Securing

the cashless

economy

www.pwc.in

2 PwC

Message from PwC

Cyber security—the protection of valuable intellectual property, business

information and nancial transactions in digital form against theft and

misuse—is an increasingly critical issue. Given the increasing pace and

complexity of threats and the clear focus on realising a more cashless economy,

we must adopt approaches to cyber security that will require much more

engagement from the industry, academia, governments, security establishments

and civil society to protect critical business information without constraining

innovation and growth.

Until now, cyber security has been treated primarily as a technology issue. This

has to change. With technology traversing industries, organisations and indeed

governments, it can no longer be just be a technology issue.

Innovation, disruption and technological advancement are constantly changing

our lives. More sophisticated threats and attacks are being unleashed, with

the same technology being exploited to bring individuals, organisations,

governments—and indeed nations—to their knees. The need of the hour is a

comprehensive, progressive and forward-looking cyber security strategy at the

national level which bridges people, processes and technology, and requires us

to deal with questions of technology, law and privacy.

As the nation stands at the cusp of a digital revolution, our work as

technologists, strategists and captains of industry is clearly cut out. We need to

focus on the basics that will help keep the growth story on course and ensure

that India adopts the right cyber security stance.

As more value migrates online and corporations adopt more innovative ways

of interacting with customers and other partners, the cyber security challenge

will only become more complex. Through this knowledge paper, we have tried

to highlight areas that needs to be re-examined. When addressed properly,

these areas shall help us protect interconnected systems and assist organisations

in India in building strong defences against cyberthreats, thus fostering

organisational growth in this digital age.

Sivarama Krishnan

Leader, Cyber Security

PwC India

3Securing the cashless economy

I am pleased to announce that ASSOCHAM is organising a workshop on

‘Securing the cashless economy’ with participation from the Government,

leading industry experts and other key stakeholders.

Post-demonetization, all forms of digital payments have achieved record

numbers of transactions. This is certainly a positive signal if we intend to move

towards a cashless economy. But the speed of technological development and its

integration into our economy far supersedes the speed of defence mechanisms

that can mitigate cyberattacks. Today, cyber security is reactive in nature, which

brings in the fundamental question of safety on the new payment platforms.

Cyber security is an evolving challenge. Companies, customers, and the

government must collectively participate to mitigate cyberattacks and minimise

their damage.

Globally, most countries are facing a shortage of professionals with the

expertise, training and motivation needed to deal with cybercriminals, and

India is no exception. What we urgently need is serious effort in capacity

building and setting up high-end cyber labs that are capable of critically

inspecting every IT component before these are deployed in critical

infrastructure across industry sectors.

Our prime minister recently asked people to embrace the digital cashless world,

reiterating that digitisation of economic activities is here to stay. We all share a

collective responsibility of building a safe and secure digital infrastructure.

I hope the workshop is a great success.

Message from ASSOCHAM

Babu Lal Jain

Co-Chairman ASSOCHAM

National Council on Cyber Security

4 PwC

Message from ASSOCHAM

The demonetisation initiative of the Government of India is likely to increase

the speed of development and deployment of digital services, thus enabling

the transition towards a cashless economy. With Digital India, the foundation

for transforming India into a digitally empowered and knowledge economy has

been laid.

There is an ever-growing threat to the economy, nancial sector, key

government departments and infrastructure set-up, which in turn leaves

internal security at risk. Therefore, ASSOCHAM believes that our Hon’ble Prime

Minister’s vision of a cashless economy can only be truly fullled with adequate

measures for cyber security.

We at ASSOCHAM have been discussing and deliberating with the concerned

authorities and stakeholders on the need for security compliance and a legal

system for effectively dealing with internal and external cyber security threats.

ASSOCHAM is privileged to be a member of the Joint Working Group on

Cyber Security set up by the National Security Council Secretariat (NSCS),

Government of India, a member of the Cyber Regulation Advisory Committee

and of the Joint Working Group on Digital India—both of which were set up by

the Ministry of Communications and IT, Government of India.

ASSOCHAM is committed to creating more awareness about cyber-related

issues and this background paper, jointly prepared by PwC and ASSOCHAM, is a

step in that direction. We congratulate the team on their efforts.

