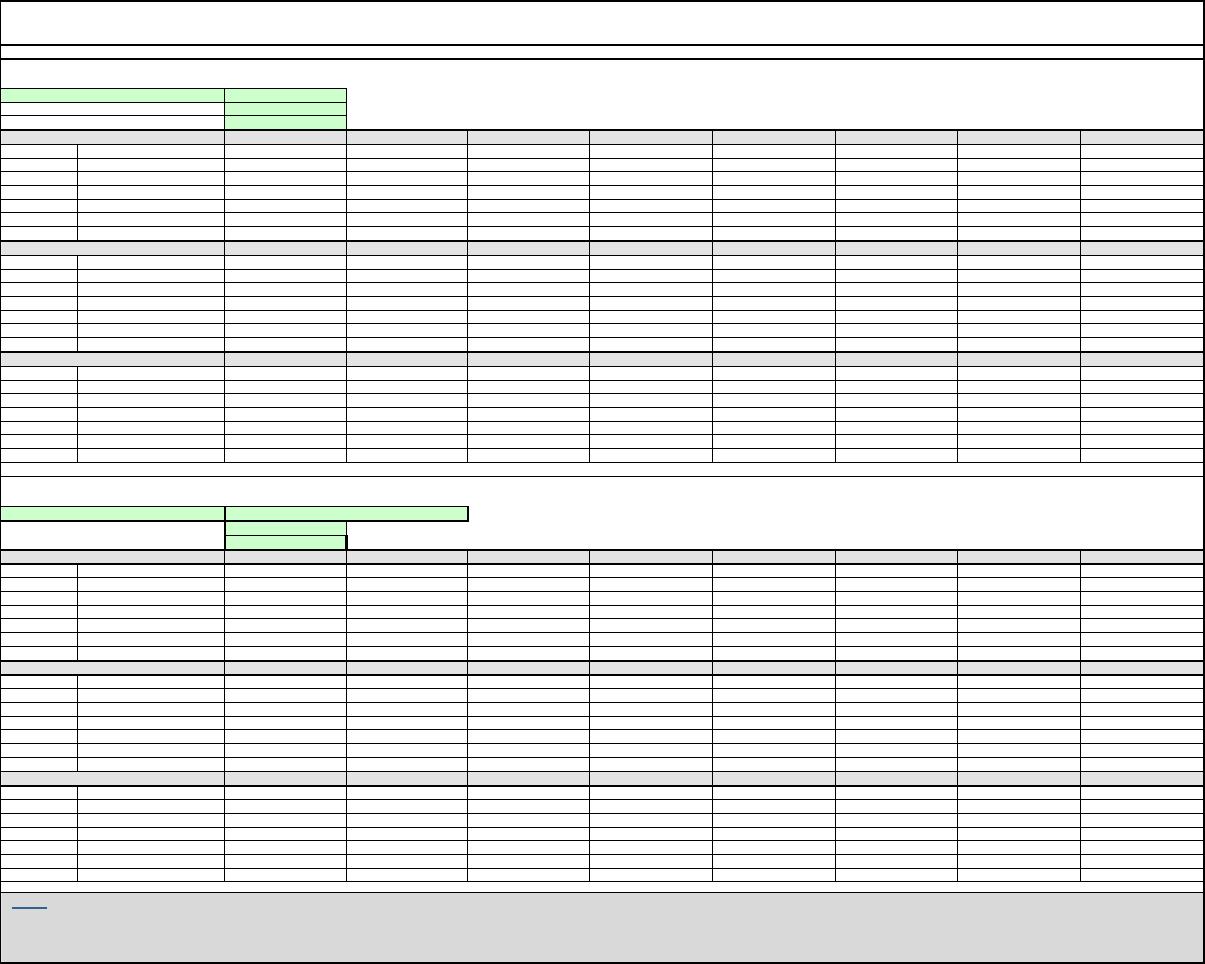

Baltimore City, Baltimore County, Anne Arundel, Carroll, Harford, Howard, and Queen Anne's Counties

