1

including promoters.

S. No.

Name of the Document

Brief Significance of the Document

Page No

MANDATORY DOCUMENTS AS PRESCRIBED BY SEBI & EXCHANGES

Account Opening Form

Tariff Sheet

Rights and Obligations

Risk Disclosure Document

(RDD)

Guidance note

Policies and Procedures

Undertaking

A. KYC form - Document captures the basic information about

the constituent and an instruction/checklist.

Document detailing the rate/amount of brokerage and other charges

levied on the client for trading on the stock exchange(s).

Document stating the Rights & Obligations of stock broker /trading

member and client for trading on exchanges (including additional rights

& obligations in case of internet/wireless technology based trading).

Document detailing risks associated with dealing in the securities

market.

Document describing significant policies and procedures of

Stock Broker.

VOLUNTARY AND OPTIONAL DOCUMENTS AS PROVIDED BY THE STOCK BROKER

Contains voluntary undertakings by the client with respect to Zerodha's

internal operations during the course of the relationship with Zerodha.

3 – 4

5 – 8

9

Annexure

A

Annexure

B

Annexure

C

Annexure

D

10 – 11

12

13

B. Document captures the additional information about the

Constituent relevant to trading account and an instruction /check list.

1

2

3

4

5

6

7

8

9

Name of the Trading Member

Name of the Clearing Member

Cash Segment

Derivatives

Running Account Authorization

and Mobile Declaration

Client Defaulter Declaration

and Client Acknowledgment

Letter of Authorization for maintaining a Running Account with Zerodha

and Client consent letter for receiving SMS from Zerodha

Client declaration stating that he is not a defaulter and Client

acknowledgment that he has read all the rules & regulations.

Document detailing do’s and dont’s for trading on exchange for

education of investors

In case not satisfied with the response, please contact the concerned exchange at:

1.

Correspondence Address : Same as above

Compliance Officer: Pankathi H Jain, Phone No. & Email ID: 91-8047181888, [email protected]

CEO: Nithin Kamath, Phone No. & Email ID: 91-8047181888, [email protected]

For any grievance please contact Zerodha at the above address or email [email protected] &

Phone no. 91-8047181888.

2

Sign wherever you see

NSE:

Zerodha Broking Limited (hereinafter referred to as "Zerodha")

Zerodha Broking Limited

NSE, BSE : Zerodha Broking Limited

NSE:

BS F&O: Zerodha Broking Limited SEBI Registration No. INZ000031633E:

CDS: Zerodha Broking Limited SEBI Registration No. INZ000031633

COM: Zerodha Broking Limited SEBI Registration No. INZ000031633

F&O: Zerodha Broking Limited SEBI Registration No. INZ000031633

CDS: Zerodha Broking Limited SEBI Registration No. INZ000031633

COM: Zerodha Broking Limited SEBI Registration No. INZ000031633

SEBI Registration Number:

Zerodha’s Registered Office:

153/154, 4th Cross, Dollars Colony, Opp. Clarence Public School, J.P. Nagar, 4th Phase Bangalore

- 560078. Ph : 91-8047181888

Zerodha Broking Limited: Member of NSE, BSE & MCX – INZ000031633

CDSL: Depository services through Zerodha Securities Pvt. Ltd. – IN-DP-431-2019

Originals Verified and Self Attested Document copies received

FPI - Category I FPI - Category II

FPI - Category III

DIN of whole time directors :

2a.

Aadhar number of Promoters/Partners/Karta :

2b.

- For Non Individuals

( )

3

Name and

Name of the organisation: Zerodha Broking Limited

I/We declare that the details furnished above are true and correct to the best of my knowledge and undertake all liabilities

w.r.t any incorrect information, I also confirm to inform Zerodha w.r.t any changes in the future. I/We are also aware that

for Aadhaar OVD based KYC, my KYC shall be validated against my Aadhaar. I/We hereby consent to sharing my/our

masked Aadhaar with readable QR code or my Aadhaar XML/Digilocker XML file, along with passcode and as

applicable, with KRA and other Intermediaries with whom I/We or Zerodha have a business relationship for KYC

purposes only. I/We hereby consent to receiving information from CVL KRA & C-KYC Registry through SMS/Email on

the above registered number/Email ID.

3b. DIN

3c. Aadhar (UID) Number

3b. DIN

3c. Aadhar (UID) Number

3b. DIN

3c. Aadhar (UID) Number

3b. DIN

3c. Aadhar (UID) Number

3b. DIN

3c. Aadhar (UID) Number

4

IFSC Code

Bank Name

Branch Address

Account Number

MICR Number

TRADING ACCOUNT RELATED DETAILS

A. BANK ACCOUNT DETAILS

Account Type: Savings Current Others | In case of NRI Account: NRE NRO

B. OTHER DETAILS

Gross Annual Income Details (please specify): Income Range per annum

Below Rs 1 Lakh 1-5 Lakh 5-10 Lakh 10-25 Lakh 25 Lakh to 1 Crore >1 Crore

Net-worth as on (date)________________ (___________________) (Net worth should not be older than 1year)

Please tick, if applicable: Politically Exposed Person (PEP) Related to a Politically Exposed Person (PEP)

C. DEPOSITORY ACCOUNT(S) DETAILS

Depository Participant Name

Beneficiary Name

DP ID BO ID

Depository Name:

NSDL CDSL

D. PAST ACTIONS

Details of any action/proceedings initiated/pending/ taken by SEBI/ Stock exchange/any other authority against the applicant/constituent or its Partners

promoters/whole time directors/authorized persons in charge of dealing in securities during the last 3 years______________________________________

E. DEALINGS THROUGH SUBBROKERS AND OTHER STOCK BROKERS

If client is dealing through the sub-broker, provide the following details:

SEBI Registration number

Fax

Website

Sub-broker's Name

Registered Office Address

Phone

Whether dealing with any other stock broker/sub-broker (if case dealing with multiple stock brokers/sub-brokers, provide details of all)

Name of Sub Broker, if any

Exchange

Name of Stock Broker

Client Code

Details of disputes/dues pending from/to such stock broker/sub-broker: ________________________________________________________________

F. INTRODUCER DETAILS (optional)

Name of the Introducer

Status of the Introducer - Sub-broker/Remisier/Authorized Person/Existing Client/Others (please specify):

Address of the Introducer

Phone Number

Signature

5

In case of non-individuals, for any of your Authorized Signatories / Promoters / Partners / Karta/Trustees / Whole time Directors

Mode in which you wish to receive the RDD, Rights & Obligations, and Guidance Note:

Physical Electronic

G. TRADING PREFERENCES / EXPERIENCE

No Prior Experience

Years in Equities _______/ Years in Derivatives _______/ Years in other Investment Related Field _______

*Please sign in the relevant boxes where you wish to trade. The segment not chosen should be struck off by the client.