Finally, we convey our best wishes for the success of the ASSOCHAM Workshop

on ‘Securing the cashless economy’ and hope that it provides more insight into

the emerging cyber-related challenges and appropriate solutions for further

securing cyberspace.

D. S. Rawat

Secretary General

ASSOCHAM

5Securing the cashless economy

Securing the cashless economy

Introduction

The recent demonetisation move

has had a huge impact on various

sectors of the Indian economy and has

signicantly impacted the way people

transact in daily life. From midnight of

8 November 2016, 500 INR and 1,000

INR notes ceased to be considered as

legal tender. While the government’s

aim was to prevent the counterfeiting

of currency, black money, tax

evasion and terrorism funding,

demonetisation also had an impact on

the way people bank in India.

Clearly, the step involved a lot of

planning and entailed measures that

were taken under utmost secrecy.

However, with the announcement

coming into effect, 86% of the total

currency (amounting to 14 trillion INR)

in circulation was abruptly revoked from

the economy.

1

In addition, restrictions

were imposed on the amount which

customers could withdraw and deposit

through platforms such as bank

branches and ATMs.

After the announcement of

demonetisation, multiple guidelines

were issued by RBI. Banks had to

implement changes such as setting

withdrawal limits, changes to cash

management applications, core banking

applications, coupled with the ability to

report additional data to the regulators.

Banks also had to push system

integrators to incorporate these changes

in the various systems such as core

banking systems, ATM switches and

cash inventory management overnight.

The ATM has been the key enabling

technology for dispensing funds. Due

to the change to note dimensions,

recalibrating the machines and making

them operational became the need of

the hour. Because this was a covert

operation, the ATM supporting industry

was unable to recalibrate machines

overnight. Further, more than two

lakh ATMs across the country had to

be recalibrated with the help of just

a few thousand technicians. The fact

that only a few machines were up

and running, together with low cash

availability, led to a domino effect.

The entire population faced a severe

cash crunch, which led to banks and

ATMs being thronged by customers.

The replacement of old notes took

longer than expected, and hence,

routine low-value transactions were

severely affected.

Simultaneously, replacing a large

amount of cash over a 50-day period put

humongous pressure on the banking

system. This led to the adoption of

alternative technology platforms. As a

result, both the number and value of

transactions through these platforms

saw a huge surge. For example,

the value of transactions through

e-wallets witnessed 301% growth

during the period from 8 November

to 27 December 2016. The number

of transactions through POS saw a

massive 95% increase during the

same period. Further, the number of

transactions through RuPay cards shot

up by 425%.

2

The government also

announced some incentives for going

cashless. For example, it was announced

that no service tax will be charged on

digital transactions up to 2,000 INR.

Digital payments made for buying

petrol and diesel were given a discount

of 0.75%. The suburban railway

network also announced a discount of

up to 0.5% to customers for monthly

or seasonal tickets booked through

digital transactions. In addition, life and

general insurance policies and renewal

premiums on public sector undertaking

(PSU) insurers’ websites provided an

8% and 10% discount, respectively.

For payments at toll plazas on national

highways using RFID card/Fast Tags, a

discount of 10% was made available to

users in the year 2016-17.

‘We carried out a secret operation [demonetisation];

it was 10 months of work involving printing new

notes and announced it on November 8.’

– PM Narendra Modi at the foundation stone laying

ceremony of the greeneld airport at Mopa plateau in

Goa (November 2016).

1

http://www.business-standard.com/article/economy-policy/86-of-currency-by-value-in-india-are-of-rs-500-rs-1-000-denominations-116110801416_1.html

2

Ministry of Electronics and Information Technology

6 PwC

By 30 December 2016, old 1,000 INR

and 500 INR notes worth around 13

lakh crore INR were deposited back in

the banking system. However, the rate

at which new notes were infused into

the economy was much lower. Clearly,

the shortage of notes has led to people

considering cashless avenues for

transactions. Although the journey to

creating a cashless economy remains

an ongoing one, there have been

several milestones along the way,

led by RBI and supported by banks

and the other players in the nancial

infrastructure system.

The government has been consistently

investing in various reforms for greater

nancial inclusion. Therefore, after the

demonetisation move, the economy

was ready with the infrastructure

required to take the leap towards a

cashless society. During the last few

years, initiatives such as Jan Dhan

accounts, Aadhaar-enabled payment

system, e-wallets and National

Financial Switch (NFS) have cemented

the government’s resolve to go cashless.

