International Journal of Recent Technology and Engineering (IJRTE)

ISSN: 2277-3878 (Online), Volume-8, Issue-1, May 2019

1220

Published By:

Blue Eyes Intelligence Engineering &

Sciences Publication

Retrieval Number: A9218058119/19©BEIESP

Journal Website: www.ijrte.org

Moving From Cash to Cashless Economy: - A

Study of Consumer Perception Towards Digital

Transactions

Richa Goel, Seema Sahai, Anita Vinaik, Vikas Garg

Abstract: In this era, we can see a very significant level of

change in the means of making and receiving payments. Due to

constant level of technological infrastructure and policy changes,

there has been an increase in the number of modes of payments.

Cashless economy is the future of Indian economy where there

will be no physical flow of cash. All the payments will be made

and received in the virtual world. Cashless economy got popular

after demonetization where plastic money was widely used. The

study is aimed towards studying the level of awareness among the

citizens about cashless economy. The study also helps in

determining the factors which influence the people to switch

from cash towards cashless payments and what are the benefits

people avail by using other means of payments.The primary data

was collected by distributing questionnaires to 280 respondents,

who have been using any digital mode of payment. Data is

collected from students, working professionals and business class

people. The questionnaire asks questions about the benefits

people avail while using digital payment methods and what are

the various factors which influence the people to use digital

payment methods and what are the risks they face associated with

digital payments.After the research conducted we can say that the

working professionals and business class people use digital

payment methods more. There are various factors which

influence the people to shift such as offers, cashback etc. There is

still a long run for India to be cashless to full extent as the

government needs to develop a smooth and secure infrastructure.

Index terms: Cashless economy, technological development,

demonetization, digital payment methods.

I. INTRODUCTION

The prime minister of India, on 8th November, 2016

demonetized the two largest denominations of currency

notes of INR 500 and INR 1000, which were ceased with

immediate effect with a few exceptions. The entire nation

was in a state of shock because such a huge render was

declared invalid in just one announcement and it was not the

first time the government of India has not taken such a step

earlier. Indian government took this step in 1946 and 1978

but in 2016 it faced a lot of criticism as people were left

with only INR 100 notes or less denomination to transact

with.

Revised Manuscript Received on 30 May 2019.

* Correspondence Author

Richa Goel, AIBS, Amity University,NOIDA, India

Seema Sahai, AIBS, Amity University,NOIDA, India

Anita Vinaik, ABS, Amity University,NOIDA, India

Vikas Garg, Amity University Greater NOIDA, India

© The Authors. Published by Blue Eyes Intelligence Engineering and

Sciences Publication (BEIESP). This is an open access article under the

CC-BY-NC-ND license http://creativecommons.org/licenses/by-nc-nd/4.0/

The main aim of this step was aimed to attack on counterfeit

currency, currency used for terrorist financing, black money

and corruption. Not only this the Prime Minister of India is

also working towards digitization of India (DIGITAL

INDIA). Thus, both moves DEMONETISATION and

DIGITIZATION if worked upon effectively will help the

Indian Economy to become Cashless Economy.Cashless

Economy refers to the term where the physical flow of

currency notes and coins are replaced with digital flow of

money, which includes use of plastic money, digital means

and over the net transactions. Such a replacement doesn’t

mean immediate removal of currency notes but slowly and

gradually expelling of paper currency by means of following

a proper procedure.Physical money means the paper

currency notes and coins issued by the government as legal

tender. Plastic money involves the use of plastic cards such

as debit cards, credit cards, pre-paid cards, contact less cards

etc. Electronic payment modes include all kinds of mobile

wallets and payments made done through smart phones,

laptops etc.