HMFA

122,200

4 person 50% limit= 61,100

1 Person 2 Person 3 Person 4 Person 5 Person 6 Person 7 Person 8 Person

20% 17120 19560 22000 24440 26400 28360 30320 32280

30% 25680 29340 33000 36660 39600 42540 45480 48420

40% 34240 39120 44000 48880 52800 56720 60640 64560

50% 42800 48900 55000 61100 66000 70900 75800 80700

60% 51360 58680 66000 73320 79200 85080 90960 96840

70% 59920 68460 77000 85540 92400 99260 106120 112980

80% 68480 78240 88000 97760 105600 113440 121280 129120

1 Person 2 Person 3 Person 4 Person 5 Person 6 Person 7 Person 8 Person

20% 428 489 550 611 660 709 758 807

30% 642 733 825 916 990 1063 1137 1210

40% 856 978 1100 1222 1320 1418 1516 1614

50% 1070 1222 1375 1527 1650 1772 1895 2017

60% 1284 1467 1650 1833 1980 2127 2274 2421

70% 1498 1711 1925 2138 2310 2481 2653 2824

80% 1712 1956 2200 2444 2640 2836 3032 3228

0-BR 1-BR 2-BR 3-BR 4-BR 5-BR 6-BR 7-BR

20% 428 458 550 635 709 782

30% 642 687 825 953 1063 1173

40% 856 917 1100 1271 1418 1565

50% 1070 1146 1375 1588 1772 1956

60% 1284 1375 1650 1906 2127 2347

70% 1498 1604 1925 2224 2481 2738

80% 1712 1834 2200 2542 2836 3130

Allegany County

MSA

FY 2024 Median Family Income: 82,300

4 person 50% limit= 42,500

1 Person 2 Person 3 Person 4 Person 5 Person 6 Person 7 Person 8 Person

20% 11900 13600 15300 17000 18360 19720 21080 22440

30% 17850 20400 22950 25500 27540 29580 31620 33660

40% 23800 27200 30600 34000 36720 39440 42160 44880

50% 29750 34000 38250 42500 45900 49300 52700 56100

60% 35700 40800 45900 51000 55080 59160 63240 67320

70% 41650 47600 53550 59500 64260 69020 73780 78540

80% 47600 54400 61200 68000 73440 78880 84320 89760

1 Person 2 Person 3 Person 4 Person 5 Person 6 Person 7 Person 8 Person

20% 297 340 382 425 459 493 527 561

30% 446 510 573 637 688 739 790 841

40% 595 680 765 850 918 986 1054 1122

50% 743 850 956 1062 1147 1232 1317 1402

60% 892 1020 1147 1275 1377 1479 1581 1683

70% 1041 1190 1338 1487 1606 1725 1844 1963

80% 1190 1360 1530 1700 1836 1972 2108 2244

0-BR 1-BR 2-BR 3-BR 4-BR 5-BR 6-BR 7-BR

20% 297 318 382 442 493 544

30% 446 478 573 663 739 816

40% 595 637 765 884 986 1088

50% 743 796 956 1105 1232 1360

60% 892 956 1147 1326 1479 1632

70% 1041 1115 1338 1547 1725 1904

80% 1190 1275 1530 1768 1972 2176

Low Income Housing Tax Credit Program Income and Rent Limits

Effective Date: April 1, 2024 (*See Note Below)

STATE OF MARYLAND

Baltimore-Towson

Income Limits Per HH Size

FY 2024 Median Family Income:

Maximum Rent Per HH Size

Maximum Rent Per Bedroom

Income Limits Per HH Size

Maximum Rent Per HH Size

Maximum Rent Per Bedroom

* NOTE: These Low Income Housing Tax Credit (LIHTC) income limits apply only to properties with a Placed in Service (PIS) Date of May 15, 2023 or later. If a LIHTC property PlS prior to this date,

please refer to the income limit calculator on the Novogradac website (www.novoco.com) to ensure that the property is using income limits that take into account the Hold Harmless provisions under

the Internal Revenue Code. The Hold Harmless Limits may be higher than the current income limits.