0 1000 2000 3000 4000 5000

RUPAY CARDS

E-WALLETS

UPI

USSD

POS

Growth in % (Value of the Transactions) Growth in % (Number of Transactions)

% Growth inDigital Transactions

On its part, RBI along with National

Payments Corporation of India (NPCI)

leveraged technology and introduced

newer avenues for banking with

the overall objective of improving

customer experience, security and

ease of transactions. The evolution of

India’s nancial infrastructure can be

divided into three phases:

• 1984: Introduction of Magnetic

Ink Character Recognition (MICR)

technology

• 1987: First ATM installed in Kolkata

• 1988: Computerised settlement

operations at clearing houses of RBI

• 1998–2000: Core banking software

2

Second phase of

technology initiatives

• 2001: Internet banking

• 2004: National Financial Switch

(NFS)

• 2004–2005: Real Time Gross

Settlement (RTGS), National

Electronic Funds Transfer (NEFT)

• 2007 : Mobile banking

• 2008: Cheque truncation systems

3

Third phase of

technology initiatives

• 2010: Immediate Payment Service

(IMPS)

• 2012: Adoption of ISO 20022

messaging standard in the Next

Generation RTGS (NG-RTGS) system

• 2014: Jan Dhan Yojana, National

Unied USSD Platform, RuPay Card,

Bharat Bill Payment System (BBPS)

• 2016: Unied Payment Interface

(UPI), payment banks, mobile wallets,

• 2017: Bharat Interface for Money

(BHIM) app

First phase of

technology initiatives

1

Comparative analysis of digital payments during the demonetisation phase

(8 November 2016 to 27 December 2016)

Number of transactions per day Value of transactions per day (in INR)

Platform 08 Nov 16 27-Dec-16 08-Nov-16 27-Dec-16

RuPay cards 3.8 lakhs 20lakhs 39.17 crore 274 crore

E-wallets 22 lakhs 79 lakhs 88 crore 353 crore

UPI 3,721 85,283 1.93 crore 38 crore

USSD 97 4001 1 lakh 49 lakhs

POS 50.2 lakhs 98.1 lakhs 1,221 crore 1751 crore

Source: Ministry of Electronics and Information Technology

7Securing the cashless economy

With the evolution of the nancial

infrastructure ecosystem, the digital

platforms available for payments have

been transformed. Financial inclusion

has gained prominence as the banking

system ourished and various

platforms were adopted in India.

With the rise of technology in the

nancial infrastructure ecosystem came

a greater ow of funds. Today, nancial

inclusion is seen as a realistic dream

because of mobile and smartphone

penetration across the country.

According to TRAI, as on 30

September 2016, 82 out of 100 citizens

in India owned a mobile phone. The

evolution of the telecom ecosystem

has occurred at an opportune time,

given that call and data rates are

decreasing signicantly, along with

the prices of smartphones, further

propelling the shift to a cashless

society. Also, initiatives like USSD and

the *99# service have ensured that

non-smartphone users are also on

board the cashless wave.

Demonetisation has given an impetus

to e-wallet services. Mobile wallets

have witnessed a massive rise in app

downloads. With programmes for

nancial inclusion, digitisation of

the economy and increased use of

smartphones, online transactions are

already quite popular among the urban

Indian population. The result has

been that leading mobile wallets have

witnessed growth of upwards of 100%

in app download numbers and have

similarly seen an increase of upwards

of 400% increase in wallet recharges.

This smartphone revolution has led

to the emergence of e-commerce,

m-commerce and other services,

including app-based cab aggregators,

who encourage digital payments for

use of various services. The value-

added services such as cashback,

bill payment facilities, loyalty

points, rewards and ease of use have

promoted increased usage of such

digital platforms.

‘Scrapping these notes has opened other

avenues to make payments. Download apps of

banks and e-payment options. Shopkeepers can

keep card swiping facilities and everyone can

ensure they pay safe using their credit and debit

cards. If not a 100% cashless society, I request

you to make India “less-cash society”.’