H. ADDITIONAL DETAILS

(I) Whether you wish to receive (a) Physical contract note (b) Electronic Contract Note (ECN)

If ECN Specify your Email id: _______________________________________________________________________________________________

(ii) Whether you wish to avail the facility of internet trading/wireless technology/mobile trading YES NO

# If, in future, the client wants to trade on any new segment, a separate authorization/letter should be taken from the client by the broker.

6

In case of non-individuals, name, designation, PAN, UID, signature, residential address and photographs of person/s

authorized to deal in securities on behalf of the company/firm/others:

________________________________________________________________________________________________

________________________________________________________________________________________________

________________________________________________________________________________________________

Any Other Information: ______________________________________________________________________________

Cash/Mutual funds

F&O Currency Commodity derivatives

Debt

BSE & NSE

Segments

If you do not wish to trade in any segment/mutual fund, please mention here _____________________________________

Exchanges

F2 (a) F2 (b) F2 (

c) F2 (d)

F2 (e)

DECLARATION

I/We hereby declare that the details furnished above are true and correct to the best of my/our knowledge and belief and I/we

undertake to inform you of any changes therein, immediately. In case any of the above information is found to be false or untrue or

misleading or misrepresenting, I am/we are aware that I/we may be held liable for it.

I/We confirm having read/been explained and understood the contents of the document on policy and procedures of the stock

broker and the tariff sheet.

I/We further confirm having read and understood the contents of the 'Rights and Obligations' document(s) and 'Risk Disclosure

Document'. I/We do hereby agree to be bound by such provisions as outlined in these documents. I/We have also been informed

that the standard set of documents has been displayed for Information on stock broker's designated website, if any.

1.

2.

3.

Place ________________________________________________________

Date _____________________________

UCC Code allotted to the Client: ________________________________________

Name of the Employee

Employee Code

Designation of employee

Date

Documents verified

with Originals

Client Interviewed By

In-Person

Verification done by

I / We undertake that we have made the client aware of 'Policy and Procedures', tariff sheet and all the non-mandatory documents.

I/We have also made the client aware of 'Rights and Obligations' document (s), RDD and Guidance Note. I/We have given/sent him

a copy of all the KYC documents. I/We undertake that any change in the 'Policy and Procedures', tariff sheet and all the non-

mandatory documents would be duly intimated to the clients. I/We also undertake that any change in the 'Rights and

Obligations' and RDD would be made available on my/our website, if any, for the information of the clients.

Signature of the Authorised Signatory

Seal/Stamp of the stock broker

Date__________________________

FOR OFFICE USE ONLY

7

Signature

Signature of all Authorized Signatory(ies)

Instructions/Checklist - As mentioned in the Circular NSE/INSP/18677 dated August 22, 2011 (Annexure 3)

Sign wherever you see

F3

Internet & wireless technology based trading facility provided by stock broker to the client

1. Stock broker is eligible for providing Internet Based trading (IBT) and securities trading through the use of wireless technology

that shall include the use of devices such as mobile phone, laptop with datacard, etc. which use Internet Protocol (IP). The stock

broker shall comply with all requirements applicable to internet based trading/securities trading using wireless technology as

may be specified by SEBI & the Exchanges from time to time.

2. The client is desirous of investing/trading in securities and for this purpose, the client is desirous of using either the internet

based trading facility or the facility for securities trading through use of wireless technology. The Stock broker shall provide the

Stock broker’s IBT Service to the Client, and the Client shall avail of the Stock broker’s IBT Service, on and subject to

SEBI/Exchanges Provisions and the terms and conditions specified on the Stock broker’s IBT website provided that they are in

line with the norms prescribed by Exchanges/SEBI.

3. The stock broker shall bring to the notice of client the features, risks, responsibilities, obligations and liabilities associated with

securities trading through wireless technology/internet/smart order routing or any other technology should be brought to the

notice of the client by the stock broker.

4. The stock broker shall make the client aware that the Stock Broker’s IBT system itself generates the initial password and its

password policy is as stipulated in line with norms prescribed by Exchanges/SEBI.

5. The Client shall be responsible for keeping the Username and Password confidential and secure and shall be solely responsible

for all orders entered and transactions done by any person whosoever through the Stock broker’s IBT System using the Client’s

Username and/or Password whether or not such a person was authorized to do so. Also the client is aware that authentication

technologies and strict security measures are required for the internet trading/securities trading through wireless technology

through order routed system and undertakes to ensure that the password of the client and/or his authorized representative are not

revealed to any third party including employees and dealers of the stock broker.

6. The Client shall immediately notify the Stock broker in writing if he forgets his password, discovers security flaw in Stock

Broker’s IBT System, discovers/suspects discrepancies/unauthorized access through his username/password/account with full

details of such unauthorized use, the date, the manner and the transactions effected pursuant to such unauthorized use,etc.

7. The Client is fully aware of and understands the risks associated with availing of a service for routing orders over the

internet/securities trading through wireless technology and Client shall be fully liable and responsible for any and all acts done in

the Client’s Username/password in any manner whatsoever.

8. The stock broker shall send the order/trade confirmation through email to the client at his request. The client is aware that the

order/trade confirmation is also provided on the web portal. In case client is trading using wireless technology, the stock broker

shall send the order/trade confirmation on the device of the client.

9. The client is aware that trading over the internet involves many uncertain factors and complex hardware, software, systems,

communication lines, peripherals, etc. are susceptible to interruptions and dislocations. The Stock broker and the Exchange do

not make any representation or warranty that the Stock broker’s IBT Service will be available to the Client at all times without any

interruption.

10. The Client shall not have any claim against the Exchange or the Stockbroker on account of any suspension, interruption, non-

availability or malfunctioning of the Stock broker’s IBT System or Service or the Exchange’s service or systems or nonexecution

of his orders due to any link / system failure at the Client/Stock brokers/Exchange end for any reason beyond the control of the

stockbroker/Exchanges.