Cumberland

Page 1 of 8

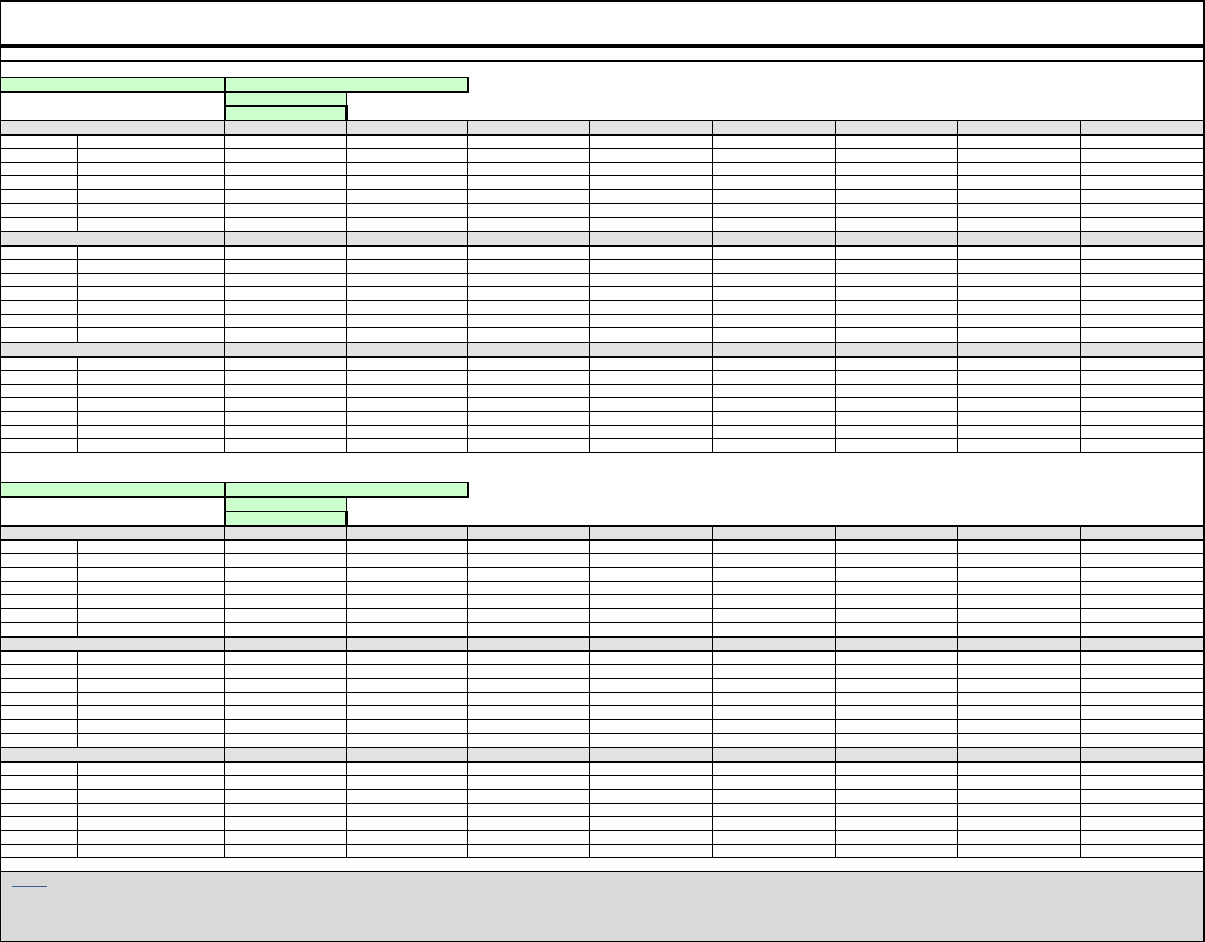

Low Income Housing Tax Credit Program Income and Rent Limits

Effective Date: April 1, 2024 (*See Note Below)