– PM Narendra Modi during his address to the

nation on 27 November 2016

Three generations of digital payments

Ecommerce/

m- commerce

Payment

gateways

Direct

benets

transfer

Point of sale/

mPOS

Payments

banks

BHIM

NEFT/RTGS

AEPS/ABPS

ATMs/micro

ATMs

ECS

BBPS

Mobile

banking

NACH

IMPS

Prepaid/

mobile wallet

NFC/

contactless

payments

Transit

payments

Inclusive

payments

Credit cards/

debit cards

UPI

First generation Second generation Third generation

8 PwC

3X increase in the download

of a leading mobile wallet app

within 2 days of the demonetisation

announcement

1 million: Number of

newly saved credit and debit cards

within two days of demonetisation

announcement

100%: Day-on-day growth

in customer enrolment with leading

mobile wallets after demonetisation

30%: Increase in app usage

and 50% increase in the download of

wallets backed by leading banks

Given the changes initiated by the

government, the steps taken by RBI

and the digital channels that have

opened up, the entire nancial

ecosystem in India has changed. While

traditional brick and mortar banks

and banking operations will still be

relevant, it is important to note that

a shift of value to digital platforms

is already occurring and is set to

increase. These developments have

given rise to a modern payment model.

3

http://www.trai.gov.in/WriteReadData/PressRealease/Document/Press_Release_120_30_12_2016.pdf

Number of transactions (in millions)

1,200

900

600

300

0

Data: Reserve Bank of India

Credit Cards Debit Cards M- wallets

2013-2014 2014-2015 2015-2016

Growth of different payment methods between 2014-2016(%)

600

500

400

300

200

100

0

Number of transactions Value of transactions

Data: Reserve Bank of India

Credit Cards Debit Cards M- wallets

Transactions carried out through mobile wallets (Rs, billion)

550

440

330

220

110

0

2012-2013 2013-2014 2014-2015 2015-2016

Data: Reserve Bank of India

9Securing the cashless economy

Merchants

Acquirer

Payment processing,

settlement and operations

Payment gateways

and aggregators

Outsourcing and

managed services

Business

Person

Government

Business

Person

Government

Issuer

Payee

Payer

Regulator Industry bodies

Support entities

International and Indian card networks

Banks and

non-bank entities

Device

manufacturers

₹

₹

₹

₹

₹

Banks and

non-bank entities

Modern payments model

Modern payment model

The nancial infrastructure ecosystem

is no longer closed due to the inclusion

of more players like payment networks

and digital platforms. The issuers

will be banks and other nancial

institutions providing wallet services

and acquirers will be service providers

who will receive payments on behalf

of the issuers.

Flexibility of transacting will be

a critical success factor for all the

digital platform service providers

in order to ensure and enhance

customer experience. With the

emergence of e-KYC, it is no longer

During this speech at the Global Citizen Festival

(19 November 2016), Prime Minister Modi

referred to the classic song by Bob Dylan: ‘We

better get out of the way as indeed the times they

are a changing.’ Thus, it is quite clear that the

cashless economy is very much a thing of the near

future in the Indian economy.

necessary to know your customer/

payer physically as the payments

model has evolved to beat limitations

related to physical presence. Due to

the emergence of new players, the

payments ecosystem has become

less of a ‘physical presence required’

banking and more of a ‘faceless’

payments ecosystem. Ecosystem

players will continue to emerge

in the modern payments model.

The payer and payee can perform

transactions through endpoints like

smartphones and tablets. That being

said, interoperability has become

realistic due to payment gateways

and aggregators.

10 PwC

Security in Cashless Economy

With more platforms being included in the banking ecosystem, the sources of

transaction origination will see a signicant increase, which means cyberthreats

will continue to evolve. Moreover, cyberthreats will only rise as India is seeing

a shift towards a cashless economy. With more time to detect and time to

respond to these attacks, the return on investments for cyberattacks is greater in

emerging markets like India as compared to developed markets like the US.

4

The

types of cyber security incidents such as phishing, scanning, website intrusions

and defacements, virus code and denial of service attacks will continue to grow.

As the country is experiencing a digital revolution, the impact of this

transformation makes it imperative for nancial service players to revisit their

cyber security resilience. The number of incidents occurring in banking systems

has increased in the last ve years. In the month of October 2016, an ATM card

hack hit Indian banks, affecting around 3.2 million debit cards.