8

(All the clauses mentioned in the “Rights and Obligations”document(s) shall be applicable.

Additionally, the clauses mentioned herein shall also be applicable.)

Sign wherever you see

Declaration

1. I/We hereby declare that the details furnished above are true and correct to the best of my/our knowledge and belief and I/we

undertake to inform you of any changes therein, immediately. In case any of the above information is found to be false or untrue or

misleading or misrepresenting, I am/we are aware that I/we may be held liable for it.

2. I/We confirm having read/been explained and understood the contents of the document on policy and procedures of the stock

broker and the tariff sheet.

3. I/We further confirm having read and understood the contents of the 'Rights and Obligations' document(s) and 'Risk Disclosure

Document'. I/We do hereby agree to be bound by such provisions as outlined in these documents. I/We have also been informed

that the standard set of documents has been displayed for Information on stock broker's designated website, if any.

Client Name ___________________________________________

Place ___________________________

Client Signature

Date :

D D M M Y Y Y Y F4

Date:__________________

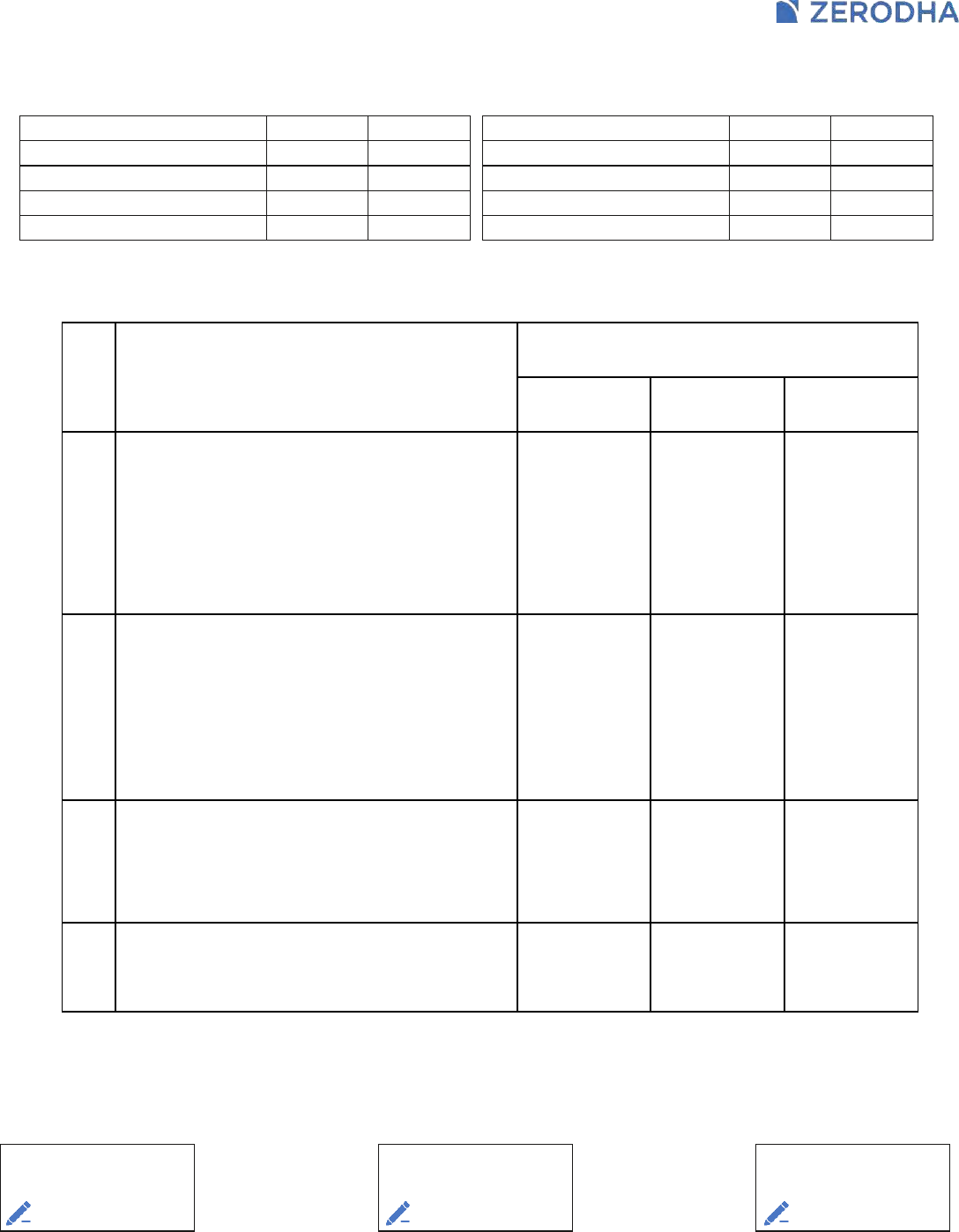

Brokerage / Charges

Rs 20 per executed order or 0.03% of Turnover whichever is lower

Rs 20 per executed order or 0.1% of Turnover whichever is lower

Rs 20 per executed order or 0.03% of Turnover whichever is lower

Rs 20 per executed order

Rs 20 per executed order or 0.03% of Turnover whichever is lower

Rs 20 per executed order

Rs 50 per order placed through a Dealer at Zerodha

Charge Head

Equity Intraday

Equity Delivery

Futures

Options

Currency Futures

Currency Options

Call & Trade Services

Charges for other value added services will be applicable at the time of availing such

service, upon your consent. Detailed explanation of all charges is available online at :

https://zerodha.com/charge-list

Disclaimer: Clients who opt to receive physicalcontract notes will be charged Rs. 20 per contract note plus courier charges. A

brokerage of 0.5% of the contract value will be charged for contracts where physical delivery happens. In addition to the

brokerage charge the following charges will also be levied.