STATE OF MARYLAND

Washington County

HMFA

FY 2024 Median Family Income: 90,900

4 person 50% limit= 45,450

1 Person 2 Person 3 Person 4 Person 5 Person 6 Person 7 Person 8 Person

20% 12740 14560 16380 18180 19640 21100 22560 24000

30% 19110 21840 24570 27270 29460 31650 33840 36000

40% 25480 29120 32760 36360 39280 42200 45120 48000

50% 31850 36400 40950 45450 49100 52750 56400 60000

60% 38220 43680 49140 54540 58920 63300 67680 72000

70% 44590 50960 57330 63630 68740 73850 78960 84000

80% 50960 58240 65520 72720 78560 84400 90240 96000

1 Person 2 Person 3 Person 4 Person 5 Person 6 Person 7 Person 8 Person

20% 318 364 409 454 491 527 564

30% 477 546 614 681 736 791 846 900

40% 637 728 819 909 982 1055 1128 1200

50% 796 910 1023 1136 1227 1318 1410 1500

60% 955 1092 1228 1363 1473 1582 1692 1800

70% 1114 1274 1433 1590 1718 1846 1974 2100

80% 1274 1456 1638 1818 1964 2110 2256 2400

0-BR 1-BR 2-BR 3-BR 4-BR 5-BR 6-BR 7-BR

20% 318 341 409 472 527 582

30% 477 511 614 709 791 873

40% 637 682 819 945 1055 1164

50% 796 853 1023 1181 1318 1455

60% 955 1023 1228 1418 1582 1746

70% 1114 1194 1433 1654 1846 2037

80% 1274 1365 1638 1891 2110 2328

Cecil County

MSA

FY 2024 Median Family Income: 114,700

4 person 50% limit= 57,350

1 Person 2 Person 3 Person 4 Person 5 Person 6 Person 7 Person 8 Person

20% 16060 18360 20660 22940 24780 26620 28460 30300

30% 24090 27540 30990 34410 37170 39930 42690 45450

40% 32120 36720 41320 45880 49560 53240 56920 60600

50% 40150 45900 51650 57350 61950 66550 71150 75750

60% 48180 55080 61980 68820 74340 79860 85380 90900

70% 56210 64260 72310 80290 86730 93170 99610 106050

80% 64240 73440 82640 91760 99120 106480 113840 121200

1 Person 2 Person 3 Person 4 Person 5 Person 6 Person 7 Person 8 Person

20% 401 459 516 573 619 665 711 757

30% 602 688 774 860 929 998 1067 1136

40% 803 918 1033 1147 1239 1331 1423 1515

50% 1003 1147 1291 1433 1548 1663 1778 1893

60% 1204 1377 1549 1720 1858 1996 2134 2272

70% 1405 1606 1807 2007 2168 2329 2490 2651

80% 1606 1836 2066 2294 2478 2662 2846 3030

0-BR 1-BR 2-BR 3-BR 4-BR 5-BR

20% 401 430 516 596 665 734

30% 602 645 774 894 998 1101

40% 803 860 1033 1193 1331 1469

50% 1003 1075 1291 1491 1663 1836

60% 1204 1290 1549 1789 1996 2203

70% 1405 1505 1807 2087 2329 2570

80% 1606 1721 2066 2386 2662 2938

Maximum Rent Per HH Size

Maximum Rent Per Bedroom

Income Limits Per HH Size

Maximum Rent Per HH Size

Maximum Rent Per Bedroom

Phila-Camden-Wilmington

Income Limits Per HH Size

Hagerstown

* NOTE: These Low Income Housing Tax Credit (LIHTC) income limits apply only to properties with a Placed in Service (PIS) Date of May 15, 2023 or later. If a LIHTC property PlS prior to this date,

please refer to the income limit calculator on the Novogradac website (www.novoco.com) to ensure that the property is using income limits that take into account the Hold Harmless provisions under

the Internal Revenue Code. The Hold Harmless Limits may be higher than the current income limits.

Page 2 of 8

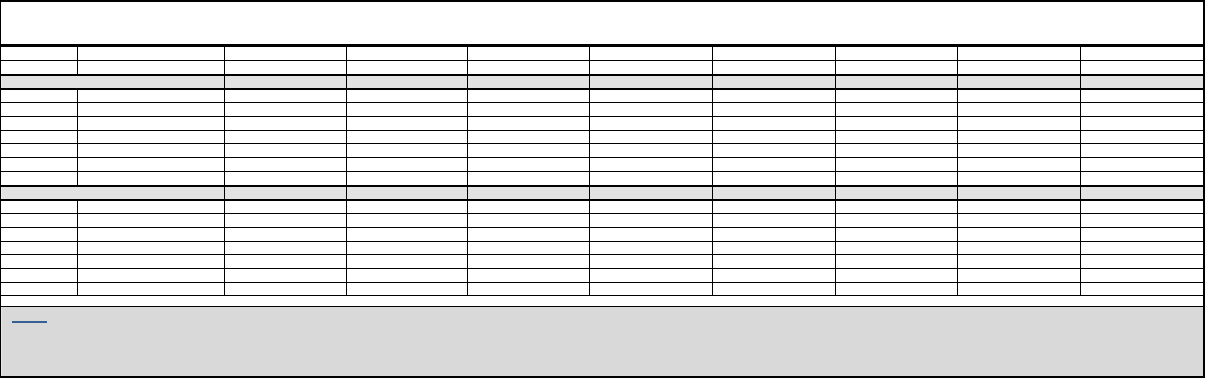

Low Income Housing Tax Credit Program Income and Rent Limits

Effective Date: April 1, 2024 (*See Note Below)