5

Hence, efforts

are needed to enhance cyber security as businesses and citizens embrace this

new digital wave.

Undoubtedly, for the players in the nancial services ecosystem, it’s not business

as usual. A collective effort is needed to ensure preparedness for the new

cashless economy. We believe that the areas below will have to be re-examined

to ensure adaptive and real-time cyber defence. While data will be at the core,

the network perimeter will extend to end devices. Faster development will

demand agile security. More intelligent transaction monitoring will have to be

carried out as part of continuous surveillance. Crisis response and recovery

strategies will have to step up along with the increased digital footprint.

Security awareness of all the stakeholders will be a vital pillar of a secure

cashless society.

4

As per data collected by CERT-In, cyber security incidents are seeing a steady rise, with a total of 39,730 incidents reported in the rst 10 months of 2016, as

against 44,679 and 49,455 observed during the years 2014 and 2015 respectively.

5

http://economictimes.indiatimes.com/industry/banking/nance/banking/3-2-million-debit-cards-compromised-sbi-hdfc-bank-icici-yes-bank-and-axis-

worst-hit/articleshow/54945561.cms

Agile security

practices

Next generation

authentication

Augmented

ecosystem control

Protecting

context-rich PII

Ubiquitous

awareness

Securing the

hyper-interfaced

environment

High velocity

identication,

containment and

eradication

Security of the

new perimeter—

mobility

11Securing the cashless economy

1. Agile security practices: For

nancial services players, faster

development and roll-out of the

services will be a critical success

factor. Accordingly, all technology

development and refresh will

be delivered using an agile

development framework. Security

in this context can no longer be

a standalone post-facto toll gate.

Security assessment and testing

will need to be embedded into the

agile development life cycle. Agile

security testing methods based

on automation will have to be

adopted. In many ways driving, a

paradigm shift is needed in the way

security testing is undertaken today.

2. Securing the hyper-interfaced

environment: The new era will

call for hyper-interoperability across

different value chain players. In

order to enable this, each ecosystem

player will need to create multiple

application programing interfaces

(APIs). While this will deliver a

seamless experience to customer,

there is also a risk of malware

injection through such APIs. With

faster proliferation of interfaces,

protecting APIs will become

critical to ensure malware

and persistent threats do not

propagate through such untrusted/

untested APIs.

3. Next generation authentication:

In the new cashless world,

frauds will be driven mainly by

impersonation and will become a

daily affair. Accordingly, the need

for stronger authentication of

transactions will gain signicance.

The current techniques of

authentication based on location

and timing will no longer be

adequate. Adaptive authentication

will need to be embedded into the

heart of transaction processing.

Next generation authentication will

use triangulation techniques while

considering larger data sets including

the nature of transaction, merchant

type and transaction channel.

4. Protecting context-rich personally

identiable information (PII):

The new generation data marts

will not be limited to traditional

transactions and account-related

information but will have enriched

data insights such as spending

patterns, patterns of digital

platform usage, preferences and

other person-specic information

sets. In an integrated ecosystem,

such data sets may be stored,

transferred or shared with third

parties for revenue generation

opportunities. Both regulators and

organisations will be obligated

to invest in strong processes and

technology to prevent the misuse

of context-driven rich PII. While

traditional controls such as data

masking and encryption will need

to be enhanced, capabilities to

hunt down any misuse of PII will

have to be built by organisations.