A. AROUND THE WORLD SCENARIO

As per the survey conducted by CNBC most cashless

countries are:

Germany:

Share of non-cash payments: 76%

Share of people using debit cards:88%

South Korea:

Share of non-cash payments:70%

Share of people using debit cards:58%

United States of America:

Share of non-cash payments:80%

Share of people using debit cards:72%

The Netherlands:

Share of non-cash payments:85%

Share of people using debit cards:98%

Australia:

Share of non-cash payments:86%

Share of people using debit cards:7

Sweden:

Share of non-cash payments:89%

Share of people using debit cards:96%

Moving From Cash to Cashless Economy: - A Study of Consumer Perception Towards Digital

Transactions

1221

Retrieval Number: A9218058119/19©BEIESP

Journal Website: www.ijrte.org

Published By:

Blue Eyes Intelligence Engineering &

Sciences Publication

United Kingdom:

Share of non-cash payments:89%

Share of people using debit cards:88%

Canada:

Share of non-cash payments:90%

Share of people using debit cards:88%

France:

Share of non-cash payments:92%

Share of people using debit cards:69%

Belgium:

Share of non-cash payments:93%

Share of people using debit cards:86%

B. METHODS OF DIGITAL PAYMENTS IN

INDIA

Banking Cards: These includes all types of plastic cards

such as credit card, debit card, cash card, travel card etc.

they provide 2 factor authentications for a secure

transaction.

USSD: Unstructured Supplementary Service Data is an

innovative of making payments without the use of internet

and smartphone. The payments can be made by a feature

phone by dialling *99#.

AEPS: Aadhar Enabled Payment System is a means by

which a person can make payments at the point of sale by

Aadhar authentication.

UPI: Unified Payment Interface powers multiple bank

accounts into a single mobile application, merging all or

some of the banking services.

Mobile Wallets: It is a means of carrying cash in digital

format. Credit card or debit card can be linked to the mobile

wallet for making payments or some money can be loaded

into the mobile wallet.

Internet Banking: It is a medium through which various

banking services like NEFT, RTGS, ECS, IMPS etc. can be

availed over the institution’s website.

Mobile Banking: It is a service provided by banks providing

its customers a platform to conduct various banking services

by use of their mobile phones or tablets through the apps

provided by the bank.

C. STRENGTHS OF INDIA GOING CASHLESS

A planned strategy: The government of India followed a

detail criterion by first SIT on black money, then Jan Dhan

Yojana which was followed by tracking on foreign accounts

and money hoarders. Then, the income declaration scheme

and finally, demonetization.

Financial inclusion: The government of India is focussing

on reaching all the corner and to every citizen. Many bank

accounts were created throughout the country as an initiative

taken up by government.

Steps taken by Government:

Launch of BHIM app for smartphone users based

on UPI.

Launch of Aadhar merchant pay.

Direct benefit transfer

D. WEAKNESS FACED BY INDIA

Cash is the dominating means of payment in the

Indian economy.

There is 24X7 electricity in India.

E-illiteracy is also a major weakness.

Smartphone market is still untapped.

Lack of technological infrastructure.

Sluggish economy.

E. OPPORTUNITIES AVAILABLE WITH INDIA

AFTER GOING CASHLESS

Curbing black money- Going cashless will bring an

end to the parallel economy running by black

money.

Tax collection- With digitization, tax collection

will be made easy.

Reduced real estate- going cashless will ensure

only payment in white money.

End of corruption- Going cashless will ensure a

proper check on bank accounts, which will reduce

the system of bribery.

F. THREAT WITH GOING CASHLESS

Threat of cyber-crimes.

Threat of loss of database.

Threat of data encryption.

Cash is considered the most convenient and fastest

means of payment.

It is very difficult to gain trust and faith among

Indians, as there are constant ups and downs in the

economy.

II. LITERATURE REVIEW

Mr. Pradeep H. Tawade (2017), “Future and scope of

cashless economy in India.” This paper helps in assessing

the future trends and the impact of going cashless in the

Indian economic scenario. After the study was conducted it

was seen that the Government of India should consider

many more steps in digitalizing India. And payment

methods should be made more secure and risk-free.

Dhanda and Arora (2017), Genesis of cashless society: A

study on growing acceptability towards plastic money. This

paper is aimed towards studying the factors responsible for

the rapid increase in acceptability of plastic card in the

recent years. After the study was conducted it was seen that

use of plastic cards is a matter of great pride among

teenagers and is considered safe and free from any frauds.