STATE OF MARYLAND

Wicomico

HMFA

FY 2024 Median Family Income: 94,000

4 person 50% limit= 46,850

1 Person 2 Person 3 Person 4 Person 5 Person 6 Person 7 Person 8 Person

20% 13120 15000 16860 18740 20240 21740 23240 24740

30% 19680 22500 25290 28110 30360 32610 34860 37110

40% 26240 30000 33720 37480 40480 43480 46480 49480

50% 32800 37500 42150 46850 50600 54350 58100 61850

60% 39360 45000 50580 56220 60720 65220 69720 74220

70% 45920 52500 59010 65590 70840 76090 81340 86590

80% 52480 60000 67440 74960 80960 86960 92960 98960

1 Person 2 Person 3 Person 4 Person 5 Person 6 Person 7 Person 8 Person

20% 328 375 421 468 506 543 581 618

30% 492 562 632 702 759 815 871 927

40% 656 750 843 937 1012 1087 1162 1237

50% 820 937 1053 1171 1265 1358 1452 1546

60% 984 1125 1264 1405 1518 1630 1743 1855

70% 1148 1312 1475 1639 1771 1902 2033 2164

80% 1312 1500 1686 1874 2024 2174 2324 2474

0-BR 1-BR 2-BR 3-BR 4-BR 5-BR

20% 328 351 421 487 543 599

30% 492 527 632 730 815 899

40% 656 703 843 974 1087 1199

50% 820 878 1053 1218 1358 1499

60% 984 1054 1264 1461 1630 1799

70% 1148 1230 1475 1705 1902 2099

80% 1312 1406 1686 1949 2174 2399

Calvert, Charles, Frederick, Montgomery and Prince George's Counties

HMFA

FY 2024 Median Family Income: 154,700

4 person 50% limit= 77,350

1 Person 2 Person 3 Person 4 Person 5 Person 6 Person 7 Person 8 Person

20% 21660 24760 27860 30940 33420 35900 38380 40860

30% 32490 37140 41790 46410 50130 53850 57570 61290

40% 43320 49520 55720 61880 66840 71800 76760 81720

50% 54150 61900 69650 77350 83550 89750 95950 102150

60% 64980 74280 83580 92820 100260 107700 115140 122580

70% 75810 86660 97510 108290 116970 125650 134330 143010

80% 86640 99040 111440 123760 133680 143600 153520 163440

1 Person 2 Person 3 Person 4 Person 5 Person 6 Person 7 Person 8 Person

20% 541 619 696 773 835 897 959 1021

30% 812 928 1044 1160 1253 1346 1439 1532

40% 1083 1238 1393 1547 1671 1795 1919 2043

50% 1353 1547 1741 1933 2088 2243 2398 2553

60% 1624 1857 2089 2320 2506 2692 2878 3064

70% 1895 2166 2437 2707 2924 3141 3358 3575

80% 2166 2476 2786 3094 3342 3590 3838 4086

0-BR 1-BR 2-BR 3-BR 4-BR 5-BR

20% 541 580 696 804 897 990

30% 812 870 1044 1206 1346 1485

40% 1083 1160 1393 1609 1795 1981

50% 1353 1450 1741 2011 2243 2476

60% 1624 1740 2089 2413 2692 2971

70% 1895 2030 2437 2815 3141 3466

80% 2166 2321 2786 3218 3590 3962

* NOTE: These Low Income Housing Tax Credit (LIHTC) income limits apply only to properties with a Placed in Service (PIS) Date of May 15, 2023 or later. If a LIHTC property PlS prior to this date,

please refer to the income limit calculator on the Novogradac website (www.novoco.com) to ensure that the property is using income limits that take into account the Hold Harmless provisions under

the Internal Revenue Code. The Hold Harmless Limits may be higher than the current income limits.

Salisbury

Income Limits Per HH Size

Maximum Rent Per HH Size

Income Limits Per HH Size

Maximum Rent Per Bedroom

Maximum Rent Per HH Size

Washington-Arlington-Alex.

Maximum Rent Per Bedroom

Page 3 of 8

Low Income Housing Tax Credit Program Income and Rent Limits

Effective Date: April 1, 2024 (*See Note Below)