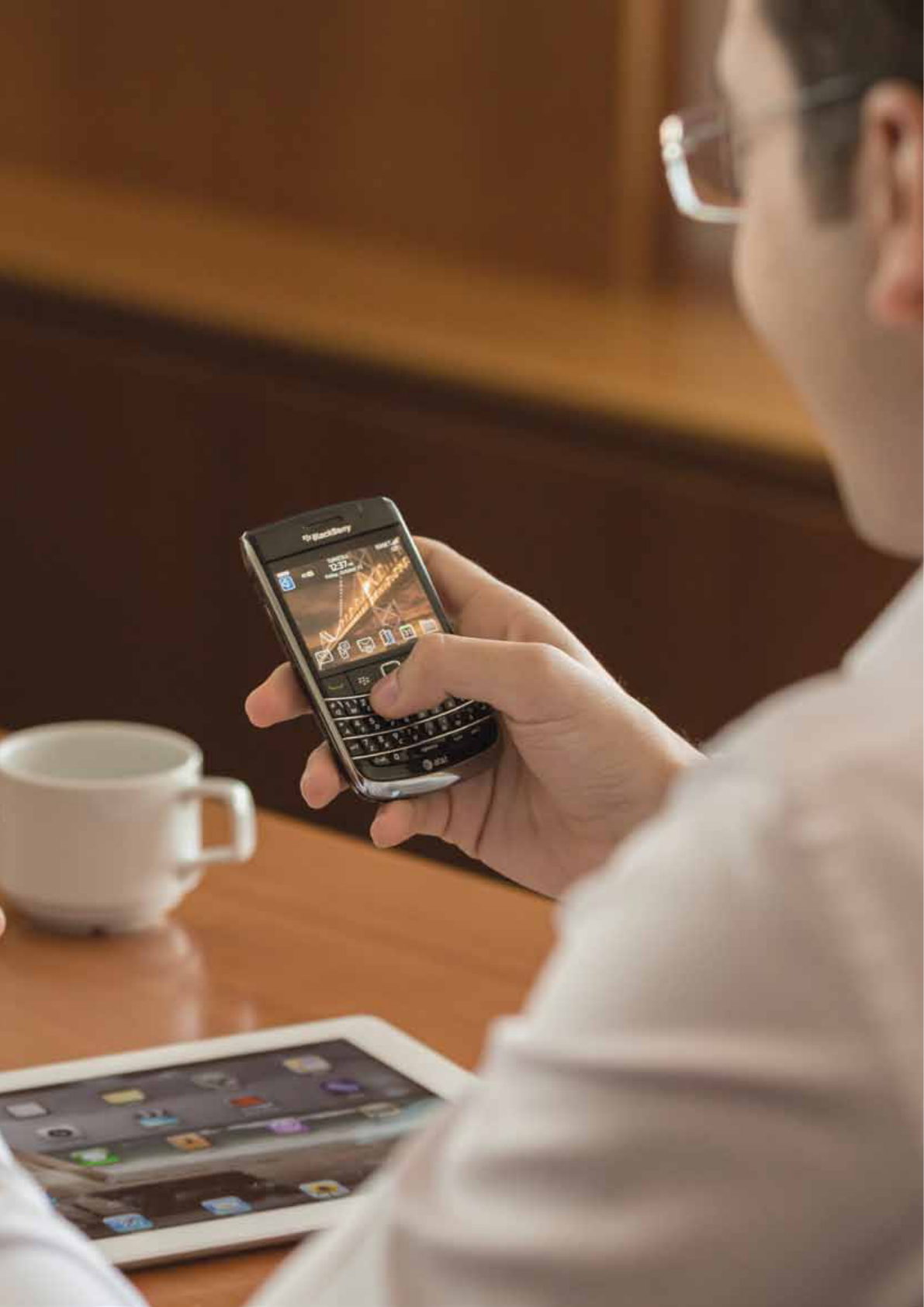

5. Security of the new perimeter—

mobility: In the new digital/

cashless economy, mobility-based

solutions will continue to gain

prominence and, hence, security

concerns will no longer be limited

to the organisation architecture

boundaries. Mobility will form a

new perimeter of the organisation.

In order to ensure endpoint

security containerised apps with

built-in advanced persistent

threat (APT) capabilities will

have to be developed. Controls for

in memory data and additional

controls like device certication will

be considered. To ensure security

of data in endpoints, there may

be a requirement for guidelines to

dene the kind of sensitive data that

end devices retain. Hence, the next

generation nancial infrastructure

may involve the adoption of

advanced end-user device

management solutions.

6. High velocity identication,

containment and eradication:

Each consumer today is using

multiple platforms and using

services across the ecosystem. Any

threat that impacts such a user can

potentially proliferate and bring the

entire nancial services ecosystem

to a standstill. As the ecosystem

continues to be interconnected and

overlapping, cybercriminals will

try to exploit possible lapses and,

hence, strategies need to be built to

deal with such eventualities. Given

this interdependence on the all the

players of the nancial ecosystem,

it becomes crucial to identify

any anomaly at a pace which

mirrors real time or near real

time. Once an anomaly is identied,

containing it is of paramount

importance before it spreads and

crosses a point where the damages

have transcended organisational

boundaries and services. Response

strategies will have to be quick and

customised to meet various incident

scenarios based on situational

awareness. Further, these strategies

will have to be orchestrated across

own infrastructure and encompass

various digital partners and other

stakeholders.