Schedule of Charges:

1. Exchange transaction charges | 2. Clearing charges | 3. Securities Transaction Tax | 4. Goods & Services Tax | 5. SEBI

Turnover fees | 6. Stamp Duty

Note :

Brokerage will not exceed the rates specified by SEBI and the Exchanges

All Statutory and Regulatory charges will be levied at actuals

Brokerage is also charged on expired, exercised, and assigned Options contracts

TARIFF SHEET

To

ZERODHA BROKING LIMITED

153/154, 4th Cross, Dollars Colony, Opp. Clarence Public

School, J.P. Nagar, 4th Phase Bangalore - 560078

Charges for Zerodha Trading Services

I/ We agree to pay the charges as per following charges structure for our Trading account with Zerodha effective

___________________.

Client ID: _______________________

Sign wherever you see

9

F5 Client Signature

ZERODHA

1.ORDER PLACEMENT INSTRUCTIONS

I understand that you require written instructions from me for placing / modifying / cancelling orders. However, since it is not practical for me to

give written instructions for placing/modifying/cancelling order. Even If I have facility to trade online through Internet and wireless technology, I

may have to place orders by physically visiting /calling/ Emailing the Call centre / branch specified for the said purpose by ZERODHA in case of

breakdown of internet connectivity or other similar reasons.

I hereby request you to kindly accept my verbal orders/instructions, in person or over phone and execute the same. I understand the risk

associated with placement of verbal orders and accept the same. I shall not disown orders under the plea that the same were not placed

by me provided I am sent ECN/Physical contract notes or trade confirmations through SMS and other modes. I indemnify ZERODHA and

its employees against all trade related losses, damages, actions which you may suffer or face, as a consequence of adhering to and

carrying out my instructions for orders placed verbally.

2.ERRORS AND OMMISSIONS

I understand and agree that inadvertent errors may occur, while executing orders placed by me. In such circumstances ZERODHA shall make

all reasonable efforts to rectify the same and ensure that I am not put to any monetary loss. I understand and agree that I shall not hold

ZERODHA responsible beyond this and claim additional damages/loss.I understand and agree that my request to modify or cancel the order

shall not be deemed to have been executed unless and until the same is confirmed by ZERODHA.

3.NO MARKET MANIPULATION

I undertake not to execute transactions, either singly or in concert with other clients, which may be viewed as manipulative trades viz. artificially

raising, depressing or maintaining the price, creation of artificial volume, synchronized trades, cross trades, self trades, etc or which could be

termed as manipulative or fraudulent trades by SEBI/Exchanges. In case I am found to be indulging in such activities, ZERODHA has every right

to inform the Exchange/SEBI/other regulatory authority of the same and suspend/close my trading account.

4.NOT TO ACT AS UNREGISTERED SUB BROKER

I undertake not to act as unregistered Sub-broker and deal only for myself and not on behalf of other clients In case I wish to deal for other

clients also, I undertake to apply to SEBI through ZERODHA to obtain a sub broker registration. In case ZERODHA perceives that I am acting as

an unregistered sub broker, ZERODHA has the right to immediately suspend my trading account and close all open positions and adjust the

credits (across all segments) against the dues owed by me to ZERODHA without the requirement of any notice from ZERODHA. Further,

ZERODHA has the right to inform the concerned regulatory authorities about the same. In aforesaid eventuality, I agree and undertake to

indemnify ZERODHA from any loss/ damage/claim arising out of such activity.

5.NOT DEBARRED BY ANY REGULATOR

I confirm and declare that there is no bar on me imposed by any Exchange or any Regulatory and/or Statutory authority to deal in securities

directly or indirectly. I agree to inform ZERODHA, in writing, of any regulatory action taken by any Exchange or Regulatory/ Statutory authority

on me in future. In case I fail to inform the same and ZERODHA on its own comes to know of such action, ZERODHA has the right to

suspend/close my trading account and refuse to deal with me.Also, ZERODHA can at its sole discretion, close all the open positions and

liquidate collaterals to the extent of trade related debit balances, without any notice to me.

6. PMLA DECLARATION

I declare that I have read and understood the contents and the provisions of the PMLA Act, 2002, which were also explained to me by ZERODHA

officials. I further declare that I shall adhere to all the provisions of PMLA Act, 2002.

I further undertake and confirm that;

a. I do not have any links with any known criminal

b. I am a genuine person and not involved or indulge knowingly or assisted, directly or indirectly, in any process or activity connected

with the proceeds of crime nor I am a party to it. The investment money is derived from proper means and does not involve any black or Hawala

money in any manner.

7.INDEMNIFICATION I hereby indemnify and hold ZERODHA, its Directors and employees harmless from and against all trade related

claims, demands, actions, proceedings, losses, damages, liabilities, charges and/or expenses that are occasioned or may be occasioned

to the ZERODHA directly or indirectly, relating to bad delivery of shares/ securities and/ or third party delivery, whether authorized or

unauthorized and fake/forged/stolen shares/ securities/transfer documents introduced or that may be introduced by or through me during

the course of my dealings/ operations on the Exchange(s) and/ or proof of address, identity and other supporting/ documents provided by

me at the time of registration and/ or subsequently.

SUB: VOLUNTARY UNDERTAKING / AUTHORISATION

With respect to Member-Constituent Relationship and Mandatory and Voluntary (optional) Documents executed

between us, I / We do hereby authorize ZERODHA to do the following:

10

153/154, 4th Cross, Dollars Colony, Opp. Clarence Public

School, J.P. Nagar, 4th Phase Bangalore - 560078

INDEMNITY OF JOINT HOLDINGS

I hereby agree to indemnify and hold ZERODHA harmless from any trade related claims, demands, actions, proceedings, losses, damages,

liabilities, charges and/or expenses arising from transactions in securities held jointly by me with any other person or persons, if any.

9.DELAYED PAYMENT CHARGES

I understand that in case my account is in debit balance and/or if I have insufficient funds to manage my trading positions, I will be

charged an interest of 0.05% per day as delayed payment charges. I confirm having read the rules & regulations pertaining to the levy of

such interest under the policies & procedures page on Zerodha's website.

10. NRI DECLARATION

I understand that if the sole/first applicant has or attains NRI Status, investments in scheme of mutual funds can be made only upon

providing Foreign Inward Remittance Certificate (FIRC) to ZERODHA every time the investment is made.

A. THIRD-PARTY PAYMENTS

ZERODHA shall have the prerogative to refuse payments received from any bank account where the client is not the first holder or which

is not mentioned in the KYC or which the client has not got updated subsequently by submitting a written request along with adequate

proof thereof as per proforma prescribed by ZERODHA. ZERODHA shall not be responsible for any loss or damage arising out of such

refusal of acceptance of payments in the situations mentioned above.