International Journal of Recent Technology and Engineering (IJRTE)

ISSN: 2277-3878 (Online), Volume-8, Issue-1, May 2019

1222

Published By:

Blue Eyes Intelligence Engineering &

Sciences Publication

Retrieval Number: A9218058119/19©BEIESP

Journal Website: www.ijrte.org

Dr. Rashmi Gujrati (2017), India’s march towards faceless,

paperless, cashless economy. The paper is aimed towards

creating a sense of awareness about cashless economy, its

benefits, challenges and the steps taken by government

toward cashless economy. After the research conducted it

was seen that cashless economy comes with various benefits

but brings in a lot more challenges with it.

Dr. Asha Sharma (2017), Potential for cashless economy in

India. The study was conducted to find the scope of India

becoming a cashless economy, challenges and opportunities

related to cashless economy. The study shows that there is a

significant scope of Cashless India as we can abolish various

problems we face today but we must be prepared for the

challenges and problems which cashless economy will

bring.

Dominic, Saranya, and Rajani (2018), A study on

transformation in behaviour of individual towards cashless

economy. The study is aimed towards studying the

behavioural changes in individual towards cashless

economy. After the study conducted it was seen that many

individuals have already moved or are moving towards a

cashless nation but there is still a long way for India to

become cashless.

Mr. Bharat Khurana (2015), Dream of cashless India:

Benefits and challenges. The paper studies the benefits and

challenges India might face if it becomes a cashless nation.

It also helps in assessing the meaning of digital India and

steps taken by government towards achieving the dream of

cashless India. After the study no matter how much the

government had done for fulfilling the dream of digital India

but there is still a lot more that can be done to achieve that

dream.

Metri and Jindappa (2017), Impact of cashless economy on

common man in India. The study focusses on effect of going

cashless on a common man living in India and the

challenges related to going cashless. The study shows that

India can never turn into a fully cashless economy as cash

has been the dominating factor and always will be. Going

cashless will only be feasible for a very small section of the

society but not the whole nation.

Kumari and Khanna (2017), Cashless payment: a

behavioural change to an economic growth. The paper aims

to study how a behavioural change led to an economic

growth in the Indian economic scenario. After the study

conducted it was seen that various factors were responsible

for such a change as people were finding various benefits

and opportunities by adopting such a change.

Felix, Rebecca and Igbinoba (2015), Appraisal of the

impact of e-banking and cashless society in the Nigerian

economy. The paper was aimed towards understanding the

impact of e-banking and cashless society on the people of

Nigeria. But after the study was conducted it was seen that

most of Nigerian citizens were not at all aware of such

concepts and those who were aware were not fully using

such facilities and there was no infrastructure development

before implementing such changes.

Kousalya and Shankar (2018), Cashless

economy/transaction. The paper was focussed towards

understanding the impact of cashless economy and its

importance in India. After the research conducted it was

seen that the introduction of cashless economy in India will

bring about a positive impact on the financial sector and will

help in modernisation of the payment system in India.

Kokila and Ushadevi (2017), A study on consumer

behaviour on cashless transaction in U.T. of Puducherry.The

paper was focussed towards understanding the awareness

and trust among the customers about cashless transactions. It

was seen that people were aware about the cashless

transaction but were still in doubt with implementing the

same in daily routine.

Thomas and Krishnamurthy (2017), Cashless rural

economy- a dream or reality. The study is focussed towards

understanding the impact of demonetisation on rural India

and to keep a check on the government initiatives to make

rural market a cashless economy. The studies show that the

government of India should initiate various schemes to

make the dream of cashless economy a reality.

Shrikala K.K. (2017), Cashless Transaction: Opportunities

and Challenges with special reference to Kodagu district of

Karnataka. The paper is aimed to find the opportunities

available in the rural part of India and the challenges which

may be faced while moving towards a cashless economy. It

was seen that there are many opportunities and every

opportunity come with its own challenges, but they can be

avoided with proper implementation.