7. Augmented ecosystem control:

The new age enterprises will adopt

the cloud for faster roll-out and

to address non-linear growth.

Technology partners could include

start-ups, garage shops and large

conglomerates, who come together

to deliver end products. The

security boundaries of the various

players will be extended to end

users, third parties and other

ecosystem partners. Security

controls will no longer be dened

in contracts limited to uptime and

resolution of vulnerabilities, but

will actually be embedded in the

partner ecosystem. The process

for monitoring of parameters will

also have to be integrated with

the company’s incident response

framework.

8. Ubiquitous awareness: TThe

cashless economy means that

the stakeholder community will

now not just be limited to internal

stakeholders but will also include

external as well as peripheral

stakeholders (like merchants).

With the inux of rst-time users,

users from various linguistic ethnic

groups and users of different

channels, the soft targets will

be multifold. The awareness

theme for tomorrow will thus

be multichannel, multilingual

and multicultural, and hence go

beyond the scope of traditional

programmes. Regulators may have

to start thinking across industries

and develop awareness programmes

that addresses this need. Social

media can be a key enabler to

propagate awareness.

12 PwC

In conclusion, cyber security will continue to be a type of asymmetric warfare:

Each organisation will face a multitude of cyber adversaries, and their ranks

will grow and become more sophisticated. The new reality is that cyberattackers

are sufciently capable and motivated to break through the defences. Hence,

organisations will have to develop novel preventive control mechanisms and

signicantly invest in reactive capabilities. We believe mastering the areas

highlighted above will help nancial services companies reach the forefront of

the industry. This is because incorporating a more agile cyber risk management

approach may enable them to more effectively harness the ongoing digital

revolution to their advantage.

13Securing the cashless economy

14 PwC

About ASSOCHAM

The Knowledge Architect of Corporate India

Evolution of Value Creator

ASSOCHAM initiated its endeavour of value creation for Indian industry in 1920. Having in its fold more than 400 Chambers and Trade Associations,

and serving more than 4,50,000 members from all over India. It has witnessed upswings as well as upheavals of Indian Economy, and contributed

signicantly by playing a catalytic role in shaping up the Trade, Commerce and Industrial environment of the country.

Today, ASSOCHAM has emerged as the fountainhead of Knowledge for Indian industry, which is all set to redene the dynamics of growth and

development in the technology driven cyber age of ‘Knowledge Based Economy’.

ASSOCHAM is seen as a forceful, proactive, forward looking institution equipping itself to meet the aspirations of corporate India in the new world of

business. ASSOCHAM is working towards creating a conducive environment of India business to compete globally.

ASSOCHAM derives its strength from its Promoter Chambers and other Industry/Regional Chambers/Associations spread all over the country.

Vision

Empower Indian enterprise by inculcating knowledge that will be the catalyst of growth in the barrierless technology driven global market and help

them upscale, align and emerge as formidable player in respective business segments.

Mission

As a representative organ of Corporate India, ASSOCHAM articulates the genuine, legitimate needs and interests of its members. Its mission is to impact

the policy and legislative environment so as to foster balanced economic, industrial and social development. We believe education, IT, BT, Health,

Corporate Social responsibility and environment to be the critical success factors.

Members – Our Strength

ASSOCHAM represents the interests of more than 4,50,000 direct and indirect members across the country. Through its heterogeneous membership,

ASSOCHAM combines the entrepreneurial spirit and business acumen of owners with management skills and expertise of professionals to set itself apart

as a Chamber with a difference.

Currently, ASSOCHAM has more than 100 National Councils covering the entire gamut of economic activities in India. It has been especially

acknowledged as a signicant voice of Indian industry in the eld of Corporate Social Responsibility, Environment & Safety, HR & Labour Affairs,

Corporate Governance, Information Technology, Biotechnology, Telecom, Banking & Finance, Company Law, Corporate Finance, Economic and

International Affairs, Mergers & Acquisitions, Tourism, Civil Aviation, Infrastructure, Energy & Power, Education, Legal Reforms, Real Estate and Rural

Development, Competency Building & Skill Development to mention a few.