However, due to oversight, if any such third-party payment has been accepted by ZERODHA and the credit for the same has been given in

the client's ledger, ZERODHA shall have the right to immediately reverse such credit entries on noticing or becoming aware of the same.

In such a case, ZERODHA reserves the right to liquidate any of the open positions and/or any of the collaterals received/ held on behalf of

the client. ZERODHA, its Directors and employees shall not be responsible for any consequential damages or losses.

B. NO DEALINGS IN CASH

ZERODHA as a policy neither accepts any funds for pay-in/margin in cash nor makes any payment or allows withdrawal of funds in cash.

No claim will be entertained where the client states to have made any cash payment or deposited cash with any Branch/Sub- Broker/

Remisier/Employee/Authorised Person of ZERODHA.

C. DISCLOSURE OF PROPRIETARY TRADING BY ZERODHA

Pursuant to SEBI Circular Number SEBI/MRD/SEC/Cir-42/2003 dated November 19, 2003, ZERODHA discloses to its clients about its

policies on proprietarytrades. ZERODHAdoesproprietarytrades in the cash and derivatives segment at NSE, BSE, and MSEI.

D. DELIVERIES

The client shall ensure that the shares are properly transferred to the designated demat account of ZERODHA, for effecting delivery to the

Exchange against the sale position of the client. Such transfers shall be entered by the client within the time specified by SEBI/

Exchanges/ZERODHA. In case the client fails to transfer the shares on time to ZERODHA, ZERODHA shall not be responsible for any

loss/damages arising out of such delayed transfers.

E. SQUARING OFF OF POSITIONS & SALE /LIQUIDATION OF COLLATERAL MARGINS (to the extent of Settlement Margin obligation)

The client shall settle the transactions, within the Exchange specified settlement time, by making the requisite payment of funds and/or

delivery of the shares. In case the client fails to settle the transactions within the settlement date, then ZERODHA has the right to square

off the open and/or unpaid positions, at an appropriate time, as it deems fit, without any notice to the client. The client shall not have any

right or say to decide on the timing of closure of the open positions that needs to be closed. ZERODHA, its Directors and Employees

shall not be responsible for any trade related loss or damages arising out of such square offs. All such square off transactions shall have

implied consent and authorization of the client in favour of ZERODHA.

After such square off of open positions by ZERODHA, as mentioned in above clauses, if there is a debit balance, the client shall pay the

same immediately. However, if the client does not clear off the debit balance, ZERODHA shall have the right to liquidate the shares and

other securities of the client (kept as collateral/margin) to the extent of the debit balance, without any intimation to the client. The client

shall not have the right to decide on the timing of liquidation of shares and securities held in collateral/margin and the shares and

securities that needs to be sold or liquidated. ZERODHA, its Directors and employees shall not be responsible for any trade related loss

or damages arising out of such selling.

8. BSE StAR MUTUAL FUND FACILITY

I am interested in availing the StAR Mutual Fund facility of the Exchange for the purpose of dealing in the units of Mutual Funds

Schemes permitted to be dealt with on the StAR platform of the Exchange. For the purpose of availing the StAR Mutual Fund

facility, I state that “Know Your Client” details as submitted by me for the opening of Trading Account may be considered for the

purpose of StAR and I/we further confirm that the details contained in same remain unchanged as on date. I am willing to abide by

the terms and conditions as has been specified and as may be specified by the Exchange from time to time in this regard. I shall

ensure also compliance with the requirements as may be specified from time to time by Securities and Exchange Board of India

and Association of Mutual Funds of India (AMFI). I shall read and understand the contents of the Scheme Information Document

and Key Information Memorandum, addenda issued regarding each Mutual Fund Schemes with respect to which I choose to

subscribe/redeem. I further agree to abide by the terms and conditions, rules and regulations of the respective Mutual Fund

Schemes subscribed by me.

Sign wherever you see

F6 Client Signature

11

I/We are dealing through you as a client in Capital Market and/or Future & Option segment and/or Currency segment

and/or Interest Rate future Segment & in order to facilitate ease of operations and upfront requirement of margin for trade.

1. I/We request you to maintain running balance in my account & retain the credit balance in any of my/our account and to use the

unused funds towards my/our margin/pay-in/other future obligation(s) of any segment(s) of any or all the

Exchange(s)/Clearing corporation unless I/We instruct you otherwise.

2. I/We request you to retain securities with you for my/our margin/pay-in/other future obligation(s) at any segment(s) of any or

all the Exchange(s)/Clearing Corporation, unless I/We instruct you to transfer the same to my/our account.

3. I/We request you to settle my fund and securities account (Choose one Option)

Once in a calendar Month

Once in every calendar Quarter except the funds given towards collaterals / margin in form of

Bank Guarantee and /or Fixed Deposit Receipt

4. In case I/We have an outstanding obligation on the settlement date, you may retain the requisite securities/funds

towards such obligations and may also retain the funds expected to be required to meet margin obligation for next 5 trading days,

calculated in the manner specified by the exchanges.

5. I/We confirm you that I will bring to your notice any dispute arising from the statement of account or settlement so made in

writing preferably within 7 working days from the date of receipt of funds/securities or statement of account or statement

related to it, as the case may be at your registered office.

6. I/We confirm you that I can revoke the above mentioned authority at any time.

7. This running account authorization would continue until it is revoked by me.

Yours faithfully,

RUNNING ACCOUNT AUTHORIZATION VOLUNTARY

mobile no. is __________________________ Further, I authorize ZERODHA that the same may be used for

giving me any information/ alert/SMS.

I further declare the above mentioned statement is tr

ue and correct.

MOBILE DECLARATION VOLUNTARY

I/We authorize you as under:

12

Date: ______________________

The entity_______________________________ having PAN_____________________ do hereby declare that my

Sign wherever you see

F7 Client Signature

F8 Client Signature

Date:___________________

This is to acknowledge the receipt of following documents. I further state and confirm that I have read and understood

all the clauses of aforesaid documents.

Sub: Acknowledgement

Duly Executed Copy of KYC

Rights and Obligations

Risk Disclosure document (RDD) for Capital, Derivatives, and Cur

rencies Segments

Guidance Note - Do's and Dont's for trading on the Exchange(s) for investors

Zerodha Tariff Sheet

Policies and Procedures Document pursuant to the SEBI circular dated December 03, 2009

General Terms & Conditions governing securities trading and broking services of Zerodha

Brief significance of the Document

Sl. No

1

2

3

4

5

6

7

Yours faithfully,

Client Name: ____________________________

CLIENT DEFAULTER DECLARATION

I further declare that the above mentioned declaration/ statement is true and correct.