Shendge, Shelar and Kapase (2017), Impact and

importance of Cashless Transaction in India. The paper

focuses on impact and importance of cashless transactions in

India. The study shows that if India becomes a cashless

economy there will be both positive and negative impact,

but negative impacts can be overlooked if the gain from

positive impact is considered.

Garg and Panchal (2017), Study on Introduction of

cashless economy in India 2016: Benefits & challenges. The

study focusses on finding benefits and challenges related to

cashless economy in India. The study shows that there are

various benefits related to cashless economy and various

challenges related to the cashless economy.

Akinola (2012), Cashless Society, Problems and

Prospects, Data Mining Research Potentials. The is focused

on understanding the cashless society and the problems

related to the same in Nigeria. The study shows that cashless

society will face a lot of challenges and criticism by the

citizens of Nigeria.

Bindra and Bindiya (2017), Going Cashless: stepping

towards Digital India. The study is focussed to find out

benefits, challenges and the growth prospects in India on the

path of moving towards digital India. The study shows that

digital India will bring a huge growth in the GDP of India

and will also have other benefits are the society and the

economy as well.

Thilagavathy and Santhi (2017), Impact and importance of

Cashless Transaction in India. The paper focuses on impact

and importance of cashless transactions in India. The study

shows that if India becomes a cashless economy there will

be both positive and negative impact, but negative impacts

can be overlooked if the gain from positive impact is

considered.

Moving From Cash to Cashless Economy: - A Study of Consumer Perception Towards Digital

Transactions

1223

Retrieval Number: A9218058119/19©BEIESP

Journal Website: www.ijrte.org

Published By:

Blue Eyes Intelligence Engineering &

Sciences Publication

Sharad Malhotra (2017), Impact of Cashless Society for the

Economic Growth in India. The paper focuses on impact

and importance of cashless transactions in India. The study

shows that if India becomes a cashless economy there will

be both positive and negative impact, but negative impacts

can be overlooked if the gain from positive impact is

considered. There would be lower costs and keep a check on

financial crimes and TAX frauds.

III. OBJECTIVES

A. PRIMARY OBJECTIVES

To study consumer awareness on cashless

transactions.

To assess the customer trust and confidence in

cashless transactions.

To study benefits of cashless economy.

To analyse future trends of cashless transactions.

B. SECONDARY OBJECTIVES

To understand the factors influencing the customer

moving towards cashless economy.

To illustrate the steps taken by government to fulfil

the dream of digital India.

To assess the preparedness of Indian Government

for implementing the cashless economy.

To study the socio-economic impact of cashless

economy on the society.

IV. RESEARCH METHODOLOGY

This study reviews literature chosen with the primary as

well as secondary data.

A. Research Design:

The research is analytical and descriptive in nature. The

researcher for the purpose here had made use of primary

data and secondary data. The researcher has made use of

close ended questionnaire where sample of 280 was used.

The data was collected and was analysed by using SPSS

Software.

Secondary sources were also used with respect to Review

of Literature, Journals and articles.

Descriptive Statistics was done by using Mean, Standard

Deviation, Frequency and inferential statistics was used like

correlation, regression and ANOVA.

B. Sources of Data

The data required for doing the research has been collected

mainly by using primary and secondary sources. The

primary sources include the questionnaire. The secondary

source includes the various journals, research paper and

internet websites.

C. Size of Sample

The study has been conducted by using the sample of 280.

V. RESEARCH FINDINGS AND ANALYSIS

SURVEY

A. RESPONSE RATE

This table shows the No. of questionnaires and their validity

received for analysis

B. FINDING OUT DESCRIPTIVE STATISTICS

FREQUENCIES

This table shows the number of respondents and their

demographic information

C. RELIABILITY

The table above shows the degree of the questionnaire’s

reliability. The value of alpha is 0.896 which is more than

0.6. This shows that the data is reliable for further analysis.

D. USING MEAN AND STANDARD DEVIATION

International Journal of Recent Technology and Engineering (IJRTE)

ISSN: 2277-3878 (Online), Volume-8, Issue-1, May 2019

1224

Published By:

Blue Eyes Intelligence Engineering &

Sciences Publication

Retrieval Number: A9218058119/19©BEIESP

Journal Website: www.ijrte.org

As we can see the mean in this table lies between 1 and 3,

it shows that the respondents have a positive approach i.e.

they opted to agree towards the parameters. Standard

deviation shows the degree at which the mean is deviating

from the actual mean.