Insight into ‘New Business Models’

ASSOCHAM has been a signicant contributory factor in the emergence of new-age Indian Corporates, characterized by a new mindset and global

ambition for dominating the international business. The Chamber has addressed itself to the key areas like India as Investment Destination, Achieving

International Competitiveness, Promoting International Trade, Corporate Strategies for Enhancing Stakeholders Value, Government Policies in

sustaining India’s Development, Infrastructure Development for enhancing India’s Competitiveness, Building Indian MNCs, Role of Financial Sector the

Catalyst for India’s Transformation.

ASSOCHAM derives its strengths from the following Promoter Chambers: Bombay Chamber of Commerce & Industry, Mumbai; Cochin Chambers of

Commerce & Industry, Cochin: Indian Merchant’s Chamber, Mumbai; The Madras Chamber of Commerce and Industry, Chennai; PHD Chamber of

Commerce and Industry, New Delhi and has over 4 Lakh Direct / Indirect members.

Together, we can make a signicant difference to the burden that our nation carries and bring in a bright, new tomorrow for our nation.

D. S. Rawat

Secretary General

The Associated Chambers of Commerce and Industry of India

ASSOCHAM Corporate Ofce:

5, Sardar Patel Marg, Chanakyapuri, New Delhi-110 021

Tel: 011-46550555 (Hunting Line) • Fax: 011-23017008, 23017009

Website: www.assocham.org

15Securing the cashless economy

About PwC

About the authors

Contacts

Sivarama Krishnan

Leader, Cyber Security

Siddharth Vishwanath

Partner, Cyber Security

siddhart[email protected]

Murali Talasila

Partner, Cyber Security

Manu Dwivedi

Partner, Cyber Security

[email protected]c.com

Sundareshwar Krishnamurthy

Partner, Cyber Security

sundareshwar.krishnamur[email protected]c.com

PVS Murthy

Executive Director, Cyber Security

pvs.murth[email protected]

Hemant Arora

Executive Director, Cyber Security

At PwC, our purpose is to build trust in

society and solve important problems.

We’re a network of rms in 157 countries

with more than 208,000 people who

are committed to delivering quality in

assurance, advisory and tax services. Find

out more and tell us what matters to you

by visiting us at www.pwc.com.

In India, PwC has ofces in these cities:

Ahmedabad, Bangalore, Chennai, Delhi

NCR, Hyderabad, Kolkata, Mumbai and

Pune. For more information about PwC

India’s service offerings, visit www.pwc.

com/in.

PwC refers to the PwC International

network and/or one or more of its

member rms, each of which is a separate,

independent and distinct legal entity in

separate lines of service. Please see www.

pwc.com/structure for further details.

©2017 PwC. All rights reserved

This knowledge paper has been co-authored by Siddharth Vishwanath, Amol Bhat, Priya

Sawkare and Somaskandan Vinit. Siddharth Vishwanath is a Partner and leads the

Financial Services focus for the Cyber Security practice. Amol Bhat is a Director with the

Cyber Security practice and works with several banks.

pwc.in

Data Classification: DC0

This document does not constitute professional advice. The information in this document has been obtained or derived from sources believed by PricewaterhouseCoopers

Private Limited (PwCPL) to be reliable but PwCPL does not represent that this information is accurate or complete. Any opinions or estimates contained in this

document represent the judgment of PwCPL at this time and are subject to change without notice. Readers of this publication are advised to seek their own

professional advice before taking any course of action or decision, for which they are entirely responsible, based on the contents of this publication. PwCPL neither

accepts or assumes any responsibility or liability to any reader of this publication in respect of the information contained within it or for any decisions readers may take

or decide not to or fail to take.

© 2017 PricewaterhouseCoopers Private Limited. All rights reserved. In this document, “PwC” refers to PricewaterhouseCoopers Private Limited (a limited liability

company in India having Corporate Identity Number or CIN : U74140WB1983PTC036093), which is a member firm of PricewaterhouseCoopers International Limited

(PwCIL), each member firm of which is a separate legal entity.