STATE OF MARYLAND

Caroline County

County

FY 2024 Median Family Income: 80,700

4 person 50% limit= 42,500

1 Person 2 Person 3 Person 4 Person 5 Person 6 Person 7 Person 8 Person

20% 11900 13600 15300 17000 18360 19720 21080 22440

30% 17850 20400 22950 25500 27540 29580 31620 33660

40% 23800 27200 30600 34000 36720 39440 42160 44880

50% 29750 34000 38250 42500 45900 49300 52700 56100

60% 35700 40800 45900 51000 55080 59160 63240 67320

70% 41650 47600 53550 59500 64260 69020 73780 78540

80% 47600 54400 61200 68000 73440 78880 84320 89760

1 Person 2 Person 3 Person 4 Person 5 Person 6 Person 7 Person 8 Person

20% 297 340 382 425 459 493 527 561

30% 446 510 573 637 688 739 790 841

40% 595 680 765 850 918 986 1054 1122

50% 743 850 956 1062 1147 1232 1317 1402

60% 892 1020 1147 1275 1377 1479 1581 1683

70% 1041 1190 1338 1487 1606 1725 1844 1963

80% 1190 1360 1530 1700 1836 1972 2108 2244

0-BR 1-BR 2-BR 3-BR 4-BR 5-BR

20% 297 318 382 442 493 544

30% 446 478 573 663 739 816

40% 595 637 765 884 986 1088

50% 743 796 956 1105 1232 1360

60% 892 956 1147 1326 1479 1632

70% 1041 1115 1338 1547 1725 1904

80% 1190 1275 1530 1768 1972 2176

Dorchester County

County

FY 2024 Median Family Income: 78,800

4 person 50% limit= 42,500

1 Person 2 Person 3 Person 4 Person 5 Person 6 Person 7 Person 8 Person

20% 11900 13600 15300 17000 18360 19720 21080 22440

30% 17850 20400 22950 25500 27540 29580 31620 33660

40% 23800 27200 30600 34000 36720 39440 42160 44880

50% 29750 34000 38250 42500 45900 49300 52700 56100

60% 35700 40800 45900 51000 55080 59160 63240 67320

70% 41650 47600 53550 59500 64260 69020 73780 78540

80% 47600 54400 61200 68000 73440 78880 84320 89760

1 Person 2 Person 3 Person 4 Person 5 Person 6 Person 7 Person 8 Person

20% 297 340 382 425 459 493 527 561

30% 446 510 573 637 688 739 790 841

40% 595 680 765 850 918 986 1054 1122

50% 743 850 956 1062 1147 1232 1317 1402

60% 892 1020 1147 1275 1377 1479 1581 1683

70% 1041 1190 1338 1487 1606 1725 1844 1963

80% 1190 1360 1530 1700 1836 1972 2108 2244

0-BR 1-BR 2-BR 3-BR 4-BR 5-BR

20% 297 318 382 442 493 544

30% 446 478 573 663 739 816

40% 595 637 765 884 986 1088

50% 743 796 956 1105 1232 1360

60% 892 956 1147 1326 1479 1632

70% 1041 1115 1338 1547 1725 1904

80% 1190 1275 1530 1768 1972 2176

Maximum Rent Per Bedroom

Maximum Rent Per HH Size

Caroline

Dorchester

Maximum Rent Per Bedroom

Income Limits Per HH Size

Maximum Rent Per HH Size

* NOTE: These Low Income Housing Tax Credit (LIHTC) income limits apply only to properties with a Placed in Service (PIS) Date of May 15, 2023 or later. If a LIHTC property PlS prior to this date,

please refer to the income limit calculator on the Novogradac website (www.novoco.com) to ensure that the property is using income limits that take into account the Hold Harmless provisions under

the Internal Revenue Code. The Hold Harmless Limits may be higher than the current income limits.

Income Limits Per HH Size

Page 4 of 8

Low Income Housing Tax Credit Program Income and Rent Limits

Effective Date: April 1, 2024 (*See Note Below)

STATE OF MARYLAND

Garrett County

County

FY 2024 Median Family Income: 86,600

4 person 50% limit= 43,300

1 Person 2 Person 3 Person 4 Person 5 Person 6 Person 7 Person 8 Person

20% 12140 13860 15600 17320 18720 20100 21480 22880

30% 18210 20790 23400 25980 28080 30150 32220 34320

40% 24280 27720 31200 34640 37440 40200 42960 45760

50% 30350 34650 39000 43300 46800 50250 53700 57200

60% 36420 41580 46800 51960 56160 60300 64440 68640

70% 42490 48510 54600 60620 65520 70350 75180 80080

80% 48560 55440 62400 69280 74880 80400 85920 91520

1 Person 2 Person 3 Person 4 Person 5 Person 6 Person 7 Person 8 Person

20% 303 346 390 433 468 502 537 572

30% 455 519 585 649 702 753 805 858

40% 607 693 780 866 936 1005 1074 1144

50% 758 866 975 1082 1170 1256 1342 1430

60% 910 1039 1170 1299 1404 1507 1611 1716

70% 1062 1212 1365 1515 1638 1758 1879 2002

80% 1214 1386 1560 1732 1872 2010 2148 2288

0-BR 1-BR 2-BR 3-BR 4-BR 5-BR

20% 303 325 390 450 502 554

30% 455 487 585 675 753 831

40% 607 650 780 901 1005 1109

50% 758 812 975 1126 1256 1386

60% 910 975 1170 1351 1507 1663

70% 1062 1137 1365 1576 1758 1940

80% 1214 1300 1560 1802 2010 2218

Somerset County

County

FY 2024 Median Family Income: 70,300

4 person 50% limit= 42,500

1 Person 2 Person 3 Person 4 Person 5 Person 6 Person 7 Person 8 Person

20% 11900 13600 15300 17000 18360 19720 21080 22440

30% 17850 20400 22950 25500 27540 29580 31620 33660

40% 23800 27200 30600 34000 36720 39440 42160 44880

50% 29750 34000 38250 42500 45900 49300 52700 56100

60% 35700 40800 45900 51000 55080 59160 63240 67320

70% 41650 47600 53550 59500 64260 69020 73780 78540

80% 47600 54400 61200 68000 73440 78880 84320 89760

1 Person 2 Person 3 Person 4 Person 5 Person 6 Person 7 Person 8 Person

20% 297 340 382 425 459 493 527 561

30% 446 510 573 637 688 739 790 841

40% 595 680 765 850 918 986 1054 1122

50% 743 850 956 1062 1147 1232 1317 1402

60% 892 1020 1147 1275 1377 1479 1581 1683

70% 1041 1190 1338 1487 1606 1725 1844 1963

80% 1190 1360 1530 1700 1836 1972 2108 2244

0-BR 1-BR 2-BR 3-BR 4-BR 5-BR

20% 297 318 382 442 493 544

30% 446 478 573 663 739 816

40% 595 637 765 884 986 1088

50% 743 796 956 1105 1232 1360

60% 892 956 1147 1326 1479 1632

70% 1041 1115 1338 1547 1725 1904

80% 1190 1275 1530 1768 1972 2176

Kent County

County

FY 2024 Median Family Income: 109,700

4 person 50% limit= 51,050

1 Person 2 Person 3 Person 4 Person 5 Person 6 Person 7 Person 8 Person

20% 14300 16340 18380 20420 22060 23700 25340 26960

30% 21450 24510 27570 30630 33090 35550 38010 40440

40% 28600 32680 36760 40840 44120 47400 50680 53920

50% 35750 40850 45950 51050 55150 59250 63350 67400

60% 42900 49020 55140 61260 66180 71100 76020 80880

Kent

Maximum Rent Per HH Size

Maximum Rent Per Bedroom

Income Limits Per HH Size

Income Limits Per HH Size

Garrett

Somerset

Income Limits Per HH Size

Maximum Rent Per HH Size

Maximum Rent Per Bedroom

Page 5 of 8

Low Income Housing Tax Credit Program Income and Rent Limits

Effective Date: April 1, 2024 (*See Note Below)