E. HYPOTHESIS

There is no significant difference between level of

consumer trust and confidence in their cashless

transactions.

There are no significant benefits of cashless

economy to public.

There is no significant difference between level of

awareness among consumers and their cashless

transactions.

There is no significant potential level of cashless

economy in India.

F. CONCEPTUAL FRAMEWORK

G. HYPOTHESIS-1

H0: There is significant difference between level of

consumer trust and confidence in their cashless transactions.

H1: There is no significant difference between level of

consumer trust and confidence in their cashless transactions.

This table shows the relationship between trust and

confidence.

This table shows the significant relationship of Trust and

Confidence, where trust is dependent, and Confidence is

independent.

The test shows that there is a significant relationship

between the level of trust and level of confidence.

So, we fail to reject the null hypothesis.

H. HYPOTHESIS-2

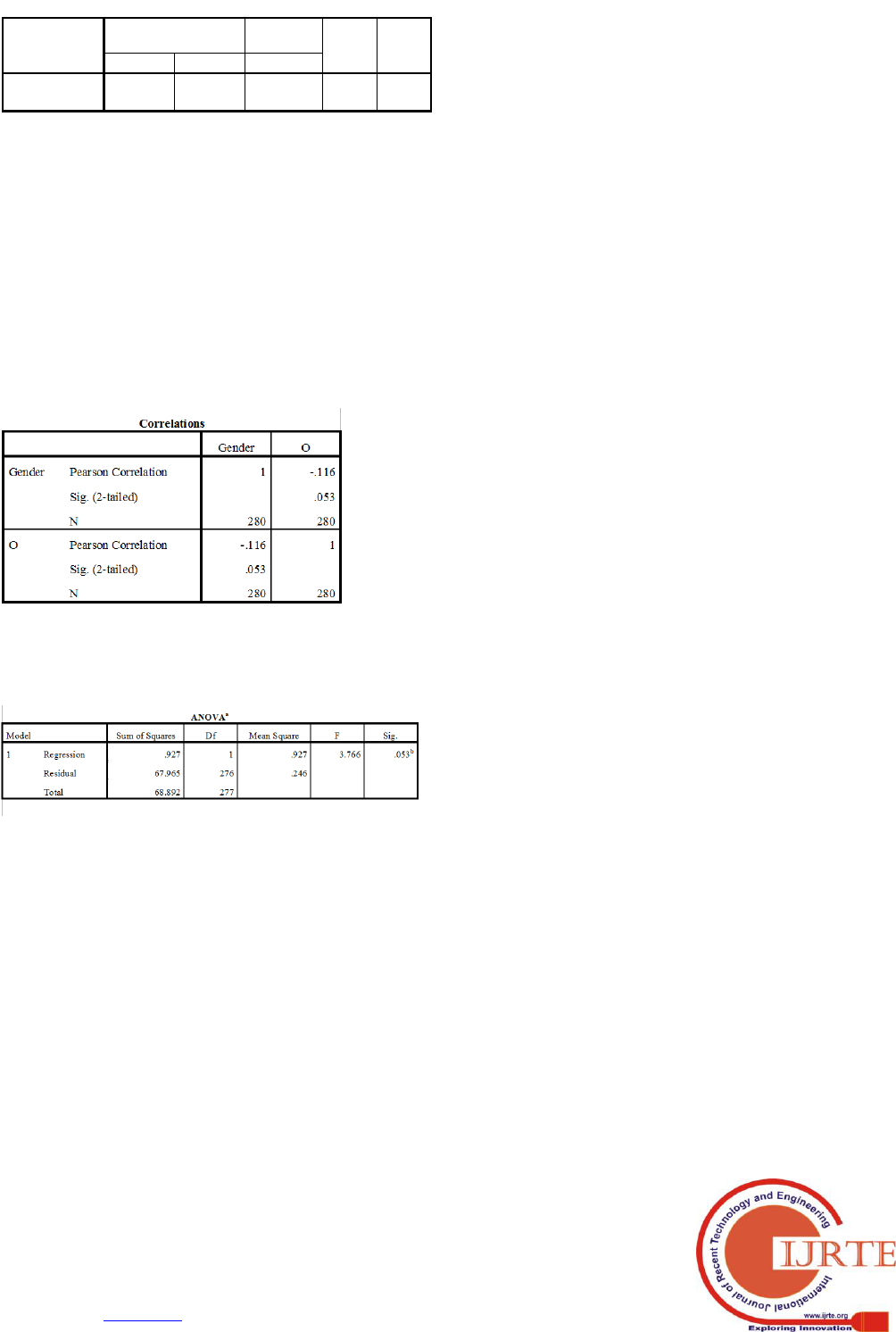

H0: There is no significant relationship between gender and

benefits of cashless economy to public.

H2: There is a significant relationship between gender and

benefits of cashless economy to public.

This table shows the relationship between Gender and

Benefits.

Moving From Cash to Cashless Economy: - A Study of Consumer Perception Towards Digital

Transactions

1225

Retrieval Number: A9218058119/19©BEIESP

Journal Website: www.ijrte.org

Published By:

Blue Eyes Intelligence Engineering &

Sciences Publication

This table shows the significant relationship of Gender and

Benefit, where Gender is dependent, and Benefits is

independent.

Coefficients

Model

Unstandardized Coefficients

Standardized

Coefficients

t

Sig.

B

Std. Error

Beta

1

(Constant)

1.499

.049

30.328

.000

B

-.025

.021

-.070

-1.161

.247

a. Dependent Variable: Gender

The test shows that there is a significant relationship

between the gender and level of benefits from the cashless

society.

So, we reject the null hypothesis and accept the alternate

hypothesis.

I. HYPOTHESIS-3

H0: There is no significant relationship between gender and

the level of optimism towards cashless transactions.