I also confirm that I have received the relevant clarifications, if any, wherever required from the officials of ZERODHA

13

VOLUNTARY

8

Running Account Authorization, Defaulter Declaration, & Mobile Declaration

The entity ______________________________ having PAN_______________________do hereby declare that we

appearing in any defaulter database as per SEBI/ Various Exchange/ Regulatory bodies, etc.

have not been involved in any terrorist activities and we have not been declared a defaulter or my name is not

To

Zerodha Broking Limited

153/154, 4th Cross, Dollars Colony, Opp. Clarence Public School, J.P. Nagar, 4th Phase Bangalore - 560078

Sign wherever you see

F9 Client Signature

F10 Client Signature

Client ID

DP ID

Details of Guardian (in case the account holder is minor)

Guardian’s Name

PAN

Relationship with the applicant

I / We instruct the DP to receive each and every credit in my / our account

(If not marked, the default option would be ‘Yes’)

[Automatic Credit]

Yes No

(To be filled by the applicant in BLOCK LETTERS in English)

I/We request you to open a demat account in my/ our name as per following details:-

Sole / First Holder’s Name

PAN

*In case of Firms, Association of Persons (AOP), Partnership Firm, Unregistered Trust, etc., although the account is opened in the

name of the natural persons, the name of the Firm, Association of Persons (AOP), Partnership Firm, Unregistered Trust, etc.,

should be mentioned above.

Type of Account (Please tick whichever is applicable)

Individual Resident

Individual Director’s Relative

Individual Promoter

Individual Margin Trading A/c (MANTRA)

Individual-Director

Individual HUF / AOP

Minor

Others(specify)

Individual

NRI NRI Repatriable

NRI Repatriable Promoter

NRI – Depository Receipts

NRI Non-Repatriable

NRI Non-Repatriable Promoter

Others (specify)

Foreign National

Foreign National Foreign National - Depository Receipts

Others (specify)

Status Sub – Status

Additional KYC Form for Opening a Demat Account

(To be filled by the Depository Participant)

Application No

Date

DP Internal Reference No

Holder Details

UID

Second Holder’s Name

PAN

UID

Zerodha Broking Ltd.

153/154, 4th Cross, 4th Phase, JP Nagar, Dollars Colony,

Opp. Clarence School, Bangalore - 560078

Sign wherever you see

Third Holder’s Name

PAN

UID

I / We would like to instruct the DP to accept all the pledge instructions in my /our account without

any other further instruction from my/our end (If not marked, the default option would be ‘No’)

Account Statement Requirement As per SEBI Regulation

Daily Weekly Fortnightly Monthly

Yes No

I / We request you to send electronic transaction-cum-holding statement at the following

Yes No

I / We would like to share the email ID with the RTA

Yes No

I / We would like to receive the Annual Report

(Tick the applicable box. If not marked the default option would be in Physical)

Physical Electronic Both Physical and Electronic

Email ID

NSE/BSE

Exchange UCC

14

Other Details

Occupation :_______________________________________________________________________________________

Please tick, if applicable:

Any other information:________________________________________________________________________________

Politically Exposed Person (PEP) Related to Politically Exposed Person (RPEP)

SMS Alert Facility

Refer to Terms &

Conditions given in

Annexure - 2.4

MOBILE NO. +91 _____________________________

[Mandatory, if you are giving Demat Debit and Pledge Instruction (DDPI)]

(if DDPI is not granted & you do not wish to avail of this facility, cancel this option).

Transactions Using

Secured Texting Facility

(TRUST). Refer to Terms

and Conditions

Annexure – 2.6

I wish to avail the TRUST facility using the Mobile number registered for SMS Alert Facility. I have

read and understood the Terms and Conditions prescribed by CDSL for the same.

I/We wish to register the following clearing member IDs under my/our below mentioned BO ID

registered for TRUST

Stock Exchange Name/ID Clearing Member Name

Clearing Member ID (Optional)

To register for easi, please visit our website www.cdslindia.com. Easi allows a BO to view his

ISIN balances, transactions and value of the portfolio online.

Yes No

Bank Details [Dividend Bank Details]

Bank Code (9 digit MICR code) IFS Code (11 character)

Account number

Account type

Saving Current Others (specify)

Bank Name

Branch Name

Bank Branch Address

City

State

Country

PIN code

(I) Photocopy of the cancelled cheque having the name of the account holder where the cheque book is issued, (or)

(ii) Photocopy of the bank statement having name and address of the BO

(iii) Photocopy of the passbook having name and address of the BO, (or) (iv) Letter from the Bank.

*In case of options (ii), (iii) and (iv) above, MICR code of the branch should be present/mentioned on the document.

15

I/We would wish to avail the following facility:

Basic Service Demat Account facility (BSDA)

Yes No

I/We wish to receive dividend/interest directly in to my bank account as given below through ECS.

(If not marked, the default option would be ‘Yes’) [ECS is mandatory for locations notified by SEBI from time to time ]

Sign wherever you see

Yes No

Gross Annual Income Details (please specify): Income Range per annum

Below Rs 1 Lakh 1-5 Lakh 5-10 Lakh 10-25 Lakh >25 Lacs

Or Net-worth as on ________________date___________________ (Net worth should not be older than 1year)

Nomination details (Please tick the appropriate options)

I / We do wish to nominate (Fill Annexure 1A)

I / We do not wish to nominate

Schedule-A Tariff Structure

Details

For individuals/HUF/corporates

POA/DDPI Clients

a.

Individuals/Non Individual (except Corporate & NRIs)

Rs.300/- + GST

b.

Non Individual - Corporate

Rs.1000/- + GST

Transaction Charges : (Market Trades)

Buy(Receive) / Sell (Debit)

Nil / Rs.13/-

Transaction Charges : (Off-Market Trades)

Buy(Receive) / Sell (Debit) Nil / 0.03% or Rs.25/- whichever is higher

Demat (Per certificate)

Remat (Per certificate)

Courier charges per Demat/Remat/Demat Rejn./CMR

Pledge Request

Unpledge Request

Pledge invocation

Rs. 20/- + Rs. 12 per request (CDSL Charges)

Rs. 20/- + Rs. 12 per request (CDSL Charges)

Rs. 20/-

Periodic Statement

a.

a.

b.

b.

