federal work participation requirements: a 50 percent work

participation requirement for all families and a 90 percent requirement for two-parent families

receiving welfare. A work-eligible individual counts as engaged in work for a month for the

overall rate if he or she participates in work activities during the month for at least a minimum

average of 30 hours per week and at least 20 of those hours per week come from participation

in nine core activities.

2

A family with two work-eligible parents counts as engaged in work for

the month for the two-parent rate if work-eligible parents in the family are participating in

work activities for a combined average of at least 35 hours per week during the month and at

least 30 of the 35 hours per week come from participation in nine core activities. If the family

receives federally funded child care assistance and an adult in the family is not disabled or

caring for a severely disabled child, then the work-eligible individuals must participate in work

activities for an average of at least 55 hours per week (at least 50 of the 55 hours per week

2

The nine core work activities include: (1) unsubsidized employment; (2) subsidized private sector employment;

(3) subsidized public sector employment; (4) work experience, if sufficient private sector employment is not

available; (5) on-the-job training; (6) job search and job readiness assistance; (7) community service programs; (8)

vocational educational training; and (9) job skills training directly related to employment.

Cash Assistance in Minnesota

Minnesota House Research Department Page 4

must come from participation in the nine core activities) to count as a two-parent family

engaged in work for the month.

3

Fourth, each state must have a system in place for determining whether the hours it reports

toward the work participation rates correspond to the hours in which work-eligible individuals

actually participate in work activities.

Finally, each state must have a system in place for sanctioning recipients who do not comply

with program requirements.

Requirements for Recipients

Cash assistance recipients must meet several requirements in order to be eligible for assistance.

Below are the basic eligibility requirements for the MFIP and GA programs.

Minnesota Family Investment Program

In order to be eligible for MFIP, a family must meet income and asset limits. To be eligible for

MFIP, family income, after all allowable deductions are made, must be below the program’s

established family wage level for a family of like size (for example, $1,436 per month for a

family of three).

The equity value of an assistance unit’s personal property (assets) must not exceed $10,000.

Personal property is limited to: (1) cash; (2) bank accounts; (3) liquid stocks and bonds that can

be readily accessed without a financial penalty; (4) vehicles that are not excluded (one vehicle

per assistance unit member age 16 or older is excluded from the personal property limitation);

and (5) the full value of business accounts used to pay expenses not related to the business.

To receive MFIP, families who meet the program’s income and asset limits must also:

have a minor child in the home (or be pregnant);

be residents of Minnesota;

be U.S. citizens, qualified noncitizens, or noncitizens otherwise lawfully residing in

the United States;

assign rights to child support;

have received fewer than 60 months of assistance; and

satisfy any other eligibility requirements of the program.

3

See Code of Federal Regulations, title 45, § 261.32.

Cash Assistance in Minnesota

Minnesota House Research Department Page 5

General Assistance

The GA program provides aid to individuals or couples who are not eligible for federally funded

assistance programs, but who are unable to provide for themselves.

4

An applicant qualifies for

GA if he or she meets the eligibility standards set by state law and has income and assets below

the limits established by the state legislature and DHS.

Maximum net earned and unearned income must be less than the need standard ($203 per

month for an individual and $260 per month for a married couple).

The equity value of an assistance unit’s personal property must not exceed $10,000. Personal

property is limited to: (1) cash; (2) bank accounts; (3) liquid stocks and bonds that can be

readily accessed without a financial penalty; (4) vehicles that are not excluded (one vehicle per

assistance unit member age 16 or older is excluded from the personal property limitation); and

(5) the full value of business accounts used to pay expenses not related to the business.

In addition to having financial need, a GA applicant must also:

be a resident of Minnesota;

be ineligible for aid from any cash assistance program that uses federal funds (i.e.,

MFIP or SSI);

be a citizen of the United States; and

be unable to work because the applicant meets certain standards of

“unemployability” including, but not limited to: (1) having a professionally certified

illness, injury, or incapacity expected to continue for more than 45 days and that

prevents the person from getting or keeping a job; (2) having a diagnosed

developmental disability or mental illness that prevents the person from getting or

keeping a job; (3) residing in a shelter facility for battered women that has a contract

with the Department of Corrections; (4) being needed in the home to care for a

person whose age or medical condition requires continuous care; or (5) being a

person whose alcohol and drug addiction is a material factor that contributes to the

person’s disability and who has been assessed by the county agency to determine if

he or she is amenable to treatment.

4

See Minn. Stat. § 256D.01.