H3: There is a significant relationship between gender and

the level of optimism towards cashless transactions.

This table shows the relationship between Gender and their

level of optimism towards cashless transactions. The

relationship is negative in nature.

The test shows that there is no significant relationship

between the gender and level of optimism towards cashless

transactions.

So we fail to reject the null hypothesis

VI. CONCLUSION

We can conclude that there is a long way for India to

become a cashless economy. People still lack trust and

confidence while using digital payment methods. A lot of

development in the field of infrastructure is required to

make the dream of Digital India a reality. There are many

people who are still not aware about the cashless economy

not only in India but outside of India. Government has faced

a lot of criticism in the past from the public for the various

plans implemented on the public. There are a lot of

challenges in fulfilling the dream of digital India but in the

long run cashless economy will help in growth and will

bring a lot of benefits and opportunities with it.

Few of the major finding according to this study are:

There are still a lot of people who do not use any

kind of digital payment method.

There are a lot of scope in the future for cashless

society.

People are mostly influenced by convenience and

offers provided for switching to cashless modes of

payments.

There is still a lot to be done to digitalise India.

People don’t feel safe sharing their financial and

personal information over the internet.

People face various problems while using digital

payment methods.

VII. KEY SUGGESTIONS

Government of India should try to educate people

about the benefits of going cashless before taking

any crucial steps.

They should also be able to implement their plans

properly and without troubling the public.

They should also tell about the opportunities which

the public will get if they become digital.

People should try and use any digital payment

method at least once.

Government should develop infrastructure to cope

up with any policy change or a plan

implementation beforehand.

People and government should work together to

develop infrastructure and technology to digitalize

India.