By Email / Physical

Free / Rs. 50/- (+Courier charges at actual)

Adhoc / Non Periodic Statement Requests

By Email

Physical

Rs.10/- per request

Rs. 50 per request upto 10 pages. Every additional page

at Rs. 5 (+Courier charges at actual)

Delivery instruction

First Delivery Instruction Book

Every Addl Booklet (10 Leaves)

Free (10 Leaves)

Rs.100/-

Rs. 350/-

Rs. 50 per ISIN

Rs. 25/- per request

Rs. 50/-

Cheque Bounce Charges

Failed Transactions

Modification in CML

KRA Upload / Download

NOTE :

• An additional discount of Rs. 0.25 will be applied to debit transactions of mutual funds and bonds.

• For all purposes the bill date shall be construed as the date demand and the bills will be considered as the bill cum

notice for payment and Zerodha Broking Ltd. reserves the right to freeze depository account for debit transaction in case

of non payment of charges after two days from the bill date.

• Zerodha may, upon obtaining consent, charge for any ancillary services not listed above as and when applicable.

• The above tariff is subject to change. Changes if any will be intimated 30 days in advance Annual Maintenance Charge

(AMC) is non refundable. GST is applicable on all above charges except stamp charges.

• I/We understand that any instruction provided by me to Zerodha to transfer securities from my account shall be rejected

by Zerodha, if there is any debit balance or any unpaid amounts due as per this tariff sheet to Zerodha.

Zerodha Broking Ltd.

153/154, 4th Cross, 4th Phase, JP Nagar, Dollars Colony,

Opp. Clarence School, Bangalore - 560078

Sign wherever you see

F11 T1S1

First/Sole Holder

or Guardian

(in case of Minor)

Second Holder

Third Holder

Rs. 100/-

Rs. 150/- per certificate

Rs. 150/- per certificate

+ CDSL Charges

Stamp charges payable upfront

Rs.50/-

Annual Maintenance Charges (charged quarterly)

Margin Pledge

Margin Unpledge

Margin Repledge

Rs. 9 + Rs. 5 per request (CDSL Charges)

Rs. 9 + Rs. 5 per request (CDSL Charges)

Rs. 2/- (CDSL charges)

b.

NRIs

Rs.500/- + GST

16

I/We hereby request you to send the statements:

Daily Fortnightly Weekly Monthly

Mode of Operations for Demat Account

We would like to update mode of operation in the Demat account number _________________ held with Zerodha Broking

Ltd. as below:

Jointly Anyone of the holder or survivor(s)

We understand that If Mode of Operation for Joint Account is chosen as anyone of the holder or survivor(s), only specified

operations such as transfer of securities including Inter-Depository Transfer, pledge/hypothecation/margin pledge/margin

re-pledge (creation, closure and invocation and confirmation thereof as applicable) of securities and freeze/unfreeze of

account and/or securities and/or specific number of securities will be permitted.

Yours faithfully,

To,

Zerodha Broking Ltd.

153/154, 4th Cross, Dollars Colony, 4th Phase, JP Nagar, Opp. Clarence Public School, Bangalore - 560078.

Dear Sir,

Sub : Requesting for bill/transaction/holding statement through email.

I/We request you to send me/us bill, transaction and holding statement of my CDSL Demat account no. __________________

________at following email address: ____________________________________________________________________

I/We fully agree and are aware of following Terms and Conditions mentioned below.

a) that I/We will not receive the bill, transaction and holding statements in paper form.

b) that I/We will take all the necessary steps to ensure confidentiality and secrecy of the login name and password of the

internet/email account.

c) that I/We am/are aware that the bill, transaction and holding statements may be accessed by other entities in case the

confidentiality /secrecy of the login name and password is compromised.

d) that I/We in case bill, transaction and holding statements are sent by email, I/We will immediately inform the Zerodha

Broking. about change in email address, if any.

In case, the Zerodha Broking is not able to provide bill/transaction statement to its Clients by email or on website due to any

reason (including bounced emails), Zerodha Broking Ltd. will ensure that the transaction statement is provided to me/us in

paper form as per the time schedule stipulated in the Bye Laws & Business Rules of CDSL.

Sign wherever you see

T2(a)

T2(b)

S2(a)

S2(b)

First/Sole Holder

or Guardian

(in case of Minor)

First/Sole Holder

or Guardian

(in case of Minor)

Second Holder

Second Holder

Third Holder

Third Holder

Date :

D D M M Y Y Y Y

Declaration

I/We have received and read the Rights and Obligations documents and terms & conditions and agree to abide by and be bound

by the same and the Bye Laws as are in force from time to time. I/We declare that the particulars given by me/us above are true

to the best of my/our knowledge as on the date of making this application.

I/We agree and undertake to intimate the DP of any change(s) in the details/particulars mentioned by me/us in this form.

I/We further agree that any false/misleading information given by me/us or suppression of any material information will render

my account liable for termination and suitable action.

I, the sole holder, or w

e, the Joint Holders confirm that we would like to designate the First Demat Account Holder (who

is

a

Resident

Indian Individual)

of

our

account

to

receive

the

CDSL

TPIN

(or

any

such other similar PIN as required by any

or all Depositories to transact as per the e-DIS facility offered by such Depository) on his/her mobile/email address for

execution/permission of all such transactions & ancillary facilities to be availed via such mechanism from any or all

Depositories.

F12(a)

F12(b)

17

DP ID Client ID

Option form for issue of DIS booklet

First Holder Name

Second Holder Name

Third Holder Name

Voluntary

I/We hereby select Option 1 Option 2

First/Sole Holder

or Guardian

(in case of Minor)

Second Holder

Third Holder

To,

Zerodha Broking Ltd.

153/154, 4th Cross, Dollars Colony, 4th Phase, JP Nagar, Opp. Clarence Public School, Bangalore - 560078.

Dear Sir,

I/We hereby state that: [select one of the option given below]

Option 1:

I/We require you to issue Delivery Instruction Slip (DIS) booklet to me / us immediately on opening my / our CDSL account

though I/ We have issued a Power of Attorney (POA)/Demat Debit and Pledge Instruction (DDPI) in favour of Zerodha

Broking Ltd. for executing delivery instructions for settling stock exchange trades (Settlement related transactions) effected

through such Clearing Member.