STATE OF MARYLAND

70% 50050 57190 64330 71470 77210 82950 88690 94360

80% 57200 65360 73520 81680 88240 94800 101360 107840

1 Person 2 Person 3 Person 4 Person 5 Person 6 Person 7 Person 8 Person

20% 357 408 459 510 551 592 633 674

30% 536 612 689 765 827 888 950 1011

40% 715 817 919 1021 1103 1185 1267 1348

50% 893 1021 1148 1276 1378 1481 1583 1685

60% 1072 1225 1378 1531 1654 1777 1900 2022

70% 1251 1429 1608 1786 1930 2073 2217 2359

80% 1430 1634 1838 2042 2206 2370 2534 2696

0-BR 1-BR 2-BR 3-BR 4-BR 5-BR

20% 357 383 459 531 592 653

30% 536 574 689 796 888 980

40% 715 766 919 1062 1185 1307

50% 893 957 1148 1327 1481 1634

60% 1072 1149 1378 1593 1777 1961

70% 1251 1340 1608 1858 2073 2288

80% 1430 1532 1838 2124 2370 2615

Maximum Rent Per HH Size

* NOTE: These Low Income Housing Tax Credit (LIHTC) income limits apply only to properties with a Placed in Service (PIS) Date of May 15, 2023 or later. If a LIHTC property PlS prior to this date,

please refer to the income limit calculator on the Novogradac website (www.novoco.com) to ensure that the property is using income limits that take into account the Hold Harmless provisions under

the Internal Revenue Code. The Hold Harmless Limits may be higher than the current income limits.

Maximum Rent Per Bedroom

Page 6 of 8

Low Income Housing Tax Credit Program Income and Rent Limits

Effective Date: April 1, 2024 (*See Note Below)