REFERENCES

1. Mr. Pradeep H. Tawade (2017), Future and scope of cashless economy

in India

2. Dhanda and Arora (2017), Genesis of cashless society: A study on

growing acceptability towards plastic money

3. Dr. Rashmi Gujrati (2017), India’s march towards faceless, paperless,

cashless economy

4. Dr. Asha Sharma (2017), Potential for cashless economy in India

5. Dominic, Saranya, and Rajani (2018), A study on transformation in

behaviour of individual towards cashless economy

6. Mr. Bharat Khurana (2015), Dream of cashless India: Benefits and

challenges

7. Metri and Jindappa (2017), Impact of cashless economy on common

man in India

8. Kumari and Khanna (2017), Cashless payment: a behavioural change to

an economic growth

9. Felix, Rebecca and Igbinoba (2015), Appraisal of the impact of e-

banking and cashless society in the Nigerian economy

10. Kousalya and Shankar(2018), Cashless economy/transaction

11. Kokila and Ushadevi(2017), A study on consumer behaviour on

cashless transaction in U.T. of Puducherry

12. Thomas and Krishnamurthy (2017), Cashless rural economy- a dream

or reality

13. Shrikala K.K. (2017), Cashless Transaction: Opportunities and

Challenges with special reference to Kodagu district of Karnataka

14. Shendge, Shelar and Kapase (2017), Impact and importance of

Cashless Transaction in India

15. Garg and Panchal (2017), Study on Introduction of cashless economy

in India 2016: Benefits & challenge

International Journal of Recent Technology and Engineering (IJRTE)

ISSN: 2277-3878 (Online), Volume-8, Issue-1, May 2019

1226

Published By:

Blue Eyes Intelligence Engineering &

Sciences Publication

Retrieval Number: A9218058119/19©BEIESP

Journal Website: www.ijrte.org

AUTHORS PROFILE

Dr. Richa Goel is Assistant Professor-Economics

and International Business at Amity International

Business School, Amity University Noida. She is a

Ph.D. in Management and has a journey of almost

18 years in academic and consistently striving to

create a challenging and engaging learning

environment where students become life-long

scholars and learners. Imparting lectures using

different teaching strategies , she is an avid teacher, researcher, and mentor.

She has to her credit a number of publications in reputed national and

international journals accompanied with participation in conferences. She is

serving as a member of review committee for conferences journals and

acting as Lead Editor of Annual International Referred Journal and

Research Coordinator with Amity International Business School. Her area

of interest includes Economics, Business Law, Human Resource

Management and Diversity Management.

Dr. Seema Sahai is Associate Professor in IT &

Operations at Amity International Business School,

Amity University Noida. She is a Ph.D. in

Management and has a journey of 23 years in

academic and consistently striving to create a

challenging and engaging learning environment

She has to her credit a number of publications in

reputed national and international journals accompanied with participation

in conferences. She has a corporate experience of 2 years and has many

projects to her credit.

Dr. Anita venaik with 19 years of work experience in

academics and 4 years in corporates. presently

working as professor at Amity business school .has

written 11 text books in Various subjects in IT

having 12 case studies published in European case

centre also more that 30 research papers in Various

national and international journals

Dr. Vikas Garg is a doctorate in commerce and

management from CCS University, Meerut. He is

currently working as an assistant HOD at Amity

Business School, Amity University Greater Noida

Campus. He is UGC NET qualified. With past

academic experience of 15 years, he has an expertise

in accounting and finance. His areas ofinterests are

financial markets, financial reporting and analysis. He

is associated with several Universities as an external guide for research

scholars. He is lifetime member of Indian Commerce Association, Indian

Accounting Association, Indian ManagementAssociation. He is certified in

Customer Relationship Management from IIM, Bangalore. As a Professor

of Amity University, has been an efficient researcher who has published

many research papers in various international and national journals. He is

highly efficient in different spheres of work and producing quality work.

He has in depth knowledge in the area of finance and accounting and has

been consistent performer in delivering accuracy in his tasks. He has

organized many seminars and workshops at different. He is very good team

leader and always performs the task with creativity.