OR

Option 2:

I/We do not require the Delivery Instruction Slip(DIS)for the time being, Since I/We have issued a POA/DDPI in favour of

Zerodha Broking Ltd. for executing the delivery instructions for settling stock exchange trades [settlement related

transaction] effected through such Clearing Member. However, the Delivery Instruction Slip (DIS) booklet should be issued

to me / us immediately on my / our request at any later date.

Date :

D D M M Y Y Y Y

18

Sign wherever you see

First/Sole Holder

or Guardian

(in case of Minor)

Request letter for registration of mobile no./email ID of person belonging to the client's family

Please note that the mobile no./email id/both mentioned in the Account opening form/ request for change in mobile no./email ID

belongs to Mr/Mrs./Ms. ______________________________________________________________________ who is my

______________________________ [relationship with the client]

[Only the mobile no./email id of your spouse, dependent children and dependent parents can be registered in your demat account]

Optional

Client E-mail ID

Client Mobile Number

Declaration

I hereby declare that the mobile no./email ID mentioned in the Account opening form/ request for change in mobile no./email

ID is my own

Annexure E

F13

S5 T5

F14

Demat Debit and Pledge Instruction (“DDPI”)

I/We agree to the terms and purpose of this DDPI document between Mr./Ms.

_____________________________________

_____ (First Holder) _______________________________

(Second holder) and _________________________________________________________ (Third

holder)________________________________________ an individual/body of individuals/a sole proprietary

concern/a partnership firm/a body corporate/trust, registered/incorporated, under the provisions of the Indian

Partnership Act, 1932/the Companies Act 2013, or any relevant Act or unregistered in nature; and Zerodha

Broking Limited (hereinafter referred to as “Zerodha”), a Company within the meaning of Companies Act, 2013

with its registered office at Zerodha Broking Ltd., #153/154, 4th Cross, Dollars Colony, Opp. Clarence Public

School, J.P Nagar 4th Phase, Bengaluru - 560078, Karnataka, India;

Whereas:

(a) I/We have

established a business relationship with Zerodha to avail services w.r.t trading, investing &

other servi

ces offered by Zerodha, having a DP ID 12081600/12081601 & Client

ID_____________________________;

(b) This DDPI document shall be in line with SEBI Circular no. SEBI/HO/MIRSD/DoP/P/CIR/2022/44 dated

April 04, 2022,

as may be updated from time to time, & I agree to the below points;

Voluntary

S.N

o

Purpose

Signature of Client

First Holder Coparcener

(for HUF only)

Coparcener

(for HUF only)

1. I/We agree and permit Zerodha to transfer any

securities held in my beneficial owner account

towards any Exchange (any SEBI Recognised

Exchanges where Zerodha is a member) related

deliveries / settlement obligations arising out of

trades executed by me/us on the Exchanges

through Zerodha;

2. I/We agree and confirm to allow pledging / re-

pledging of securities in favour of Zerodha and the

clearing member (CM) with whom Zerodha is a

member of, for the purpose of meeting my/our

margin requirements in connection with the trades

executed by me/us on the Exchanges.

3. I/We agree enabling Mutual Fund transactions (buy

or sell) to be executed via stock exchange operated

order entry platforms, such as BSEStar MF & NSE

NMF.

4. I/We agree to enable tendering of shares submitted

by me under any open offers via stock exchange

platforms

Dated at Bangalore on this_________________________________________day of__________________________________

First/Sole Holder

or Guardian

(in case of Minor)

Coparcener

(for HUF only)

11000011

Particulars DP ID Client ID Particulars

DP ID

Client ID

CDSL BSE Principal A/C

CDSL NSE Pool A/C

CDSL NSE-SLB Early Pay-in A/c

CDSL NSE Early Pay-in A/C

00013706

00000061

00000748

00019678

CDSL BSE Early Pay-in A/C

NSDL NSE Pool A/C

NSDL BSE Pool A/C

11000010

IN304287

IN304287

00023629

10000004

10000045

11000023

12081600

12081600

CDSL NSE-SLB Pool A/c

12081600

23213431

Annexure B

Coparcener

(for HUF only)

Most Important Terms and Conditions

1. Your trading account has a “Unique Client Code” (UCC), different from your demat account number. Do not allow anyone

(including your own stock broker, their representatives and dealers) to trade in your trading account on their own without

taking specific instruction from you for your trades. Do not share your internet/mobile trading login credentials with anyone

else.

2. You are required to place collaterals as margins with the stock broker before you trade. The collateral can either be in the

form of funds transfer into specified stock broker bank accounts or margin pledge of securities from your demat account.

The bank accounts are listed on the stock broker website. Please do not transfer funds into any other account. The stock

broker is not permitted to accept any cash from you.

3. The stock broker’s Risk Management Policy provides details about how the trading limits will be given to you, and the tariff

sheet provides the charges that the stock broker will levy on you.

4. All securities purchased by you will be transferred to your demat account within one working day of the payout. In case of

securities purchased but not fully paid by you, the transfer of the same may be subject to limited period pledge i.e. seven

trading days after the pay-out (CUSPA pledge) created in favor of the stock broker. You can view your demat account

balances directly at the website of the Depositories after creating a login.

5. The stock broker is obligated to deposit all funds received from you with any of the Clearing Corporations duly allocated in

your name. The stock broker is further mandated to return excess funds as per applicable norms to you at the time of

quarterly/ monthly settlement. You can view the amounts allocated to you directly at the website of the Clearing

Corporation(s).

6. You will get a contract note from the stock broker within 24 hours of the trade.

7. You may give a one-time Demat Debit and Pledge Instruction (DDPI) authority to your stock broker for limited access to your

demat account, including transferring securities, which are sold in your account for pay-in.

8. The stock broker is expected to know your financial status and monitor your accounts accordingly. Do share all financial

information (e.g. income, networth, etc.) with the stock broker as and when requested for. Kindly also keep your email ID

and mobile phone details with the stock broker always updated.

9. In case of disputes with the stock broker, you can raise a grievance on the dedicated investor grievance ID of the stock

broker. You can also approach the stock exchanges and/or SEBI directly.

10.Any assured/guaranteed/fixed returns schemes or any other schemes of similar nature are prohibited by law. You will not

have any protection/recourse from SEBI/stock exchanges for participation in such schemes.

Client Signature