Cash Assistance in Minnesota

Minnesota House Research Department Page 6

Funding for Cash Assistance

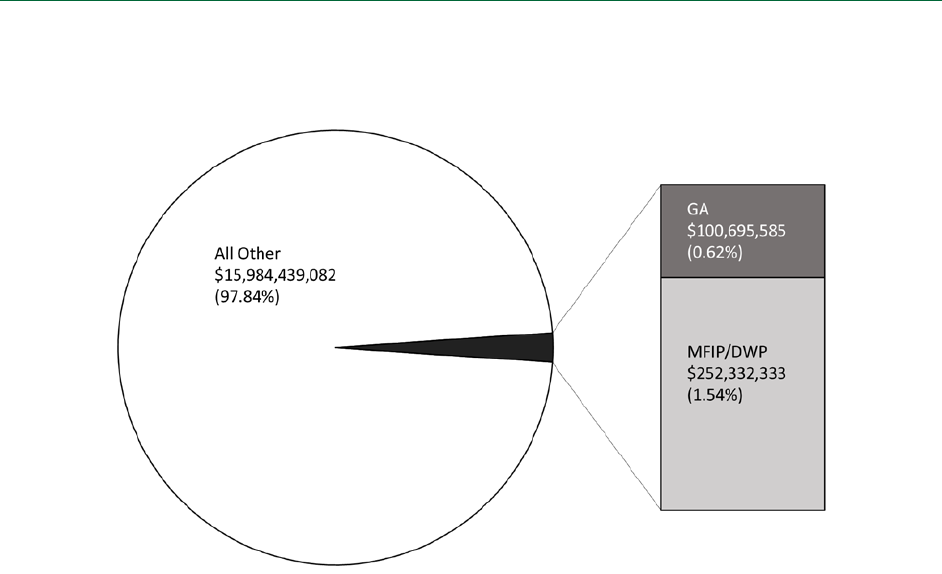

The charts below show the percentage of the state general fund budget spent on cash

assistance and the percentage of the health and human services portion of the general fund

budget that is spent on cash assistance for fiscal years 2022 to 2023.

The percent of state general fund dollars projected to be spent on cash assistance is less than 1

percent (0.66 percent).

Percent of State General Fund Used for Cash Assistance Programs

FY 2022-2023 (Projected)

DWP: Diversionary Work Program

5

Source: Minnesota Department of Human Services, February 2022 Forecast

When accounting for just the general fund money allocated for health and human services,

cash assistance makes up more than 2 percent of those funds.

5

DWP is a program lasting for four months that helps people to quickly find work so that they don't need to receive

MFIP assistance. When people first apply for MFIP, many will be enrolled in DWP.

Cash Assistance in Minnesota

Minnesota House Research Department Page 7

Percent of HHS General Fund Budget Used for Cash Assistance Programs

(FY 2022-223)

Source: Minnesota Department of Human Services, February 2022 Forecast

The following tables show annual funding for MFIP and GA for fiscal years 2014 to 2023. Total

annual state payments for MFIP increased in fiscal years 2020 and 2021, primarily due to

increasing caseloads due to the COVID-19 pandemic and increased monthly benefits that took

effect on October 1, 2021, before decreasing in fiscal year 2022 and beyond. Total annual

payments for GA have increased over time due to increased caseloads.

Cash Assistance in Minnesota

Minnesota House Research Department Page 8

MFIP Total Annual Cash and Food Federal and State Payments

FY 2014-2023 (in thousands)

Source: Minnesota Department of Human Services, February 2022 Forecast

*FY 2022 and 2023 numbers are projections

GA Total Annual State Payments

FY 2014-2023 (in thousands)

Source 2014 2015 2016 2017 2018 2019 2020 2021 2022* 2023*

State $51,125 $51,436 $50,444 $49,556 $48,883 $50,302 $49,778 $56,011 $49,399 $51,297

Source: Minnesota Department of Human Services, February 2022 Forecast

* FY 2022 and 2023 numbers are projections

Program Recipients

Number of People Receiving Cash Assistance?

The table below shows the number of average monthly recipients (average monthly cases for

GA) in Minnesota for fiscal years 2014 to 2023.

The MFIP caseload increased during fiscal year 2021 due to the COVID-19 pandemic. In fiscal

year 2023, a monthly average of 82,458 people are estimated to receive MFIP.

Cash Assistance in Minnesota

Minnesota House Research Department Page 9

The number of cases for GA is projected to be 23,460 for fiscal year 2023. The GA caseload

tends to increase during economic downturns, since it is a safety net program.