STATE OF MARYLAND

St. Mary's County

County

FY 2024 Median Family Income: 143,900

4 person 50% limit= 66,550

1 Person 2 Person 3 Person 4 Person 5 Person 6 Person 7 Person 8 Person

20% 18620 21280 23940 26620 28740 30880 33020 35140

30% 27930 31920 35910 39930 43110 46320 49530 52710

40% 37240 42560 47880 53240 57480 61760 66040 70280

50% 46550 53200 59850 66550 71850 77200 82550 87850

60% 55860 63840 71820 79860 86220 92640 99060 105420

70% 65170 74480 83790 93170 100590 108080 115570 122990

80% 74480 85120 95760 106480 114960 123520 132080 140560

1 Person 2 Person 3 Person 4 Person 5 Person 6 Person 7 Person 8 Person

20% 465 532 598 665 718 772 825 878

30% 698 798 897 998 1077 1158 1238 1317

40% 931 1064 1197 1331 1437 1544 1651 1757

50% 1163 1330 1496 1663 1796 1930 2063 2196

60% 1396 1596 1795 1996 2155 2316 2476 2635

70% 1629 1862 2094 2329 2514 2702 2889 3074

80% 1862 2128 2394 2662 2874 3088 3302 3514

0-BR 1-BR 2-BR 3-BR 4-BR 5-BR

20% 465 498 598 692 772 852

30% 698 748 897 1038 1158 1278

40% 931 997 1197 1384 1544 1704

50% 1163 1246 1496 1730 1930 2130

60% 1396 1496 1795 2076 2316 2556

70% 1629 1745 2094 2422 2702 2982

80% 1862 1995 2394 2768 3088 3408

Talbot County

County

FY 2024 Median Family Income: 106,500

4 person 50% limit= 53,250

1 Person 2 Person 3 Person 4 Person 5 Person 6 Person 7 Person 8 Person

20% 14920 17040 19180 21300 23020 24720 26420 28120

30% 22380 25560 28770 31950 34530 37080 39630 42180

40% 29840 34080 38360 42600 46040 49440 52840 56240

50% 37300 42600 47950 53250 57550 61800 66050 70300

60% 44760 51120 57540 63900 69060 74160 79260 84360

70% 52220 59640 67130 74550 80570 86520 92470 98420

80% 59680 68160 76720 85200 92080 98880 105680 112480

1 Person 2 Person 3 Person 4 Person 5 Person 6 Person 7 Person 8 Person

20% 373 426 479 532 575 618 660 703

30% 559 639 719 798 863 927 990 1054

40% 746 852 959 1065 1151 1236 1321 1406

50% 932 1065 1198 1331 1438 1545 1651 1757

60% 1119 1278 1438 1597 1726 1854 1981 2109

70% 1305 1491 1678 1863 2014 2163 2311 2460

80% 1492 1704 1918 2130 2302 2472 2642 2812

0-BR 1-BR 2-BR 3-BR 4-BR 5-BR

20% 373 399 479 554 618 681

30% 559 599 719 831 927 1022

40% 746 799 959 1108 1236 1363

50% 932 998 1198 1385 1545 1704

60% 1119 1198 1438 1662 1854 2045

70% 1305 1398 1678 1939 2163 2386

80% 1492 1598 1918 2216 2472 2727

Income Limits Per HH Size

Maximum Rent Per HH Size

Maximum Rent Per Bedroom

* NOTE: These Low Income Housing Tax Credit (LIHTC) income limits apply only to properties with a Placed in Service (PIS) Date of May 15, 2023 or later. If a LIHTC property PlS prior to this date,

please refer to the income limit calculator on the Novogradac website (www.novoco.com) to ensure that the property is using income limits that take into account the Hold Harmless provisions under

the Internal Revenue Code. The Hold Harmless Limits may be higher than the current income limits.

Maximum Rent Per Bedroom

Income Limits Per HH Size

California - Lexington Park

Talbot

Maximum Rent Per HH Size

Page 7 of 8

Low Income Housing Tax Credit Program Income and Rent Limits

Effective Date: April 1, 2024 (*See Note Below)

STATE OF MARYLAND

Worcester County

County

FY 2024 Median Family Income: 103,400$

4 person 50% limit= 51,700$

1 Person 2 Person 3 Person 4 Person 5 Person 6 Person 7 Person 8 Person

20% 14480 16560 18620 20680 22340 24000 25660 27300

30% 21720 24840 27930 31020 33510 36000 38490 40950

40% 28960 33120 37240 41360 44680 48000 51320 54600

50% 36200 41400 46550 51700 55850 60000 64150 68250

60% 43440 49680 55860 62040 67020 72000 76980 81900

70% 50680 57960 65170 72380 78190 84000 89810 95550

80% 57920 66240 74480 82720 89360 96000 102640 109200

1 Person 2 Person 3 Person 4 Person 5 Person 6 Person 7 Person 8 Person

20% 362 414 465 517 558 600 641 682

30% 543 621 698 775 837 900 962 1023

40% 724 828 931 1034 1117 1200 1283 1365

50% 905 1035 1163 1292 1396 1500 1603 1706

60% 1086 1242 1396 1551 1675 1800 1924 2047

70% 1267 1449 1629 1809 1954 2100 2245 2388

80% 1448 1656 1862 2068 2234 2400 2566 2730

0-BR 1-BR 2-BR 3-BR 4-BR 5-BR

20% 362 388 465 537 600 662

30% 543 582 698 806 900 993

40% 724 776 931 1075 1200 1324

50% 905 970 1163 1344 1500 1655

60% 1086 1164 1396 1613 1800 1986

70% 1267 1358 1629 1882 2100 2317

80% 1448 1552 1862 2151 2400 2648

Documentation for Maryland Low Income Housing Tax Credit Program Income and Rent Limits

All Median Family Income data, 50% income limits, and 30% income limits are based on the HUD Multifamily Tax Subsidy Projects (MTSP) data sets. Please see the following HUD source:

Data Sets - HUD USER - Policy Development and Research's Information Service

Income Limits and Rent Limits for other housing programs (i.e. Section 8, HOME, etc.) may differ from LIHTC income and rent limits. Information in this chart is to be used only for purposes of the LIHTC program.

All 20%, 30%, 40%, 60%, 70% and 80% income limits calculated based on published 50% income limits as shown in the table below:

Income Limits Based on 50%

20 multiply by 0.4

30 multiply by 0.6

40 multiply by 0.8

50 from HUD/MTSPs

60 multiply by 1.2

70 multiply by 1.4

80 multiply by 1.6

Rent limits per household assume 30% of the income limit as affordability index, divided by 12 for the monthly rent.

Rent limits per bedroom assume 1 person for studio/efficiency and 1.5 persons per bedroom, thereafter.

All calculated income and rent figures are rounded down.

Maximum Rents Per HH Size

Income Limits Per HH Size

* NOTE: These Low Income Housing Tax Credit (LIHTC) income limits apply only to properties with a Placed in Service (PIS) Date of May 15, 2023 or later. If a LIHTC property PlS prior to this date,

please refer to the income limit calculator on the Novogradac website (www.novoco.com) to ensure that the property is using income limits that take into account the Hold Harmless provisions under

the Internal Revenue Code. The Hold Harmless Limits may be higher than the current income limits.

Worcester

Maximum Rent Per Bedroom

Page 8 of 8