6

MFIP and GA Average Monthly Recipients

FY 2014-2023

Program 2014 2015 2016 2017 2018 2019 2020 2021 2022* 2023*

MFIP 104,116 93,995 91,159 95,165 90,736 81,908 79,756 91,517 81,676 82,458

GA 23,019 23,250 23,230 23,238 23,238 23,176 23,361 25,501 22,740 23,460

Source: Minnesota Department of Human Services, February 2022 Forecast

* FY 2022 and 2023 numbers are projections

** GA numbers are average monthly cases

Average Length of Time Receiving Assistance

The federal TANF law sets a lifetime limit of 60 months

7

for assistance units that include an

adult who receives assistance using federal TANF money. According to DHS, the average length

of time MFIP-eligible adult cases spent on MFIP in December 2018 was 31 months.

There is no time limit for GA recipients. The average length of time a person receives GA is

currently 19 months for each occurrence

8

and 41.2 cumulative months.

Amount of Benefits Received

Minnesota Family Investment Program

MFIP benefits are based on family size, with the MFIP grant composed of a cash portion and a

food portion.

9

The table below shows the maximum amount of cash and food assistance a

family would receive based on family size, assuming no income. Benefit amounts are reduced

6

For more information on GA caseload trends, see the December 2019 General Assistance Report, Minnesota

Department of Human Services, August 2021, page 10 (https://edocs.dhs.state.mn.us/lfserver/Public/DHS-6128L-

ENG).

7

The state MFIP law specifies several situations where time spent on MFIP does not count toward the 60-month

lifetime limit on assistance. For example, MFIP caregivers who are age 60 or over are exempt from the 60-month

lifetime limit on assistance. In addition, some families may be eligible for MFIP after they reach the 60-month

limit if they meet the eligibility criteria for an extension under one of three categories: ill or incapacitated, hard to

employ, or certain employed participants.

8

For more information on GA caseload trends, see the December 2019 General Assistance Report, Minnesota

Department of Human Services, August 2021, pages 27 to 28 (https://edocs.dhs.state.mn.us/lfserver/Public/DHS-

6128L-ENG).

9

MFIP families receive the food portion of assistance as a part of the MFIP grant, instead of receiving a separate

benefit through the federal SNAP program. The MFIP food portion uses the same EBT mechanism to deliver the

food benefits as the SNAP program does.

Cash Assistance in Minnesota

Minnesota House Research Department Page 10

as family income

10

increases, but families with income are better off overall. For example, as of

January 1, 2022, the maximum MFIP benefit for a household of three with no income is $1,189.

For a household of three working 30 hours per week at $10.33 per hour, gross monthly

earnings are $1,332.57 and the MFIP benefit is $674, for total monthly income of $2,006.57.

11

In addition to the assistance standards below, households meeting certain criteria are also

eligible for a housing assistance grant of $110 per month.

MFIP Assistance Standards

Effective October 1, 2022

Family Size

Full Transitional

Standard

Food Portion Cash Portion

1 $615 $235 $380

2 1,014 431 583

3 1,305 619 686

4 1,570 788 782

5 1,810 945 865

6 2,095 1,148 947

7 2,282 1,252 1,030

8 2,528 1,426 1,102

9 2,772 1,600 1,172

10 3,009 1,777 1,232

over 10 (add for each

additional member) 236 178 58

House Research Department

General Assistance

GA recipients receive a monthly cash assistance payment, called a grant. The amount of a

recipient’s grant is determined by subtracting the recipient’s net income from the applicable

monthly GA assistance standard.

10

MFIP benefit calculations include an earned income disregard of the first $65 of earned income per wage earner

plus half of the remaining earned income of the assistance unit.

11

For more information on MFIP benefit amounts, see Minnesota Department of Human Services Bulletin #22-11-

01, “Work Will Always Pay with MFIP, January 1, 2022

(https://www.dhs.state.mn.us/main/idcplg?IdcService=GET_FILE&RevisionSelectionMethod=LatestReleased&Re

ndition=Primary&allowInterrupt=1&noSaveAs=1&dDocName=dhs-331418).

Cash Assistance in Minnesota

Minnesota House Research Department Page 11

Monthly GA Standards for Single Persons and Childless Couples

Eligible Units

Monthly

Standard

One adult $203

Emancipated minor 203

One adult, living with parent(s) who have no

minor children 203

Minor not living with parent, stepparent, or legal

custodian (with social service plan approval) 250

Married couple with no children 260

One adult, living in a medical facility or in group

residential housing 111

Other Program Eligibility

Cash assistance recipients may be eligible for several other federal and state programs,

including:

subsidized health care programs such as Medical Assistance or MinnesotaCare;

food support;

child care assistance;

subsidized housing; and

other short-term assistance.

For more information on other programs, see the House Research Department publication

Minnesota Family Assistance, January 2022.

Minnesota House Research Department provides nonpartisan legislative, legal, and

information services to the Minnesota House of Representatives. This document

can be made available in alternative formats.

www.house.mn/hrd | 651-296-6753 | 155 State Office Building | St. Paul, MN 55155